Pinecrest Announces Start of Drill Program at Its 100% Owned Enchi Gold Project, Ghana & Management Update

Pinecrest Resources Ltd. (TSXV:PCR) (the “Company” or “Pinecrest”) is pleased to announce the commencement of a 3,000 metre Reverse Circulation (“RC”) drill program on the 100% owned Enchi Gold Project (“Enchi or the Project”), located in Southwest Ghana, a region well-known for prolific gold production.Highlights on the Enchi Gold Project Pinecrest has commenced a RC …

Pinecrest Resources Ltd. (TSXV:PCR) (the “Company” or “Pinecrest”) is pleased to announce the commencement of a 3,000 metre Reverse Circulation (“RC”) drill program on the 100% owned Enchi Gold Project (“Enchi or the Project”), located in Southwest Ghana, a region well-known for prolific gold production.

Highlights on the Enchi Gold Project

- Pinecrest has commenced a RC drilling program testing shallow extensions of the existing open pit, one million ounce, Inferred gold resource (37.36 Mt grading 0.9 g/t) at Enchi

- The program includes 3,000 meters in approximately 27 RC drill holes

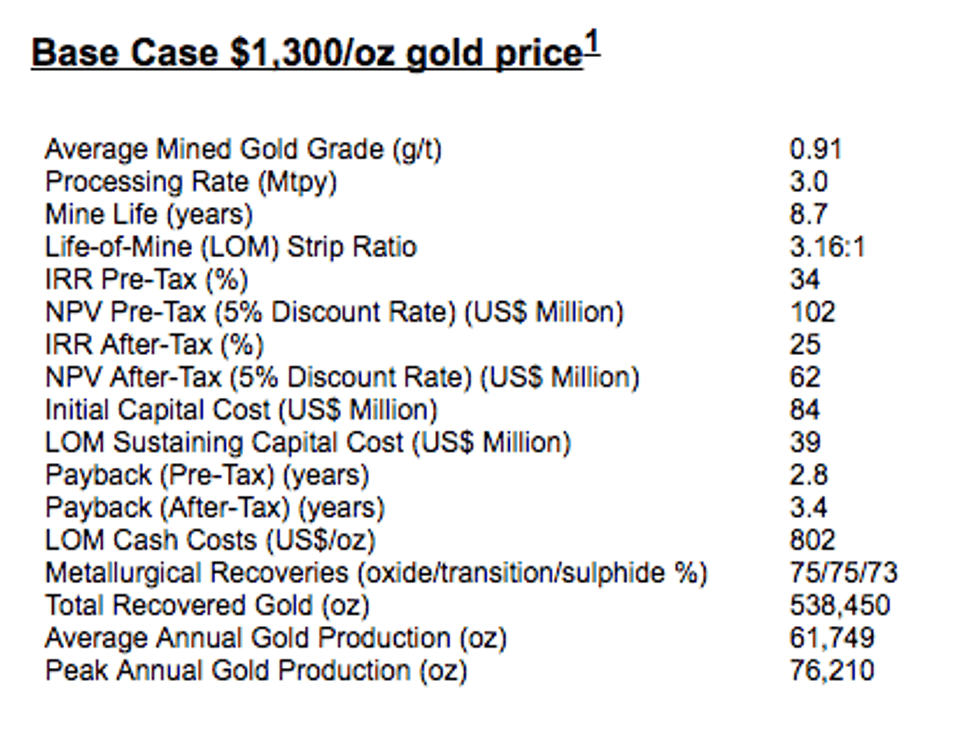

- Past work at Enchi has included extensive RC and diamond drilling (52,385 m in 646 drill holes), resource estimation and a Preliminary Economic Assessment (“PEA”) study (Pre-Tax NPV 5%: US$102 million using US$1,300/oz gold)

- The Enchi gold deposit remains open for further resource expansion along strike and to depth. Numerous, additional high priority gold targets exist on the 568 km2 property

Ryan King, President and Director of Pinecrest, commented: “The Company is pleased to be starting the 2017 RC drilling program which will test on-strike targets of the current gold resource and follow-up on high priority targets where previous drilling has been limited. Based on the current Preliminary Economic Assessment, at market gold prices we have the potential for a robust project however we believe there is significant opportunity to expand on the current one million ounce gold resource. The Enchi gold deposit covers 40 km of the prolific Bibiani Shear Zone were several multi-million-ounce gold deposits have been discovered and mined including the Chirano gold mine operated by Kinross Gold Corporation located 70 km northwest of the Project.”

The 2017 Enchi Drill Program

The 2017 RC drill program will include approximately 27 holes totalling 3,000 metres of infill, step out and exploration drilling on the Boin and Sewum Zones and two new zones outside of the maiden Inferred Resource; Boin northwest and Kojina Hill both representing high priority targets based on geological, geochemical and geophysical surface work and previous drilling.

BOIN NORTHWEST (‘NW”) TARGET

Boin NW target is located approximately 1000 metres northwest of the main Boin Gold Zone and importantly not currently included in the NI 43-101 Inferred Resource Estimate or PEA. Previous trenching intersected 26 metres grading 0.61 g/t Au and 40 metres grading 0.54 g/t Au including 10 m grading 1.64 g/t Au. Past limited drilling intersected 23 m at 0.43 g/t Au and 39m at 0.43 g/t Au within the near surface oxidized material.

KOJINA HILL TARGET

Kojina Hill is located approximately 400 metres northwest of the Nyam Gold Zone and not included in the previous NI 43-101 Inferred Resource Estimate. Previous drilling highlights from only 8 drill holes included near surface intercepts of: 42 metres grading 1.68 g/t Au and 17 metres grading 0.94 g/t Au.

