Shrey Patel and Jonah Raskas of The Lithium Spot look back at the lithium space in Q4 2017 through the lens of value investing.

By Shrey Patel and Jonah Raskas of The Lithium Spot

Having trained under the budding value investing program at Fordham Gabelli School of Business, we are proud to think of ourselves as value investors. We look for companies which have strong earnings potential, great management, strong resources, and numerous upcoming catalysts, with “Mr. Market” not fully incorporating these attributes into the market price. We like to see where value is locked and how we think it’ll become unlocked shortly.

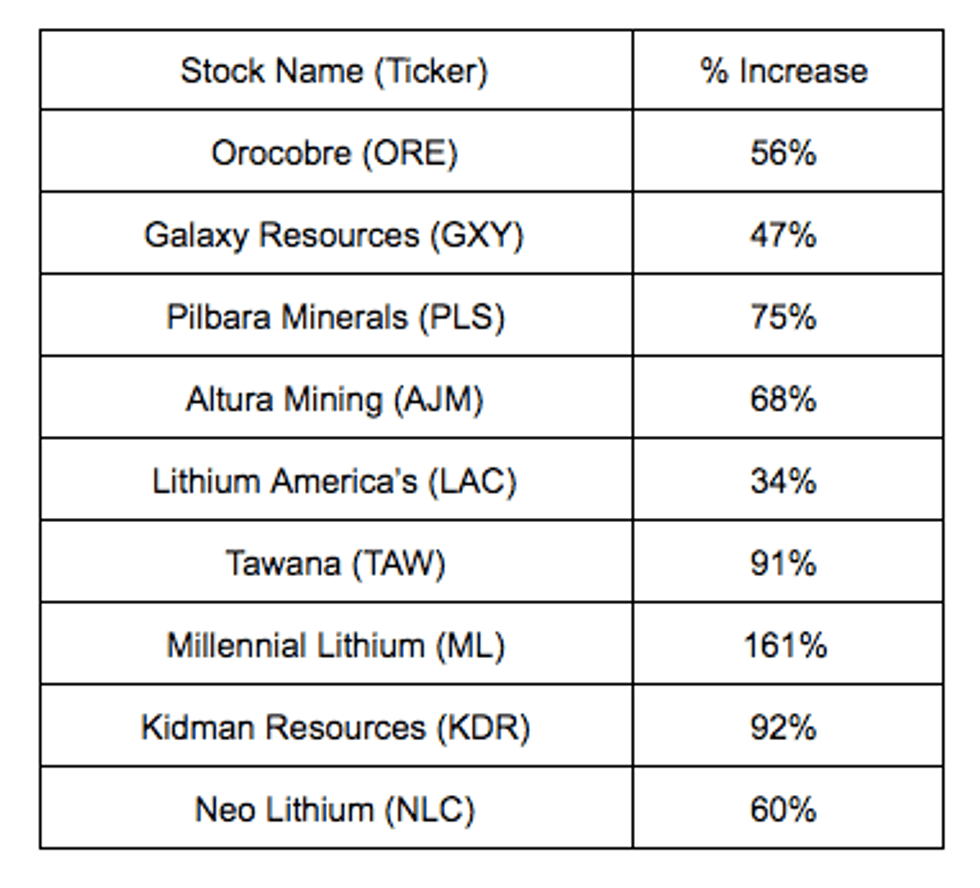

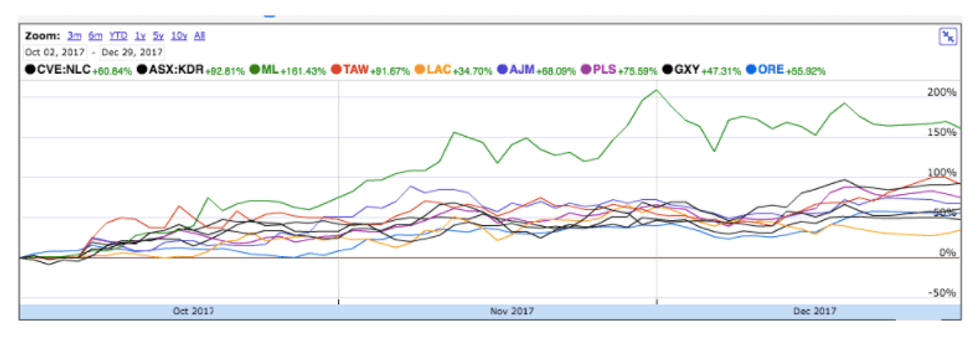

As value guys in the lithium space, we felt the fourth quarter market rally was worth calling out. The Lithium market was a strong one in 2017 with the strongest performance potentially belonging to the 4th Quarter (October – December). Overall, you’ll notice when looking across a range of the more well known Junior miners, that stock performance was extremely strong. We’ve provided a table and chart to visually show you what we’re referencing at the end of this article.

