Simon Moores: US Domestic Supply Chain Build Out “Far Too Slow”

“It is not too late for the US, but action is needed now,” Simon Moores of Benchmark Mineral Intelligence told the US Senate on Tuesday.

Building supply chains for a lithium-ion economy is critical, but progress in the US has been “far too slow,” according to Benchmark Mineral Intelligence Managing Director Simon Moores.

“Those who invest in battery capacity and supply chains today are likely to dominate this industry for generations to come,” Moores said at a US Senate hearing on Tuesday (June 24). “It is not too late for the US, but action is needed now.”

Since 2017, the number of battery megafactories in China has increased from nine to 107, of which 53 are now active and in production. Meanwhile, the US has gone from three to nine battery megafactories in the pipeline, of which only three are active — the same number as in 2017.

“A new global lithium-ion economy is being created,” Moores said. “Yet any US ambitions to be a leader in this lithium-ion economy continue to only creep forward and be outstripped by China and Europe.”

Looking at the raw materials needed to supply that lithium-ion economy, Benchmark Mineral Intelligence forecasts that by 2029, demand for nickel will double, while demand for cobalt will grow by three times, flake graphite by four times and lithium by more than six times.

“The tectonic plates of the industry have shifted,” said Moores, who has testified to the US Senate two other times previously. “Layered on top of this are new, emerging demands of supply chain security, transparency and accountability.”

Speaking about the impact of COVID-19 in the critical minerals space, Moores said the pandemic has not only shown the weakness of truly global supply chains and the need to build domestically, but has also continued to shine a spotlight on how these raw materials are extracted around the world.

“In the US, progress is far too slow on building out a domestic lithium-ion economy, but the opportunities that remain are vast and pioneers have emerged,” he said, mentioning efforts in Texas, Ohio, Alabama, Georgia and Tennessee.

“Yet most of these developments are more standalone achievements than a coherent US plan, and all rely on imported raw materials and chemicals for the two main components that make a lithium-ion battery: the cathodes and anodes,” Moores said.

Compared to China, which produces over two-thirds of global supply from more than 100 cathode facilities, the US has only three cathode plants producing under 1 percent of global output.

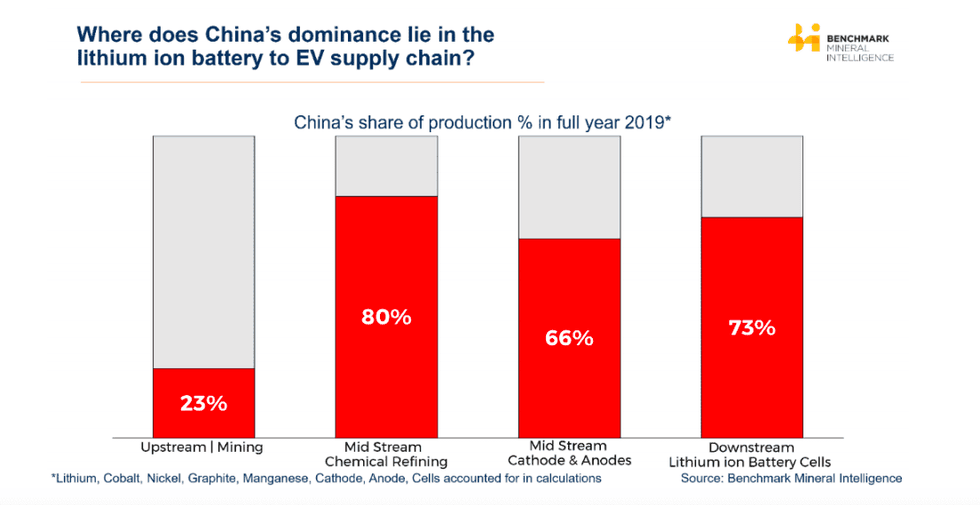

Chart via Benchmark Mineral Intelligence.

On the graphite anode side, the US has zero manufacturing plants that can supply automotive-grade anode at scale. China has 48 plants and controls 84 percent of total global supply.

“Developing this midstream of the supply chain will create a domestic ecosystem, an engine for more battery plants to be built, more electric vehicles to be made, and will spark the development of domestic mining and chemical processing,” Moores told the US Senate.

Benchmark forecasts that China will account for 70 percent of lithium-ion battery capacity in 2029 versus 16 percent in Europe and 9 percent in the US. Europe’s capacity investments over the last 18 months have allowed it to increase its share of the global capacity pie from 6 percent to 16 percent.

“China’s supply chain dominance lies in the midstream of the lithium-ion battery to electric vehicle supply chain,” Moores said. “While many long-term contracts and asset owners secure raw materials located in foreign countries, China’s domestic chemical conversion, cathode and anode capacity creates an ecosystem for lithium-ion battery and electric vehicle production to flourish.”

The Tuesday hearing was chaired by US Senator Lisa Murkowski, who said the COVID-19 pandemic has shown how delicate US supply chains are and that more needs to be done.

“Our job is not simply to impose a royalty on mineral production on federal lands and then call it a day,” she said. “It is to rebuild our supply chains, and to recognize that no realistic level of subsidies and incentives can compete with having raw materials available here at home.”

The senator is behind the American Minerals Supply Act, which she introduced in May last year. It provides the framework for a sustainable domestic mineral supply chain.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.