In this Lithium-ion Bull (Forest Hills) article, Howard Klein covers the latest developments in the lithium space, from company to market news.

January 8 — New Year’s Resolutions

- To help Found and Launch one or more Battery Materials Investment Product(s)

- To help Make North Carolina Great Again for lithium mining and processing

- To continue to analyze, inform and entertain on Twitter, LinkedIn and the FREE Lithium-ion Bull

- To visit Western Australian Lithium Producers and Developers

- To visit Argentina Lithium Producers and Developers

- To help an old friend of mine who is seriously considering a run for a US Senate seat.

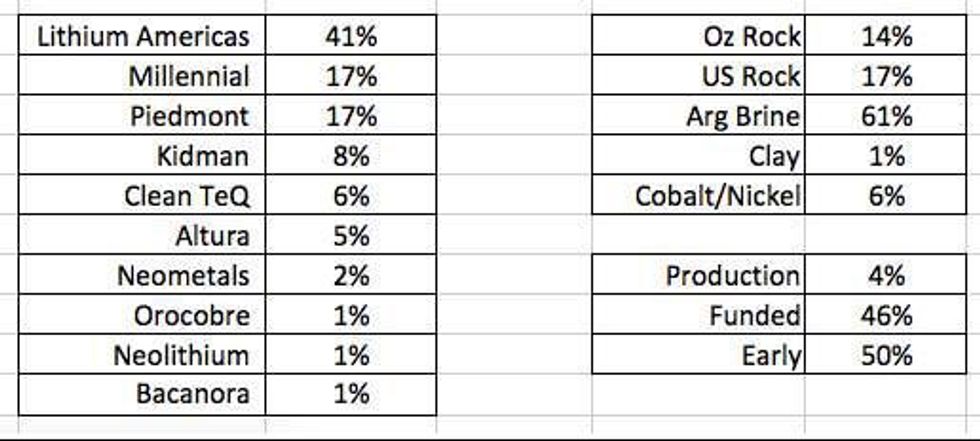

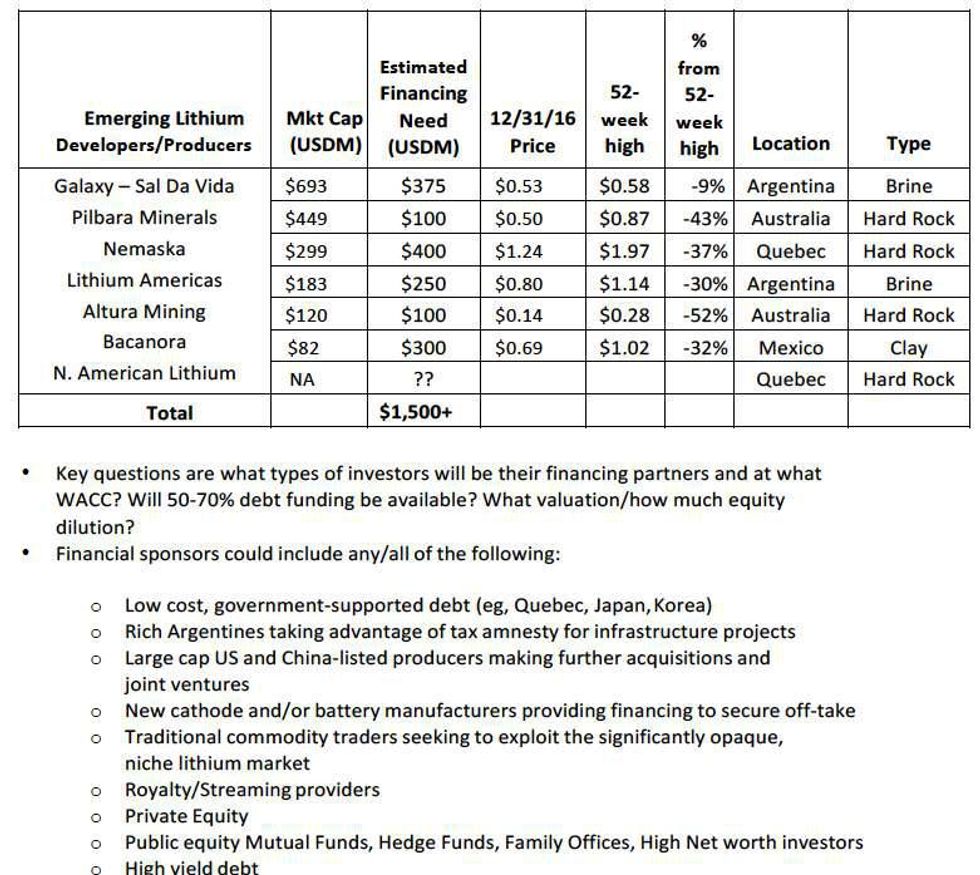

In the interest of more disclosure, I share a slide for a pitch deck I just prepared.

