Live from Colorado: Watch the Sector's Stars Present to Bankers and Institutions Keen for Deals

Resource Maven Gwen Preston reports on Richmont Mines, Kaminak Gold, Integra Gold and Constantine Metal Resources from the Precious Metals Summit.

By Gwen Preston

Gwen Preston is the mind behind Resource Maven, an investment newsletter focused on metals exploration, development, and mining. To follow Gwen’s investment ideas and learn her strategies for managing risk in this volatile market, visit www.resourcemaven.ca and sign up for a free trial.

Disclosure: Gwen owns shares of Kaminak Gold.

The broad markets are volatile and the metals markets have been bear for almost five years. In short, it’s ugly out there.

But the best opportunities are born when, as the saying goes, “there’s blood in the streets.”

Mining majors and portfolio managers are heading to Colorado this week to look for these opportunities at the Precious Metals Summit, where the select group of explorers and developers who have not just survived the bear market but continue to thrive are gathering to talk shop.

Four companies come to mind. All four have multiple drill rigs turning in multi-million dollar programs. Collectively, three of the four have raised more than $100 million in financings over the last two years. The fourth has a partner spending many millions to earn a minority stake in its flagship project.

These are the kinds of companies that will move first and farthest when the metals markets resurface – or before. Mining companies know the best time to acquire new assets is at the bottom. Colorado is a chance for them to talk to targets about news and results…and to advance potential deals. Portfolio managers will be similarly on the hunt, for new buys.

This year investors can get a glimpse into this event, which previously was restricted to buy-side institutions only. The Precious Metals Summit is making videos of each talk available, which means you can see how the president of a promising juniors pitches his or her company to the movers and shakers of mining.

There are 103 companies presenting at the show, so how to know which talks to watch?

I suggest starting with the four companies I just mentioned.

Reporting Live from Colorado: Watch Exclusive Webcasts

Join 150 buy side institutions, 75 sell side brokers, analysts and bankers in Beaver Creek, just 120 miles west of Denver

+Constantine Metals: Launch webcast with CEO, Garfield MacVeigh

+Integra Gold: Launch webcast with CEO, Stephen de Jong

+Kaminak: Launch webcast with CEO, Eira Thomas

+Richmont Mines: Launch webcast with CEO, Renaud Adams

Why these companies? Because mining markets are reliably cyclical and when they rebound certain kinds of companies always outperform.

The first to move when metals rise are producers – and they amplify the movement. Makes sense: if a miner can produce gold for $1,000 an ounce, a gold price increase from $1,100 to $1,300 triples their profit margin!

In a good market, miners carry a price premium for that exact reason. But this is not a good market. It is a market where you can buy into a profitable gold miner with cash in the bank and a rising production profile for 30% what it cost a few years ago. Provided you can hold on until gold starts to go, that kind of company represents a pretty safe bet.

The next kind of company that moves when metals go are those with assets nearly ready for development. To be ready takes permits, engineering, metallurgy, social legwork, and – above all – economics. The proposed mine has to make sense economically, and that means turning a profit at today’s low metal prices.

There is a dearth of such projects today – good ones at least – because the bear market robbed many assets of momentum. That lack is good, for the companies that do have near-development assets in hand. When mining starts to move, majors looking to restock their hollowed out project pipelines will be fighting to acquire these assets. Investing in these near development assets is another safe way to position for profit within the mining rebound.

Enough setting of the stage. Let’s look at a few examples.

Richmont Mines

Richmont Mines (TSX:RIC,NYSEMKT:RIC) offers all of the attributes I listed to look for in a gold miner. The company owns two gold mines: the Island mine in Ontario and the Beaufor mine in Quebec. Beaufor is an older mine that is only expected to produce some 20,000 to 25,000 oz. in 2015. Richmont just decided to develop the recently discovered Q zone, which will add two years of 20,000 to 25,000-oz. per year production. The ounces will help, but Beaufor is not the focus.