Enchi Gold Project Preliminary Economic Assessment Highlights

The Enchi Gold Project is road accessible, is on the Ghanaian power grid and is situated along the eastern margin of the Sefwi gold belt that hosts multi-million ounce producing mines such as the Chirano Gold Mine and past producing Bibiani Gold Mine. Enchi includes six prospecting licenses within a total 568km2 land package. Previous work carried out on the project has included: RC and diamond drilling (52,385 m), airborne geophysical surveys, soil samples and trenching from numerous targets which resulted in an Inferred Resource Estimates and a Preliminary Economic Assessment conducted on three main gold zones (Boin, Nyam and Sewum). All zones within the Inferred Resource are open for expansion down dip and along strike, particularly the Boin zone that has undrilled internal gaps in the well-defined structure of up to 400 metres in strike length. Additional new high priority targets include Boin Northwest and Kojina Hill both located within 10 km of the main Boin zone where previous work completed includes trenching and drilling.

A NI 43-101 compliant Preliminary Economic Assessment (the “PEA” or the “Study”) completed in 2015 was prepared by WSP Canada Inc. (“WSP”) using a base case, pit constrained Inferred Mineral Resource of 1.07 million ounces (oz) of gold (37.3 million tonnes grading 0.9 gram of gold per tonne (g/t Au), at a cut-off of 0.5 g/t Au). The PEA contemplated an owner operated, open pit, heap leach operation processing 3.0 million tonnes per year (Mtpy). All currency figures are in US Dollars (US$ or $) and using a base case gold price of $1,300/oz, the Study shows that the Project has net Pre-Tax cash flow of $145 million, a Pre-Tax Net Present Value (NPV) at 5% discount rate of $102 million and an Internal Rate of Return (IRR) of 34%. (See news release linked here dated June 29, 2015 for full details and Technical Report filed on SEDAR under Pinecrest Resources Ltd.)

The PEA is preliminary in nature, and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the preliminary economic assessment will be realized. Numbers may not add exactly due to rounding. Cash cost includes all operating costs, royalties, refining charges, environmental monitoring, tenure fees as well as general and administration costs. Cash cost excludes any capital cost, either initial or sustaining and closure and remediation costs.

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

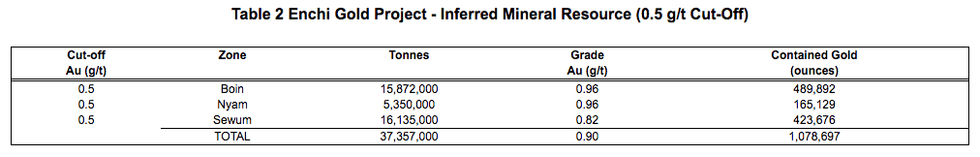

The PEA was based on the July 15, 2014 NI 43-101 Inferred Mineral Resource estimate prepared by WSP and using a 0.5 g/t cut-off. (See Table 2 for details).

Table 2 Enchi Gold Project – Inferred Mineral Resource (0.5 g/t Cut-Off) (See Table 2 for details).

- CIM definition standards were followed for the resource estimate.

- The 2014 resource models used ordinary kriging (OK) grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids.

- A base cut-off grade of 0.5 g/t Au was used for reporting resources with a capping of gold grades at 18 g/t.

- A US$1,300/ounce gold price, open pit with heap leach operation was used to determine the cut-off grade.

- A density of 2.45 g/cm3 was applied.

- Numbers may not add exactly due to rounding.

- Mineral Resources that are not mineral reserves do not have economic viability.

The 2014 Mineral Resource estimate was based on 52,385 metres of diamond and RC drilling in 646 holes as well as data from 102 surface trenches totalling 13,799 metres. The drilling is generally spaced at 25 to 50 metre intervals.

Mr. Gregory Smith, P.Geo, the Vice-President of Exploration of the Company, is the Qualified Person as defined by NI 43-101, and is responsible for the accuracy of the technical data and information contained in this news release.

Management Update

The Company also announces that Mr. George Salamis is stepping down as Chief Executive Officer of the Company effective immediately to focus on his new roll as President and CEO of Integra Resources Corp. Mr. Salamis will continue as a director of Pinecrest. The Board of Directors would like to thank Mr. Salamis for his contribution as a Senior Officer of Pinecrest and looks forward to continuing to work with George at the Board level. Ryan King, current President and Director of the Company will expand his current role with his appointment as President & Chief Executive Officer.

About Pinecrest Resources

Pinecrest engages principally in the acquisition, advancement and development of precious metal properties with the Company’s primary focus being the 100% owned Enchi Gold Project located in Southwest Ghana. Major shareholders of Pinecrest include Kinross Gold Corporation, Management and Directors.

Pinecrest Resources Ltd.

“Ryan King”

Ryan King

President, CEO & Director

For further information contact:

Ryan King

604 628-1012

www.pinecrestresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

This news release contains certain forward-looking statements, Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or does not expect”, “is expected”, anticipates” or “does not anticipate” “plans”, “estimates” or “intends” or stating that certain actions, events or results “ may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

Safe Harbor Statement under the United States Private Securities Litigation Reform Act of 1995: Except for the statements of historical fact contained herein, the information presented constitutes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements including but not limited to those with respect to the price of gold, potential mineralization, reserve and resource determination, exploration results, and future plans and objectives of the Company involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of Atlas to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Source: globenewswire.com