And, my Joe Battery Pack Euronet Cash Machine Portfolio, as at December 31, 2017:

NOTE: Nothing in the Lithium-ion Bull is Investment Advice.

Read Disclaimer and Do Your Own Research.

What Did Mr. Market Say in 2017 and What Should Investors Focus on in 2018?

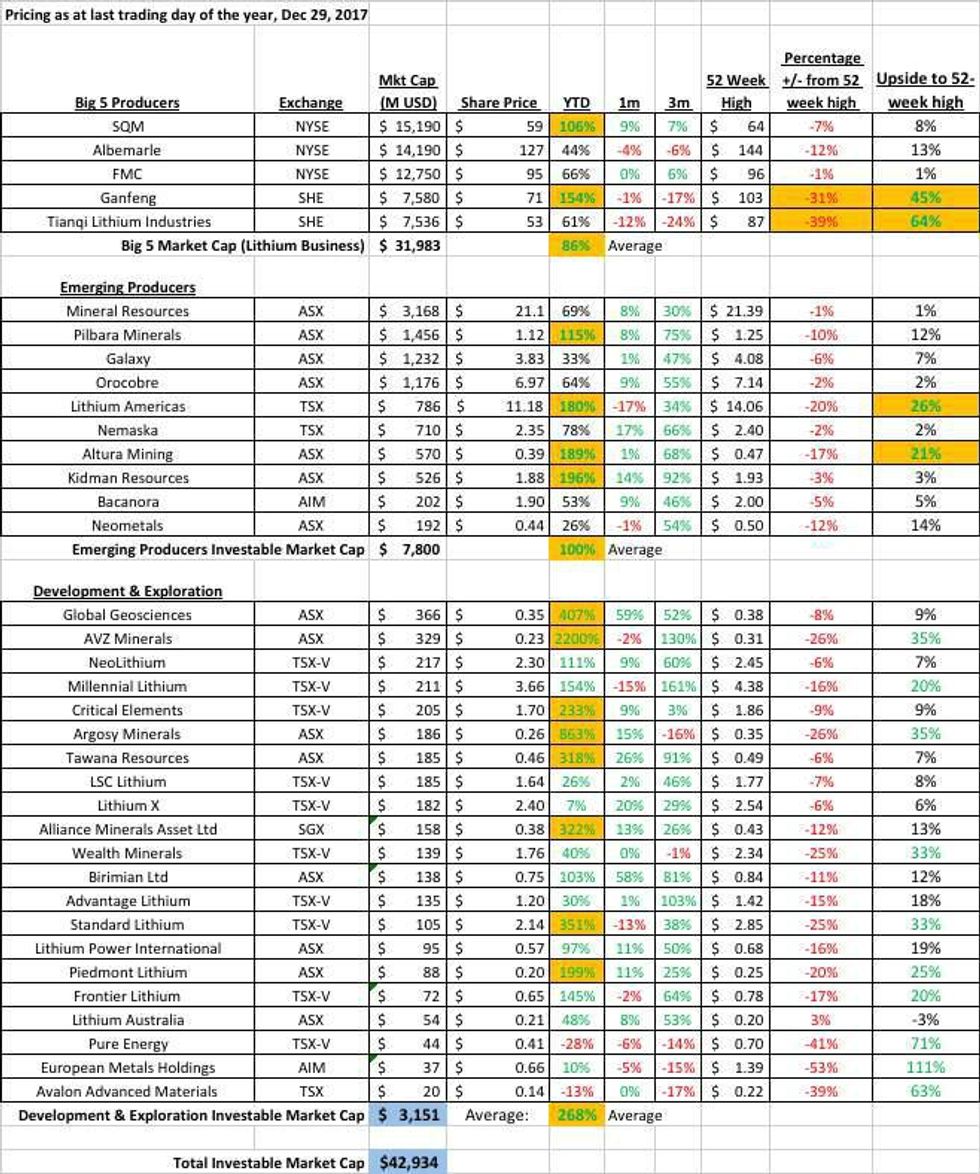

Lithium Heaven 2017. Average Gains:

Big 5: 86%

Emerging Producers: 100%

Development: 268%

This is as it should be as Greed, aka, Fear of Missing Out, displaces just plain Fear, and risk seekers flock to high-beta, Series A, B and C-style public venture risk capital for pre-Resource to DFS Developers.

