High-Grade Mineralization Intersected Including 1.62% eU3O8 over 2.6 Metres

Strong Alteration and Large Fault Structures Intersected 1.8 km Southwest Along "42 Zone" Corridor

Joint Venture Doubles 2022 Exploration Program Budget to $5 Million

CanAlaska Uranium Ltd. (TSXV: CVV) (OTCQB: CVVUF) (FSE: DH7N) ("CanAlaska" or the "Company") is pleased to announce the successful completion of the 2021 drilling program at the West McArthur uranium project in the Eastern Athabasca Basin, a joint venture with Cameco Corporation (TSX: CCO) (NYSE: CCJ) ("Cameco"). The objectives of the drill program were extension of the high-grade "42 Zone" mineralization and evaluation of the southwestern extension of the "42 Zone" controlling structure along the C10 conductive corridor. Program objectives were successfully met with the completion of the six hole, 5,419 m drill program in early November. Initial probing results include a high-grade intersection of 1.62% eU3O8 over 2.6 metres (m). Based on the positive results of the program, a $5 million exploration program in 2022 has been approved, double the 2021 budget. The 2021 program was funded by CanAlaska, the project operator, increasing the Company's majority interest in the West McArthur project to 75.55%.

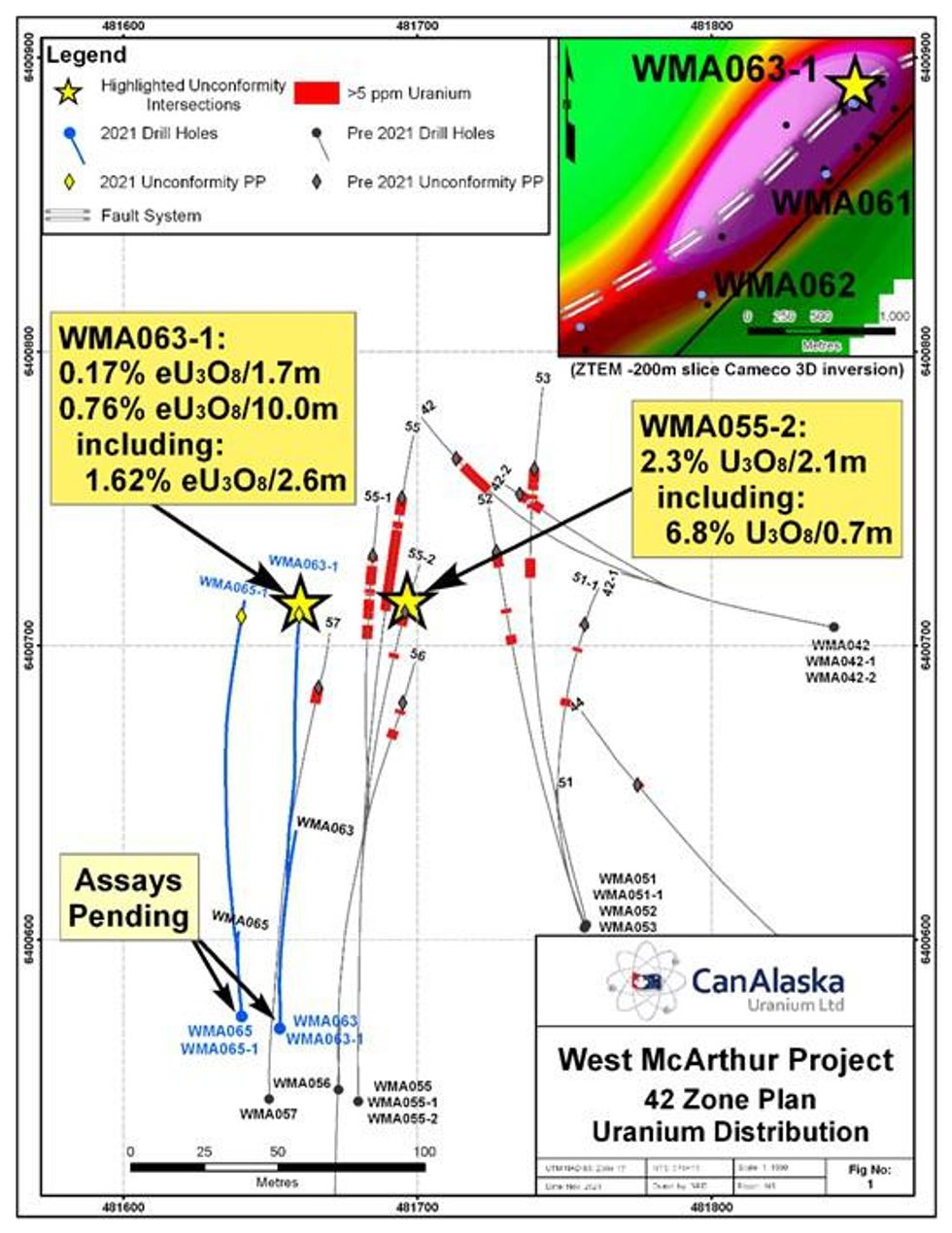

At the "42 Zone", drilling intersected two zones of mineralization above the unconformity. The two zones of mineralization are contained within a strongly bleached lower sandstone column that has black sooty pyrite, red hydrothermal hematite, and strong structurally-controlled clay alteration. Due to the strong clay alteration and faulting, very poor core recovery was experienced. As a result, the Company is reporting calibrated probe values grading 0.17% eU3O8 over 1.7 m from 760.9 m and 0.76% eU3O8 over 10.0 m from 767.0 m, including 1.62% eU3O8 over 2.6 m from 769.1 m. These intersections in WMA063-1 have successfully extended the "42 Zone" by 35 metres to the west of previous high-grade hole WMA055-2.