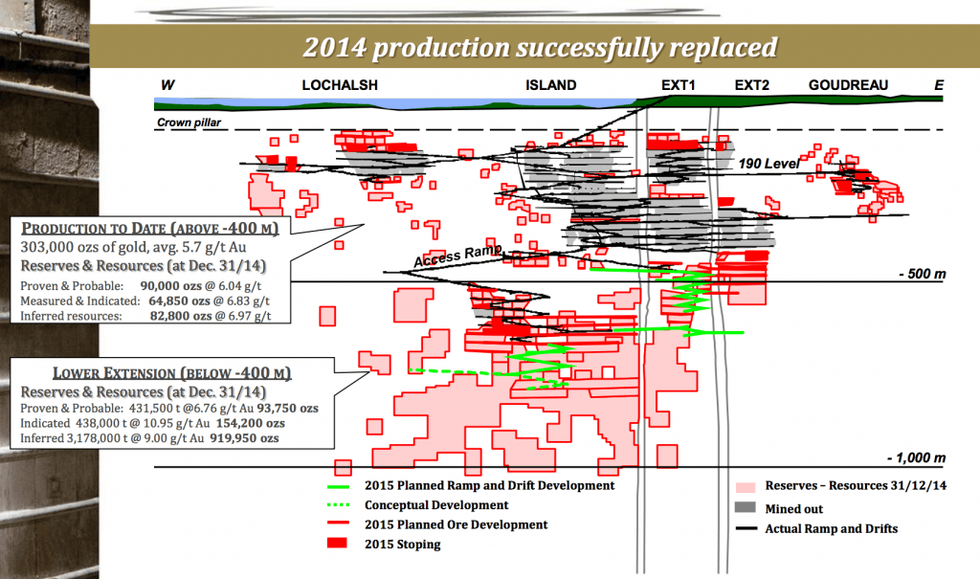

Island is another story. The mine churned out 42,000 oz. gold last year and is on track to better that amount this year. Costs have crept up some, but there is good reason for that.

Richmont has been operating the mine since 2007, but in 2012 the company ramped up exploration and drilled 100,000 metres in 24 months. The effort outlined a high-grade, million-ounce resource beneath the existing mine. Specifically, the new zone offers 154,200 indicated oz. at 10.95 grams gold and 919,950 inferred oz. at 9 grams gold. And now Richmont is looking for even more gold through a 23,000-metre drill program that will probe deeper.

Nice grades, better in fact than the resource that has been mined to date, and sitting right below the mine.

Richmont took this achievement and ran with it. In early 2014 the company closed a $35-million financing, then repeated that feat in early 2015. With that pile of cash RIC is developing the new resource as quickly as possible.

The company is spending $48 million at Island this year. The big jobs are extending the main ramp to 750 metres depth and the east ramp to 570 metres depth, adding a 600-metre long exploration drift, and completing 61,000 metres of exploration drilling and 59,000 metres of infill drilling.

The goal is to transform Island into a longer life mine with higher production, which means higher free cash flow. There are details yet to be determined, like precisely how to optimize the 800-tonne-per-day setup using the existing ramp and what might be possible with other infrastructure if Richmont were to expand Island to its permitted 900-tpd capacity. These questions are being addressed in an external mining study, preliminary results from which are expected shortly.

In the meantime, Richmont continues to make money. In the second quarter the company netted $2.9 million; through the first six months of the year net earnings totaled $7.4 million. All-in sustaining costs are sitting between US$1,075 and US$1,190 per oz.

The company is getting important benefit from the operating in Canada – and in Canadian dollars. Richmont is Canadian through and through, which means its costs are all in Canadian dollars. But it sells its product in US dollars, banking the forex difference each time.

Live Webcast Richmont Mines Inc.