Stock picking can make a difference. The battery materials investment space is one in which active fund management can create high Alpha, in addition to high Beta.

SQM raced ahead of ALB, up 106% vs. 44%. SQM’s market cap of $15B is now a full $1B Bigger than ALB. I doubt this goes down well in Charlotte’s HQ that SQM’s market cap is bigger. Who will ALB buy in 2018?

Likewise, Ganfeng, now equivalent market cap to Tianqi, up 154% in 2017 vs. Tianqi 61%.

It’s worth noting, however, that the two Shenzen players, whose trading patterns are peculiar and tend not to be correlated to ASX, TSX or NYSE lithium plays, have fallen sharply in recent months. Both stand out as being down ~30 -40% off their 52 -week highs, which is another way of saying they have ~50%+ upside, if you think it’s likely that these two industry leaders will trade back to last year’s highs and potentially hit new ones from there. In other words, for those, unlike me who will find it difficult to trade SHE-listed shares, for those who can trade Chinese A shares, liquid Ganfeng and Tianqi look tempting.

Lithium Americas and Kidman were the best performing Emerging Producers up 180% and 196%. I’ve written previously about the path companies like these can take from $100M to $250M to $500M to $1B to $ 4-5B over the next several years as partnering and funding turns to construction, production and low cost, high margin cash flow.

On this SQM/Ganfeng/LAC/KDR thematic I am in perfect harmony with @globallithium

#LithiumSA, Lithium Star Alliance.

RESPECT AJM was no slouch, up 180%. But, in my opinion, traded at year-end at a still-too-large 61% discount to Pilbara, which rose a hefty 115% and actually has attained the biggest market cap of all the Emerging Producers, despite announcing a $50M cost over-run in December.

Supply-side watchers should have their eyes fixed on construction to production announcements at AJM, PLS and also Tawana, who have guided the market for commissioning/production Q1/Q2. I have a reasonable degree of confidence that two of these three will likely be late. Ramp up is not so simple. This may cause working capital strains and under-delivery in terms of supply forecasts.

