Gold Resource Corporation Reports First Quarter Net Income Of $0.01 Per Share, Maintains 2019 Production Outlook

Gold Resource Corporation (NYSE:GORO) (the “Company” or “GRC”) reported production results for the first quarter ended March 31, 2019 of 6,538 ounces of gold and 364,653 ounces of silver, which along with base metal revenue generated $26.6 million in net revenue and $0.9 million, or $0.01 per share in net income for the quarter.

Gold Resource Corporation (NYSE:GORO) (the “Company” or “GRC”) reported production results for the first quarter ended March 31, 2019 of 6,538 ounces of gold and 364,653 ounces of silver, which along with base metal revenue generated $26.6 million in net revenue and $0.9 million, or $0.01 per share in net income for the quarter. Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. The Company has returned $111 million to its shareholders in consecutive monthly dividends since July 2010 and offers its shareholders the option to convert their cash dividends into physical gold and silver and take delivery.

Q1 2019 HIGHLIGHTS

- $0.9 million net income, or $0.01 per share

- $8.5 million cash and cash equivalents (a $0.8 million increase)

- $26.6 million net sales

- 6,538 gold ounces produced

- 364,653 silver ounces produced

- $340 total cash cost per gold equivalent ounce sold (after by-product credits)

- $834 total all-in sustaining cost per precious metal gold equivalent ounce sold

- $18.4 million base metal by-product credits, or $2,327 per precious metal gold ounce sold

- $0.3 million dividend distributions, or $0.005 per share for quarter

- $3.7 million gold and silver bullion

- Connected the Aguila project, Oaxaca, Mexico to the federal power grid in March 2019

- Began circulating first leach solution to the Isabella Pearl pad in March 2019

Overview of Q1 2019 Results

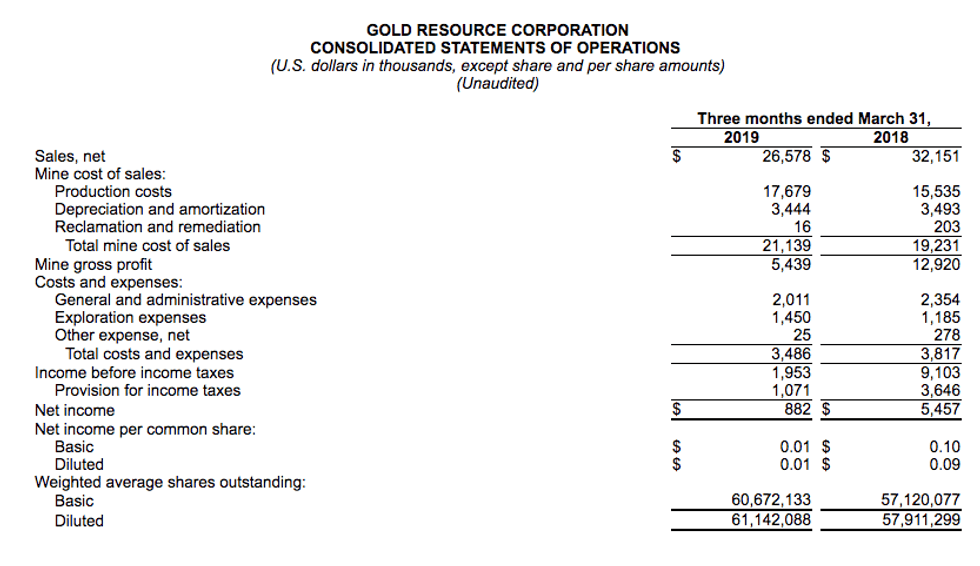

Gold Resource Corporation sold 7,911 precious metal gold equivalent ounces at a total cash cost of $340 per ounce (after by-product credits), benefiting from strong base metal production and sales. Average realized metal prices during the quarter included $1,339 per ounce gold and $15.74 per ounce silver*. The Company recorded net income of $0.9 million, or $0.01 per share. The Company paid $0.3 million to its shareholders in dividends, or $0.005 per share during the quarter. Cash and cash equivalents at quarter end totaled $8.5 million.

