Desert Gold Announces Binding Letter of Intent To Acquire Ashanti Gold Corp.

Desert Gold Ventures Inc. (TSXV:DAU) (“Desert Gold”) and Ashanti Gold Corp. (TSXV:AGZ) (“Ashanti”) are pleased to announce that they have entered into a binding letter of intent (the “LOI”) contemplating the acquisition by Desert Gold of all of the outstanding common shares of Ashanti (the “Ashanti Shares”), (the “Proposed Transaction”).

Desert Gold Ventures Inc. (TSXV:DAU) (“Desert Gold”) and Ashanti Gold Corp. (TSXV:AGZ) (“Ashanti”) are pleased to announce that they have entered into a binding letter of intent (the “LOI”) contemplating the acquisition by Desert Gold of all of the outstanding common shares of Ashanti (the “Ashanti Shares”), (the “Proposed Transaction”).

Under the terms of the LOI, all of the issued and outstanding Ashanti Shares will be exchanged on the basis of 0.2857 Desert Gold common shares (each whole share, a “Desert Gold Share”) for each Ashanti Share (the “Exchange Ratio”). The Exchange Ratio implies consideration of CAD $0.0514 per Ashanti Share based on the closing price of the Desert Gold Shares on the Toronto Venture Stock Exchange (“TSXV”) on March 8, 2019. This represents a premium of 28.5% based on the closing price of Ashanti Shares on the TSXV on March 8, 2019. The Proposed Transaction value is approximately CAD $3.8 million on a fully diluted in-the-money basis, representing 31% dilution to Desert Gold shareholders. The parties have until April 15, 2019 to enter into a definitive agreement and have set a longstop date of September 30, 2019 to close the Proposed Transaction.