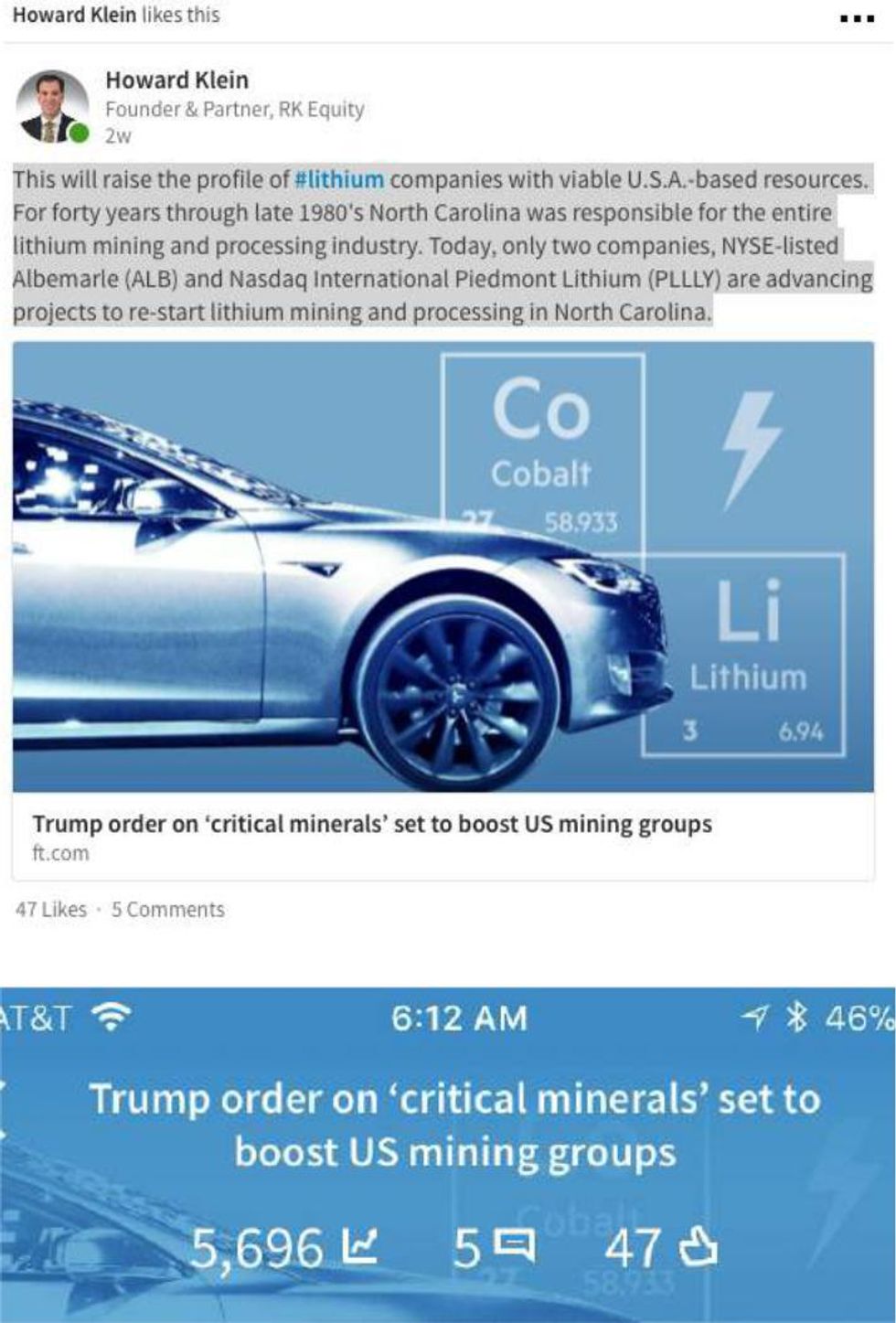

Make North Carolina and Nevada Great Again

Among the high-Beta, series B and C developers from $100 – $350M market cap, I highlight my late December LinkedIn post, which proved to be my most popular of the year – 5,700 views, with more than 160 employees of the Big 3 NYSE listed lithium producers ALB, SQM and FMC among them.

https://www.linkedin.com/feed/update/urn:li:activity:6349698561990541313

Uptown Girl Piedmont Lithium was up a respectable 200% in 2017, but at still USD 88M at year-end and 20% off its 52-week high, my sense is Nasdaq International PLLLY, will continue to be Born to Run.

- KISS Principal #1: Insider Buying. CEO Keith Phillips was again on the tape in late December.

- Another milestone to start the year: Piedmont PLLLY received a ‘Buy’ initiation and USD 23 initial target from US microcap and clean-tech specialist Roth Capital Partners. Analyst Joe Reagor called and covered Nemaska from early on.

Lithium Americas’ “ Free Bird” project Lithium Nevada presents upside not factored by Mr. Market at present, but is easy to extrapolate some value from Global Geoscience and Bacanora market valuations.

Mrs Robinson Global Geosciences rose 11% in the first four days of 2018 – another direct beneficiary of the positive side of America First Trumpism within a lithium Nirvana mindset.

Trump’s Tax Reform preserved the $7,500 EV credit. Lithium catalyst.

January headline “California setting 2040 date to kill ICE.” Lithium catalyst.

FMC’s spinoff, likely on the NYSE. Lithium catalyst.

FMC will be a scarce pure-play producer on NYSE. I suspect it will garner a premium valuation, despite FMC’s considerably lower margins than SQM’s. It will raise the profile of Argentina. LAC should benefit as a comp trading soon on the NYSE, skipping the NYSE American step. As should PLLLY, which is expected to take the NYSE American step by 1H of this year. Worth noting that PLLLY and FMC have significant presence in Charlotte area.

More Chinese M&A in Argentina?

In Argentina, I suspect we will see in 2018 more swashbuckling Chinese investment and potentially outright acquisition like LIX. Will be interesting to see how the GCL/Millennial relationship evolves. Similar sentiment seems to be affecting soaring Argosy on ASX in first days of 2018.

Continued Bottlenecks = Continued Tight Markets

It’s starting to sink in how much lithium DEMAND growth is very, very real. And that SUPPLY is a real bottleneck for several years. Bottlenecks = tight markets, high prices, strong cash flows. Also, at times, feeding frenzies and panic buying.

Every CEO I speak with talks about how much interest they have not just from Chinese, but US, European, Japanese and Korean strategics as well. It’s a sellers’ market for those with robust lithium development projects. James Bond Robert Friedland calls it “Revenge of the Miners”. Incidentally, everything I’m saying about lithium applies as well for Heart of the Sunrise Clean TeQ. And I wouldn’t be surprised to see “Vuja De” entering regular press discourse as has Tipping Point and some other once references below.

To demonstrate lithium supply slowness, consider my comments exactly 12 months ago in the inaugural Lithium-ion Bull.