Production totals for the first quarter of 2019 included 6,538 ounces of gold, 364,653 ounces of silver, 433 tonnes of copper, 2,153 tonnes of lead and 5,838 tonnes of zinc. The Company maintains its 2019 Annual Outlook, targeting a plus or minus 10 percent production of 27,000 gold ounces and 1,700,000 silver ounces.

*Average realized metal prices include final settlement adjustments for previously unsettled provisional sales. Provisional sales may remain unsettled from one quarter into the next. Realized prices will therefore vary from average spot metal market prices upon final settlement.

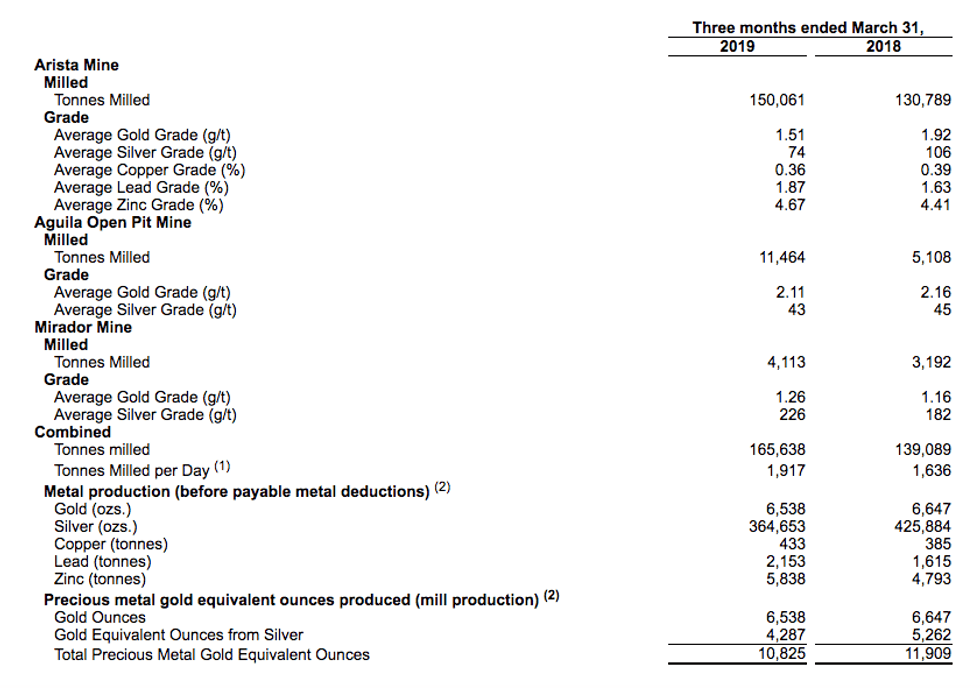

The following Production Statistics table summarizes certain information about our Oaxaca Mining Unit operations for three months ended March 31, 2019 and 2018:

| (1) | Based on actual days the mill operated during the period. |

| (2) | The difference between what we report as “ounces/tonnes produced” and “payable ounces/tonnes sold” is attributable to the difference between the quantities of metals contained in the concentrates we produce versus the portion of those metals actually paid for by our customers according to the terms of our sales contracts. Differences can also arise from inventory changes incidental to shipping schedules, or variances in ore grades which impact the amount of metals contained in concentrates produced and sold. |