Transaction Highlights

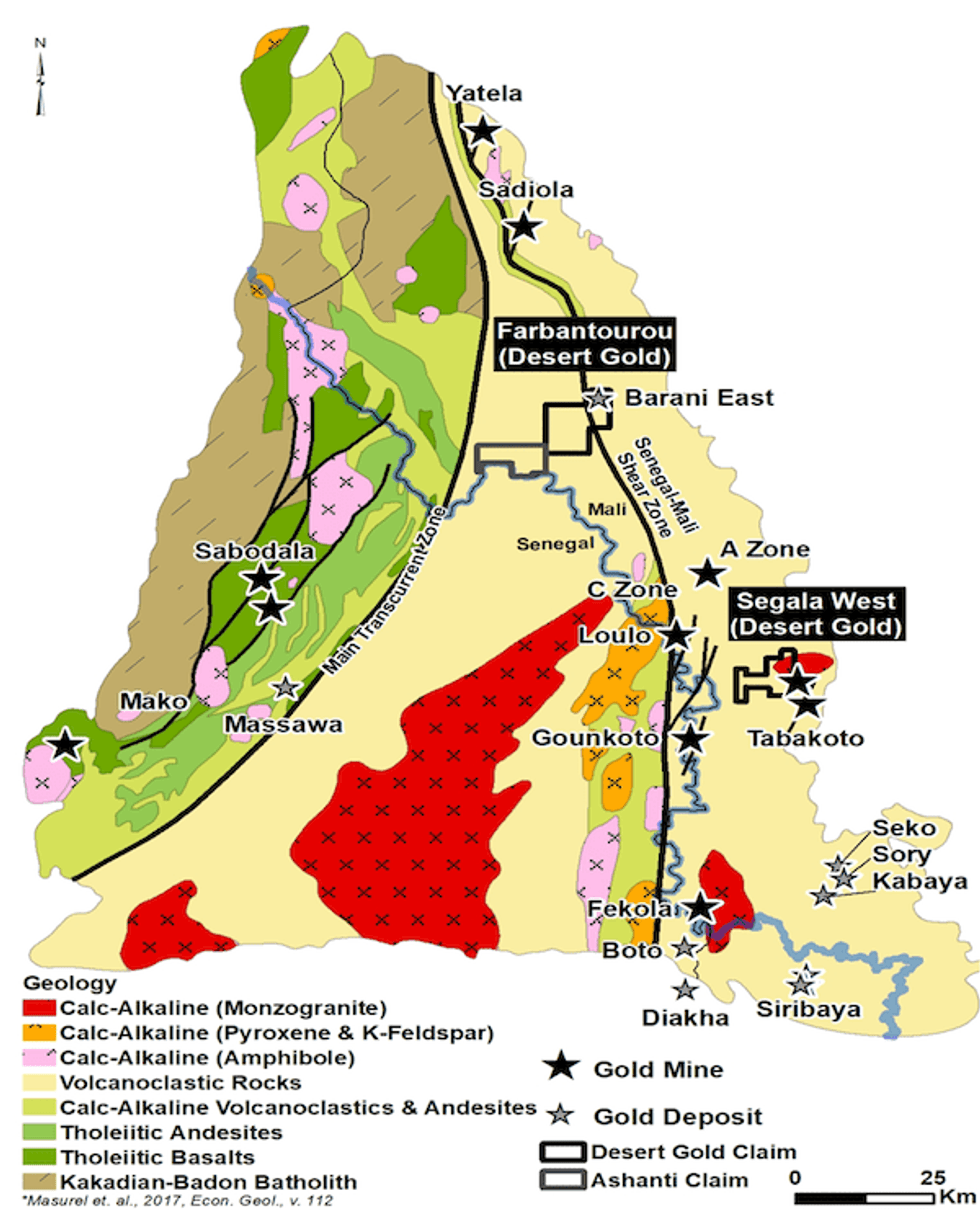

- Excellent Location on Prolific Senegal Mali Shear (SMSZ) and Main Transcurrent Shear Zones (MTSZ) – The district-scale land package spans the SMSZ, which is related to 30 million + oz gold of production and resources(1) and the MTSZ, which hosts Barrick’s >3 million ounce Massawa Deposit(2). The combined property overlies portions of these two structures and the interaction zone between them (see Figure 1)

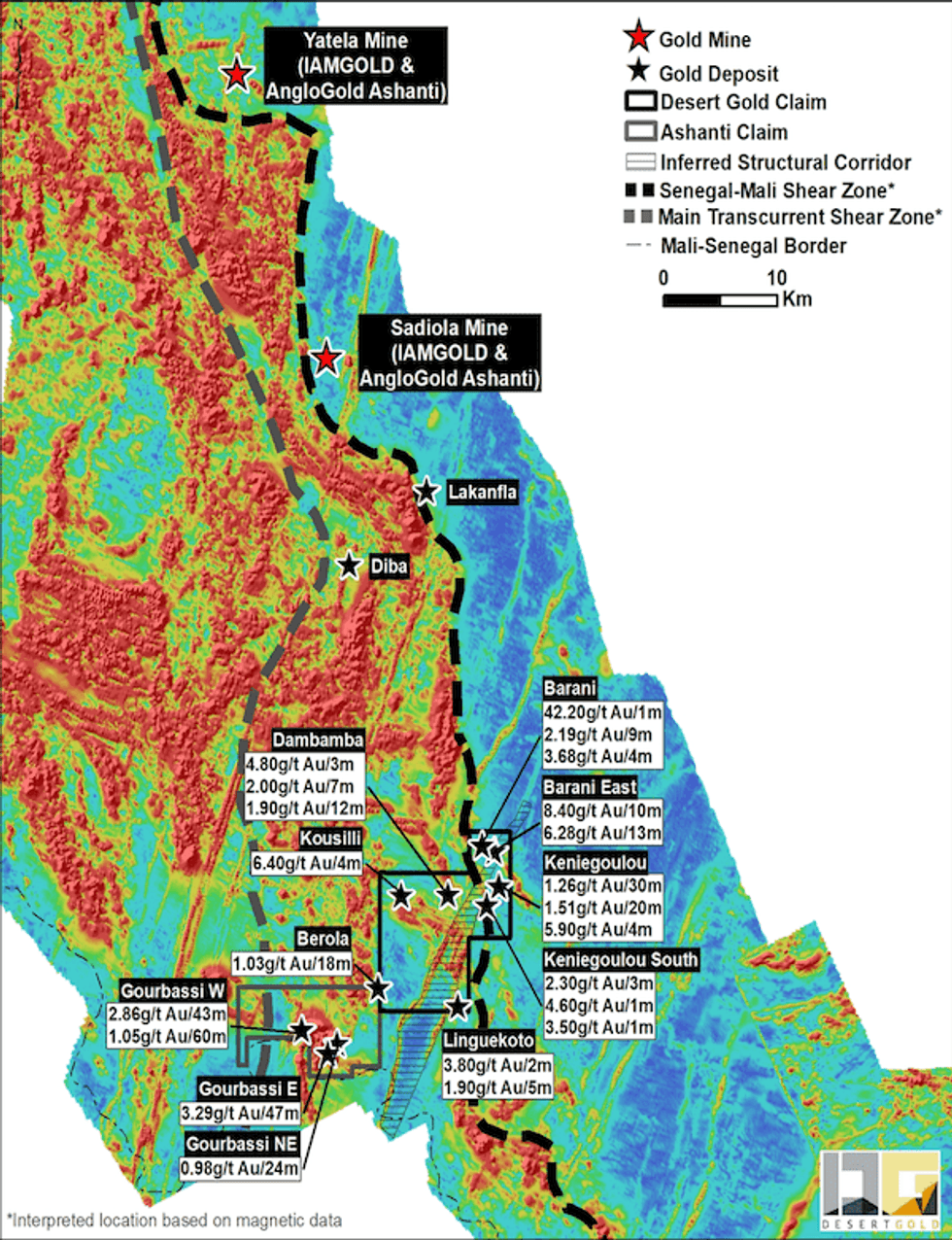

- District-Scale Land Package – Consolidated properties (see Figure 1 below) create an ~15 km across by ~25 km long, ~190 km2, target-rich, land package (see Figure 2)

