Weekly Round-Up: Gold Price Steady After Big Drop Last Week

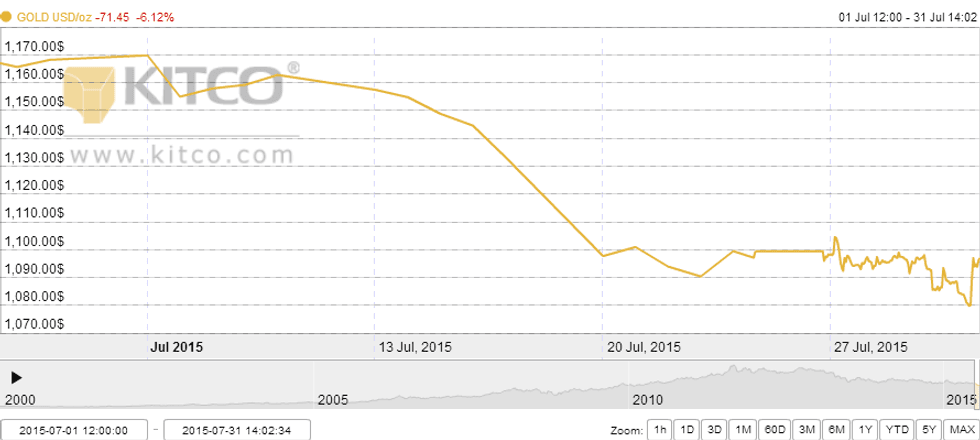

However, the yellow metal is on track for a 6.6-percent loss in July.

Gold fared abysmally last week, hitting its lowest price since Q1 2010, and unfortunately for fans of the yellow metal, this week’s price action wasn’t much better.

As of 1:00 p.m. EST on Friday, the gold price was sitting at $1,096.25 per ounce, almost exactly the same price it was this time last week. The only real bright spot is that the metal is up from $1,079.80, the low it reached Friday morning as investors cut their gold holdings in anticipation of higher US interest rates.

According to The Wall Street Journal, the US Federal Reserve “appears closer to raising rates for the first time in nearly a decade.” The central bank sees positive stats in employment, real estate and manufacturing as signals that the US economy no longer needs the emergency measures it put in place after the financial crisis in 2008.

All in all, gold is on track for a 6.6-percent loss in July. As the chart below shows, it began the month just below the $1,170 mark.

The silver price fared much better than gold last week, and much the same can be said this week. As of 1:00 p.m. EST on Friday, the white metal was sitting at $14.79 per ounce. That’s up slightly from last week’s close of $14.67.

On the base metals side, three-month copper on the London Metal Exchange was down Friday by 0.6 percent, at $5,230 per tonne; earlier in the day it had sunk by as much as 1 percent. Commenting, Richard Fu, director of Asian commodities trading at Societe Generale Newedge in London, told Reuters, “[c]opper rebounded after the dollar weakened and shorts were taking profit at the month-end.”

Like gold, copper has had a poor month overall — the news outlet states that LME copper dropped by 9 percent in July. That’s it second-largest drop since 2012.

Finally, oil prices were also not doing so hot on Friday. Money Morning states that the WTI crude oil price hit an intraday low of $47.35 per barrel following the news that July production from OPEC was 32 million barrels per day, an increase of 140,000 barrels from the previous month. Similarly, Brent crude was down $0.48, at $52.83 in early trading Friday.

Increased production from OPEC will only exacerbate the large supply glut in the oil market.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Weekly Round-Up: Gold Price Lowest Since Q1 2010

Weekly Round-Up: Metals Prices Rise Following China Meltdown

Weekly Round-Up: Gold, Silver Boosted by US Labor Market Data

Weekly Round-Up: Precious Metals Prices Down on Greece Uncertainty

Weekly Round-Up: Gold Price Poised for Second Straight Week of Gains