First Cobalt Announces Inferred Mineral Resource for Iron Creek Project – Open at Depth and Along Strike

First Cobalt Corp. (TSXV:FCC, OTCQX:FTSSF, ASX:FCC) (the “Company”) is pleased to announce results of its first NI 43-101 Mineral Resource Estimate for the 100%-owned Iron Creek Cobalt Project in Idaho, USA.

First Cobalt Corp. (TSXV:FCC, OTCQX:FTSSF, ASX:FCC) (the “Company”) is pleased to announce results of its first NI 43-101 Mineral Resource Estimate for the 100%-owned Iron Creek Cobalt Project in Idaho, USA.

Highlights

- Inferred mineral resources of 29.6 million tons (26.9 million tonnes) grading 0.11% cobalt equivalent (0.08% cobalt and 0.30% copper) under a base case scenario pit constrained and deeper mineral resource. An alternative underground-only scenario results in 4.9 million tons (4.4 million tonnes) grading 0.30% cobalt equivalent (0.23% cobalt and 0.68% copper)

- Resource contains 45 million pounds (20,411 tonnes) of cobalt and 175 million pounds (79,379 tonnes) of copper for 62.9 million pounds (28,528 tonnes) of cobalt equivalent

- Resource is considered to be open along strike and at depth, with true widths between 10m and 30m

- Preliminary metallurgical testing concludes that simple flotation methods are applicable, yielding recoveries of 96% for cobalt and 95% for copper in rougher floatation

- 30,000m drill program ongoing to double the strike length for an updated resource estimate planned for early 2019

Trent Mell, President & Chief Executive Officer, commented:

“The initial resource estimate and the pace of progress at Iron Creek have exceeded our expectations. We have delineated a sizeable primary cobalt deposit on patented property and mineralization continues to expand to the east, west and at depth. The mineralogy is simple and initial metallurgical test work is very encouraging with high metal recoveries. Cobalt is associated with pyrite rather than minerals containing arsenic, which may offer processing and offtake advantages.”

Mr. Mell went on to say, “Idaho has a long history of mining and we have enjoyed strong support from the State and inWashington, DC. This initial Inferred Resource estimate is an important step forward to a potential source of ethical cobalt in America. Drilling is now underway to test the mineralization strike length from 450 metres to over 900 metres, while also systematically testing depth extensions to over 300 metres to support an updated resource estimate in early 2019.”

Mine Development Associates (MDA) in Reno, Nevada was retained to prepare a resource estimate for the Iron Creek cobalt and copper project, located in Idaho, USA. The resource estimate was based on data from 62 diamond drill holes, totaling 49,983 feet (15,235 metres), drilled by the Company in 2017 and early 2018.

The estimate of Inferred cobalt and copper resource is 29.6 million tons (26.9 million tonnes) at average grades of 0.08% cobalt and 0.30% copper, for a cobalt equivalent grade of 0.11%. These are reported at a cutoff of 0.03% CoEq for pit-constrained mineralization and 0.18% CoEq cutoff for potentially underground mineralization. As an alternative, an underground only scenario was estimated at a cutoff of 0.18% CoEq.

The tabulations at 0.15%CoEq, 0.20%CoEq and 0.35%CoEq represent material that could be available if only an underground scenario is to be considered.

Table 1: Summary of Inferred Resource Estimate

| Cutoff % CoEq(2) | Tons (000s) | Tonnes (000s) | CoEq (%) | Cobalt (%) | Cobalt (Mlbs) | Copper (%) | Copper (Mlbs) |

| 0.03/0.18(3) | 29,630 | 26,880 | 0.11 | 0.08 | 45.4 | 0.30 | 175.4 |

| 0.15 | 6,223 | 5,645 | 0.27 | 0.21 | 25.5 | 0.64 | 79.2 |

| 0.18(4) | 4,858 | 4,407 | 0.30 | 0.23 | 22.3 | 0.68 | 66.7 |

| 0.20 | 4,100 | 3,719 | 0.32 | 0.25 | 20.2 | 0.71 | 58.4 |

| 0.35 | 1,144 | 1,038 | 0.47 | 0.39 | 8.9 | 0.84 | 19.2 |

| (1) | Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration. The Mineral Resources in this press release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council. |

| (2) | Cobalt equivalent is calculated as %CoEq = %Co + (%Cu/10) based on US$30/lb Co and US$3/lb Cu. No metallurgical recoveries were applied to either metal because it is expected that the metallurgical recoveries will be similar for both metals. |

| (3) | All classified resource blocks located between the surface and the open pit shell with grades greater than 0.03% CoEq were included in the reported mineral resources and resource blocks located below the pit-confining surface and with grades greater than 0.18% CoEq were included in the reported underground mineral resources. |

| (4) | For the underground-only scenario, a 0.18% CoEq cutoff grade was used for estimating the potential underground material in the reported mineral resources |

| (5) | The cutoff grade utilized in the above table was derived from US$30/lb Co and US$3/lb Cu. |

