The Toronto Stock Exchange and its sister exchange, the TSX Venture, is the most important bourse in the world for mining investment. But who are the key players and companies behind this mining and energy marketplace? Click on the infographic to find out.

Both exchanges are owned by the TMX Group, which in 2001 purchased the Canadian Venture Exchange (CDNX) and renamed it the TSX Venture Exchange. The CDNX, whose focus was junior resource companies deemed too small to list on the TSX, was in turn a merger of the Vancouver Stock Exchange (VSX) and the Alberta Stock Exchange, and later, the Winnipeg Stock Exchange and the Bourse de Montreal. The VSX, some resource investors may recall, was the home of the Canadian junior mining sector for many years and was considered a highly speculative, though potentially rewarding, venue to invest.

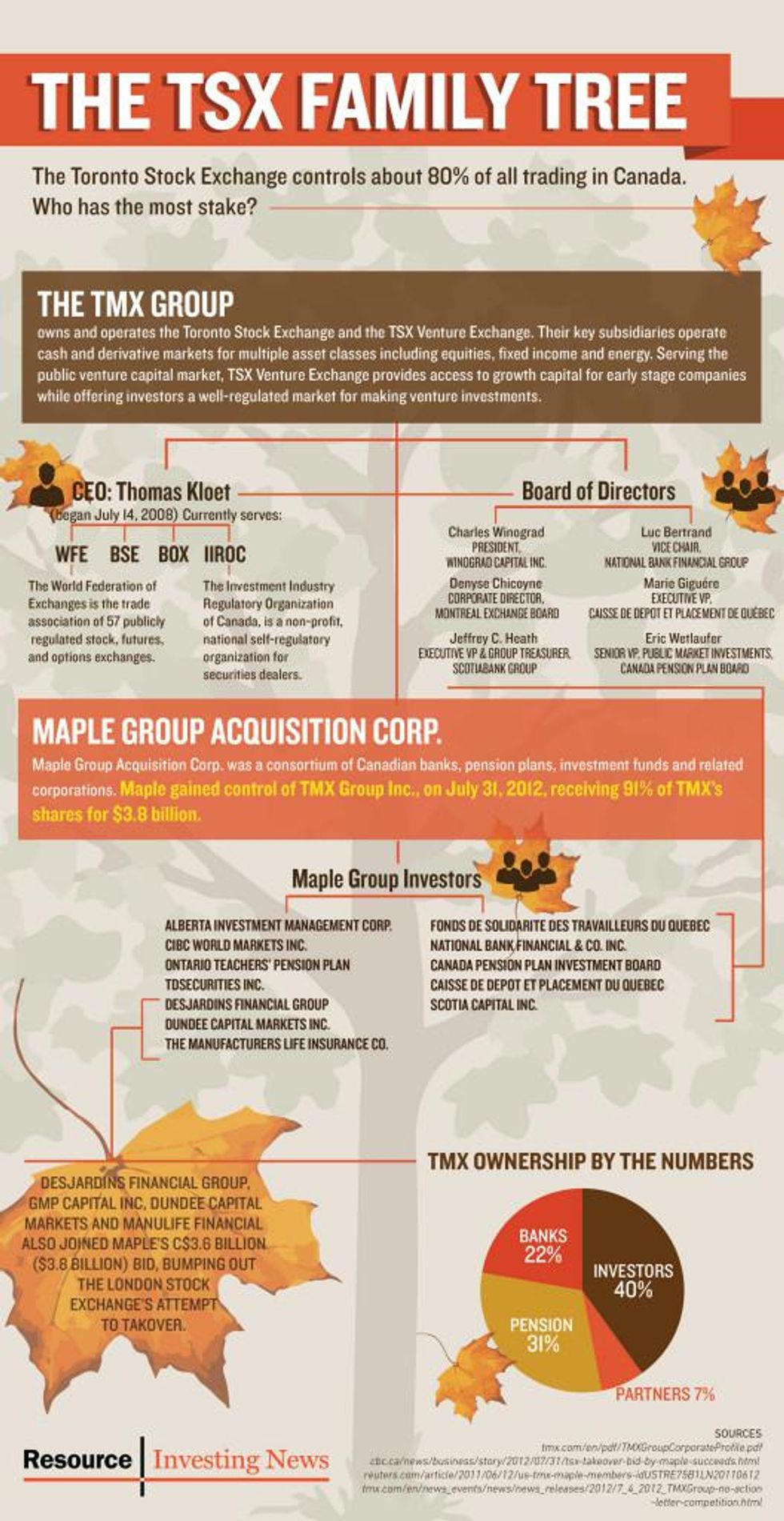

The TMX Group controls about 80 percent of stock trading in Canada.