Evaluation of the conductive corridor that hosts the controlling structure for the "42 Zone" mineralization was also successful over the extension to the southwest during the 2021 drilling program. Two drill hole fences, 700 m and 1,800 m to the southwest, evaluated the fault system in three new drill holes. Along the conductive corridor, these drill holes confirmed that it is strongly altered, both in the basement and sandstone.

West McArthur Project - 42 Zone Plan, Uranium Distribution

To view an enhanced version of this map, please visit:

https://orders.newsfilecorp.com/files/2864/107782_c6b7664604c8abc8_001full.jpg

Drill hole WMA063-1, collared at an azimuth of 360˚ with a dip of -79.4˚ (Figure 1), intersected the two zones of uranium mineralization above the unconformity (Table 1), 35 m to the west of drill hole WMA055-2 in the Company's "42 Zone" area. WMA055-2, completed in 2019 at an azimuth of 358˚ with a dip of -75.5˚, intersected 2.3% U3O8over 2.1 m, including 6.8% U3O8 over 0.7 m. Important to note is that assay data for drillhole WMA055-2 upgraded calculated eU3O8 values in the highest grade interval (see press release dated October 15th, 2019).

The new uranium intersection in WMA063-1 is contained within a strongly bleached lower sandstone column that contains black sooty pyrite, red hydrothermal hematite, and strong structurally-controlled clay alteration. Due to the strong clay alteration and faulting, very poor core recovery, approximately 5%, was experienced over a 4.8 m interval from 767.6 - 772.4 m, within the highest grade interval of the mineralized zone.

