Dunnedin Acquires 100% Interest in MPD Copper-Gold Porphyry Project in South Central British Columbia

Dunnedin Ventures Inc. (TSXV:DVI) (the “Company” or “Dunnedin”) today announced it has entered into a purchase agreement to acquire 100% ownership of the consolidated Man, Prime and Dillard properties, the “MPD Project”, in south-central British Columbia.

Dunnedin Ventures Inc. (TSXV:DVI) (the “Company” or “Dunnedin”) today announced it has entered into a purchase agreement to acquire 100% ownership of the consolidated Man, Prime and Dillard properties, the “MPD Project”, in south-central British Columbia. The MPD Project is an excellent strategic fit with Dunnedin’s 100% owned Trapper copper-gold porphyry project (“Trapper”, see news release November 27, 2018), located in the northern Golden Triangle area of British Columbia and joins this project to form a strong copper-gold porphyry portfolio that has the potential to stand alone from Dunnedin’s Kahuna Diamond Project in the future.

Claudia Tornquist, President of Dunnedin said, “MPD is a quality project with immediate exploration upside and the potential to yield a major copper-gold porphyry system. We are genuinely excited about this asset and pleased to have secured it on favourable terms. Our philosophy in the Discovery Group of companies has generated industry-leading returns for shareholders over the past year at Northern Empire Resources and Great Bear Resources. This philosophy can be summed up as finding and advancing known mineral discoveries that are undervalued, but with strong economic potential. These projects have geological characteristics that can drive rapid value growth for investors when modern exploration methods and management’s experience is applied. Dunnedin’s new MPD project has these attributes and could mirror these recent successes in 2019.”