Technical and economic factors likely to influence the “reasonable prospects for eventual economic extraction” were evaluated using the best judgement of Mr. Steven J. Ristorcelli, C.P.G., Principal Geologist for MDA and a Qualified Person under NI 43-101. Potential for underground mining was assessed by running stope optimizations using mining costs, processing costs, and anticipated metallurgical recoveries for similar size operations in the western United States. For evaluating the open-pit potential, MDA ran a series of optimized pits using variable cobalt and copper prices, mining costs, processing costs, and anticipated metallurgical recoveries related to flotation recovery and smelting of the concentrates, and hydrometallurgical extraction for cobalt, and appropriate G&A costs for modest-sized open pit and underground mining operations.

MDA reports resources at cutoffs that are reasonable for deposits of this nature given anticipated mining and processing methods and approximate though current operating costs, while also considering economic conditions. MDA used an inverse distance estimation methodology to estimate block-diluted Inferred resources at several cobalt equivalent grades.

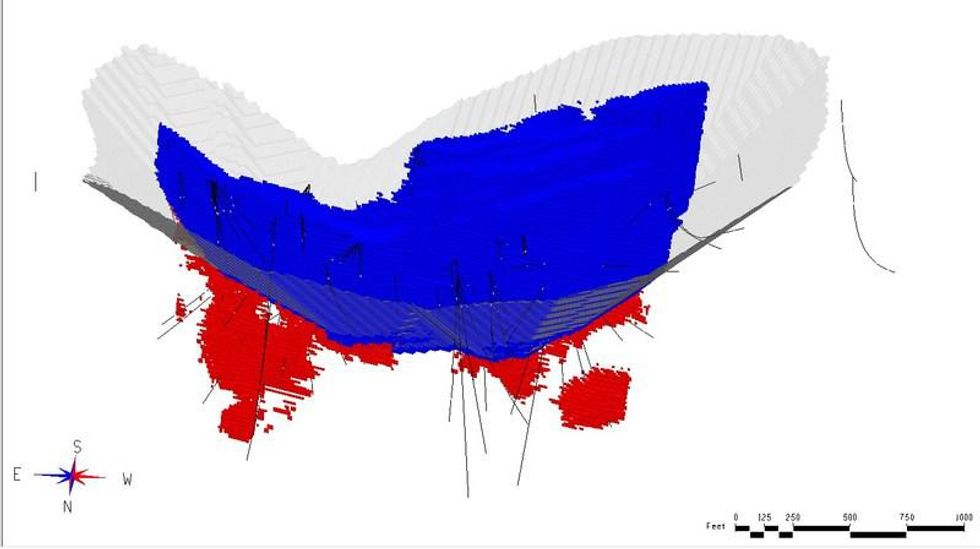

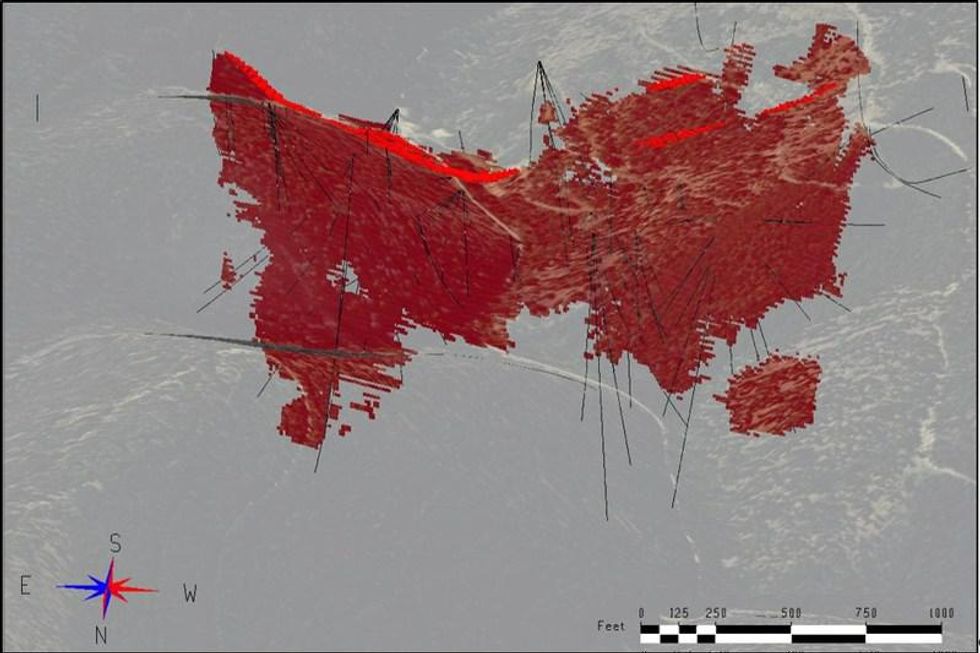

MDA identifies a little over half of the resources as lying within the No Name Zone, with the remainder in the Waite Zone, in the footwall to the No Name Zone. More drilling internally should upgrade these resources. The deposit remains open along strike in both directions and at depth.

