Mining Investor Guide: The Newmarket-Crocodile Gold Merger

Cipher Research breaks down the recently announced merger between Newmarket Gold and Crocodile Gold.

On May 11, 2015, Crocodile Gold Corp and Newmarket Gold Inc. announced that they are merging to establish a new platform for gold asset consolidation.

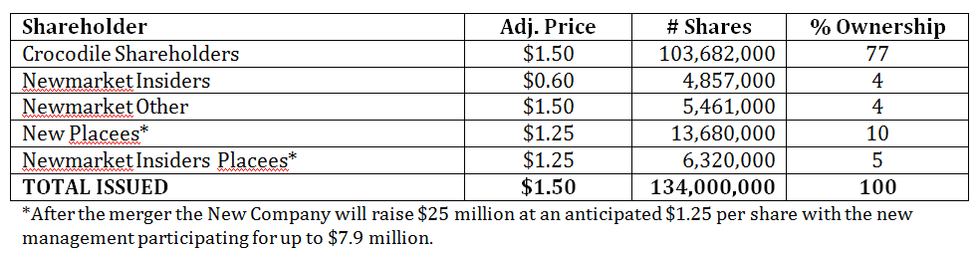

Based on reported information, the structure of the new company (“NewCo”) will look roughly like this:

Newmarket brings a good management team, less than $1.5 million in cash and a market cap of $15 million to the table in exchange for which, Crocodile has agreed to give up 8% of the new company.

The question is: why would a quality gold mining company with a “track record of free cash flow generation” be willing to pay such a high price for what amounts to a high quality management team?

The answer is that on the surface things may appear better than they actually are.

Although production has been increasing and Crocodile has generated slightly positive free cash flows over the last two years; operating costs are a major concern. They represent over 70% of revenues for each of the last 3 years, leaving very little room for further development of mining operations never mind generating a return for shareholders. The high percentage of operating costs is due to the relatively low grades for the underground mines and will not change until gold prices increase dramatically.

Investments in mining property (IMP) have been uncharacteristically low at 24% of revenues over the last two years (down 45% in 2012). In our opinion this number will rise significantly in the coming years as the mines will require increased development work to maintain production levels than has been done in the last two years. Even a small increase in IMP will erode what little cash flows exist.

The next question: what is the value to each party?

Value to Newmarket Gold

Newmarket stated as far back as 2013 that they were looking to acquire production and near production opportunities and grow into a mid-tier gold mining company.

Crocodile Gold provides a perfect vehicle from which to launch this strategy:

- Relatively large resource base

- Significantly large global resource base (total Proven, Probable, Measured, Indicated and Inferred Reserves and Resources of 7.26 million oz Au);

- Production Increasing

- Currently at almost 225,000 oz/yr

- Positive Cash Flows (slightly)

- A result of very disciplined cost controls over the last couple of years

- Low market valuations

- Market capitalization (MC)/oz of $18/oz and enterprise value (EV) of $27/oz prior to the merger announcement on May 11

- In late 2014 Crocodile’s MC and EV were as low as $10/oz and $18/oz

- Peers have MC and EV’s of in range of $75/oz and $100/oz

- Ability to acquire positions well below market value

- Management owns 56% and controls at least 75% (38.73 million shares) at ave cost of $0.12/share of Newmarket or $0.60/share of NewCo (less if admin fees of $1.25 million to related parties are factored in)

- Newmarket shareholders will own 8% (10.3 million shares) of NewCo’s expected 134 million @ $1.50/share

- Newmarket mgmt. and associates invested $4.6 Mi and were paid $1.25 Mi in fees (through Dec 2014); they will get an expected $15 Mi worth of shares in NewCo

- Crocodile traded 80 million shares (25% of total issued) at ave $0.18/share in 8 months leading up to May 11th announcement (closed at $0.30)

Value to Crocodile Gold

- Increased Liquidity and Valuations

- Over the last couple years the company’s efforts have been geared toward cost cutting and turning the operation around to show positive cash flows and this has come at the cost of marketing. Liquidity levels have dropped significantly; as a result the share price has fallen from $1.60 at the end of 2010 to as low as $0.13 in late 2014 before rebounding to its current level of around $0.30.

The new management will be able to move the share price up and then embark on an M&A strategy adding more ounces to the resource base and increasing production. This should result in higher cash flows higher liquidity and valuations for existing shareholders. It follows that Crocodile Gold would eagerly support the proposed merger.

The real question now is: What is a fair value for the merged entity and what strategy should be employed?

Cipher’s take

Cipher conducted its Geonomic Valuation for Crocodile and came up with $200 million or $0.42 per share based on current operations and assets. If the company demonstrates an ability to maintain positive cash flows form its existing operations by keeping its IMP at current levels without impacting production this value could rise by up to 5 times.

With a current market capitalization of $170 million we would consider Crocodile Gold as a very speculative buy on its own.

NewCo is expected to have 134 million shares issued at a projected share price of $1.50 on closing, valuing NewCo around $200 million.

The Newmarket team will be well positioned and will likely promote NewCo to MC and EV per ounce at least as high and most likely exceeding those of its peers. Once this is achieved they will likely raise significant capital and embark on an M&A strategy to acquire additional production and reserves and resources and grow a mid to major size gold mining company. The result will be dilutive growth in value but liquidity should rise considerably as market cap grows.

Cipher’s strategy is to acquire positions in Crocodile around the $0.30 level ($1.50 post merger) and look for a double or more after closing and leading up to the next acquisition.

Strategy beyond that will be dependent on the Value of the assets acquired.

Columnist Rod Husband is a partner at Cipher Research. Cipher Research is an independent research and analysis company that covers the mining and metals sector of the commodity markets. For more information on this topic or on Cipher Research please visit: https://www.cipherresearch.com or contact info@cipherresearch.com.