Mining investment central

The combined TSX/TSXV is considered to be one of the most important repositories of mining investment in the world.

Click to view full sizeAccording to TMX Group data, the two exchanges are home to over half (57 percent) of the world’s publicly traded mining companies. Last year, nearly three quarters (70 percent) of the equity capital raised globally for mining companies was raised on the TSX and TSXV — an amount equal to $10.3 billion. Combined, Canada’s two exchanges currently list 1,673 mining companies, compared to 145 on the Alternative Investment Market (AIM) in London, 708 on the Australian Stock Exchange (ASX), 49 on the Johannesburg Stock Exchange (JSE), 57 on the Hong Kong Stock Exchange and 128 on the New York Stock Exchange. The exchanges are a truly global marketplace, with half of the 9,000 mineral exploration projects held by TSX and TSXV companies being operated outside of Canada, according to the TMX Group.

The TSX and TSXV are also leaders in the oil and gas sector, with more oil and gas companies listed on them than any other bourse.

There is no doubt that the TSX is a powerhouse in mining and energy, but just who is behind this powerful exchange? Resource Investing News recently did some geneology to find out.

Who’s in the club?

We discovered that the TMX Group is controlled by CEO Thomas Kloet and a board of directors. Kloet has been CEO since 2008 and answers to the World Federation of Exchanges, an association of 57 publicly traded stock, futures and options exchanges. He also serves the Investment Industry Regulatory Organization of Canada, a non-profit regulatory organization for securities dealers in Canada.

The TMX Group is comprised of six members from financial institutions. Charles Winograd, the president of the board, is from Winograd Capital. Executive vice president is Marie Giguère from Caisse de dépôt et placement du Québec, and vice chair Luc Bertrand is from National Bank Financial Group. Treasurer Jeffrey Heath, who also serves as executive vice president, is from Scotiabank Group, and Eric Wetlaufer from the Canada Pension Plan board serves as the Group’s senior vice president of public market investment.

There is an impression that the TMX Group is controlled by the big banks, but that is not entirely true. Our research shows that investors own about 40 percent of the TSX. Banks own 22 percent and pension groups owns 31 percent, while other partners account for 7 percent.

Maple Group takes control

In 2012, Maple Group Acquisition gained control of the TMX Group. The consortium of Canadian banks, pension plans, investment funds and related corporations received 91 percent of TMX’s shares for $3.8 billion — outbidding the London Stock Exchange’s attempt to control the TSX.

Alberta Investment Management, the Ontario Teachers’ Pension Plan, TD Securities and Manulife Financial (TSX:MFC) are among the investors behind the Maple Group. Also included are Desjardins Financial Group, Scotia Capital, National Bank Financial and Dundee Capital Markets.

New kids in town?

Recently the TMX Group has come under fire from a number of quarters for failing to adequately serve investors and issuers. This past summer, Royal Bank of Canada (TSX:RY,NYSE:RY) announced that it was leading a group of investors and brokers to compete with the TMX Group. The consortium, backed also by Barclays, CI Financial, IGM Financial, ITG Canada and PSP Public Markets, said it was planning to file an application to regulators by the end of the year. Central to the concerns of the new entity, to be run by Aequitas Innovations, is the rise of algorithmic trading.

The Financial Post reported that Aequitas plans to challenge “certain predatory high frequency trading strategies which have impacted the quality of existing equity markets,” the group said in a statement. “Marketplaces in Canada and around the globe are increasingly out of sync with their traditional users as they attract and cater to volume and revenue-generating trading over traditional investors.”

Meanwhile, the TSX Venture could also be getting some competition, from CNSX Markets, the company that operates the Canadian National Stock Exchange (CNSX). Particularly in mining circles, the CNSX is increasingly seen as a rival to the TSX Venture, which has lost significant value alongside recent declines in commodity prices and mining equities. Issuers on the TSXV have grown increasingly frustrated with the exchange’s seeming inability to attract venture capital and to lower costs for issuers, a topic that has been covered extensively on these pages.

The CNSX was recently given a shot in the arm when Ned Goodman, CEO of Dundee (TSX:DC.A), announced that he was acquiring a third of CNSX Markets to promote the CNSX as a viable alternative to the Toronto Stock Exchange.

Related reading:

Dundee CEO Grabs a Third of CNSX

Venture Alternative? Q&A with Richard Carleton of the CNSX