Multiple cutoff grades are presented to provide an indication of material that would be available for potential exploitation as underground resources (Table 2).

Table 2: Inferred Resource Estimate at Various Cutoff Grades

| Cutoff % CoEq | Tons (000s) | Tonnes (000s) | CoEq (%) | Cobalt (%) | Cobalt (Mlbs) | Copper (%) | Copper (Mlbs) |

| 0.03 | 41,590 | 37,730 | 0.09 | 0.07 | 58.2 | 0.22 | 185.5 |

| 0.04 | 33,501 | 30,391 | 0.11 | 0.08 | 54.2 | 0.26 | 175.5 |

| 0.06 | 21,173 | 19,208 | 0.14 | 0.11 | 44.5 | 0.36 | 152.0 |

| 0.08 | 13,915 | 12,624 | 0.18 | 0.13 | 36.7 | 0.47 | 129.4 |

| 0.03/0.18(2) | 29,630 | 26,880 | 0.11 | 0.08 | 45.4 | 0.3 | 175.4 |

| 0.10 | 10,232 | 9,282 | 0.21 | 0.16 | 31.9 | 0.54 | 111.3 |

| 0.12 | 8,182 | 7,422 | 0.24 | 0.18 | 29.0 | 0.59 | 96.4 |

| 0.14 | 6,789 | 6,159 | 0.26 | 0.2 | 26.3 | 0.62 | 84.3 |

| 0.15 | 6,223 | 5,646 | 0.27 | 0.21 | 25.5 | 0.64 | 79.2 |

| 0.16 | 5,723 | 5,192 | 0.28 | 0.21 | 24.3 | 0.66 | 75.0 |

| 0.18 | 4,858 | 4,407 | 0.30 | 0.23 | 22.3 | 0.69 | 66.7 |

| 0.20 | 4,100 | 3,719 | 0.32 | 0.25 | 20.2 | 0.71 | 58.4 |

| 0.25 | 2,610 | 2,368 | 0.37 | 0.29 | 15.2 | 0.79 | 41.4 |

| 0.30 | 1,707 | 1,549 | 0.42 | 0.34 | 11.6 | 0.83 | 28.4 |

| 0.35 | 1,144 | 1,038 | 0.47 | 0.39 | 8.9 | 0.84 | 19.2 |

| 0.40 | 756 | 686 | 0.53 | 0.44 | 6.6 | 0.87 | 13.1 |

| (1) | See footnotes at Table 1. |

| (2) | All classified resource blocks located between the surface and the open pit shell with grades greater than 0.03% CoEq were included in the reported open pit mineral resources and resource blocks located underground with grades greater than 0.18% CoEq were included in the reported underground mineral resources. |

Flotation Tests

McClelland Laboratories Inc. (McClelland) conducted preliminary mineral processing and metallurgical testing commissioned by First Cobalt which is described within the report. Flotation results indicate that a fairly standard bulk sulfide flotation reagent suite (a combination of dithiophosphate and PAX) worked well for generating high rougher flotation cobalt and copper recoveries of 96% cobalt and 95% copper.

Preliminary flotation tests were completed using three bulk samples extracted from one of three adits on the property. McClelland notes two samples had copper grades close to 1.0% and all three had cobalt grades in the range of 0.25% to 0.40%. All samples responded very well when subjected to rougher flotation using standard conditions. Copper recovery into the bulk concentrate averaged over 97% for the two high-grade samples and 92.5% for the low grade sample. Cobalt was recovered in the pyrite product. For all three bulk samples this product contained more than 90% of the cobalt at grades of 1.2% to 1.8% cobalt.

No testwork has yet been done on recovery of the cobalt from the pyrite concentrates. However, McClelland states that two approaches appear to be technically viable. One is to roast the concentrate, followed by leaching the cobalt from the resulting sinter and concentrating the cobalt using solvent extraction. Final recovery of the cobalt would be as a salt or electrowon metal. The second approach is the use of an autoclave to oxidize the pyrite and solubilize the cobalt, to be subsequently recovered by solvent extraction.

Iron Creek Property

The Iron Creek property consists of mining patents and exploration claims covering an area of 1,698 acres. Significant infrastructure is in place to support multiple drills and underground activity. Historic underground development includes 600 metres of drifting from three adits and an all-weather road connecting the project to a state highway.