MPD Project, South-Central British Columbia, Canada

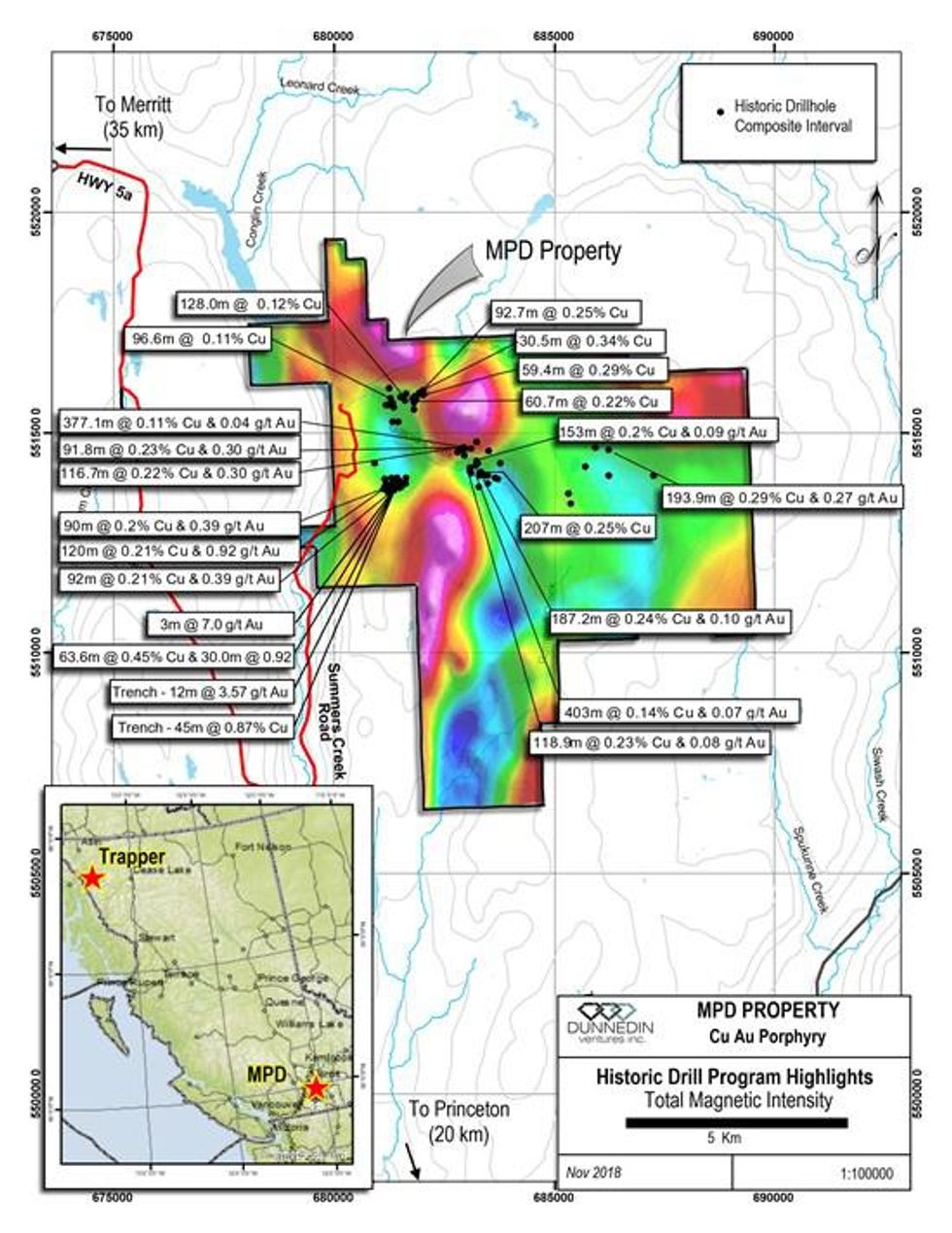

Refer to Figure 1

- Recently consolidated 78.5 km2 MPD land package (historically called Man, Prime and Dillard properties) located in a known, productive copper-gold porphyry belt

- Many historically drilled copper intervals have similar grades to those reported at adjacent copper mines

- 129 drill holes (25,780 metres) were completed from 1966 to 2014. Previous operators include Rio Tinto PLC and Newmont Mining Corp.

- Copper has been drill confirmed to-date across a large, 10 square kilometre area

- Historic drill results often have favourable gold to copper values and are consistent with multiple porphyry centres having associated base and precious metal mineralization,

- Large untested copper and gold-in-soil anomalies represent new near-term drill targets

- Copper and gold mineralization extends from surface, with early historic drill holes rarely testing below 200 metres vertical depth. Limited deeper drilling confirms significant depth/size potential

- Many historic copper intervals were not assayed for gold, and adjacent samples show strong gold results suggesting underexplored gold potential

- Accessible year-round by service roads and trails from adjacent highway linking Princeton and Merritt

Highlights of historical drill results (1966 to 2014) are shown on Figure 1 and include:

- 63.6 metres of 0.45% copper and 30 metres 0.92 g/t gold

- 194 metres of 0.29% copper and 0.27 g/t gold

- 120 metres of 0.21% copper and 0.92 g/t gold

- 403 metres of 0.14% copper and 0.07 g/t gold

- High gold grades include 3.0 metres of 7.0 g/t gold with 0.91% copper and 12 metres of 3.6 g/t gold

The MPD Project is located in the Quesnel Trough, British Columbia’s primary copper-producing belt that hosts Teck Resource’s world-class Highland Valley Mine, Imperial Metals’ Mount Polley Mine, and Centerra Gold’s Mount Milligan Mine (see Table 1). The MPD project’s Nicola Belt geology has many similar characteristics to the neighbouring alkalic porphyry systems at the Copper Mountain Mine to the south, New Gold’s New Afton Mine to the north, and Evrim Resources’ nearby Axe Project which was recently optioned to Antofagasta

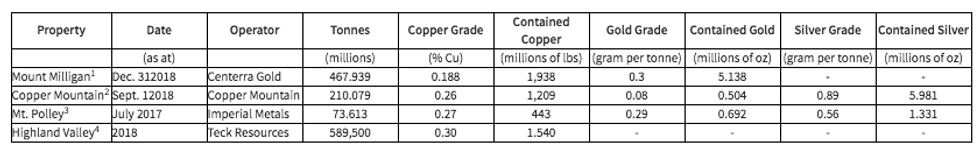

Table 1: Proven and Probable Reserves – Selected Quesnel Trough Copper Porphyry Mines

Sources:

- https://www.centerragold.com/operations/mount-milligan/production-and-reserves

- https://www.cumtn.com/operations/copper-mountain-mine/overview/

- https://www.imperialmetals.com/assets/docs/2017-reserve_resource%20table.pdf

- https://www.teck.com/investors/reserves-&-resources/

Figure 1: MPD Copper-Gold Porphyry Property

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/3803/41331_0c521465f43cf842_002full.jpg

