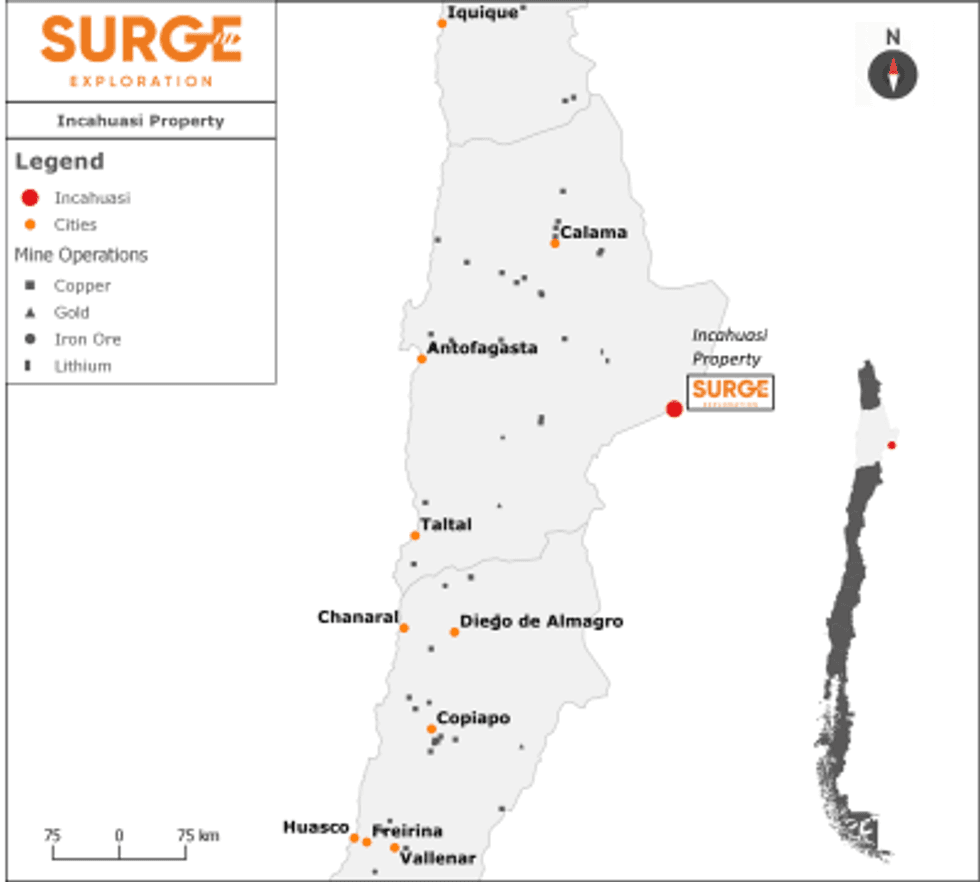

Surge Exploration Enters into MOU for an Option to Acquire Incahuasi Lithium Project in the Antofagasta Region of Chile

Surge Exploration Inc. (TSXV:SUR, OTCQB:SURJF, FRA:DJ5C) is pleased to announce that it’s wholly owned subsidiary, Surge Exploration Chile SpA has entered into an arm’s length non-binding Memorandum of Understanding (the “MOU”) with Mr. Miguel Angel Perez Vargas ( “MAPV”) for an option to acquire up to 100% of the Incahuasi Lithium Project in the prolific Antofagasta mining region in Northern Chile. The Incahuasi Lithium Project comprises 10 exploration concessions totalling 2,300 hectares, and the Incahuasi Salar is located on the Chile/Argentina national border approximately 75 km / 46 mi southeast from the famed Atacama Salar in Chile.

Surge Exploration Inc. (TSXV:SUR, OTCQB:SURJF, FRA:DJ5C) is pleased to announce that it’s wholly owned subsidiary, Surge Exploration Chile SpA has entered into an arm’s length non-binding Memorandum of Understanding (the “MOU”) with Mr. Miguel Angel Perez Vargas ( “MAPV”) for an option to acquire up to 100% of the Incahuasi Lithium Project in the prolific Antofagasta mining region in Northern Chile. The Incahuasi Lithium Project comprises 10 exploration concessions totalling 2,300 hectares, and the Incahuasi Salar is located on the Chile/Argentina national border approximately 75 km / 46 mi southeast from the famed Atacama Salar in Chile. The Atacama Salar is well-known to be the world’s largest and actively mined source of lithium with over 15% of the global supply of lithium contained within its boundaries.

