Red Pine Announces New Mineral Resource Estimate for the Surluga Gold Deposit at its Wawa Gold Project, Ontario

Red Pine Exploration Inc (TSXV:RPX) (“Red Pine” or the “Company”) announces an updated Mineral Resource estimate conducted by Golder Associates Ltd. (“Golder”) for the Company’s Surluga Deposit at the Wawa Gold Project located near Wawa, Ontario.

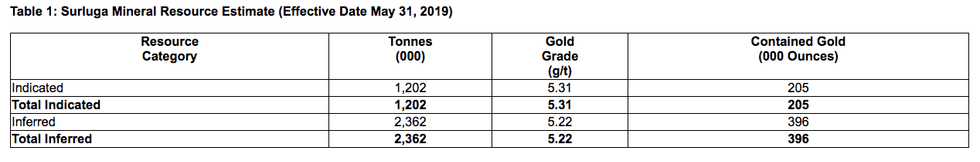

Red Pine Exploration Inc (TSXV:RPX) (“Red Pine” or the “Company”) announces an updated Mineral Resource estimate conducted by Golder Associates Ltd. (“Golder”) for the Company’s Surluga Deposit at the Wawa Gold Project located near Wawa, Ontario. The new Mineral Resource estimate was evaluated for an underground mining scenario and is reported at a 2.7 g/t cut-off within a 2 g/t envelope, and now stands at 1,202,000 tonnes at 5.31 g/t for 205,000 ounces gold in the Indicated category and 2,362,000 tonnes at 5.22 g/t for 396,000 ounces gold in the Inferred category.

The 2015 NI 43-101 Mineral Resource estimate for the Surluga Deposit was an Inferred resource of 19,820,000 tonnes at 1.71 g/t using a 0.40 g/t cut-off (Mineral Resource Statement, Surluga-Jubilee Gold Deposit, Wawa Gold Project, Ontario, SRK Consulting (Canada) Inc., May 26, 2015). This new underground resource represents a significant increase in grade, quality and continuity of the gold zones at Surluga and a shift from an open-pit development plan to a high-grade underground model.

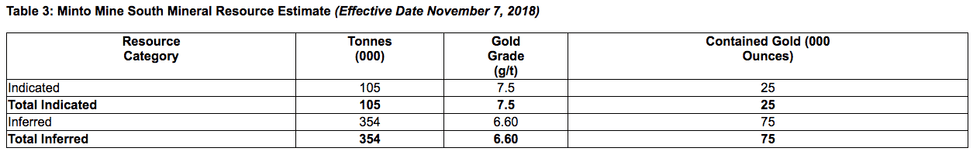

Golder’s new technical report will include both Mineral Resource estimates identified, to date, on the Wawa Gold Project – the updated Surluga Deposit noted above, and the previously reported NI 43-101 Minto Mine South Deposit (105,000 tonnes at 7.5 g/t gold in the Indicated category for 25,000 ounces of gold and 354,000 tonnes at 6.6 g/t gold in the Inferred category for 75,000 ounces of gold, Initial Technical Report for the Minto Mine South Property, Golder Associates Ltd., effective Nov. 7, 2018). The technical report will be filed on SEDAR within 45 days of this press release.

Highlights of Golder’s Mineral Resource estimates include:

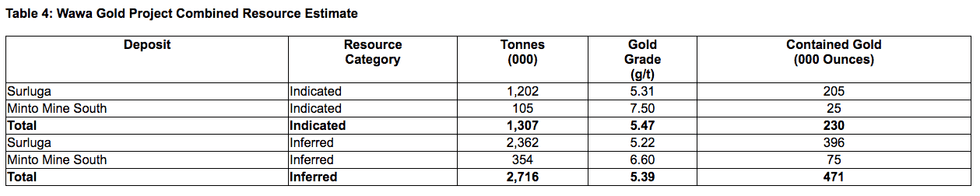

- The combined Minto Mine South and Surluga deposits contain 1,307,000 tonnes @ 5.47 g/t gold for 230,000 ounces of gold in the Indicated Category;

- The combined Minto Mine South and Surluga deposits contain 2,716,000 tonnes @ 5.39 g/t gold for 471,000 ounces of gold in the Inferred Category;

- Over 95% of the contained ounces at both deposits are located between surface and 350 metres depth;

- Both deposits remain open at depth; and

- The underground developments of the historic Jubilee and Surluga mines provide access to the zones of the Surluga resource.