MPD Project Transaction Details

Dunnedin has entered into a definitive agreement to acquire 100% of the MPD Property from a private vendor, subject to the approval of the TSX-Venture Exchange. The consideration for MPD consists of:

- $100,000 in cash and 1,800,000 Dunnedin shares payable upon closing of the transaction; and

- $100,000 in cash payable on April 1, 2019

- A 1.25% to 2% NSR is payable on only three of a total 28 mineral claims. No royalties are payable on the remaining 25 claims.

Further details of the MPD and Trapper copper-gold porphyry projects are provided on Dunnedin’s web site at www.dunnedinventures.com. Technical information will be updated as recently acquired historical data are evaluated.

Management will provide further information on 2019 exploration plans at MPD as the project database is analyzed.

Webinar

Dunnedin will host a webinar to discuss the Company’s recent news. The webinar will take place on Friday, November 30th at 11:00am PST/2:00pm EST. Management will be available to answer questions following the presentation. Online access and dial-in numbers are as follows:

Readytalk Platform (access at the time of event):

* https://www.readytalk.com/join

* Access code: 5147677

Dial-In Numbers:

* Canada: +1-647-722-6839

* United States: +1-303-248-0285

* Access Code: 5147677

Disclaimer

Management cautions that Dunnedin has not performed any exploration on the MPD Project to date. Historic information reported herein was obtained from publicly available sources and industry related reports. This news release contains historic data that Dunnedin believes to be from reliable sources using industry standards at the time, but the Company has not independently verified, or cannot guarantee, the accuracy of the information disclosed and readers should use caution in placing reliance on such information. Comparisons to adjacent or similar mineral properties, deposits and mines are provided for information purposes only. Dunnedin has no interest in, or rights to explore or mine any such properties and references to deposits and reserves reported herein are not indicative of deposits or results obtained on the Company’s properties.

Jeff Ward, P.Geo, Vice President Exploration and a Qualified Person under National Instrument 43-101, has reviewed and approved the technical information contained in this release.

On behalf of the Board of Directors

Dunnedin Ventures Inc.

Chris Taylor

Chief Executive Officer

Claudia Tornquist

President

About Dunnedin Ventures Inc.

Dunnedin Ventures Inc. (TSXV: DVI) is focused on its 100% owned, advanced-stage Kahuna Diamond Project in Nunavut which hosts a high-grade, near surface inferred diamond resource and numerous kimberlite pipe targets. The Company holds diamond interests in 1,664 km2 of mineral tenure located 26 kilometres northeast of Rankin Inlet and adjacent to Agnico Eagle’s Meliadine gold mine. The Kahuna Diamond Project has an Inferred Resource Estimate of 3,987,000 tonnes at an average grade of 1.01 carats per tonne, totalling over 4 million carats of diamonds (+0.85 mm) (see news release dated March 31, 2015). Dunnedin’s drilling is aimed at the discovery of diamondiferous kimberlite pipes, and the Company is working with advisor and largest shareholder Dr. Chuck Fipke to define and prioritize drill targets based on an extensive historic data set, and diamonds and indicator minerals recovered from a series of kimberlite and till samples over four seasons of field work. Dunnedin also holds a 100% interest in the Trapper Project near Atlin in the northern “Golden Triangle” region of British Columbia. The Trapper Project is interpreted to overlie a gold-rich copper porphyry complex having a surface geochemical, geophysical and regional alteration signature of over 15 square kilometres. Based in Vancouver, Dunnedin is backed by a world-renowned team of exploration experts with decades of combined exploration experience and significant capital market strength.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Statements included in this announcement, including statements concerning our plans, intentions and expectations, which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements”. Forward-looking statements may be identified by words including “anticipates”, “believes”, “intends”, “estimates”, “expects” and similar expressions. The Company cautions readers that forward-looking statements, including without limitation those relating to the Company’s future operations and business prospects, are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, except as required by applicable securities laws.

Click here to connect with Dunnedin Ventures Inc. (TSXV:DVI) for an Investor Presentation.

Source: www.newsfilecorp.com