The 2016 lithium financing appetizer should be followed by a 2017 main course of $1-2B in capital commitments over the next 6-12 months to fund advanced lithium development projects into construction. Many, perhaps all, of the following seven companies — with expected OPEX at the lower quartile of the cost curve, supportive shareholders, strong managements, solid economics and credible production paths expected to begin from 2017-2019 — could get full funding in 2017.

NOTE: Only 3 of the above – Lithium Americas, Pilbara and Altura got full funding. Supply Delayed.

North American Lithium, with world class Chinese Battery manufacturer CATL, is now producing spodumene. Hats off to my friend Nathaniel Klein who took over the bankrupt Quebec Lithium Project and has now helped turn it into the first Quebec lithium miner and spodumene producer with downstream carbonate plant a year away.

I expect Q1 2018 will witness a greater degree of institutional syndicated public equity investments for those seeking to fully fund as part of their financing. Nemaska and Bacanora, for example.

It’s very unclear what progress is being made on Galaxy’s Sal da Vida though most recent speculation was about a European or Japanese partnership.

Brown Eyed Girl Bacanora

Bacanora’s Robust DFS and $50M investment from Next View (same group that’s buying LIX) is a significant step toward full funding in coming months, which likely explains Canaccord’s upgrade last week.

Bacanora Chairman, Mark “Van Morrison” Hohnen, was also seemingly quoting the LI Bull with a reference in the Australian newspaper about Ford buying rubber plantations in the early 20th Century. Sidebar: though there is indeed a lot of rubber in Malaysia, Ford’s Fordlandia investment was in Brazil 🙂

“Brown Eyed Girl” Sonora Lithium Project, Bacanora up 42% in the first five days of trading this year.

Market cap: USD 265M. Financing need: ~$400-450M.

BCN has the Lithium World’s Strongest Share Register all who can follow their money. More than 50% held by:

- Blackrock

- Capital Group

- M&G Capital

- Fidelity

- Hanwa

- NextView

SQM – The Art of the Incumbent

Lithium is still an evolving Oligopoly. By no means a cartel. But certainly one prone to incumbent behavior.

Smooth Operator SQM is a leading Price Maker. That’s what you can do when you’re the low cost and largest operator. SQM is the most transparent. You can see every quarter the tons they sold and the revenues to calculate revenue per ton. Their pricing has increased in each of the last 5+ quarters.

Their growth strategy through Lithium Americas and Kidman will ensure, at the very least, that SQM will have operational control of three world class assets in Australia, Argentina and Chile producing 153,000 LCE Tons (Chile: 63K, Arg: 50K, Oz: 40K) by 2021. The lithium market in 2021 should be 350,000 tons, according to Deutsche Bank, implying SQM-controlled assets will have 40% market share.

Strong joint venture partnerships should enable SQM to maintain its global role as Price Maker/Price Setter. Which should benefit LAC and KDR as well.

The multiple facets of SQM make it by far the most fascinating company to observe.

Mr. Market is starting to recognize SQM’s technical superiority and growth strategy. Also benefiting from equity market sentiment that billionaire businessmen Presidents are good for the economy. Commodity Emerging Markets = High Beta Investment Layups in times like these.

SQM is a bit of a national champion. A Chile/Commodity proxy.

- Positive country risk.

- Copper price rise very good for Chile

- CORFO dialogue rapidly progressing

- Divestment of POT’s 32% overhang a catalyst

What’s happening in China is quite opaque to most everyone in the market. Understanding Ganfeng better is a 2018 objective of mine. Ganfeng controls a very large quantum of off-take from many different mines – the pricing mechanisms vary. Is Ganfeng a Price Maker?

I plan similar to dig deeper into Tianqi. And Altura’s partners J&R Optimum Nano.

Macro and Political Backdrop

The remainder of this Lithium -ion Bull and a start to what will be a more frequent commentary is on the macro economic and political considerations that greatly influence the Electric Vehicle, Utility and niche battery materials supply chain.

The New New Normal – The Return of the Old Normal

Normal is not the first word that comes to mind upon reflecting on twelve months of dysfunctional U.S. Political and Media discourse. But as the year concluded, I began to believe what I secretly wished a few hours after the shock of the election sunk in last November. Trump – a Green Swan Event?! The inverse of the Black Swan leading to the Global Financial Crisis. Green, as in Money, Money, Money:

For the Love of Money – The Apprentice: https://www.youtube.com/watch?v=9paNJJqMn3c

—–

You don’t hear “Secular Stagnation” much anymore. Nor “Risk Off, Risk On”. Mostly just “Risk On”.

https://blogs.wsj.com/moneybeat/2017/12/29/the-year-everything-went-up-markets-in-18-charts/

Tax Reform and De-regulatory stimulus are working.