____________________

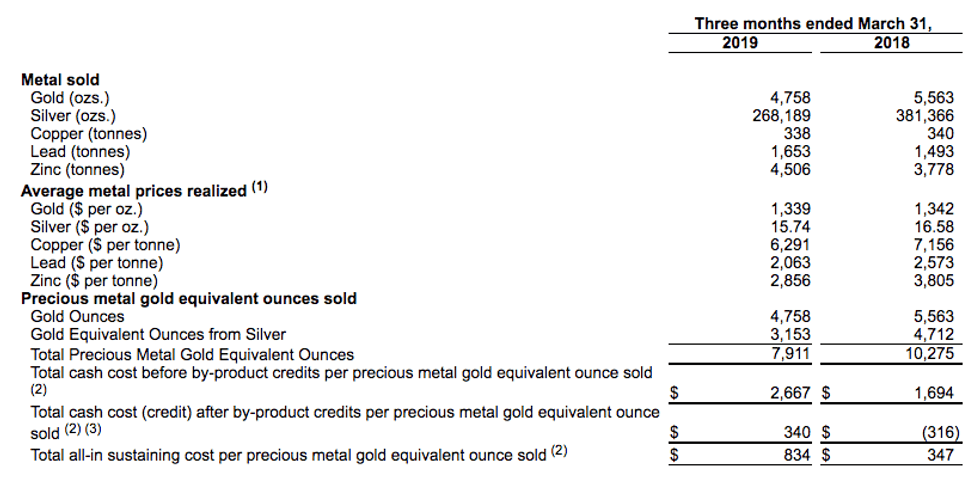

The following Sales Statistics table summarizes certain information about our combined Oaxaca Mining Unit operations for three months ended March 31, 2019 and 2018:

____________________

| (1) | Average metal prices realized vary from the market metal prices due to final settlement adjustments from our provisional invoices when they are settled. Our average metal prices realized will therefore differ from the market average metal prices in most cases. |

| (2) | For a reconciliation of this non-GAAP measure to total mine cost of sales, which is the most comparable U.S. GAAP measure, please see Non-GAAP Measures in our most recently filed Form 10-K. |

| (3) | Total cash cost after by-product credits are significantly affected by base metals sales during the periods presented. |

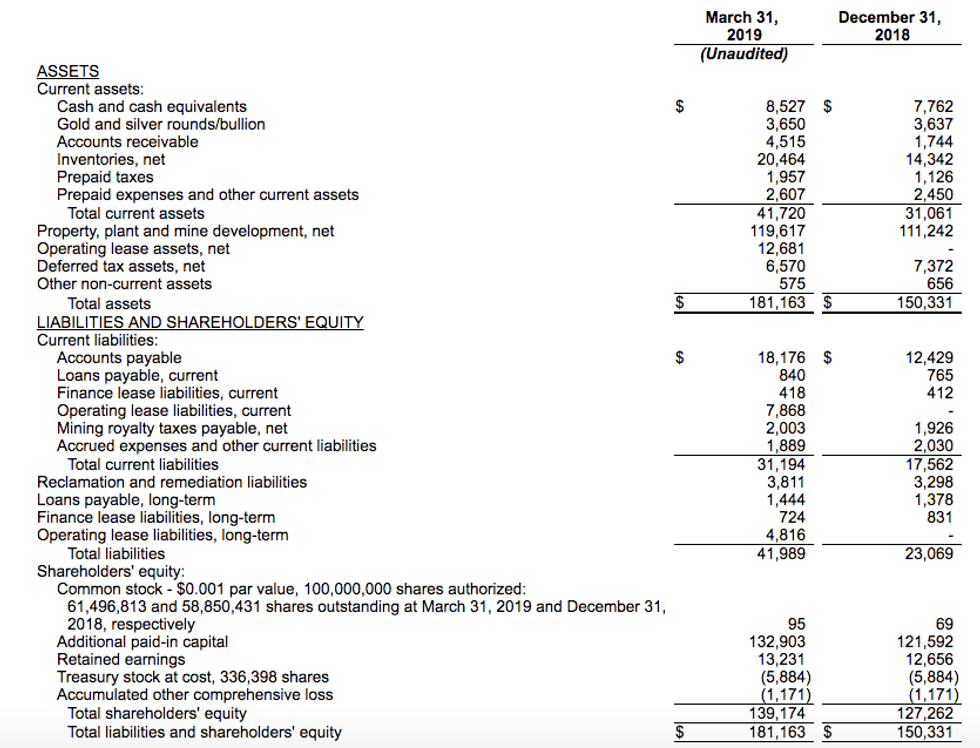

GOLD RESOURCE CORPORATION CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share and per share amounts)

