Aluminum Outlook 2021: Surplus Expected, Lower Prices Ahead

What’s the aluminum outlook for 2021? Read on to find out experts’ thoughts about the market next year in this overview.

Click here to read the latest aluminum outlook.

After a year that was focused on the US-China trade war, one of the key catalysts for the aluminum market at the start of 2020 was an expected Phase 1 deal.

But the COVID-19 pandemic changed the forecast for the year, and many market participants are now wondering what could happen to aluminum in 2021.

Read on for a more detailed overview of the main factors that impacted the market in 2020, plus analysts’ aluminum outlook for 2021.

Aluminum trends 2020: The year in review

Looking back at the main trends in the aluminum space in 2020, the coronavirus without a doubt dictated the course of prices and the market.

Ami Shivkar, principal analyst for aluminum markets at Wood Mackenzie, told the Investing News Network that the market and price trajectory for the metal were split into two halves in 2020. Following the height of the pandemic in April, the London Metal Exchange price has been on an upward path.

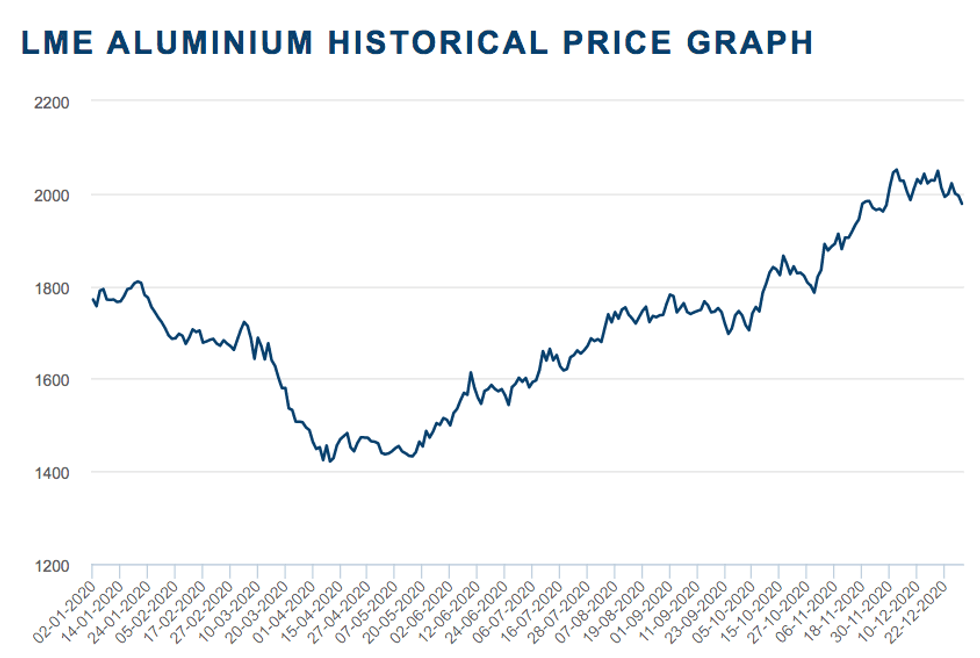

2020 aluminum price performance. Chart via the London Metal Exchange.

“Since June, the monthly average cash price has risen by an average of US$80 a tonne per month, with the exception of September, when the emergence of a second and third wave of virus infections in the rest of the world spooked the markets,” she said.

Aluminum prices on the London Metal Exchange started the year trading at US$1,771 per tonne, and had surpassed the US$1,800 mark by mid-January as investor optimism about a Phase 1 trade deal between the US and China increased.

But what seemed to be the main story of the first quarter in the early days of 2020 was quickly overshadowed by the coronavirus pandemic, which had spread throughout the world by the end of Q1. In April, aluminum prices hit their lowest level of the year at US$1,421.50.

“Unprecedented lockdowns in an effort to control the fast-spreading COVID-19 pandemic have acutely hampered the global economy, in turn severely hurting base metal demand and sending aluminium prices crumbling to an over four-year low in early April,” analysts at FocusEconomics said in an April report. “On the supply side, the Chinese smelter sector continued to exhibit marked excess capacity and over-production in the first quarter, further depressing the prices.”