- Combined Properties host >11 known Gold Zones – Consolidated properties host greater than 11 known gold zones occurring both east and west of the SMSZ and MTSZ, suggesting significant exploration potential in a variety of geological settings

Benefits to Desert Gold Shareholders

- Strategic acquisition to create a district-scale land package over regional-scale structures (SMSZ and MTSZ) that are related to numerous, multi-million ounce gold deposits

- Exposure to well-situated Anumso gold property in the multi-million ounce Ashanti Belt in Ghana

- Combined entities will likely increase shareholder liquidity, trading and capital markets exposure

- Further strengthen Desert Gold’s exploration and development pipeline

- Anticipated costs savings from consolidating operations

Benefits to Ashanti Shareholders

- Acquisition premium (28.5% based on the closing price of Desert Gold common shares on the TSX Venture Exchange on March 8, 2019.)

- Increased exposure to combined properties’ overlying regional-scale structures (SMSZ and MTSZ) that are related to numerous, multi-million ounce deposits

- Exposure to Desert Gold projects contiguous to BCM’s Tabakoto and Hummingbird Resources’ Yanfolila gold mines in Mali

- Access to a strong, in-country operational team with capabilities to significantly advance combined properties

- Improved capital markets exposure

- Anticipated costs savings from consolidating operations

Figure 1. Regional Scale Geological Setting

Figure 2. Consolidated Property Package with Highlight Results

Highlighted Historic Drill Results from Consolidated Properties*

*True widths cannot be determined with the information available. All results have been presented in previous news releases.

LOI Conditions & Steps to Definitive Agreement

The Proposed Transaction is subject to a range of conditions, including, but not limited to, Desert Gold and Ashanti entering into one or more binding definitive agreements containing customary terms and conditions, including representations and warranties customary in a transaction of this nature. In the event that definitive agreement(s) are entered into between the parties, and subject to the final transaction structure, the closing of the Proposed Transaction will be subject to additional conditions precedent including, but not limited to, the receipt of all required approvals, approval of the Proposed Transaction by the requisite majority of shareholders of Ashanti by way of special meeting of Ashanti shareholders and agreement on customary non-solicitation covenants, board support and fiduciary-out provisions for transactions of this nature. In addition to shareholder and regulatory approvals, the closing of the Proposed Transaction is conditional on Ashanti being granted a renewal of its Kossanto East exploration permit in Western Mali which is due to expire May 7, 2019. Under the terms of the LOI, Ashanti’s CEO Tim McCutcheon will be offered a board seat on the board of Desert Gold upon closing of the Proposed Transaction.

Desert Gold and Ashanti are committed to consummating the Proposed Transaction in an expedited manner and will issue further information about the Proposed Transaction in the near future. There can be no assurances that any transaction relating to the Proposed Transaction or otherwise will result, or as to the final definitive terms thereof.

Desert Gold’s President Jared Scharf commented “We’ve been monitoring Ashanti’s progress for several years and their success in advancing the Kossanto East property, albeit in a very challenging market. The acquisition of Ashanti will be a strategic milestone for Desert Gold as the consolidation of the Kossanto East and Farabantourou properties creates a district-scale land package covering two of the most prolific regional super-structures in West Africa, the Senegal Mali Shear and the Main Transcurrent Fault Zone. Even with the consolidated land package already showing significant gold mineralization, we’ve only scratched the surface in terms of understanding the exploration potential of this vast area. Consolidating these contiguous assets under one corporate entity is a major step towards creating and realizing value for the Desert Gold and Ashanti shareholders. The proposed acquisition of Ashanti is at the core of Desert Gold’s strategy to continually expand our exploration footprint in Western Mali.”

About Desert Gold

Desert Gold Ventures Inc. is a gold exploration and development company which holds 3 gold exploration permits in Western Mali (Farabantourou, Segala West and Djimbala) and a mining license at its Rutare gold project in central Rwanda.

About Ashanti

Ashanti is a gold-focused, exploration and development company that targets projects where it has a competitive advantage due to past work experience of the team and specific project know-how. The Company is driving forward its 100%-owned Kossanto East project in Mali on the prolific Kenieba Belt, which hosts such deposits as Loulo, Fekola and Sadiola. Ashanti is also working to advance, together with its earn-in partners, the Anumso project and the Ashanti Belt project in Ghana, which are near-adjacent to the Akyem deposit.

