According to the World Gold Council’s latest report, global gold demand fell 9 percent year-on-year in the third quarter of 2017.

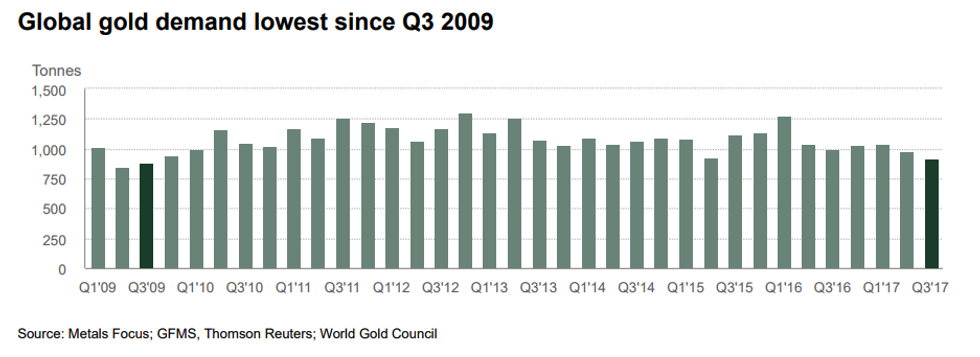

Global gold demand fell 9 percent year-on-year in Q3, touching its lowest level in eight years on the back of decreased ETF inflows and lower demand from the jewelry sector.

In its latest report, released Thursday (November 9), the World Gold Council (WGC) said that during Q3 demand for the yellow metal hit 915 tonnes, down from 1,001.1 tonnes in the same period last year. Global gold demand is down 12 percent so far this year.

ETFs had another quarter of positive inflows, said the WGC, but fell short of 2016 levels. Global holdings of gold-backed ETFs grew by just 18.9 tonnes in Q3, down from 144 tonnes a year earlier.

“ETF inflows year-to-date are a fraction of the stellar inflows we saw last year,” said Alistair Hewitt, the WGC’s head of market intelligence. “India is similarly weak.”

Demand from the jewelry sector also fell on weakness from India, which has been undergoing a changing tax regime and tighter regulations around transactions. Jewelry demand dropped to 478.7 tonnes, a 3-percent decrease compared to 2016.

“Our view remains that the market will continue to adapt to GST, allowing demand to recover to a certain extent,” the WGC explained.

Looking over to the bar and coin sector, demand rose by 17 percent in Q3 to hit 222.3 tonnes. The increase was driven by China, which saw a 57-percent jump in demand. In contrast, demand from India, the world’s second-largest bar and coin market, was weak, falling 23 percent to 31 tonnes.

Chart via the World Gold Council.

“Despite the rise in interest rates and the rally in stock markets, gold continues to be bought by investors. They still see value in gold and see it as an inexpensive way to buy portfolio protection,” Juan Carlos Artigas, the WGC’s director of investment research, told Kitco. “The gold market is global and that gives it depth and robustness.”

Central bank gold buying also grew by 25 percent to come in at 111 tonnes in the third quarter. Russia led the increase, followed by Turkey and Kazakhstan. The three countries accounted for over 90 percent of total central bank gold purchases in the quarter.

Similarly, gold demand from the technology sector extended its recent recovery, reaching 84.2 tonnes in Q3, up 2 percent year-on-year. “Strong momentum in memory chip demand led to another quarter of double-digit growth,” the WGC said.

In terms of supply, mine production declined 1 percent year-on-year to come in at 841 tonnes, while recycling was down 6 percent, at 315 tonnes.

On Thursday, the gold price edged up on the back of a weaker US dollar, and was trading at $1,287.35 per ounce as of 1:00 p.m. EST.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.