Quentin Yarie, President and Chief Executive Officer of Red Pine, stated, “One year ago, we began a strategic optimization of the gold assets at our Wawa Gold Project. This new resource estimate speaks to the un-tapped potential of the gold deposits on the property. With our 59,000 metres of diamond drilling and the development of a robust geological model, we have significantly improved the quality, grade and the continuity of the high-grade gold zones identified so far, at the Wawa Gold Project. The new resource also highlights the fact that we’ve only ‘scratched the surface’ at Wawa.

“The Surluga and Minto Mine South deposits are estimated to contain approximately 230,00 ounces of Indicated and 471,000 ounces Inferred Mineral Resources at grades over 5 g/t, between surface and 350 metres depth. (Figure 1) Other gold deposits in Canada and around the world typically extend to vertical depths exceeding 2 kilometres. The down-dip extensions of the Minto Mine South and Surluga deposits, below 350 metres vertical depth, remain open for expansion. Additionally, the numerous gold-bearing structures identified on the property, some of them hosting historic gold mines, are under-explored.

“The underground workings of the historic Surluga and Jubilee mines access most of the Surluga Deposit resource. This will facilitate any potential underground development plan, and the short distance between the Minto Mine South Deposit and the Surluga Deposit, outlines the potential synergies for the future development of those gold deposits.”

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d9d5e63d-ebab-4e9a-8742-c5ea9e2e175f

Mineral Resource Estimate

Golder prepared a Mineral Resource estimate of the Surluga deposit, part of the Wawa Gold Project (the Project) for Red Pine in accordance with National Instrument (NI) 43-101 and following the requirements of Form 43-101F1. Golder’s estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Estimation of Mineral Resource and Mineral Reserves Best Practices Guidelines (November 2003).

The Qualified Person (QP) for the Surluga Mineral Resource estimate is Mr. Brian Thomas, P.Geo., an independent QP, as defined under NI 43-101. The effective date of this Mineral Resource estimate is May 31, 2019.

A QP personal site inspection of the Wawa Gold Project was conducted between March 21, 2019 – March 22, 2019, in order to observe site conditions, review geological data collection and Quality Assurance and Quality/Control (QA/QC) procedures and results, confirm drill collar locations, and complete verification sampling of drill core.

The new Mineral Resource estimates for the Wawa Gold Project are supported by approximately 53,000 metres of new diamond drilling in the Minto Mine South and the Surluga deposits that were completed between November 2016 and January 2019. The resource update for the Surluga Deposit also includes the results from the sampling of 42,000 metres of historic drill core that were never previously assayed.

Table 1 reports the Indicated and Inferred Mineral Resources for the Surluga Project, and Table 2 summarizes the sensitivity relative to other mining cut-offs. Mineral Resources for Surluga were evaluated for mining continuity by reporting within a 2 g/t reporting envelope.

The reader is cautioned that Mineral Resources are not Mineral Reserves, and do not demonstrate economic viability. There is no certainty that all, or any part, of this Mineral Resource will be converted into Mineral Reserve. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

Notes:

- All Mineral Resources are reported at a 2.7 g/t gold cut-off from within a 2 g/t envelope.

- A 2.7 g/t cut-off is supported for potential underground long hole mining by the following economic assumptions: Gold Price: $1,200 USD, Foreign exchange rate: $CA/$US 0.75, Gold Recovery: 90%, Operating Expense (OPEX): CAD $125 / tonne ($85 mining, $25 milling, $15 G&A).

- Tonnage estimates are rounded to the nearest 1,000 tonnes.

- g/t – grams per tonne.

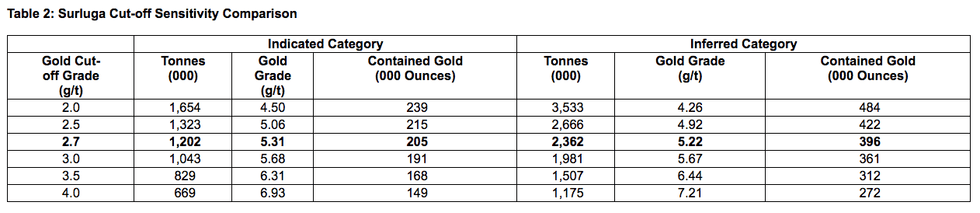

Table 2: Surluga Cut-off Sensitivity Comparison

Notes:

- Official Mineral Resource estimate highlighted in bold.

- Tonnage estimates are rounded to the nearest 1,000 tonnes.

- g/t – grams per tonne.

The Wawa Gold project also includes the Minto Mine South Deposit which has a current Mineral Resource estimate effective November 7th, 2018. The Minto Mine South estimate is summarized in Table 3.