Renaud Adams, President & CEO

TSX & NYSE MKT: RIC

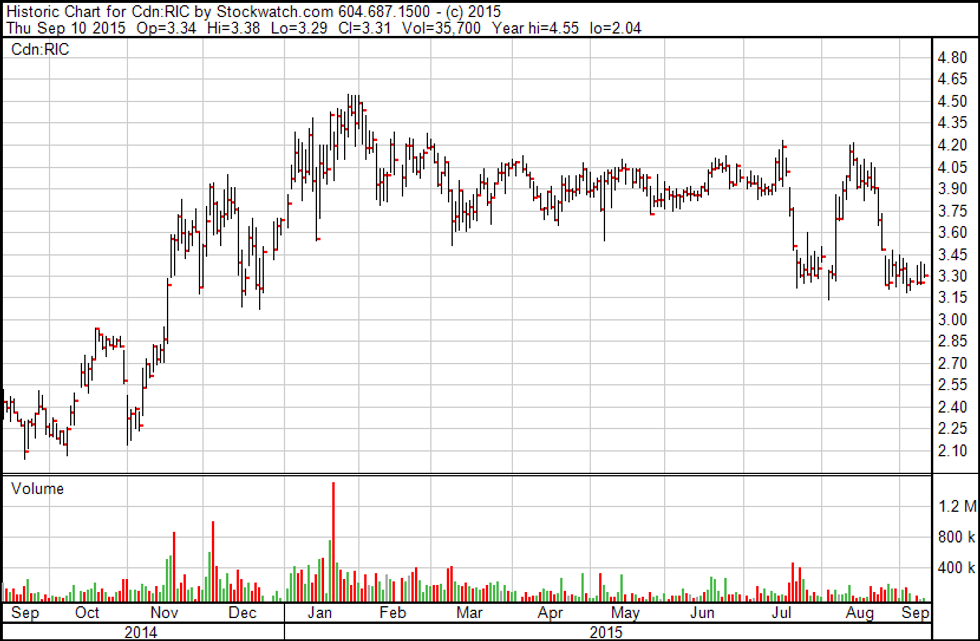

Richmont’s share price has defied the odds, gaining as much as 115% in the last year and currently sitting up 57%. It seems the market still has energy to support a profitable gold miner making headway against the odds.

One reason for this performance is Richmont’s share structure and balance sheet. The company has only 58 million shares outstanding, a nice tight count for a producer that increases each share’s exposure to a rising gold price or a share price movement.

And Richmont has $78 million in the bank, enough to fund capital and operating programs at Island and Beaufor.

Richmont is expanding a gold mine while others contract. It is looking ahead to increased profitability once the mine expansion is complete. The odds of finding more high-grade gold in its current drill program are pretty darn good. It has money in the bank, no debt, and a tight share structure. All told, it’s a bright light in a dark sector.

Kaminak Gold

In the list of companies with near development assets, Kaminak Gold (TSXV:KAM) is a stand out. Kaminak’s Coffee project is in northern Canada’s Yukon territory. It hosts 4 million oz. of gold that recovers rapidly and readily via simple, conventional heap leaching. The gold sits in contiguous zones that sit at or near the top of a hill, which makes for straightforward open pit mining with a manageable strip ratio.

These things are all outlined in a preliminary economic assessment (PEA) published in mid-2014. That study outlined a mine producing 167,000 oz. gold annually over an 11-year mine life, at an all-in sustaining cost of US$688 per oz. Capital costs total just $305 million and the mine should generate a 32.8% pre-tax internal rate of return.

Now Kaminak is working to turn that PEA into a full feasibility study, due out early next year. The new study will incorporate several changes that should reduce costs, both operational and capital. Testwork has shown that Coffee’s ore lets go of its gold so easily that the planned 0.5-inch crush size is unnecessary, which means the new mine plan will likely eliminate one or more stages of crushing. An alternative heap leach site has the potential to reduce costs and shorten construction timelines. And metallurgical work has shown that the uppermost transition mineralization (the layer closest to the oxide resource) responds well to heap leaching, which means it will be considered ore rather than waste.

The road will be another big change. For the PEA Kaminak assumed the need to build a road up from Carmacks, a 250-km distance of which 180 km would have been new road. This summer the company realized that existing roads actually almost connect Coffee with Dawson City, to the north; completing the route will only require an estimated 30 km of new road construction.

Live Webcast Kaminak Gold Corporation

Eira Thomas, President & CEO

TSX-V: KAM

Feasibility studies require extensive infill drilling to upgrade the resource confidence, detailed engineering work, in-depth metallurgical testing, extensive environmental work, and much more. In other words, they are not cheap.