| GOLD RESOURCE CORPORATION | |||||||

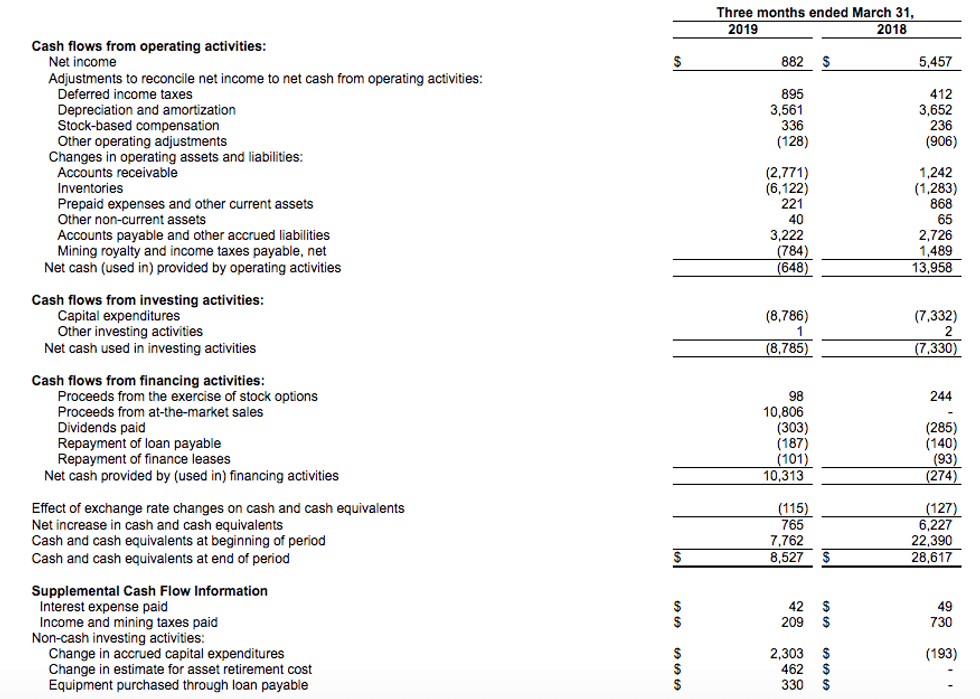

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||

| (U.S. dollars in thousands) | |||||||

| (Unaudited) |

See Accompanying Tables

The following information summarizes Gold Resource Corporation’s financial condition at March 31, 2019 and December 31, 2018, its results of operations including the three months ended March 31, 2019 and 2018, and its cash flows for the three months ended March 31, 2019 and 2018. The summary data as of March 31, 2019 and for the three months ended March 31, 2019 and 2018 is unaudited; the summary data for the year ended December 31, 2018 is derived from our audited financial statements contained in our annual report on Form 10-K for the year ended December 31, 2018, but do not include the footnotes and other information that is included in the complete financial statements. Readers are urged to review the Company’s Form 10-K in its entirety, which can be found on the SEC’s website at www.sec.gov.

The calculation of our cash cost per precious metal gold equivalent per ounce and total all-in sustaining cost per precious metal gold equivalent per ounce contained in this press release are non-GAAP financial measures. Please see “Management’s Discussion and Analysis and Results of Operations” contained in the Company’s most recent Form 10-K for a complete discussion and reconciliation of the non-GAAP measures.

This press release contains forward-looking statements that involve risks and uncertainties. The statements contained in this press release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. When used in this press release, the words “plan”, “target”, “anticipate,” “believe,” “estimate,” “intend” and “expect” and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, without limitation, the statements regarding Gold Resource Corporation’s strategy, future plans for production, future expenses and costs, future liquidity and capital resources, and estimates of mineralized material. All forward-looking statements in this press release are based upon information available to Gold Resource Corporation on the date of this press release, and the company assumes no obligation to update any such forward-looking statements. Forward looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. The Company’s actual results could differ materially from those discussed in this press release. In particular, there can be no assurance that production will continue at any specific rate. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the Company’s 10-K filed with the SEC.About GRC:

Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. The Company targets low capital expenditure projects with potential for generating high returns on capital. The Company has returned $111 million back to its shareholders in consecutive monthly dividends since July 2010 and offers its shareholders the option to convert their cash dividends into physical gold and silver and take delivery. For more information, please visit GRC’s website, located at www.goldresourcecorp.com and read the Company’s 10-K for an understanding of the risk factors involved.

Cautionary Statements:

Contacts:

Corporate Development

Greg Patterson

303-320-7708

www.Goldresourcecorp.com

Click here to connect with Gold Resource Corporation (NYSE:GORO) for an Investor Presentation.

Source: www.globenewswire.com