Global Energy Metals Completes Initial Resource Report On Its Canadian Primary Cobalt Project Supporting High Grade Cobalt Mineralisation

Global Energy Metals Corporation (TSXV:GEMC) announces the completion of a National Instrument 43-101 Resource Report (the “Report”) carried out by AGP Mining Consulting Inc. (“AGP”) on the Werner Lake Cobalt Property (“Werner Lake”) around the historic underground workings at the “Old Mine Site”, now referred to as the Minesite Deposit and the West Cobalt Deposit.Highlights: Indicated Resource of …

Global Energy Metals Corporation (TSXV:GEMC) announces the completion of a National Instrument 43-101 Resource Report (the “Report”) carried out by AGP Mining Consulting Inc. (“AGP”) on the Werner Lake Cobalt Property (“Werner Lake”) around the historic underground workings at the “Old Mine Site”, now referred to as the Minesite Deposit and the West Cobalt Deposit.

Highlights:

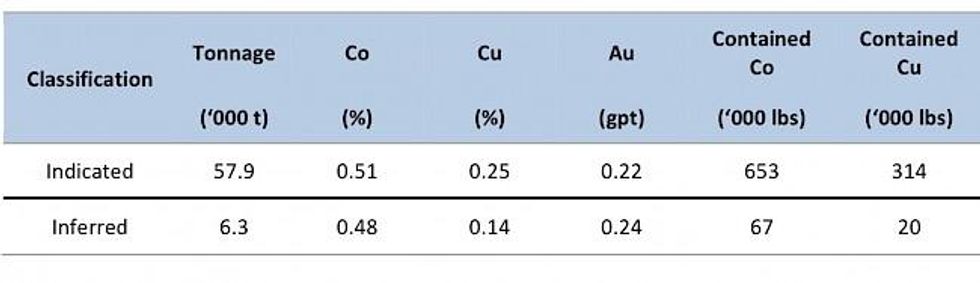

- Indicated Resource of 0.51% Co (57,900 tonnes) and Inferred Resource of 0.48% Co (6,300 tonnes) at a 0.25% cut-off (see Table 1).

- Significant potential for increased tonnage at Werner Lake exists.

- Cobalt cut-off grade was estimated based on 3 year metal prices of USD $15.60/lb.

- Cobalt is currently trading at USD $27.67/lb (MetalPrices.com, September 1, 2017), a 175% premium to the price used in this report.

- Drill program recommended to test for additional mineralization in areas of the greatest potential.

- At present both the Minesite and West Cobalt deposits remain open at depth and along strike.

Mitchell Smith, CEO:

“This report positions Global Energy as a leading project developer in the competitive cobalt market – no other junior has an advanced primary cobalt deposit in the region. The initial resource results supports the need for further investment into the project as we identify high-calibre joint venture partners for the cobalt deposit. Advancing Werner Lake with the right partner will allow us to build on the value of the project and continue our strategy of acquiring project stakes in other highly prospective projects.”

Paul Sarjeant, VP Projects commented on the results of the Report:

“We are very pleased with the work done by AGP and the results of the first Ni 43-101 resource report on a Canadian primary cobalt deposit. This result compares favourably with historic estimates. There is still excellent potential down dip and along strike at the deposit to increase the mineralized envelope and the next phase of exploration will address this opportunity”.

The Report was compiled from the extensive library of existing exploration data assembled by GEMC. The estimate was completed based on the concept of a small-scale underground operations for both the Old Mine and West Cobalt Zones in order to update historic mineral resource estimates to meet disclosure and reporting requirements set forth in National Instrument 43-101. Mineral resources are estimated in accordance with the CIM Mineral Resource definitions referred to in NI 43-101 Standards of Disclosure for Mineral Projects.

Table 1: Mineral Resources for the Werner Lake Deposit at a 0.25% cut-off grade.