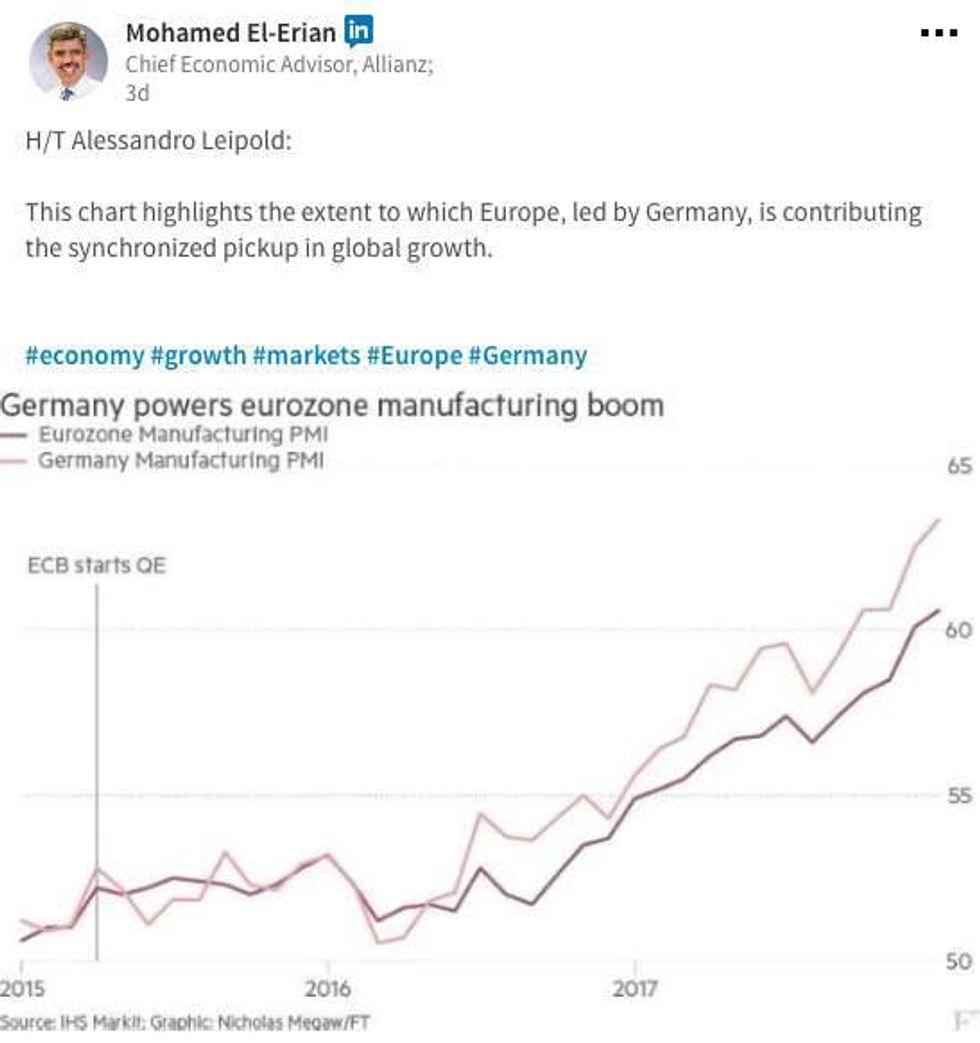

“Synchronized Global Growth” is back. Led by a robust USA Economy – 3%+ GDP growth, soaring Stock markets. But EU too. Led by Germany.

Industrial Production Led – A “Manufacturing Boom” = Good for Commodities

Faster growth. Low unemployment. Rising Wages. Still low inflation. “Goldilocks”.

THE OLD NORMAL !

Retail investor speculators making fortunes in bitcoin, weed, and lithium.

The New New Normal

Infrastructure stimulus coming soon. More Industrial Investment = Demand for Commodities = Rising Commodity Price = Commodity Equities follow Commodity Prices.

The Old Normal

Super-duper Mining Friendly Administration in USA.

The New New Normal

Emerging Markets – high Beta plays on U.S. and Synchronized Global Growth

Emerging Markets – benefit from rising commodity prices

The Old Normal

Argentina – $9B Bond. 4.5% – Lowest Interest Rates Ever! 2.4X oversubscribed.

The New New Normal

Sidebar 1: LAC’s paying 8-9.5% from the generous Bank of Ganfeng and Bangchak.

Sidebar 2: Gotta love ORE paying 4.5% from the more generous Bank of Japan.

