Aluminum News: AEC Files Petition Against China's Zhongwang

The US Aluminum Extruders Council filed a petition against Chinese aluminum extrusion producer Zhongwang Holdings for evading US import duties.

Controversial aluminum news hit late last week when the US Aluminum Extruders Council (AEC) filed a petition against Chinese aluminum extrusion producer Zhongwang Holdings (HKEX:1333) for evading US import duties.

The circumvention and scope clarification case, which was filed with the US Department of Commerce on Thursday evening, alleges that the Asian company “systematically and illegally” evaded US duties on aluminum products, including pallets and 5050 alloy extrusions.

According to a press release, the scheme involved hundreds of millions of pounds of aluminum extrusions that were simply cut and welded into aluminum slabs, which aren’t subject to the same duties. It states, “[u]pon entering the US these extrusions are being identified as ‘pallets’ even though the testimony the Council has gathered makes it clear the sole purpose of these extrusions is to re-melt them back into billets.”

The AEC also alleges that China Zhongwang has been exporting 5xxx series alloy extrusions into the US in order to avoid anti-dumping and countervailing duties. The Department of Commerce has 45 days to review the petition and make a decision whether or not to launch a full investigation.

The Hong Kong-listed company told the Financial Times that it exported and classified its products in accordance with government regulations and international trade rules, and said exports into the US were not covered by duties.

“The report lacks basic knowledge of the industry,” Zhongwang told the publication.

The anti-dumping and countervailing duties were introduced in 2011 when the industry suffered declines in production and shipments after unfair imports from China decimated the markets for several years.

This isn’t the first time Zhongwang has been accused of illegal businesses practices. In fact, this past July, Dupre Analytics put out a report accusing the company of inflating sales by sending shipments to its offshore companies and systematically defrauding investors by fabricating at least 62.5 percent of its revenue since 2011.

Zhongwang quickly responded to the allegations, calling the report “malicious and groundless,” and saying that the shipments were transported to independent third parties.

China’s impact on the aluminum price

China currently accounts for over half of the world’s aluminum output and consumption, and as the aluminum surplus widens, it has caused a surge in exports and has distorted the supply-demand balance. According to the MetalMiner Annual Metal Outlook, Chinese exports are still up 22 percent compared to 2014 despite exports falling in recent months.

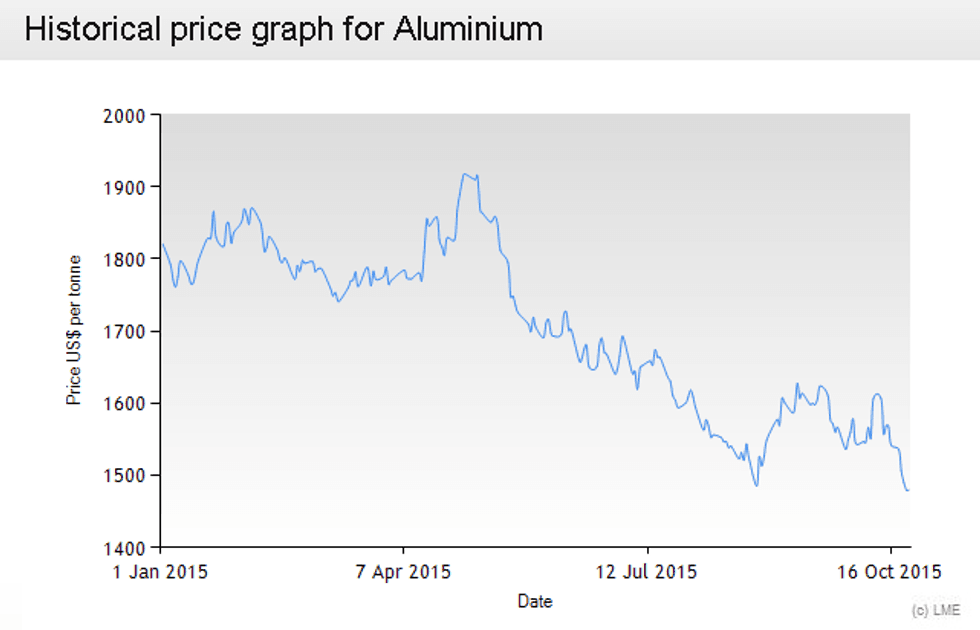

There has also been weaker demand for the metal as manufacturing, automobile and real estate activity in China continues downward — that means prices are likely to stay suppressed. According to the report, aluminum prices are expected to stay low into 2016, and based on market conditions, the firm expects three-month aluminum prices to average $1,550 per metric ton.

“Despite the fact that low prices have already caused producers to cut production, we believe that it will still be a while until aluminum prices make a substantial upward price move,” states the report. “The lows seen during 2009, $1,350 per metric tonne, could act as a support through the year. Buyers should consider fluctuations below $1,840 per metric tonne as normal within the falling market, and reconsider their strategy if prices break above this resistance level.”

A report put out by BofA Merrill Lynch Global Research predicts that aluminum prices will drop as low as $1,200 per tonne, noting that nearly half of the world’s aluminium smelters are not profitable at current prices. It adds that pressure will force more offline. Aluminum prices fell just below $1,500 per tonne last Thursday.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Related reading:

What Does the Alcoa Split Say About the Aluminum Industry?

Investing in Aluminum: What Investors Need to Know

Aluminum Price Outlook: BMO Says ‘Lower for Longer’