Kaminak has it covered, having attracted significant investments from two famed mining investors last year. In mid-2014 Ross Beaty and Lukas Lundin each bought 9.98% stakes in Kaminak, financings priced at $0.80 that put $13.5 million into Kaminak’s coffers.

Feasibility work is not only expensive; it is also a challenging stage during which to hold investors’ attention. Infill drilling, metallurgical results – these things are essential but are not the kind of news bites that generate excitement. Nevertheless, Kaminak’s share price has done well to hold its ground, amidst a feasibility program and a terrible mining market.

Many had postulated that Kaminak would get taken out before reaching full feasibility. Well, the mining bear market nixed that – but today’s timing is not a bad thing.

By pushing through to full feasibility, Kaminak is making Coffee much more valuable. The project is not simply a good gold discovery – it is a delineated set of gold deposits with significant expansion potential that have been engineered into a straightforward mine with very good economics. When I say Kaminak is a stand out on the list of near development projects, those attributes are why.

Integra Gold

Integra Gold Corp.(TSXV:ICG) is the most active explorer on the Venture exchange. The company has five drills turning at its Lamaque project in Quebec, a number that will soon rise to ten, working away at a 100,000-metre drill program that is fully funded and proving its worth.

The Abitibi earned a reputation as one of the most prolific gold mining districts in the world by spitting out more than 156 million oz. gold since the 1930s. Nine million of those ounces came from the Sigma and Lamaque mines, which sit a few kilometres north of Integra’s main resources.

The area has been explored for decades but for much of that time it was very divided. Competing companies refused to share data on what they had figured out on their side of the property line, which stymied efforts to find the next big zone.

Then the price of gold fell and labour unrest and anti-mining politics in Quebec and the Sigma and Lamaque mines ended up shuttered.

Over time the area ended up divided in two: Lamaque North and Lamaque South. Integra earned full ownership of Lamaque South in 2009. Late last year the company inked a deal for Lamaque North, consolidating the area for the first time and adding the historic Lamaque and Sigma mines to its holdings.

The Lamaque North deal was a game changer for Integra. It gave Integra a permitted mill and tailings facility that are literally adjacent to its deposits (more on that later). It added defined resources. And it increased the potential scale of a new Lamaque mine by adding a long list of exploration targets.

Integra has not yet had time to touch those targets because it has remained focused on Lamaque South property, where it has delineated 811,010 oz. of indicated gold at an average grade of 9.5 grams gold plus 276,030 oz. of inferred gold at 10.9 grams gold.