What does this mean? Well, it’s hard to say. Again, we try not to take too much stock in the actual charts but this overall trend was “screaming” to be looked at. As value investors, here are some general trends we are thinking about, and use to approach the market, after many Junior miners have run up so much.

- Do your homework. There were many lithium companies entering the space throughout 2017, and it is now getting very difficult for investors to sift through them. As such, before even thinking about buying a stock, we follow in the footsteps of many fundamental value investors before us and do a ton of homework. From thoroughly reading public filings, press releases, transcripts, and presentations, to primary research like speaking with customers, industry experts, and management, there is a lot of information that we need to collect in order to make the best investment decision. After collecting all of the information, we try to analyze it in a way that is different from the consensus. By doing so, which is much easier said than done, we can hope to earn returns greater than the overall market, which in our case could potentially be represented by the LIT ETF.

- Buy the strong names that are already producing or will be producing shortly. After sifting through the numerous companies and analyzing their competitive positioning, consider honing in on the stronger junior miners that are also either already generating cash flow or will be shortly. Strong cash flow generation is one of the biggest attributes that value investors look for. In the lithium space, however, we believe there are additional reasons to follow these companies- they are in the best position to take advantage of current lithium prices, as well as establish long term relationships with customers. Thus, they would potentially be lower risk investments than pre-revenue mining hopefuls that have a few years of execution left ahead of them before they can even begin stealing market share and earning meaningful revenue.

- Investigate those producers coming online after 2019. While the previous bullet point is true, we don’t mean investors should completely ignore future producers. Value can still be found in future producers that are being ignored by the market. Thus, you might want to start investigating those producers who are coming online in the longer term. At this point in time, we feel it is pretty clear which producers will be coming online in 2018 and 2019. What’s less clear is those who are coming online after that. There will be value in the producers that come online after this period. Yet, since there are so many companies coming online in this space, real due diligence and a deep understanding of the field will be crucial to recognize the winners vs. the losers. The management, grade, cost of production, JV partners, among other factors will be a good place to begin.

- Buy the dips. Finally, after forming conclusions on specific investments, the next step would be to build a position in the stocks. When the entire sector goes down, an event causes a sudden and temporary overreaction or scare, or the entire market goes down, consider buying the dips. Essentially, when anything occurs that does not drastically or tremendously change the story of the Lithium field or the particular Junior minor, consider buying more. For example, on the surface, when Nemaska recently put out strong results, the stock went down. We believe this is a great opportunity to buy the dip if you believe in the long term fundamentals of Nemaska and its place in the lithium mining industry. While sometimes there will be bumps along the road, if the overall story hasn’t changed, investors should add to their positions in companies they believe will be strong players in the future on any selloff, instead of getting spooked by Mr. Market and selling their positions.

About the authors — Jonah’s passion for the Lithium space is fueled around Market Research, valuation and of course, making some smart investments! His passion for Market Research started out early on his career when he worked in the White House’s SpeechWriting office. There, Jonah was tasked with researching for the President’s and Vice President’s speeches on a diverse set of topics ranging from Defense to Agriculture to Policy Announcements. Following that, Jonah’s career took a turn to Wall Street where he worked for two separate investments banks. It was there that he worked on the capital markets desk getting an up close sense of valuation and the market. He worked on many different offerings ranging from IPO’s to Secondary offerings as well as in depth analysis on a wide range of companies. Most recently, Jonah’s core strength of market research has helped him earn widespread praise from a variety of consulting and MBA internship opportunities. Having just completed his MBA at the Gabelli School of Business (summa cum laude) in Marketing & Accounting, Market Research is again at a focal point for his job in Brand Management for a Fortune 500 company.

Shrey’s interest in Lithium began when he was asked to cover the space during his time on the specialty chemicals team at GAMCO Investors. Interning for a well-respected analyst, and a famed value investor, he learned a tremendous amount while researching and writing an in-depth industry report on the rapidly emerging Lithium sector, and covering Albemarle Corporation. With an undergraduate background in Biomedical Engineering and Economics from UNC (University of National Champions!), and an MBA in Finance and Accounting from the Gabelli School of Business, Shrey approaches the industry from both a technical as well as a business perspective. This background also affords him the ability to get into the nitty-gritty fundamentals while maintaining a perspective on the broader, global interconnections of the industry and economy. Through his time on both the buy and the sell-sides, as well as his experience managing capital raised from friends and family, Shrey brings tremendous research and investing insight to the table.

Source: thelithiumspot.com