The No Name and Waite Zones are roughly parallel and dip roughly 75° to the north, remaining open at depth. Additional mineralization has been encountered during drilling and some holes in the 2018 program are intended to confirm the potential for additional mineralized zones beyond No Name and Waite. The No Name Zone and the Waite Zone have true widths between 10m and 30m. Mineralization also occurs between the No Name and Waite Zones as 1mto 5m pods.

Cobalt-copper mineralization occurs as semi-massive and disseminated pyrite and chalcopyrite along stratabound bands within finely layered meta-sedimentary rocks consisting of interbedded argillite and quartzite. Cobalt is associated with pyrite. Thin veins of chalcopyrite also cut the bands and meta-sedimentary rocks. Quartzite units make up the hangingwall and footwall to the mineralized meta-sedimentary horizon. This stratigraphic sequence has been mapped at surface and by drilling to extend along strike for at least two kilometres.

The principal mineral assemblage consists of pyrite, chalcopyrite, pyrrhotite, and magnetite with much lesser quantities of native copper and arsenopyrite locally. Scanning-electron and microprobe tests indicate the cobalt occurs largely or entirely within pyrite and there is a distinct lack of cobaltite, a common cobalt ore mineral containing arsenic. Drill results demonstrate that the cobalt and copper mineralization are in part separated from each other spatially, and in part overlapping.

Recommendations

MDA notes that thicker zones can be correlated with the present drill spacing with moderate confidence. Infill drilling will be required for upgrading the Inferred resources to Measured and Indicated classifications. MDA also concludes that the resource estimate should be considered only as a snapshot in time as the Company is continuing to explore the Iron Creek deposit.

MDA concludes that the Iron Creek Project is a project of merit requiring additional exploration and infill drilling along strike and at depth. They believe that First Cobalt’s planned exploration drilling, both inside and outside the main resource area, totaling 70,000ft (21,336m) and a total planned budget of ~$8.6 million is justified.

On June 11, First Cobalt announced a $9 million program intended to extend the known mineralization along strike and bring a portion of the Inferred Mineral Resource estimate into a Measured and Indicated Resource estimate. Longer holes will test cobalt-copper mineralization intersected by 2017 drilling in the footwall, which may extend to surface. Drilling will also test the down dip extension of mineralization below the existing underground adits.

An NI 43-101 Technical Report to be prepared by MDA with an effective date of September 18, 2018, will be posted on www.firstcobalt.com and the Company’s profile on SEDAR at www.SEDAR.com within 45 days of the date of this news release.

Qualified and Competent Person Statement

The technical content of this press release has been reviewed by Steven J. Ristorcelli, C.P.G., P.G. of Mine Development Associates, a Qualified Person as defined by National Instrument 43-101. Dr. Frank Santaguida, P.Geo., is the Qualified Person who has reviewed and approved this news release. Dr. Santaguida is also a Competent Person (as defined in the JORC Code, 2012 edition) who is a practicing member of the Association of Professional Geologists of Ontario (being a ‘Recognised Professional Organisation’ for the purposes of the ASX Listing Rules). Dr. Santaguida is employed on a full-time basis as Vice President, Exploration for First Cobalt. He has sufficient experience that is relevant to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code. The term “Competent Person” is not recognized by Canadian securities regulatory authorities, and the term is used by the Company with reference to the JORC Code, and to ensure compliance with the ASX Listing Rules and applicable reporting requirements in Australia.

About First Cobalt

First Cobalt is a vertically integrated North American pure-play cobalt company. First Cobalt has three significant North American assets: the Iron Creek Project in Idaho, the Canadian Cobalt Camp and the only permitted cobalt refinery in North America capable of producing battery materials.

On behalf of First Cobalt Corp.

Trent Mell

President & Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects’, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved”. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements are set forth in the management discussion and analysis and other disclosures of risk factors for First Cobalt, filed on SEDAR at www.sedar.com. Although First Cobalt believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, First Cobalt disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Cautionary Note to Investors – Resource Estimates

In accordance with applicable Canadian securities regulatory requirements, all mineral resource estimates of the Company disclosed or incorporated by reference in this news release have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), classified in accordance with Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Reserves Definitions and Guidelines” (the “CIM Guidelines”).

The Company uses the terms “mineral resources”, and “inferred mineral resources”. While those terms are recognized by Canadian securities regulatory authorities, they are not recognized by the United States Securities and Exchange Commission (the “SEC”) and the SEC does not permit U.S. companies to disclose resources in their filings with the SEC. Pursuant to the CIM Guidelines, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with measured or indicated mineral resources, have the least certainty as to their existence, however, it is reasonable to expect that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Pursuant to NI 43-101, inferred mineral resources may not form the basis of any economic analysis, including any feasibility study. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.

For further information: visit www.firstcobalt.com or contact: Heather Smiles, Investor Relations, info@firstcobalt.com, +1.416.900.3891

Source: www.newswire.ca