Recommendation:

The Report has shown that further work is warranted at Werner Lake. Several key recommendations have been made in order to advance the development of the project, these include:

- A minimum of 16 drill holes (3,500 m) to further explore for and define the known zone at depth and bring inferred resources to indicated category,

- Surface channel sampling over mineralized veins at surface to provide greater confidence in mineral resource classification,

- Dewatering of the underground workings to provide access to underground workings which will allow mapping and re-sampling of the existing excavations, and

- Metallurgical test work to bring historic work to current standards.

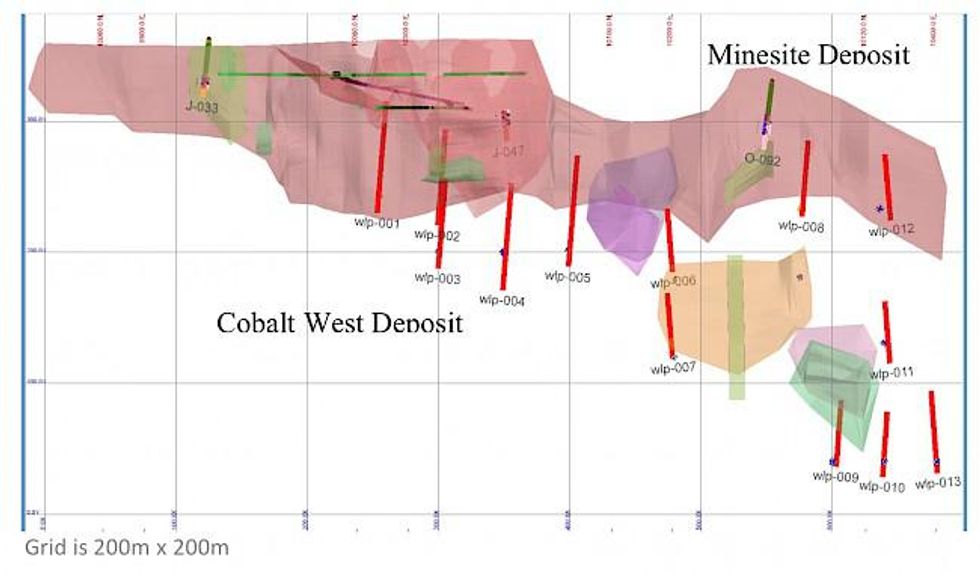

AGP has recommended a drill program (see Figure 1) that identifies the minimum drilling required to test lateral and depth extension of the current mineralized envelope. Additional holes would be required to support successful intercepts and bring areas of expected mineralization into CIM compliant resource categories. Other drill holes recommended would target zones within the resource area to upgrade resource confidence.

Figure 1. Proposed Drill Hole Locations; longitudinal section looking north (60 m viewing corridor).

Notes on the Mineral Resource Estimate Parameters and Method:

- Mineral resources are estimated in accordance with the CIM Mineral Resource definitions referred to in NI 43-101 Standards of Disclosure for Mineral Projects. This mineral resource estimate has an effective date of August 18, 2017 and was carried out by AGP Mining Consultants Inc. for the Werner Lake Property that includes the Old Mine Zone and West Cobalt Zone.

- The estimate was completed based on the concept of small-scale underground operations for both the Old Mine and West Cobalt Zones.

- For the 1995 – 1997 and 2001 Canmine drill campaigns, the samples were assayed at TSL Laboratories in Saskatoon, Saskatchewan. Samples were crushed to a minimum of 70% passing a 10 mesh. The samples were then riffle split to approximately 250 g, which was pulverized to 90% passing 100 mesh; and from 1997 passing 150 mesh. Co, Cu and As were digested in 20 ml HCl/HNO3 and then re-dissolved with 20% 3:1 HCl/HNO3. Assays over 5,000 ppm were analyzed by Atomic Absorption Spectrophotometry.