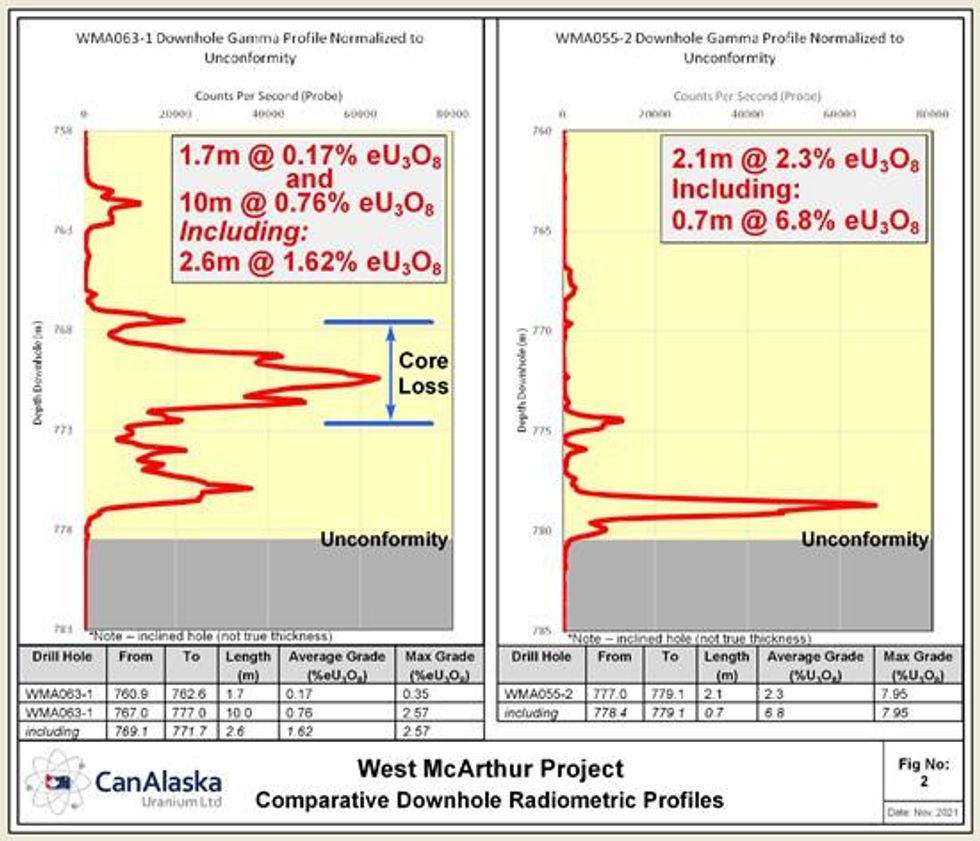

The new uranium intersection in WMA063-1 contains similar radiometric values as in WMA055-2 but over a wider interval, as shown in the comparison of radiometric probe profiles (Figure 2). Geochemical assays of the mineralization are pending for WMA063-1, however, due to the very poor core recovery, will need to be supplemented with radiometric probing equivalents data to evaluate the grade and thickness of this new mineralization which extends the "42 Zone".

Table 1 - Radiometric Uranium Equivalent Grades (eU3O8)

| Drill Hole | From | To | Length (m) | Average Grade (%eU3O8) | Max Grade (%eU3O8) |

| WMA063-1 | 760.9 | 762.6 | 1.7 | 0.17 | 0.35 |

| WMA063-1 | 767.0 | 777.0 | 10.0 | 0.76 | 2.57 |

| including | 769.1 | 771.7 | 2.6 | 1.62 | 2.57 |

Figure 2 - Comparative downhole radiometric profiles from WMA063-1 and WMA055-2. Profiles show similar radiometric values in WMA063-1 spread over a wider interval than WMA055-2.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/2864/107782_c6b7664604c8abc8_002full.jpg

Evaluation of the conductive C10 corridor that hosts the controlling structure for the "42 Zone" mineralization was also successful to the southwest during the 2021 drilling program. Wide re-activated structural zones with strong associated alteration in drill hole fences 700 m and 1,800 m to the southwest of the "42 Zone" were intersected during the program.