Technical Disclosure

This press release contains certain scientific and technical information of Desert Gold and Ashanti. Each party is solely responsible for the contents and accuracy of any scientific and technical information disclosure relating to it.

Don Dudek, P.Geo. is a director of Desert Gold and a Qualified Person under National Instrument 43-101, has reviewed and approved the Desert Gold scientific and technical information contained in this press release.

Dr. Paul Klipfel, CPG (AIPG certification #10821), Ashanti’s COO and Chief Geologist is a Qualified Person as defined by Canadian NI 43-101 and has supervised the preparation of the scientific and technical information that forms the basis for this news release. Dr. Klipfel is responsible for all aspects of the work on the Kossanto East property including the Quality Control/Quality Assurance programs. Dr. Klipfel is not an Independent Person, as he is a shareholder of Ashanti.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This press release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. All statements other than statements of present or historical fact are forward-looking statements, including statements with respect to the Letter of Intent and the likelihood that the definitive agreement(s) will be entered into and that Proposed Transaction will be consummated on the terms and timeline provided herein or at all, the benefits of the Proposed Transaction to Desert Gold and Ashanti and the receipt of all required approvals including without limitation the companies shareholders and applicable regulatory authorities and applicable stock exchanges. Forward-looking statements include words or expressions such as “proposed”, “will”, “subject to”, “near future”, “in the event”, “would”, “expect”, “prepared to” and other similar words or expressions. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include general business, economic, competitive, political and social uncertainties; the state of capital markets; risks relating to (i) the preliminary and non-binding nature of the LOI, (ii) the ability of the parties to satisfy the conditions precedent to the execution of any definitive agreement(s) or to ultimately agree on definitive terms, (iii) the impact on the respective businesses, operations and financial condition of Desert Gold and Ashanti resulting from the announcement of the Proposed Transaction and/or the failure to enter into definitive agreement(s) or to complete the Proposed Transaction on terms described or at all, (iv) a third party competing bid materializing prior to the effective date of any definitive agreement(s) or the completion of the Proposed Transaction, (v) delay or failure to receive board, shareholder regulatory or court approvals, where applicable, or any other conditions precedent to the completion of the Proposed Transaction, (vi) unforeseen challenges in integrating the businesses of Desert Gold and Ashanti, (vii) failure to realize the anticipated benefits of the Proposed Transaction, (viii) other unforeseen events, developments, or factors causing any of the aforesaid expectations, assumptions, and other factors ultimately being inaccurate or irrelevant; and other risks described in Desert Gold’s and Ashanti’s documents filed with Canadian securities regulatory authorities. You can find further information with respect to these and other risks in filings made with the Canadian securities regulatory authorities and available at www.sedar.com. Desert Gold’s and Ashanti’s documents are also available on their respective websites at www.desertgold.ca and www.ashantigoldcorp.com. We disclaim any obligation to update or revise these forward-looking statements, except as required by applicable law.

For more information contact:

Desert Gold Ventures Inc.

Jared Scharf

President and Director

Email: jared.scharf@desertgold.ca

Tel.: +1 (858) 247-8195

Website: www.desertgold.ca

Ashanti Gold Corp

Tim McCutcheon

President and CEO

Email: tmccutcheon@ashantigoldcorp.com

Tel.: +1 (604) 396-1336

Website: www.ashantigoldcorp.com

1) Randgold’s Loulo-Gounkoto mine complex to the west with ore reserves of 32 Mt average at 4.6 g.t for 3.7 million oz Au in the Proven and Probably category. Endeavour Mining’s Tabakoto and Segala mines which hosts ~3 million oz Au (18.5 Mt at 3.5 g/t for 1.8 million oz Au measured and indicated, 9 Mt at 3.6 g/t for 1 million oz Au inferred and 6.4 Mt at 3.5 g/t for 0.7 million oz Au proven and probable. B2Gold Fekola mine to the south with ore reserves of 48.3 million Mt average at 2.37 g/t gold for 3.34 million oz Au in the Proven and Probably category and 65.8 million Mt average at 2.13 g/t gold for 4.5 million oz Au. To the north Sadiola/Yatela mine contains ore reserves of 38 million Mt at 1.57 g/t gold for 2 million oz Au and 87 million Mt at 1.58 g/t gold for 6 million oz Au in the measured and indicated category.

2) Barrick website – https://barrick.q4cdn.com/788666289/files/quarterly-report/2018/Randgold-2018-Reserves-Resources.pdf ; Estimated Indicated mineral resources of 23Mt @ 4.0 g/t Au totalling 2.5 million ounces of gold and estimated inferred mineral resources of 6 Mt @ 3.0 g/t Au totalling 0.51 million ounces of gold

Source: www.stockwatch.com