- For the 2010 Puget Ventures drill program, the samples were sent to Accurassay Laboratories in Thunder Bay, Ontario. Sample preparation consisted of crushing the samples to a minimum of 85% passing 10 mesh, a 500g split was pulverized to 90% passing 200 mesh (procedure APL1). Platinum metals (Pt and Pd) and gold were analyzed using procedure code APLPG1 which is a fire assay with atomic absorption spectrophotometry (AAS) finish on 30 g. sub-sample. Samples were also analyzed for a suite of 30 elements using a multi -acid digestion (HNO3, HCl, HF, HClO4) with Inductively coupled plasma atomic emission spectroscopy (ICP-OES) finish, procedure code ALMA1. Accurassay laboratory in Thunder Bay declared bankruptcy as of February 2017.

- AGP validated the assays in the database using historical records comprising of internal Canmine assay compilation sheets, TSL laboratory original assay certificates, ALS Chemex pulps re-assays laboratory certificates and Accurassay’s laboratory certificates. In total, for all assays above 0.19% cobalt, 94% of the values in the Geovia GEMS™ database were validated against the original laboratory certificates. The remaining 6%, the values were sourced from Canmine assay compilation sheets where the grades likely originated from the TSL laboratory however, AGP cannot verify this statement. AGP validation rate is lower for cobalt assays below 0.19% which mostly includes material outside of the mineralized zones.

- The quality control and quality assurance program for the Puget Ventures drilling consisted of regular insertion of blanks and standard reference material obtained from a Canadian laboratory. AGP is aware that a portion of the historical sample pulps analyzed at TSL laboratory were re-submitted to ALS Chemex laboratory in Winnipeg Canada.

- The West Cobalt Zone was interpolated with 157 core holes completed by Canmine and Puget Ventures from 1995 through to 2010, totaling 23,173 metres and containing 4,057 assay values. The Old Mine Zone was interpolated with 109 drill holes completed by Canmine and Puget Ventures from 1995 through to 2010 totaling 17,530 meters of drilling and containing 288 assay values.

- The construction of the mineralized wireframes targeted cobalt mineralization grading 0.05% or above located preferably within the logged West Cobalt zone (WCBZ) or the MINEZ code in the lithology table. The wireframes were generally extended through non-mineralized drill holes as long as there was indication that the zone was present. Wireframes measuring less than 1.5m horizontally at the drill hole intercepts were visually expanded to approach a 1.5m minimum mining width. The mineralized wireframes more or less followed the direction indicated by the hanging wall and footwall contact of the MIX Unit.

- Canmine preferentially sampled the drill core nominally between 0.5 and 1 m intervals. Puget Ventures mainly sampled the drill core at a nominal 1 m intervals. Composite intervals were created across the mineralized intersections to create a single composite per hole per intersection. The average composite length was 4.9 m.

- For the treatment of outliers in the West Cobalt Zone, raw assays were capped at 4.90 %Co and 4.48 %Cu. In the Old Mine Zone, raw assays were capped at 6.76 % Co and 1.10 %Cu

- Specific Gravity (SG) in the resource model was derived from a suite of 56 core samples. The specific gravity measurements were carried out at ALS Chemex using the pycnometer method. Since SNC Lavalin used a linear equation to calculate the SG in the 2002 resource estimate, AGP elected to retain the methodology with the following modifications;

- The linear regression was completed using the cobalt + copper values.

- Since the back calculated SG did not match the original sample distribution, an adjustment factor was introduced in the calculation so that the distribution of the calculated SG in the resource model matches the distribution of the original samples at the 5th, 10th, 25th, 50th, 75th, 90th and 95th percentile.

- A (3D) geological and block model was generated using GeoviaGEMS™ software. The block model matrix size of 5 m x 5 m x 1 m (width x length x height) was selected was based on the size deemed suitable for an underground mining scenario.