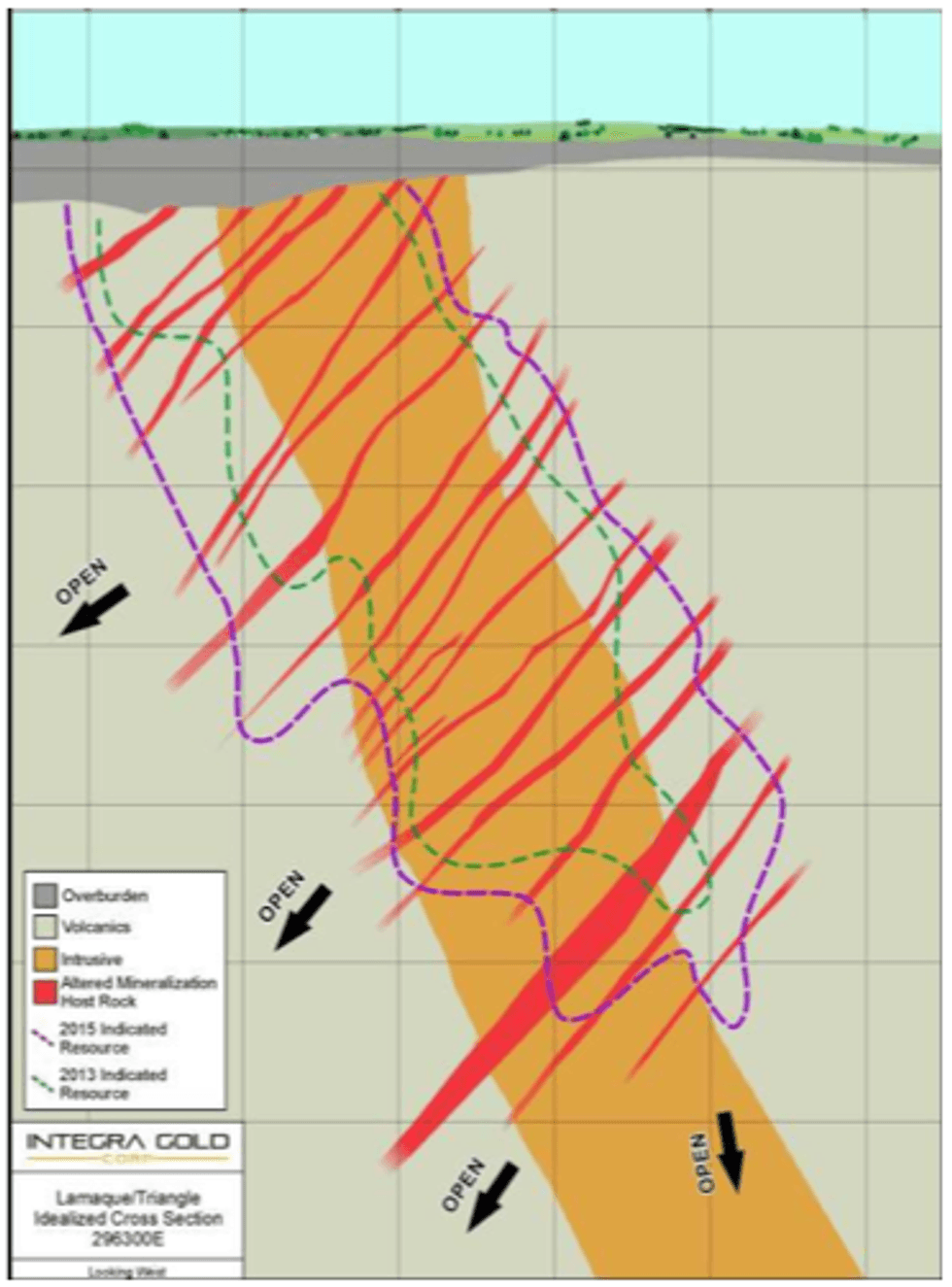

The gold sits in plugs, each a steeply dipping intermediate to mafic intrusion. The Lamaque mine pulled 3.7 million oz. from one such plug. Integra has identified multiple high-grade plugs on Lamaque South and has outlined ounces in six.

Live Webcast Integra Gold Corp.

Stephen de Jong, President & CEO

TSX-V: ICG

Finding mineralization is one thing. Outlining mineralized bodies that could be mined economically is another. After proving that Lamaque still hosts gold, Integra moved on to that second challenge.