Notes:

- All Mineral Resources reported at a 3.5 g/t gold cut-off.

- A 3.5 g/t cut-off is supported by the following economic assumptions for potential underground cut and fill mining: Gold Price: $1,200 USD, Foreign exchange rate: $CA/$US 0.75, Gold Recovery: 90%, Operating Expense (OPEX): CAD $160 / tonne ($120 mining, $25 milling, $15 G&A).

- Tonnage estimates are rounded to the nearest 1,000 tonnes.

- g/t – grams per tonne.

The combined Mineral Resource estimate for the Wawa Gold Project, consisting of the Surluga and Minto Mine South deposits, is summarized in Table 4 as follows.

Notes:

- Surluga Mineral Resources reported at a 2.7 g/t gold cut-off from a 2-g/t envelope. The 2.7 g/t cut-off is supported by the following economic assumptions for potential underground long hole mining: Gold Price: $1,200 USD, Gold Recovery: 90%, Operating Expense (OPEX): CAD $125 / tonne ($85 mining, $25 milling, $15 G&A).

- Minto Mineral Resources reported at a 3.5 g/t cut-off which is supported by the following economic assumptions for potential underground cut and fill mining: Gold Price: $1,200 USD, Gold Recovery: 90%, Operating Expense (OPEX): CAD $160 / tonne ($120 mining, $25 milling, $15 G&A).

- Tonnage estimates are rounded to the nearest 1,000 tonnes.

- g/t – grams per tonne.

Exploration potential of the Wawa Gold Project

The Wawa Gold Project hosts several gold-bearing structures that, combined, form the Wawa Gold Corridor, a structure that extends for more than 6 kilometres. The new 2019 Mineral Resource estimate for the Wawa Gold Project indicates that near-surface gold deposits grading over 5 g/t gold can be found along this corridor.

Red Pine’s drilling in the Surluga Deposit has been limited to 350 metres depth. In the Minto Mine South Deposit, drilling was mostly constrained to 250 metres below surface. Widely spaced gold intersections in both the Minto Mine South and the Surluga Deposit, beyond the footprints of the estimated resources, indicate that the structures extend at depth, that they remain mineralized, and that additional drilling could further expand the estimated resources. Also, many shallow drilling gaps, which showed significant gold mineralization in the 2018 drill program, remain to be tested in the Surluga Deposit.

The Wawa Gold Corridor also includes many other gold-bearing structures and historic mines that remain under-explored: the recently discovered Cooper Structure, the Hornblende, the Grace mine, the Minto B, the Parkhill #4-Minto Lower, the southern extension of the Jubilee Shear Zone. Gold mineralization is known to occur in many of these structures and historic mining and/or diamond drilling suggests a potential for near-surface resource definition.

Red Pine’s future drilling programs will be focused on converting additional exploration targets into Mineral Resources.

On-site Quality Assurance/Quality Control (“QA/QC”) Measures

Drill core samples were transported in security-sealed bags for analyses to Activation Laboratories Ltd. in Ancaster, Ontario. Individual samples are labeled, placed in plastic sample bags and sealed. Groups of samples are then placed into durable rice bags and then shipped. The remaining coarse reject portions of the samples remain in storage if further work or verification is needed.

Red Pine has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. As part of its QA/QC program, Red Pine inserts external gold standards (low to high grade) and blanks every 20 samples in addition to random standards, blanks, and duplicates.

Qualified Persons

Quentin Yarie, P.Geo. is the qualified person responsible for preparing, supervising and approving the scientific and technical content of this news release.

Brian Thomas, P.Geo. is the qualified person responsible for the contents of the Mineral Resource Estimate section of this news release.

About Red Pine Exploration Inc.

Red Pine Exploration Inc. is a gold and base-metals exploration company headquartered in Toronto, Ontario, Canada. The Company’s common shares trade on the TSX Venture Exchange under the symbol “RPX”.

Red Pine has a 60% interest in the Wawa Gold Project with Citabar LP. holding the remaining 40% interest. Red Pine is the Operating Manager of the Project and is focused on expanding the existing gold resource on the property.

For more information about the Company visit www.redpineexp.com

Or contact:

Quentin Yarie, President & CEO, (416) 364-7024, qyarie@redpineexp.com

Or Mia Boiridy, Investor Relations, (416) 364-7024, mboiridy@redpineexp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Click here to connect with Red Pine Exploration Inc (TSXV:RPX) for an Investor Presentation.

Source: www.globenewswire.com