- Variography was carried out on the various domains of the Werner Lake Deposit. Only one reliable variogram was produced based on the largest mineralized vein (Domain WC2100) in the West Cobalt Zone. The ranges from this variogram was used in determining search neighbourhoods for the Werner Lake Deposit. The grade model was interpolated using inverse distance cubed, and validated using ordinary kriging and nearest neighbour models.

- The interpolation was carried out in three passes with increasing search ellipsoid dimensions. For both zones, the classification was based primarily on the number composites used to estimate a block and the distance to the nearest composite. Isolated Inferred blocks within core areas of Indicated resource blocks were captured within a closed polyline and upgraded to the Indicated category.

- The Old Mine Zone was historically mined in 1950’s and the West Cobalt Zone was explored via underground development and bulk sampling in the 1990’s. Historical records indicated that;

- In the West Cobalt Zone, Canmine (AIF, 1998) reported that about 20,000 tonnes of cobalt bearing material was planned for extraction and milling; and that approximately 10,000 tonnes had been extracted by the end of 1997.

- In the Old Mine zone, Thomson (1950) reported that the shaft accessing the underground workings was developed to a depth of 100 feet. Carlson (1957) reported that approximately 143,000 lbs Co was removed.

- For the current resource estimate, AGP removed mined out material from the current mineral resources. For the West Cobalt mine, a series mine plans and one longitudinal section dated November 1998 were used to digitize a 3D wireframe of the material assumed to be mined out. For the Old Mine Zone, the resource model was sliced horizontally in 8 ft vertical lift. Volume report for each of the slice was accumulated until 143,000 lbs of Cobalt was reached. This determined the lower elevation of the mined-out areas. AGP attempted to reasonably estimate the amount of material mined-out and the likely location of the tunnels and stopes despite the poor historical records. This is only an estimate and AGP cannot be certain if the specific locations of the mined-out material is accurate or not.

- Metallurgical testwork on a flotation concentrate sample from the Werner Lake deposit was carried out in 1997 at Lakefield Research (now SGS Canada Inc.) in Lakefield, Ontario. The information available was reviewed by AGP’s metallurgist and AGP noted that no information was provided in the report on the specific origin of the concentrate sample, or the flowsheet used to produce it.

- Under CIM definitions, Mineral Resources should have a reasonable prospect of economic extraction. A cobalt price of US$ 15.60/ lb Co was used for the cut-off calculation which corresponded to three year rolling average seller’s price as of August 16, 2016. The cut-off calculation included 85% metallurgical recoveries based on the SNC Lavalin 2002 estimate. In order to assess the Mineral Resources an in situ resource cut-off grade of 0.25% Co has been applied for potential material amendable to underground extraction. The blocks above the cut-off were visually examined to ensure they were coalescent in reasonable mining shapes.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Rounding of tonnes as required by reporting guidelines may result in apparent differences between tonnes, grade, and contained metal content.

- The 1997-1998 historical resource estimates pre-dating the 2002 SNC Lavalin report that are circulating in the literature for the Werner Lake project (Harper 2015) are considered not valid by AGP and therefore cannot be compared.

Qualified Person

Mr. Paul Sarjeant, P. Geo., the Company’s VP Projects and Director, is the qualified person for this release as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has reviewed and verified the technical information contained herein.

Global Energy Metals Corporation (TSXV:GEMC | FSE:5GE1)

Global Energy Metals is focused on offering security of supply of cobalt, a critical material to the growing rechargeable battery market, by building a diversified global portfolio of cobalt assets including project stakes, projects and other supply sources. GEMC anticipates growing its business by acquiring project stakes in battery metals related projects with key strategic partners. Global Energy Metals currently owns and is advancing the Werner Lake Cobalt Mine in Ontario, Canada and has entered into an agreement to earn-in to the Millennium Cobalt Project in Mt. Isa, Australia.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219 extensions 236/237

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change. For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

We seek safe harbour.

Click here to connect with Global Energy Metals Corporation (TSXV:GEMC) to receive an Investor Presentation.

Source: www.globalenergymetals.com