Formation Metals Announces PEA Results For Idaho Cobalt Project: Post-tax NPV $113 Million IRR 24 Percent

Formation Metals (TSX:FCO) announced results of a preliminary economic assessment (PEA) for its Idaho Cobalt project, comprised of a mine and mill located outside the town of Salmon in Lemhi County, Idaho as well as a cobalt production refining facility along a railroad in southern Idaho.

As quoted in the press release:

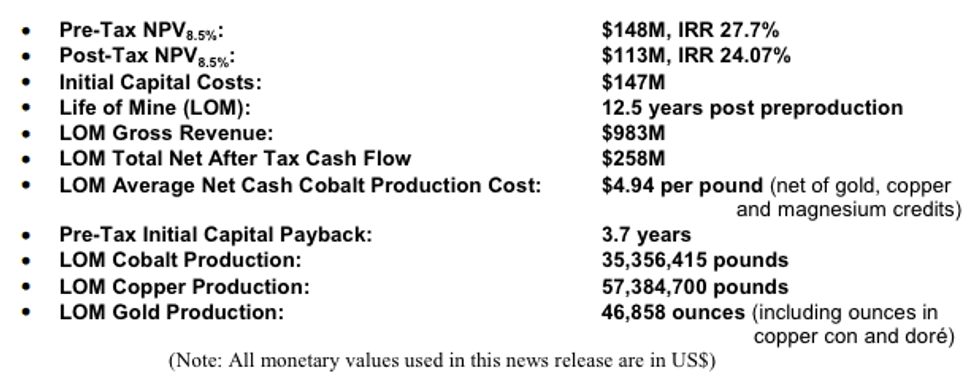

The PEA is based on an underground mine with a target production rate of 800 tons per day (“tpd”) with a weighted average annual production of 2,771,000 lbs of cobalt, 4,533,000 lbs of copper and 3,600 oz of gold over a 12.5 year mine life with an estimated pre-production period of 21 months utilizing a 0.20% cobalt cut-off. The economic model uses a 35% corporate tax rate and an 8.5% discount rate, resulting in an after tax NPV of $113.45M and an IRR of 24.07%.

In July 2007, the Company completed a feasibility level study on the ICP utilizing a previously calculated resource base to produce high purity cobalt metal suitable for critical applications in the aerospace sector. By November 2012, the Company had completed two of three stages of construction at the mine and mill when the property was placed on care and maintenance in May 2013. This current PEA utilizes an updated resource, mine model and mine schedule with intentions to produce cobalt and copper sulfate chemicals and gold at the CPF. Additional information regarding comparisons to previous work on the project can be found in the “Background” section in this news release.

Current plans are for the production of a combined cobalt/copper/gold concentrate from the mine and mill to be shipped to the CPF for hydrometallurgical processing of cobalt and copper bearing sulfides to produce cobalt sulfate heptahydrate utilized in the production of cathodes for the rechargeable battery sector. Other marketable by-products include copper concentrate, copper sulfate pentahydrate and magnesium sulfate used primarily in the agricultural industry, and gold. The substitution of magnesium oxide for lime as a neutralizing agent at the CPF results in the production of agricultural grade magnesium sulfate. Copper in concentrate will initially be scalped from the bulk concentrate at the CPF utilizing a standard froth flotation circuit and free gold will be recovered through a gold carbon in leach circuit producing gold-loaded carbon.

The ICP is 100% owned by Formation and there is no underlying royalty on the property. The PEA has been compiled in accordance with National Instrument 43-101 guidelines and will be made available on SEDAR and on the Company’s website within 45 days of this news release. Readers are strongly encouraged to review the final PEA report in its entirety.

Formation Metals president and CEO, Paul Farquharson, said:

Management is very encouraged with the results of the PEA and looks forward to advancing the ICP towards feasibility. As announced in January 2015, metallurgical test work suitable for a feasibility study has already commenced on samples from the project to characterize the final end products we plan on producing. The Company is optimistic about the future of the cobalt market and believes the ICP will be well positioned to meet the growing demand for battery grade cobalt chemicals in the U.S. The ICP offers a unique near term potential for North American consumers to secure an ethically sourced, environmentally sound supply of battery grade cobalt chemicals, mined safely and responsibly in the United States.

Click here to read the Formation Metals (TSX:FCO) press release

Click here to see the Formation Metals (TSX:FCO) profile.