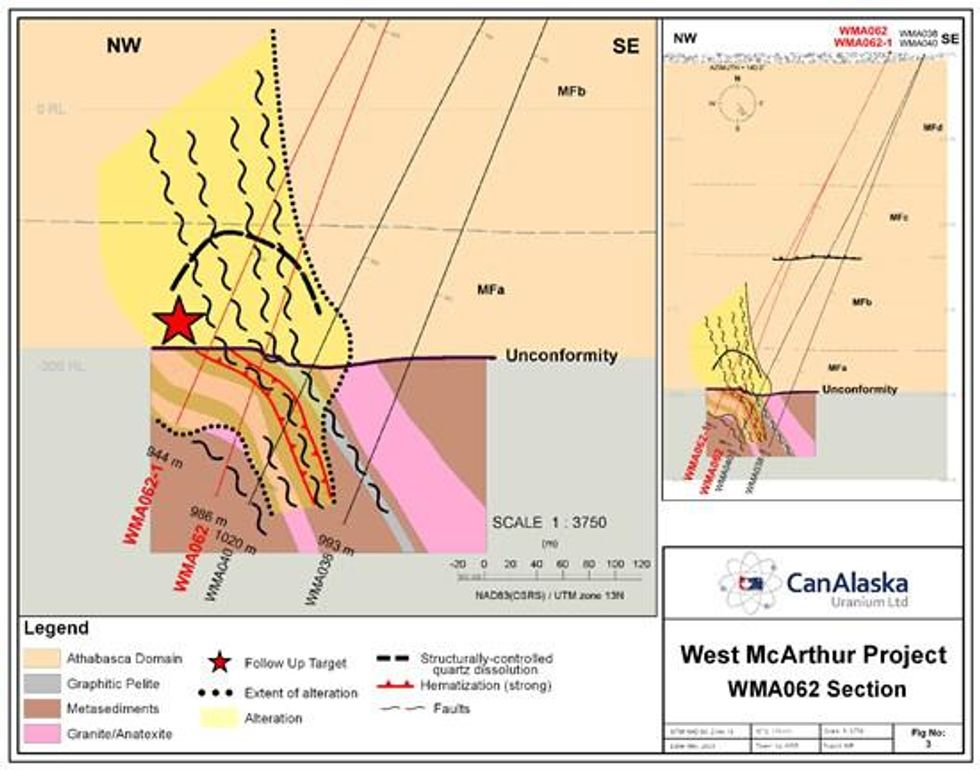

Figure 3 - Sandstone and basement alteration associated with a wide structural zone

1,800 m to the southwest of the "42 Zone".

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/2864/107782_c6b7664604c8abc8_003full.jpg

WMA062 and wedge hole WMA062-1, collared at an azimuth of 320˚ with a dip of -65.4˚, 1,800 m to the southwest of the "42 Zone", intersected the unconformity 40 m and 90 m northwest of WMA040 (Figure 3). The basal sandstone column along this fence is characterized by strong bleaching and limonite alteration with structurally-controlled quartz dissolution and patches of grey sooty pyrite alteration, that increase in width and intensity to the NW in WMA062-1. Several 10 - 20 m wide re-activated zones of sandstone structure, characterized by broken core and poor recovery, are intersected throughout and lead up to the fault zone that straddles the unconformity - basement contact in WMA062-1. The main fault zone, which is 51 m wide at the unconformity in WMA062-1, is characterized by strongly disrupted sandstone with broken to blocky core, locally preserved sandy-clay gouge, and pervasive strong bedding- and fracture-controlled quartz dissolution causing very poor recovery (0 - 30%).

In the basement along this fence, the targeted fault zone is characterized by broken to blocky core with re-activated chloritic clay gouges hosting angular clasts of wall rock and ductile shear fabrics. Within the fault zone, the rock is strongly altered with hematite, chlorite, clay replacement, and bleaching. Pervasive hydrothermal basement alteration continues at depth in both WMA062 and WMA062-1. WMA062-1 has been left open for potential re-entry to test the extension of the alteration both into the basement and at the unconformity.

WMA061, drilled at an azimuth of 298˚ with a dip of -72.8˚, 700 m to the southwest of the "42 Zone", intersected the unconformity 70 m north-northwest of WMA049-1. WMA061 intersected a broad interval of faults in the lower sandstone column associated with bleached sandstone, increased interstitial illitic clay, patches of sooty pyrite, remobilized hematite, and structurally-controlled limonite and clay alteration. The sandstone structure and alteration indicate that WMA061 intersected the unconformity approximately 30 - 35 m north of the ideal target, leaving the target open on this fence.

CanAlaska VP Exploration, Nathan Bridge, comments, "The CanAlaska team has successfully executed again, completing the 2021 drilling program on time and within budget. I am encouraged by the intersection of additional uranium mineralization along strike immediately to the west of the "42 Zone". Furthermore, the increased sandstone and basement alteration along the controlling structural corridor 1,800 m to the southwest of the "42 Zone" continues to show the discovery potential for this trend. Re-activated fault zones with the right intensity and style of associated alteration, known to host uranium mineralization at the "42 Zone" and nearby Fox Lake deposit, are intersected along this trend to the southwest. The Company looks forward to the next phase of exploration, with an approved 2022 budget, as we continue to test this highly prospective trend."

