Simon Moores: Energy Storage Revolution is Coming, but Expect Delays

Simon Moores of Benchmark Mineral Intelligence, who recently testified to the US Senate, says that understanding the supply chain is critical.

With electric car sales forecasts increasing almost every day, the energy storage revolution that is expected to take place in the coming years is at this point very difficult to refute.

Speaking at this year’s Miller Thomson PDAC “Lithium-ion Battery Materials and Supply Chains” seminar, Benchmark Mineral Intelligence Managing Director Simon Moores said that even though the energy storage revolution is coming, it will be delayed.

Looking to 2030, Moores pointed to delays in new supply, and as a result delays in raising capital, saying that this will lead to further delays in battery supply and in new electric vehicle (EV) production.

Moores, who recently testified to the US Senate on the current outlook for the energy and minerals markets, said that understanding the supply chain is critical.

“It’s not only where raw materials like cobalt, lithium and graphite are being mined, but where they are being refined,” said Moores, pointing to how China dominates the chemical sector.

“The key is understanding the nuances of each raw material supply chain, because that is going to make or break any new supply coming into the battery EV market,” he added.

When looking specifically at lithium, there are about 15 steps from lithium mine to EV battery, “so there are 15 steps where things could go wrong,” said Moores. The expert divided the steps into five stages: mining, chemical processing/refining, cathode or anode production, lithium-ion battery cell manufacturing and end use.

Having expertise in several of those steps is what a new lithium producer has to have, “so it’s no wonder we are seeing problems in the space in scaling the supply at present.”

Speaking about the quality factor impacting raw materials, Moores said that battery manufacturers are also experiencing similar issues.

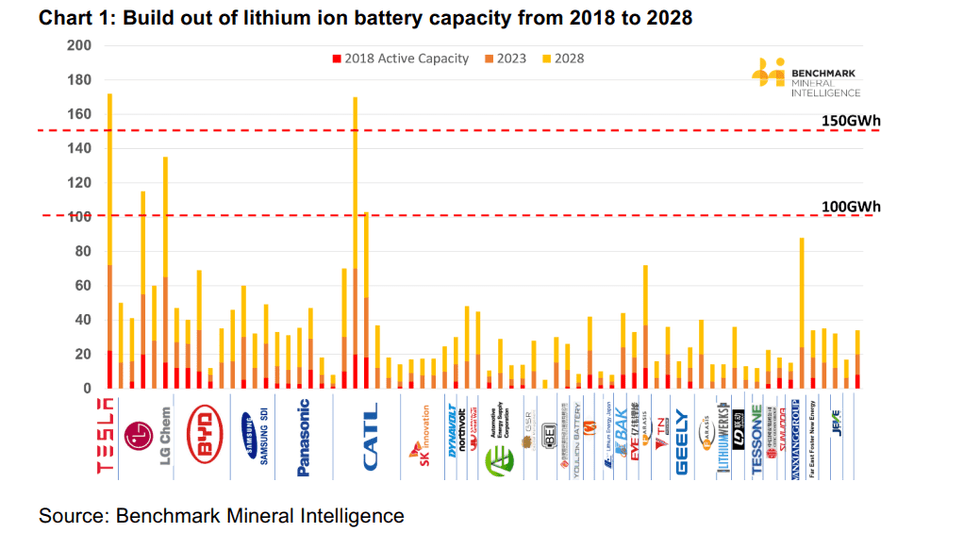

Moores then shared Benchmark Mineral Intelligence’s forecast for lithium-ion battery megafactory capacity, which for the 2019 to 2028 period has risen from 289 GWh to 1.54 TWh. However, according to the firm, the real-world expectation is that 70 percent of this capacity will be realized.

To meet Benchmark Mineral Intelligence’s demand forecast to 2030, which is 1.8 TWhz, lithium supply will need to increase to 1.7 million tonnes — but the London-based firm expects that number to be around 1.2 million tonnes.

“The biggest challenges are until 2025 — that will build the blueprint of what will be the next 20 years,” Moores said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.