Nexus Gold Plans Drill Program at Dakouli 2 Gold Concession, Burkina Faso, West Africa

Nexus Gold Corp. (TSXV:NXS) (OTC:NXXGF) (FSE:N6E) is pleased to provide an update regarding the proposed November drill program at it’s 100%-owned Dakouli 2 gold concession, located in Burkina Faso, West Africa.

Nexus Gold Corp. (“Nexus” or the “Company”) (TSXV:NXS) (OTC:NXXGF) (FSE:N6E) is pleased to provide an update regarding the proposed November drill program at it’s 100%-owned Dakouli 2 gold concession, located in Burkina Faso, West Africa.

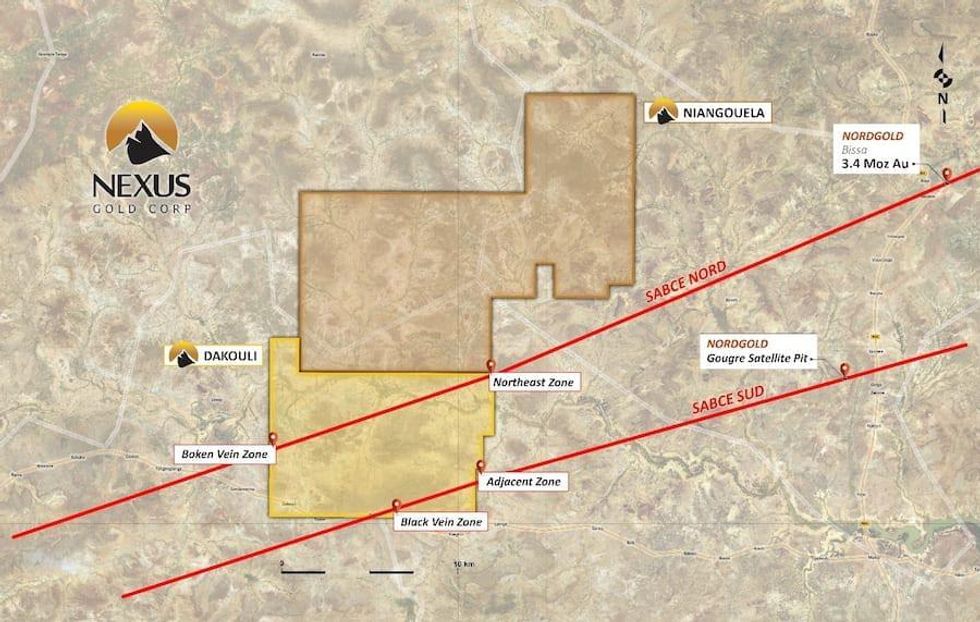

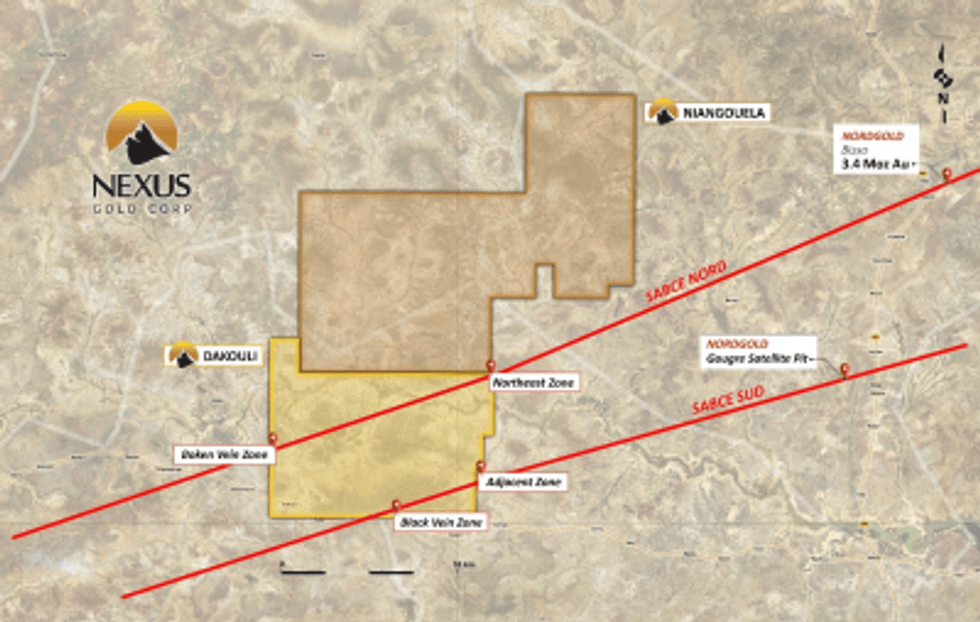

The Dakouli 2 exploration permit is a 98-sq km (9,800 hectares) gold exploration property located approximately 100 kilometers due north of the capital city Ouagadougou. The drill program, which would consist of up to 2000 meters, is designed to test several of the ground gold anomalies identified to date. The Company is currently determining crew and drill rig availability.

In late 2018 Company geologists conducted a comprehensive ground reconnaissance program to the west and south of the main orpaillage (artisanal zone) and identified new near surface workings being exploited by artisanal miners. Rock samples collected from these new zones returned contained various concentrations of visible gold, including coarse nuggety samples.

A total of 12 samples were taken from the Northeast Zone, obtained between 8-18 meters below surface from artisanal shafts and pits, with six returning significant grades between 2.90 g/t Au and 29.5 g/t Au, including 27.5 g/t Au and 12.4 g/t Au from samples containing visible gold (see Figure 1, and Company news release dated January 8, 2019).

Figure 1: Example of visible gold in quartz recovered at the Dakouli 2 concession

Follow up work outlined an anomalous zone extending some 500 meters west from the sample zones. Based on those results the Company initiated a 150-line kilometer soil geochemical survey covering the northern half of the Dakouli 2 property and southern portions of the contiguous Niangouela property. This survey identified three prominent gold geochemical trends. The primary gold trend parallels the Sabce fault zone extends for approximately 10 kilometers, in a northeast – southwest direction and bisects the property from the north east corner of the property to its western boundary. The Sabce fault hosts multiple deposits including Nordgold’s 3.4M oz Bissa Mine, located approximately 25km east of the Dakouli ground.

