Wolf Minerals Increases Reserves by 34 Percent and Extends Pit Depth at Hemerdon

The company announced Wednesday a 34-percent increase in ore reserves at the project.

Wolf Minerals (ASX:WLF,LSE:WLFE) has been working hard to make progress at its UK-based Hemerdon tungsten-tin project, also known as the Drakelands mine, and it seems its efforts are paying off.

The company announced Wednesday a 34-percent increase in ore reserves at the project. Not to be confused with mineral resources, which are potentially valuable and have reasonable prospects for eventual extraction, ore reserves are both valuable and legally, economically and technically feasible to extract

Hemerdon’s ore reserves now sit at 35.7 million tonnes at 0.18 percent WO3 and 0.03 percent tin. That’s reported above a cut off of 0.05 percent tungsten, or 0.063 percent WO3. In turn, mine life has risen by about three years.

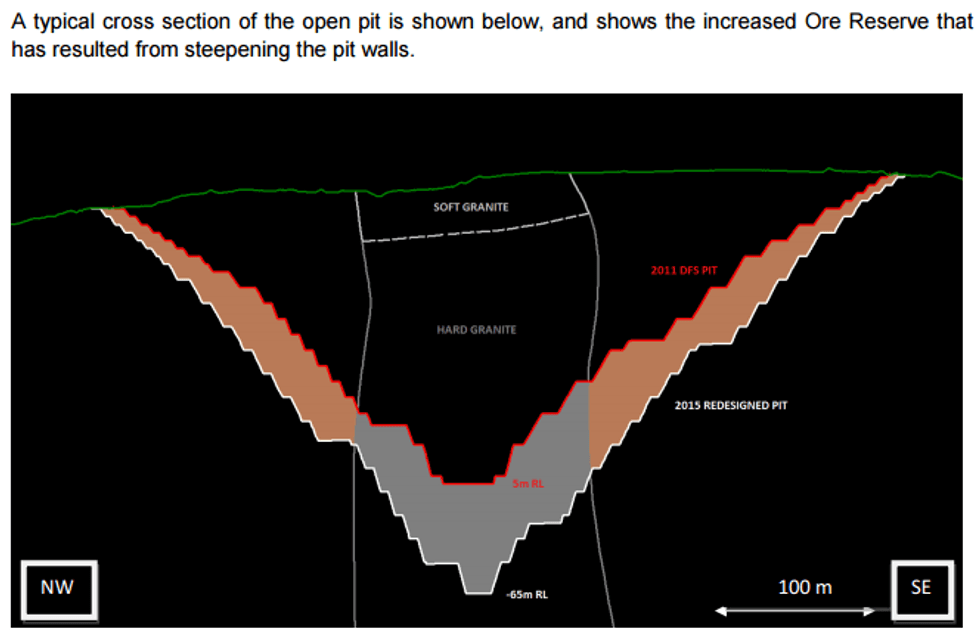

Wednesday’s numbers replace those reported in a 2011 definitive feasibility study, and are the result of a six-hole geotechnical drilling program that targeted the parameter of the open pit and was completed in Q4 2014. Wolf has been looking to expand the project, and that program showed the company that it will be possible to steepen the final pit slope to create a deeper open pit.

Digging deeper

Wolf has already gone back to the drawing board to draft up a new pit design (shown below). It takes the pit floor approximately 65 meters deeper, and it’s that deepening that led to the increases in ore reserves and mine life.

The pit now extends below the bottom of the majority of the drill holes in the deposit, and Wolf plans to begin additional work to increase its confidence in the resource at depth. The company believes that ore reserves and mine life could potentially be extended even further.

Commenting on the increase, Russell Clark, managing director of Wolf, said in Wednesday’s release, “[t]his is the next stage of optimising the Drakelands Mine, and comes ahead of commencing operations at the new process plant.” He also said the project remains on schedule and “is fully funded and commissioning of some of the installed equipment has commenced, with a view to introducing ore into the plant in July 2015.”

Other aspects of the Hemerdon project

Wolf also provided a new mineral resource estimate for Hemerdon that’s compliant with the JORC 2012 code. The measured and indicated resource for the project is now 58.6 million tonnes at 0.17 percent WO3 and 0.02 percent tin, while the inferred resource is 86.6 million tonnes at 0.14 percent WO3 and 0.02 percent tin. Altogether that’s 145.2 million tonnes at 0.15 percent WO3 and 0.02 percent tin.

Hemerdon is currently the third-largest tungsten and tin resource in the world, and is set to be the first new metal mine in Great Britain for over 45 years. Production is estimated at 5,000 tonnes per year of tungsten concentrate and 1,000 tonnes of tin concentrate.

The company has already taken steps to ensure waste from the mine will have somewhere to go by constructing a mine-waste facility, which is set to finish by the time the new processing plant begins operation in July 2015. The company’s interim financial report states that “during construction of the Mine Waste Facility 100,000 tonnes of ore has been extracted and stockpiled, forming the basis of the initial feed to the processing plant.”

At close of day Wednesday, Wolf’s share price was up 6.49 percent on the ASX, at AU$0.41. In London it was up 6.33 percent, at GBP0.21.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Wolf Minerals is a client of the Investing News Network. This article is not paid-for content.