Map of Chile – Incahuasi Property

Click Image To View Full Size

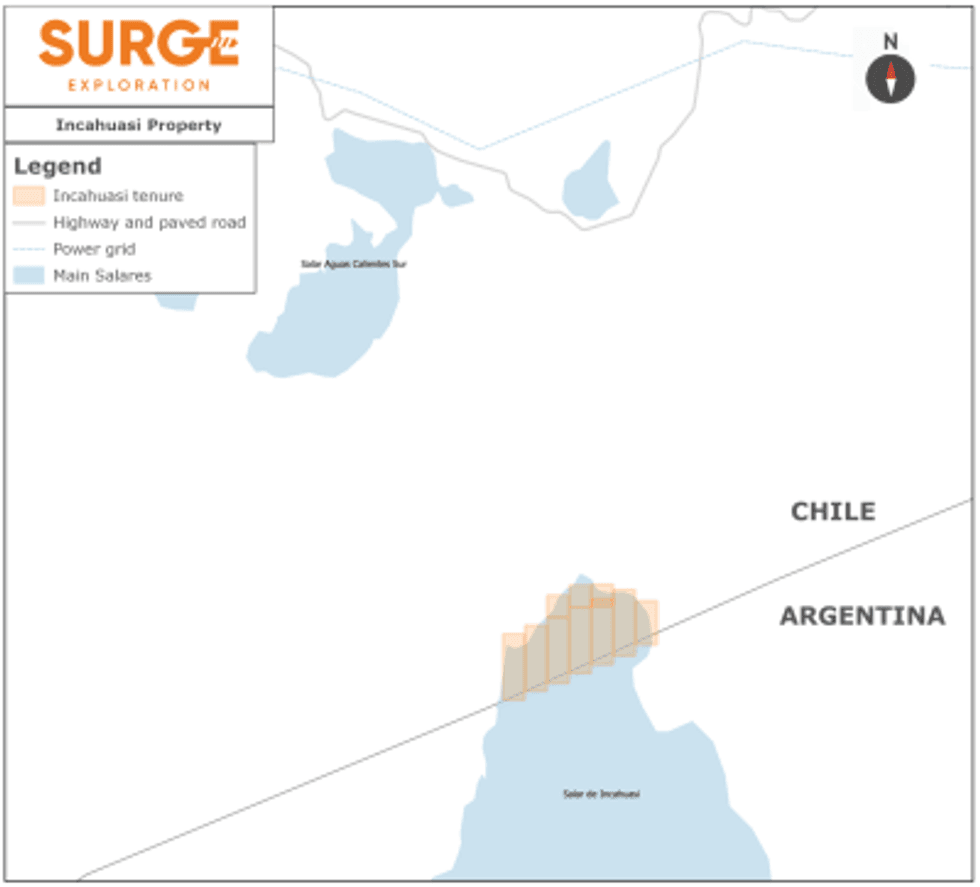

Tenure Map – Incahuasi Salar

Click Image To View Full Size

The MOU, when superseded by a definitive option agreement (the “Agreement”), will require Surge to make certain cash and common share payments totalling USD$2.22 million and making certain work and development commitments during the term of the option agreement.

The Incahuasi Lithium Project exhibits many highly desirable and key acquisition attributes, including:

the appearance of a low-cost resource definition opportunity;

the overall project size fits well within the capability of a junior company;

the property is well situated within the Incahuasi Salar with nearby highway and paved road access;

within the Incahuasi Salar lithium brines appear to exist near the surface resulting in potential lower costs of exploration; and

the proposed Incahuasi lithium exploration concessions lie beside existing lithium exploration operations in Argentina that are held by other publicly traded mining companies.

The Company intends to undertake a preliminary resource definition program upon receipt of the National Instrument 43-101 report, which is expected to be completed in 2019.

“We are excited about the opportunity to earn a significant interest in a lithium concession located in the Lithium Triangle, the world’s most prolific lithium producing region with over 70% of the world’s lithium reserves. We look forward to develop this concession, for the benefit of all our shareholders.” says Tim Fernback, Surge’s President & CEO.