CanAlaska CEO, Cory Belyk, comments, "Both objectives of the 2021 exploration program have been met with this program. The further intersection of high-grade uranium mineralization at the "42 Zone" highlights the continued potential of this area to produce a deposit of proper scale and grade for these large unconformity deposits in the Basin. In addition, and importantly, this program has now outlined a brand new area of exploration potential and focus immediately southwest of "42 Zone" that has the CanAlaska team very excited about the next stage of exploration. This was an incredibly successful drill program for the West McArthur project joint venture, and CanAlaska shareholders."

Geochemical assay results for the 2021 drilling program are pending.

2022 Program and Budget Approved

The Company is pleased to announce completion of the JV Technical and Management Committee meetings in advance of the 2022 program. The JV has approved an increased budget for the 2022 program of $5 Million, which is double the 2021 approved budget. The 2022 program will focus on continued testing of the 42 Zone area and the newly identified alteration and structure along the immediate 2 km southwest extension. In addition, geophysics and drilling is planned in a regional program along the remainder of the Grid 5 conductive corridor. CanAlaska will fully fund the 2022 program, further increasing it's majority ownership, as Cameco has elected to continue to dilute on the project.

Use of Radiometric Equivalent Grades and Geochemical Sampling

During active exploration programs, following the completion of a drillhole, the hole is radiometrically logged using calibrated downhole GeoVista NGRS and TGGS (Triple GM) gamma probes which collect continuous readings along the length of the drill hole. Preliminary radiometric equivalent uranium grades ("eU3O8") are then calculated from the downhole radiometric results. The probe is calibrated using an algorithm calculated from the calibration of the probe at the Saskatchewan Research Council facility in Saskatoon. A 0.1% eU3O8 cut-off is used for compositing and reporting the data. The equivalent uranium grades preliminary and are subsequently reported as definitive assay grades following sampling and chemical analysis of the mineralized drill core. In the case where core recovery within a mineralized intersection is poor, radiometric grades are considered to be more representative of the mineralized intersection and may be reported in the place of assay grades. Radiometric equivalent probe results are subject to verification procedures by qualified persons employed by CanAlaska prior to disclosure.

Drill core samples have been shipped to the Saskatchewan Research Council Geoanalytical Laboratories (SRC) in Saskatoon, Saskatchewan in secure containment for preparation, processing, and multi-element analysis by ICP-MS and ICP-OES using total (HF:NHO3:HClO4) and partial digestion (HNO3:HCl), boron by fusion, and U3O8 wt% assay by ICP-OES using higher grade standards. Radiometric assay samples are chosen based on radiometric equivalent uranium grades and scintillometer (SPP2) peaks, and comprise 0.3 to 0.8 m continuous split-core samples over mineralized intervals. Sandstone and basement geochemical composite samples are comprised of multiple equal sized full core "pucks" spaced over the sample interval. The SRC is an ISO/IEC 17025/2005 and Standards Council of Canada certified analytical laboratory. Blanks, standard reference materials, and repeats were inserted into the sample stream at regular intervals by CanAlaska and the SRC in accordance with CanAlaska's quality assurance / quality control (QA/QC) procedures.

All reported depths and intervals are drill hole depths and intervals, unless otherwise noted, and do not represent true thicknesses, which have yet to be determined.

Other News

The Company reports the resignation of Mr. Simon Szeto from CanAlaska's Advisory Board and would like to thank Simon for his past service to the Board of Directors.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSXV: CVV) (OTCQB: CVVUF) (FSE: DH7N) holds interests in approximately 300,000 hectares (750,000 acres), in Canada's Athabasca Basin - the "Saudi Arabia of Uranium." CanAlaska's strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company's properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world's richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds. For further information visit www.canalaska.com.

The qualified technical person for this news release is Nathan Bridge, MSc., P.Geo., CanAlaska's Vice President, Exploration.

On behalf of the Board of Directors

"Peter Dasler"

Peter Dasler, M.Sc., P.Geo.

President

CanAlaska Uranium Ltd.

Contacts:

Cory Belyk, Executive VP and CEO

Tel: +1.604.688.3211 x 306

Email: cbelyk@canalaska.com

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company's control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107782