Weekly Round-Up: Gold Price Reacts to Fresh US Jobs Data

The latest US jobs data shows that 148,000 jobs were created in the US in December, well below the amount added in November.

The gold price was sitting at $1,320.20 per ounce as of 12:00 p.m. EST on Friday (January 5), up a few dollars from levels seen earlier in the day.

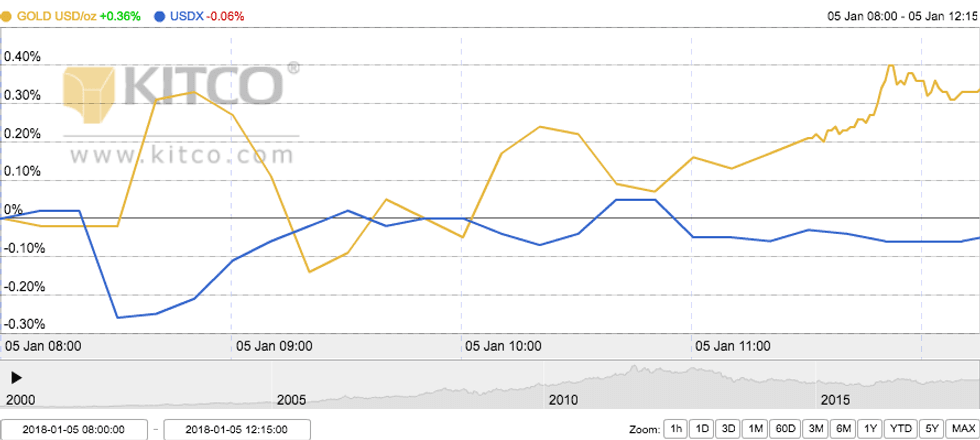

The yellow metal was trending lower in the morning in anticipation of the latest US jobs report, but jumped immediately after its release. The report shows that 148,000 jobs were created in the US in December, well below the 252,000 created in November.

The US dollar generally trades inversely to gold, and it saw a decline when the jobs report was released. The less-positive-than-expected jobs report has some market watchers thinking that the US Federal Reserve may raise interest rates more slowly this year.

Gold price and US dollar index for the morning of January 5, 2018. Chart via Kitco.

Higher interest rates tend to be negative for gold, as they reduce the appeal of non-yielding bullion; conversely, lower interest rates tend to be beneficial for gold. The Fed hiked rates three times over the course fo 2017, and while more hikes are anticipated this year, the number is unclear.

Minutes from the Fed’s most recent meeting show that there is not a firm consensus on how many increases there will be in 2018 — six Federal Open Market Committee members predict three, but three others are calling for four and another three anticipate two.

Some members are resistant to a high number of hikes due to the yield curve, a technical indicator that compares interest rates on the different kinds of borrowing done by the federal government. “In response to our rate hikes, the yield curve has flattened significantly, potentially signaling an increasing risk of a recession,” said Neel Kashkari, president of the Federal Reserve Bank of Minneapolis.

For its part, the silver price moved much the same as gold on Friday, rising as high as $17.25 after the jobs report was released. Later in the day it had sunk slightly; as of 2:09 p.m. EST it was changing hands at $17.07. So far this year the white metal is up 1.54 percent.

On the base metals side, copper prices were fairly flat this week, and took a downward turn on Friday. According to Metal Bulletin, COMEX copper for March delivery was down 1.2 percent, at $3.22 per pound, that day; technical selling and the weak US jobs data weighed on the metal. Copper fared much better last week, when it hit a four-year high on the back of Chinese import data.

Finally, oil prices rose to their highest level since mid-2015 on Wednesday (January 3), buoyed by political risk in Iran. However, experts have emphasized that OPEC’s output is unlikely to be impacted by events in Iran, and many are warning that a correction is coming.

Eugen Weinberg, head of commodities research at Commerzbank (OTCMKTS:CRZBY), told CNBC on Friday that the oil price rally is “definitely due to massive overheating of the speculators and is likely to correct over the next month.” He added, “(I expect) the price of oil to correct by at least 10 to 15 percent over the coming months because the current fundamentals are not justifying this kind of strength.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.