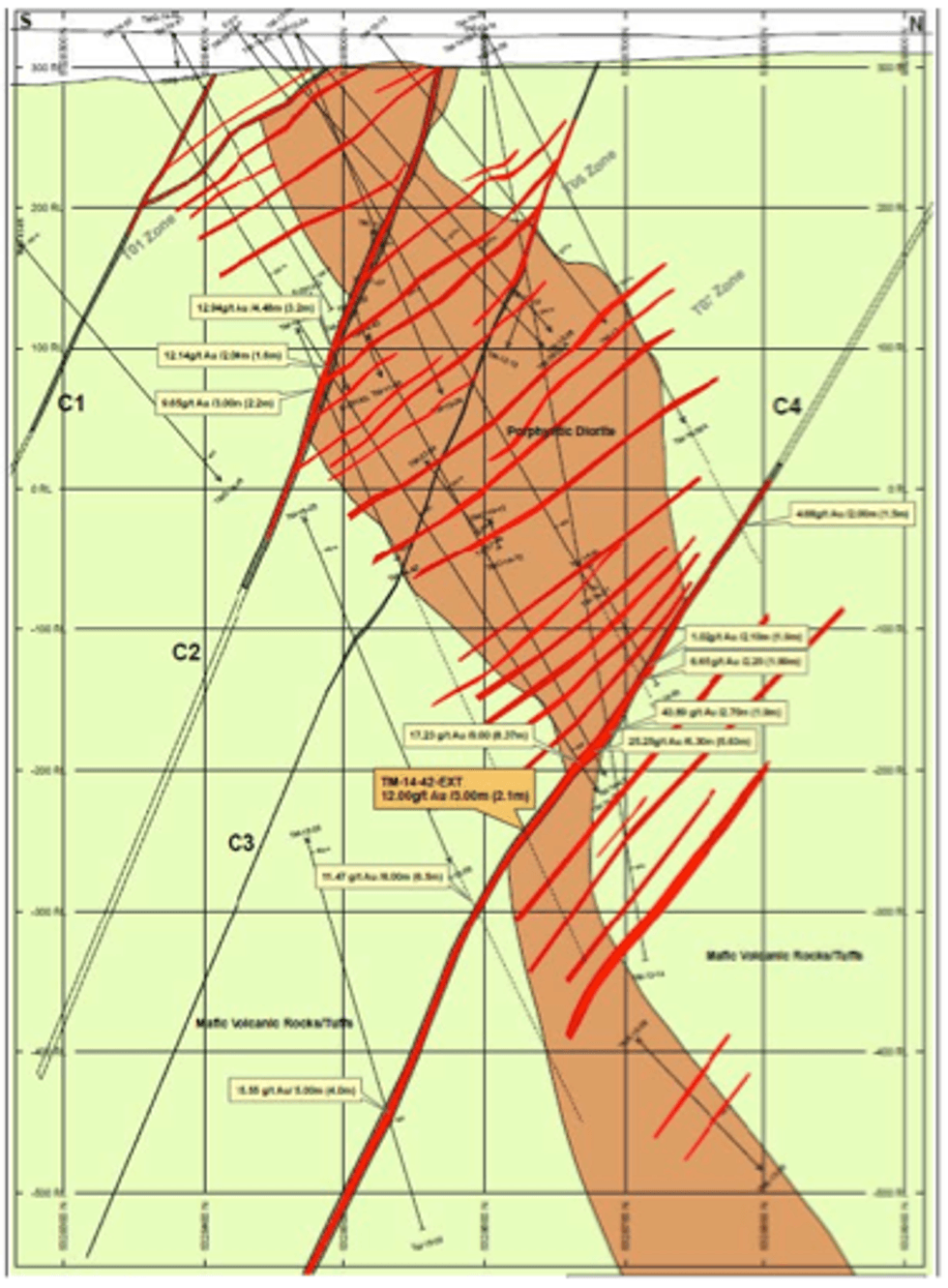

The work has already paid off. Triangle is a steep plug cut across with mineralized veins. In the last year, Integra’s understanding of the Triangle zone changed from the image on the left to the one on the right.

The key change is a much more detailed understanding of the vein system, including recognition of a set of C Shear Veins that dip more steeply, carry better grades, and extend not only all the way across the intrusive plug but also into the surrounding volcanic rock.

In other words, they’re longer, thicker, higher grade, and easier to mine than all the T Veins. The latest results from some of these Triangle zone C veins include 39 grams gold over 2 metres and 22 grams gold over 4 metres within the intrusive plug, plus 7.5 grams gold over 5 metres in the volcanics 150 metres away.

Integra is currently pummeling the Triangle zone with drill holes to inform a high-confidence resource due out before the end of the year. With that resource in hand, Integra will be able to start really planning how to mine this thing.

That is the focus, though the rest of Lamaque offers another universe of potential.

Take depth extent. At the moment the resources at Triangle and Parallel extend to roughly 600 metres depth. They remain open below – and that is significant. The Lamaque mine extended to 1,100 metres depth while Sigma went 2,200 metres underground. Odds are good that Integra’s known deposits continue at depth and even that mineralization continues below the bottom of the old Lamaque mine.

Then there are all the other known mineralized zones on Integra’s initial South Lamaque property, as well as a raft of other targets on North Lamaque.