The second half of 2020 brought a U-turn for aluminum, which started to recover as China reopened and vaccine rollouts began.

“We had assumed that most of the positive catalysts in the market had been priced in, and that upward momentum in the price would be capped,” Shivkar said.

“Even so, continued fund buying and a further acceleration in Chinese economic activity fueled a price rally, with London Metal Exchange aluminum trading above US$2,000.”

Aluminum hit its highest point of the year on December 2 at US$2,051.50.

Aluminum outlook 2021: What’s ahead

As 2021 kicks off, investors might be wondering what’s next for the aluminum outlook.

In terms of demand, given the strong performance of the Chinese economy in H2, Wood Mackenzie is expecting Chinese primary consumption to grow by 2.1 percent to reach 37.5 million tonnes in 2020.

“China is currently experiencing a revival in post-lockdown economic activity,” Shivkar said. “Key end-use sectors such as construction and infrastructure are driving an uptick in demand. As such, we see 2021 growth at 2.7 percent.”

Outside China, Wood Mackenzie estimates that demand will fall in 2020 by 12 percent followed by 7 percent growth in 2021. Global demand is expected to rise by 4.5 percent.

“A strong restocking phase is underway across the downstream value chain,” Shivkar said. “This should drive further expansion in offtake through H2 2021.”

Tensions between the US and China have been the main topic of discussion in the aluminum market for some time. Commenting on whether Joe Biden’s upcoming presidency could be good news for the space, Shivkar said he is likely to take the rhetoric and antagonism out of US-China trade relations.

“However, we do not expect a complete reset of tariffs and trade restrictions between the two countries.”

Looking over to the supply side of the equation, Wood Mackenzie is forecasting aluminum production in regions outside China to increase by 2.9 percent in 2021. “High-cost smelters in the world ex-China regions that were on the brink of closure are now either increasing or maintaining steady output,” Shivkar added. “Meanwhile, China is adding new capacity at breakneck speed.”

Chinese aluminum output is forecast to grow by 4.5 percent to 38.7 million tonnes in 2021, with overall global output to rise by 3.8 percent, reaching 67.7 million tonnes by 2021, according to Wood Mackenzie.

The firm’s assessment of global aluminum market fundamentals points to a 2.1 million tonne surplus of the metal in 2020, followed by a surplus of 1.8 million tonnes in 2021.

“A key risk is the buildout of power transmission in Yunnan province,” Shivkar said. “Yunnan’s smelter projects were constructed and commissioned at such a rapid pace that it has outpaced the construction of the supporting power systems. As such, smelters in Yunnan might not ramp up as quickly had the power transmission systems already been in place.”

Commenting on prices, Shivkar said Wood Mackenzie is expecting the London Metal Exchange price to move lower in the first quarter of 2021 on seasonality in demand in China.

“Even a modest retrenchment in fund positioning could set in motion a sharper reduction in buying activity and drag the London Metal Exchange price down sharply in 2021,” she explained.

FocusEconomics analysts believe prices are set to ease from their present level in 2021, as the current focus on demand gradually gives way to downside pressures stemming from global oversupply.

“Planned additions to production capacity, including an expected increase in Chinese output, and the global supply overhang are set to weigh on prices (in 2021), more than offsetting upside pressures stemming from recovering global economic activity and healthy demand in top consumer China,” analysts at the firm said in December. “Unstable US-China trade relations further cloud the outlook.”

Panelists polled by FocusEconomics see prices averaging US$1,850 in Q4 2021 and US$1,833 in Q4 2022.

When looking at the market in 2021, investors should keep an eye on several key catalysts, one of them of course being the ripple effects of the global pandemic, which will continue to reverberate this year.

“While there has been significant progress on vaccines, a global vaccination program is still some way off,” Shivkar said. “While developments with vaccines offer a pathway to business as usual, there is still the specter of additional waves of virus outbreaks over the next few months.”

Another factor to keep in mind is US government policy, which is the single largest risk to US premiums, according to the expert.

“The risk of removing tariffs on primary aluminum imports under Section 232 will continue to keep US buyers on edge,” she said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Aluminum Applications: Car and Aircraft Manufacturing | INN ›

- How to Invest in Aluminum | INN ›

- Top Aluminum-producing Countries | INN ›