Two secondary gold trends which extend for approximately 6.5 kilometers each are oriented in a northwest to southeast direction and bisect the primary trend. All three gold geochemical trends are coincidental to geophysical trends identified from the national regional airborne geophysics. The geochemical surveys and sampling work done to date have generated multiple compelling targets the Company intends to begin testing in this initial drill program.

The Dakouli permit lies immediately south of, and contiguous to, the Company’s Niangouela Gold Concession, which has been explored over the past two years. Drilling at Niangouela has returned significant intercepts, including 26.69 g/t Au over 4.85m, including 132 g/t Au over 1m, and 4 g/t Au over 6m, including 20.5 g/t Au over 1m (see Company news releases dated March 7, 2017 and April 5, 2017).

Click Image To View Full Size

Figure 2: Dakouli 2 concession with artisanal zones, and bisecting Sabce faults in red

About the Company

Nexus Gold is a Canadian-based gold development company with an extensive portfolio of nine exploration projects in West Africa and Canada. The Company’s West African-based portfolio totals over 560-sq kms (56,000+ hectares) of land located on active gold belts and proven mineralized trends, while it’s 100%-owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario, the New Pilot Project, located in British Columbia’s historic Bridge River Mining Camp, and three prospective gold-copper projects (3,300-ha) in the Province of Newfoundland. The Company is focusing on the development of several core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its growing portfolio.

For more information please visit www.nexusgoldcorp.com.

Warren Robb P.Geo., Vice-President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for the technical information contained in this release.

On behalf of the Board of Directors of

NEXUS GOLD CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.