Global Energy Metals Releases Initial Resource Report for Werner Lake

According to the company, the report shows that “significant potential” exists for increased tonnage at the Ontario-based cobalt property.

Cobalt-focused Global Energy Metals (TSXV:GEMC) reached a key milestone on Wednesday (September 6) with the release of an initial resource report for its Werner Lake property.

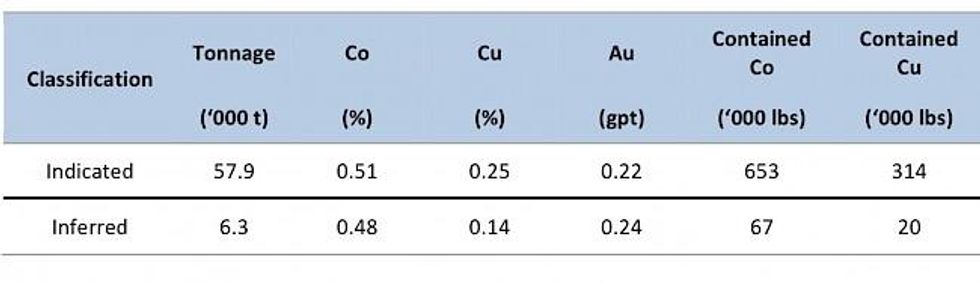

The initial resource covers historic underground workings located at the property’s Minesite and West Cobalt deposits. It shows that the area has an indicated resource of 57,900 tonnes at 0.51 percent cobalt and an inferred resource of 6,300 tonnes at 0.48 percent cobalt.

A cut-off grade of 0.25 percent was used for both calculations. It was estimated based on a three-year cobalt price of US$15.60 per pound. According to the company, cobalt was changing hands at US$27.67 as of last Friday (September 1).

Mineral resources for Werner Lake at a cut-off grade of 0.25 percent. Chart via Global Energy Metals.

Cobalt prices have surged since the beginning of the year, spurred upward by increasing demand for lithium-ion batteries. Lithium-ion batteries are used to power electric vehicles, and demand for cobalt and the other metals used to make them is expected to keep rising in the coming years.

The initial resource was compiled using an “extensive library of existing exploration data” assembled by Global Energy Metals. “This result compares favourably with historic estimates. There is still excellent potential down dip and along strike at the deposit to increase the mineralized envelope and the next phase of exploration will address this opportunity,” said Paul Sarjeant, the company’s VP projects.

Mitchell Smith, president and CEO of Global Energy Metals, also commented positively on the initial resource, saying, “[t]his report positions Global Energy as a leading project developer in the competitive cobalt market — no other junior has an advanced primary cobalt deposit in the region.”

The report was completed by AGP Mining Consulting, and the firm has recommended that Global Energy Metals complete a drill program and other work to test for further mineralization in the areas of the property that have the greatest potential. Specifically, AGP recommends:

- A minimum of 16 drill holes (3,500 m) to further explore for and define the known zone at depth and bring inferred resources to indicated category,

- Surface channel sampling over mineralized veins at surface to provide greater confidence in mineral resource classification,

- Dewatering of the underground workings to provide access to underground workings which will allow mapping and re-sampling of the existing excavations, and

- Metallurgical test work to bring historic work to current standards.

Smith also said that Global Energy Metals will work to “identify high-calibre joint venture partners” for the property. “Advancing Werner Lake with the right partner will allow us to build on the value of the project and continue our strategy of acquiring project stakes in other highly prospective projects,” he explained.

Global Energy Metals listed on the TSXV at the beginning of March. At close of day Wednesday, its share price was sitting at $0.13. In addition to Werner Lake, the company has the right to earn up to a 75-percent interest in the Australia-based Millennium cobalt project.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Global Energy Metals is a client of the Investing News Network. This article is not paid-for content.