Structure of the MOU and subsequent Agreement:

The proposed transaction to acquire 100% of the mining rights associate with the Incahuasi Lithium Project shall be effected by payment of the amounts described below:

a non-refundable payment of US$10,000 in cash by the Company to be paid to MAPV within fifteen business days of signing the MOU. This payment guarantees a six-month period of exclusivity for Surge to conduct its due diligence and for the negotiation and signing of Definitive Option agreement.

Upon approval of the Option Agreement and Transaction by the TSX Venture Exchange, the Company shall pay the sum of US$50,000 in cash immediately (this date is referred to as the “Effective Date”);

the Company shall pay the sum of US$150,000 in cash to MAPV no later than twelve (12) months from the Effective Date;

the Company shall pay the sum of US$200,000 in cash to MAPV no later than twenty-four (24) months from the Effective Date;

the Company shall pay the sum of US$250,000 in cash to MAPV no later than thirty-six (36) months from the Effective Date;

the Company shall pay the sum of US$1,540,000 in cash and or common shares to MAPV no later than forty-eight (48) months from the Effective Date. This sum will be paid as follows: i) USD$1,000,000 will be paid in cash and, at the sole discretion of Surge ii) USD$540,000 in cash or equivalent common shares of Surge Exploration Inc.); and

the Company shall have the exclusive right to accelerate all payments due under this agreement.

Once Surge has completed the foregoing conditions, the Company must also have completed the following work commitment in order to exercise the option and acquire 100% interest in the Incahuasi Lithium Project.

Work Commitments:

Surge shall be required to complete the following under its “Work Commitment” obligations with the exploration phase starting immediately after the conclusion of the Option Agreement, with the assurance that Surge produces a geophysical survey and at least one drill hole completed within 24 months from the Effective Date (the “Exploration Program”).

Net Smelter Return (“NSR”) Royalties:

Once Surge completes all the prerequisites of the Agreement, and therefore owns the rights to the lithium mineral claims, MAPV shall receive a 2% NSR in the Incahuasi Lithium Project. Surge will retain the right to repurchase 50% of the NSR to MAPV at a price of USD$3,500,000.

The transaction will be subject to TSX-Venture approval. Finders fees are payable in connection with the sourcing and negotiation of the potential acquisition of the Incahuasi Lithium Project.

Qualified Person: The technical content of this news release has been reviewed and approved by Thomas Eggers. Mr. Eggers is a non-independent Qualified Person within the meaning of National Instrument 43-101 Standards, as a Registered Member of the Chilean Mining Commission.

About Surge Exploration Inc. https://surgeexploration.com/

The Company is a Canadian-based mineral exploration company which has been active in the resource sector in British Columbia and elsewhere in Canada. The Company has an exploration office in Santiago, Chile to review mineral exploration opportunities in Chile and elsewhere in South America.

Incahuasi Lithium Project, Salar de Incahuasi, Chile:

The property is located on the northernmost section of the Incahuasi salar, 75 km southeast from both the town of Tilomonte, Chile and the Salar de Atacama, where mining is the largest economic activity, and the mining industry is one of the region’s major employers. The Incahuasi salar is located on the national border between Chile and Argentina at an elevation of 3,260 m. The Incahuasi Lithium Project consists of 10 mineral exploration concessions totalling 2,300 hectares with the adjoining 9,843 hectare property located directly over the national border in Argentina is held by Advantage Lithium (TSX-V: AAL OTCQB:AVLIF).

Cobalt Ontario Properties, Cobalt ON, Canada:

The Company has an option to earn an undivided 60% interest in the Glencore Bucke Property and the Teledyne Property, located in Cobalt Ontario.

Atacama Cobalto Project, Copiapo, Chile:

The Atacama Cobalto Project is located in the Atacama Province in northern Chile, 15 km northwest of the town of Copiapo, where mining is the largest economic activity, and the mining industry is one of the region’s major employers. The Atacama Cobalto Project consists of 1,059 hectares and is located only 3 km East of the Cerro Iman Mine. To date, CAP Mineria has drilled over 20,250 m on the Atacama Coblato Project. The option on this project is subject to TSXV approval.

Hedge Hog Property, Barkerville BC, Canada:

The Company has an option to earn an undivided 60% interest seven mineral tenure covering 2,418 hectares (5,972 acres) located approximately 80 km northeast of the town of Quesnel, BC and 20 km north of the historic gold mining towns of Wells and Barkerville.

On Behalf of the Board of Directors

“Tim Fernback”

Tim Fernback

President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Source: www.thenewswire.com