—–

Andy Kessler in a WSJ editorial “Unicorns Need IPOs” stole another one of my lines about a famous Prince song:

https://www.wsj.com/articles/unicorns-need-ipos-1515361043

2018 should be great, but I still believe 2019 will be THE OLD NORMAL Partying like it’s 1999:

Prince – 1999: https://www.youtube.com/watch?v=rblt2EtFfC4

The immense lack of market volatility is NOT normal – there’s a meaningful possibility some time in 2018 broader equity markets correct by 10-20%. High beta plays like the lithium space could get hit harder.

At the same time, one of the smartest Value Investors on the planet, Jeremy Grantham at GMO, used a phrase last week I tweeted last month: “melt-up,” over the next 6 to 24 months. Melt-ups, are when High Beta speculations like lithium reach the Euphoric Tipping Point.

I see a lot of merit in Mr. Grantham’s thinking. Though he admits that higher valuations than earlier decades are now the norm and likely here to stay.

I suspect 2018 – 2019 will bring both the 10-20% correction – a head fake dip buy opportunity – followed by melt-up in the land of lithium -ion battery commodities.

Houses of the Holy

Led Zeppelin Pegmatites?!

2017: Lithium Heaven. Worth Repeating. Thank God.

2018 – 2019: Side One, Song One. The Song Remains the Same

https://www.youtube.com/watch?v=y7MYipg6rZ0

1975 Earls Court

The title, excitement and energy booming from this song perfectly befit what I previously called Lithium Nirvana. I encourage you to truly hear Jimmy Page’s guitar, Robert Plant’s voice and John Bonham’s drums, in its entirely. With head phones, hi volume!

I had a dream

Oh, yeah

Crazy dream, uh-huh

Anything I wanted to know

Any place I needed to go…

Hear my song

Yeah, people don’t you listen now?

Sing along

Oh, You don’t know what you’re missing, now (Aging Skeptics)

Any little song that you know (Lithium Equities)

Everything that’s small has to grow (Emerging Producers)

And it’s gonna grow (Exploration and Development)

push push, yeah (Lithium-ion Bull)…

City Lights are Oh so bright…

The Song Remains the SAAAAAME!!

Holiday Break Scenes from Israeli and Hungarian Restaurants…

Religion and Politics are more risky topics to write about than Sex, Drugs and Rock & Roll.

But after re-connecting with some Houses of the Holy Land for the first time in 10 years, and the birth place of George Soros and Intel’s Andrew Grove for the first time in 5 years, it seems relatively innocuous to share…

Jerusalem’s Old City

“Morning in America” Ronald “Tear Down this Wall” Reagan

Budapest’s “Freedom Square” (with Parliament behind).