Back to the near development opportunity. In March 2014 the company completed a preliminary economic assessment (PEA) based on toll milling. The numbers were good: more than 110,000 oz. annual gold production at an all-in sustaining cost of $805 per oz., at a mine that could be built for $69 million and would generate a 38% after-tax internal rate of return.

Great – but the market wanted more. There was a permitted 2,200-tonne-per-day mill and tailings facility sitting unused next door to the project. Surely that offered advantages?

It certainly did if Integra could secure a deal to buy Lamaque North, which it did in November. For $8 million the company bought a property with infrastructure worth $100 million (replacement value). Not surprisingly, adding a permitted and operational mill and tailings facility into the mix enhanced Lamaque considerably.

A new PEA boosted the project’s post-tax NPV to $113.5 million (from $88.5 million) and its post-tax IRR to 59% from 38%, despite using a lower gold price (US$1,175 per oz. versus US$1,275). Capital costs fell to $62 million, including refurbishing the mill, and all-in sustaining costs fell almost 10% to $731 per oz.

Those numbers put Integra in an enviable position. Lamaque offers one of the highest IRRs of any development-stage gold project, while also offering one of the lowest capital costs. And once built the mine should be able to produce gold almost as cheaply as any of its development-stage peers.

As bonus, the permits that came with Lamaque North simplify the regulatory process significantly. As another bonus, the updated PEA incorporated the mill but did not consider the resources that Integra defined between late 2013 and early 2015. The company is drilling like mad right now and will produce a new resource estimate before the end of the year.

And Integra has enough cash to fund all these activities, having raised $35.8 million in the last two years. Most recently Eldorado Gold, a mid-sized gold miner with a history of taking stakes in companies before buying them out, bought 15% of the company in a $14.6-million financing.

I think the grade and level of confidence in that resource will attract renewed attention to this story. This is an asset showing increasing potential to become a high grade mine with well-controlled costs in one of the best mining jurisdictions in the world, right beside a town full of experienced underground miners wanting to work.

Constantine Metals

Constantine Metal Resources Ltd. (TSXV:CEM) offers a different style of exploration upside: a prospective and growing high-grade, partner-funded copper-zinc-gold asset near infrastructure in Alaska.

Palmer is a volcanogenic massive sulphide (VMS) project near Haines. It is in prime VMS country: just north is Windy Craggy, one of the largest VMS deposits in the world, and on strike south is Greens Creek, one of the richest.

Management has a long history with VMS systems and with Palmer itself. Constantine president Garfield MacVeigh kept the project within reach for years awaiting the right opportunity and VP exploration Darwin Green studied Palmer for his masters degree.

Their opportunity arose in 2007, when booming markets allowed CEM to drill test its geologic theories. The test worked, returning two strong VMS intercepts. Follow up drilling in 2008 and 2009 defined an initial resource with good potential for expansion.

Then the markets died.

The initial resource should have added Palmer’s momentum. Instead, Constantine struggled through the next few years, caught in the sector’s classic conundrum: with little cash and a depressed share price, the only ways to advance Palmer were to attempt a highly dilutive financing or look for a project partner.

They wisely chose the latter and spent most of 2011 and 2012 searching for the right deal. Their persistence paid in early 2013, when Constantine signed with Japan’s Dowa Metals and Mining. Dowa can earn a 49% stake in Palmer by spending US$22 million on exploration over four years.

Live Webcast Constantine Metals

Garfield MacVeigh, President & CEO

TSX-V: CEM

CEM negotiated one hell of a deal with Dowa.

For one, Constantine retains majority ownership. Second, CEM not only remains project operators but also gets paid by Dowa to do so. Third, there is no graduated earn-in; Dowa gets nothing unless it spends all US$22 million. Fourth, the deal does not give Dowa an option to increase its stake down the road, something very common in joint venture agreements.

Fifth, Dowa is no upstart. Dowa Metals and Mining is the largest zinc smelter operator in Japan. Before smelting became its mainstay Dowa spent 120 years finding, developing, and operating mines in northern Japan’s Kuroko VMS district.

