Palladium Still the Fairest Precious Metal: BMO Capital Markets

Last week the firm downgraded its price forecasts for gold, silver and platinum, but boosted its long-term palladium outlook to $950 per ounce.

BMO Capital Markets made waves last week with the announcement that it’s lowered its price expectations for gold, silver and platinum.

That’s bad news for precious metals investors, but luckily there’s still one such metal that the firm believes will do well. That, of course, is palladium.

By the numbers

In a report, BMO Nesbitt Burns analyst Jessica Fung said the firm sees gold averaging $1,190 per ounce in 2015, lower than its previous forecast of $1,275, and $1,238 in 2016, a drop from $1,250. Meanwhile, it sees platinum averaging $1,413 in 2015, down from the previously announced $1,500, and just $1,425 in 2016, a decline from $1,550.

Those numbers aren’t particularly encouraging, but in terms of percentage, the biggest downward outlook revisions made by BMO were for silver. The firm sees the white metal achieving an average price of $17.50 in 2015, a significant drop from its earlier estimate of $20.25. In 2016, it anticipates silver perhaps making it to $19.50.

As mentioned, the bright spot amidst that gloom is palladium. Though BMO’s report states that a “near-term downside risk” is Norilsk Nickel‘s (MCX:GMKN) proposed purchase of US$2 billion worth of palladium from the Russian government, it has nevertheless upped its long-term forecast for the precious metal to $950 from $850.

The reason? BMO anticipates that increased auto demand in countries like China and the US will spur a palladium deficit in the coming years.

Where’s the price?

Discussions about the future are all well and good, but where exactly is the palladium price now?

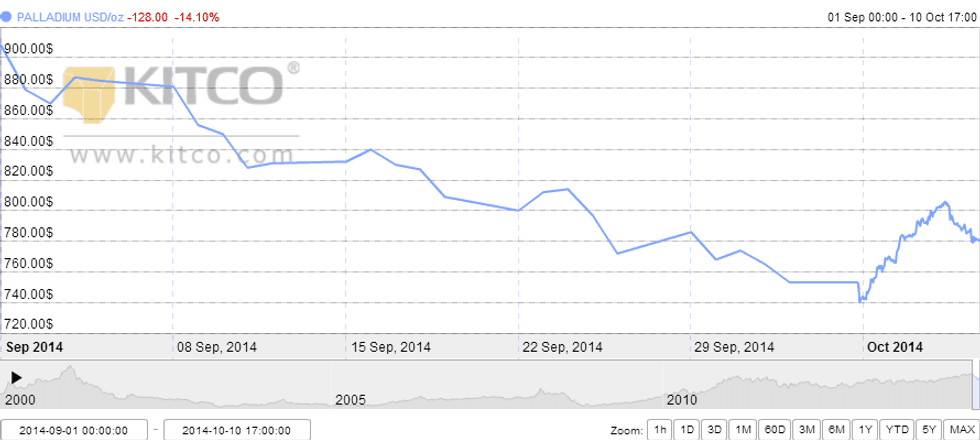

As the chart below shows, the precious metal spent September trending downward, but has had much better luck in October. According to Bloomberg, the metal’s change in fortune at first came as a drop in the dollar pushed all the precious metals up last week. However, the news that Russia and South Africa may attempt to use central bank purchases to boost prices also provided some upward momentum.

There’s been a slight decline in the palladium price since then, and if The Wall Street Journal is to be believed, it’s because investors — unlike BMO — are concerned that economic growth won’t be strong enough to boost car sales (and thus push up palladium demand). “People are looking ahead, and they don’t see a very promising picture of growth outside the U.S.,” INTL FCStone analyst Edward Meir told the news outlet, adding, “[t]his is making them cautious.”

The upshot

BMO’s palladium price outlook is certainly promising, and if investors are lucky, it will eventually play out. However, the fact that the metal’s price is being hurt by concern about car sales even as BMO’s report is optimistic on the same topic is worth noting — it’s a reminder that investors should keep in mind long-term forecasts like BMO’s, but also pay attention to current events.

Palladium closed Friday at $780.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.