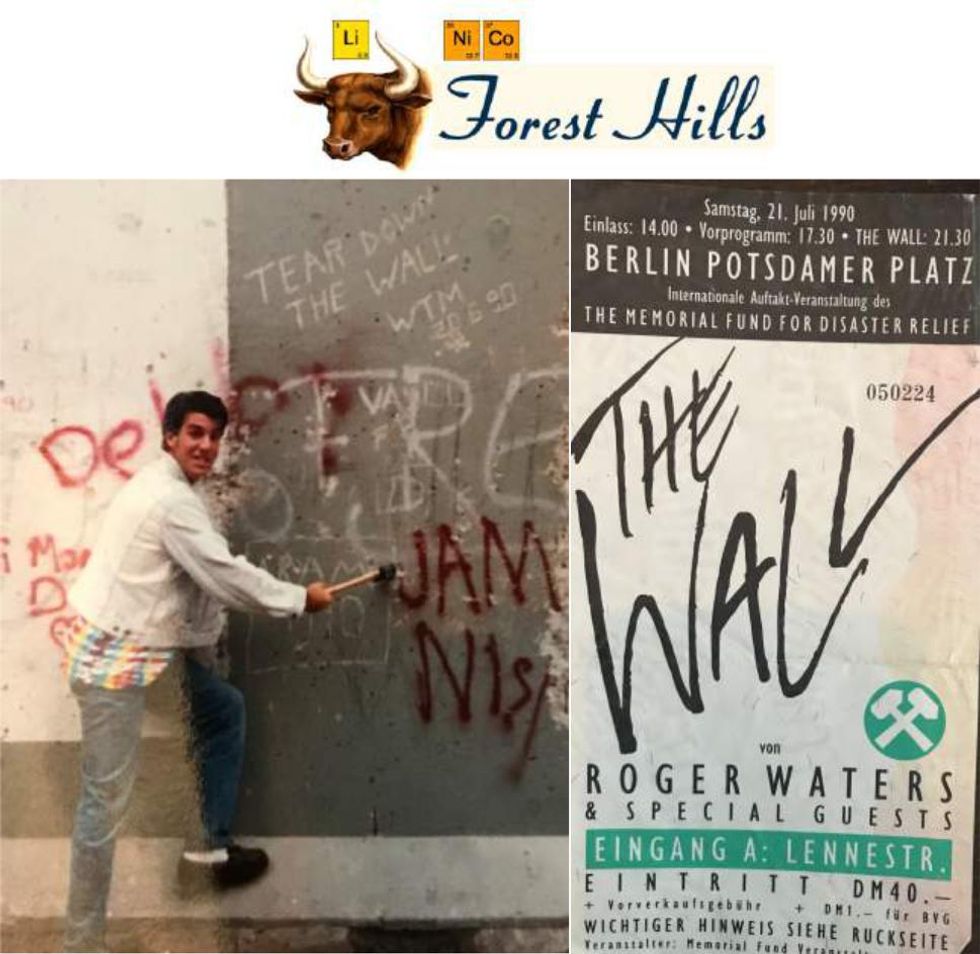

Tie-dyed Lithium-ion Bull at Berlin Wall July 1990 – 40 Deutsche Marks!

Israel and Hungary are relevant in our EV future.

Jerusalem is not typically Israel’s corporate tech hub, but 2017 witnessed Intel’s $15B purchase of “car of the future” Mobileeye, a proudly Jerusalem-based tech venture and the largest M&A deal ever in Israel.

https://newsroom.intel.com/news-releases/intel-mobileye-acquisition/

Meanwhile, I caught news in Budapest about Korea’s SK Innovation making a significant $750M+ battery plant investment, second only in Europe to LG Chem’s Poland plant.

https://europe.autonews.com/article/20171130/ANE/171139994

Other topics for future Lithium-ion Bull:

“Globalization and its Discontents”. RIP and Good Riddance Steve Bannon

“The Rise and Fall of Great Powers”- “China and non-China” – US and Them

Election Day – November 8, 2016

By great coincidence, I found myself on Election Night at one of the last performances on Broadway of Fiddler on the Roof. After seven years of post GFC “Secular Stagnation,” which I believe is the single most relevant Economics catch phrase to describe the last six years of Obama’s Progressive Presidency, I was feeling a bit like a modern-day Tevye:

“You made many, many poor people

I realize, of course, it’s no shame to be poor

But it’s no great honor either

And what would be so terrible

If I had a small fortune?”

If I Were a Rich Man: https://www.youtube.com/watch?v=RBHZFYpQ6nc

“He’s going to win. I can’t believe it”- were the first words I read via text message from my business partner Ari Raskas when the show concluded at 9PM. Tears welled up in my wife’s eyes. I put on rose colored glasses.

Exactly this time last year when I launched the Lithium-ion Bull, I wrote, but never published a broader market and political commentary ahead of Trump’s inauguration. Excerpt:

…I was among the significant majority of Americans who harbored a negative opinion about Hillary Clinton ahead of the election – her server, the Clinton Foundation, the foreign policy morass in the Mideast, 4 more years of progressive government economic headwinds. At the same time, things I liked about the concept of Donald Trump were overshadowed by the many conflicting and negative messages of much of his 2016 election branding.

As a New Yorker, I knew my vote was of no consequence — the last time New York voted for a non-Democrat for President was Ronald Reagan – in both 1980 and 1984. But, unlike some like-minded New York friends who filled in a “protest” Trump vote, I held my nose and filled in for the person I thought would be most supportive of the lithium investment theme.

Would the stock market and lithium equity market be as buoyant as today if Hillary had won? I doubt it. Would China would be a bit less bold at taking over the world?

I can’t say for sure there’s a direct correlation, but it is a fact that after a year of Trump, we are experiencing:

Houses of the Holy: Side Two, Song One:

“Dancing Days”: https://www.youtube.com/watch?v=JHM40KrbA_k

Disclaimer: Lithium-ion Bull (Forest Hills) is a periodic publication, written through my advisory firm RK Equity Advisors, LLC. I may act, or may have acted in the past, as a financial advisor, or capital raiser for certain of the companies mentioned herein and may receive, or may have received, remuneration for services from those companies. I, RK Equity as well as their respective partners, directors, shareholders, and employees may hold stock, options or warrants in issuers mentioned herein and may make purchases and/or sales from time to time, subject, of course, to restricted periods in which we may possess material, non-public information. The information contained herein is not financial advice and whether in part or in its entirety, neither constitutes an offer nor makes any recommendation to buy or sell any securities.

Source: www.libull.com