This partner brings experience, money, and long-term zinc demand to the table, as evidenced when Dowa announced last year that Japan Oil, Gas and Metals National Corp (JOGMEC) had joined the Palmer team. JOGMEC is earning up to 45% of Dowa’s interest in Palmer, which leaves CEM’s stake unchanged but adds as a partner a government entity focused on finding resources for Japanese industry. That’s a big bonus.

And in a time when survival was the name of the game, the Dowa deal not only kept Constantine alive but pushed Palmer ahead. Last year’s drill program proved that mineralization continued and even thickened downdip of the defined deposit. When Constantine updated the estimate this spring, resources at Palmer had almost doubled to 8.1 million tonnes grading 1.4% copper, 5.25% zinc, 0.32 gram gold, and 31.7 grams silver.

That is what they have proven to date – but the exploration upside at Palmer is ample. Last year Constantine grew the land package six-fold by winning the right to lease almost 100,000 hectares of land around its original land package. There is strong evidence of additional VMS mineralization across Constantine’s 116,000 hectares of land, evidence made weightier by the fact that VMS deposits generally occur in clusters.

Today there are two drills turning at the property, advancing a 6,000-metre program. Constantine’s modus operandi this season and last has been to focus on significantly expanding the resource, which has meant drilling sizeable step outs. It very much worked last year. CEM has not released any results yet from this year but news should be out shortly. And of course Dowa and JOCMEG are funding the entire US$5-million program (C$7.3 million), plus paying Constantine to operate it.

Constantine’s deal with Dowa is the reason Palmer is a growing resource rather than a stagnant asset. And Palmer deserves to grow. It is ideally located, sitting adjacent to a paved state highway. Deep-sea port facilities in Haines are just 60 km away.

Topography is also on Constantine’s side. Palmer’s lenses of mineralization dip steeply within steep hills. That sounds rough and rugged, but in fact it’s an ideal scenario for bulk underground mining. Blasted ore would fall to an adit at the base of the mountain for easy extraction. And initial metallurgical work shows the rock responds well to conventional processing.

These comments are a bit ahead of the story, as Constantine is still an explorer, not a mine developer. But Dowa and JOCMEG are not interested in Palmer because of its fascinating geology. They want feed for their smelters and the fact that they continue to out money towards their $22-million commitment means they see Palmer as a likely source of that feed.

Constantine’s Japanese partners have another year to complete their earn in. When they do, the setting will shift. Perhaps they will offer to buy the rest of the project. Perhaps they will continue to pay Constantine to operate the asset while more work is done.

Whatever happens, Constantine has drills turning at a high-grade and growing VMS deposit in an easy location, all of partner funded. Its partners are a smelter and a Japanese state entity focused on finding resources for Japanese industry.

In short, the company has supply (Palmer) and demand (its partners) already sorted out. And now it has another 18 months to expand its resource on someone else’s dime, a perfect way to not just survive what remains of this bear market but to emerge from it successful.

Wrap Up

No one knows when the next upcycle will get underway, but it will happen.

Chinese growth is slowing, but that economy is now so large that 7.3% growth last year created more new copper demand than 14% growth in 2007. Without zinc the steel skeletons under all our infrastructure would rust and crumble but zinc mines are shutting down, with very limited new supply on the horizon. Sixty nuclear reactors currently under construction and another 488 planned or proposed will triple uranium demand; Japan’s nuclear hiatus has the market oversupplied right now but that will change.

As for gold, there is good reason to believe it will lead the metals rebound. Why?

- The metals market is reliably cyclical and gold usually leads the way.

- Global economic turmoil turns investors and central banks to the safe haven that is gold and a slew of indicators suggest economic turmoil is on the horizon, from an aged and now narrow bull market in the US to slowing growth in China to currency wars around the world.

- Production cuts during the downturn have limited output just as the sector is running low on ‘easy’ deposits, the best ones having already been mined and 20 years of slowing exploration revealing fewer and fewer real successes.

Gold and metals will go. The unknown is time: when things will turn around and what rate the rally will hold. I have reason to think 2016 will be the start of the next upcycle. But whenever it happens, you will want to be invested in the companies that move first and farthest.