Ausenco Study Doubles Production Potential of First Cobalt Refinery

First Cobalt Corp. (TSXV:FCC, OTCQX:FTSSF, ASX:FCC)(the “Company”) is pleased to announce that a scoping study for the restart of the First Cobalt Refinery in Canada using third party cobalt hydroxide as feed material concluded that annual production could reach over 5,000 tonnes per annum (“tpa”) of cobalt, more than twice the previous estimate.

First Cobalt Corp. (TSXV:FCC, OTCQX:FTSSF, ASX:FCC)(the “Company”) is pleased to announce that a scoping study for the restart of the First Cobalt Refinery in Canada using third party cobalt hydroxide as feed material concluded that annual production could reach over 5,000 tonnes per annum (“tpa”) of cobalt, more than twice the previous estimate. By eliminating the Refinery’s autoclave circuit and addressing production constraints, the debottlenecking study by Ausenco Engineering Canada Inc. estimated the incremental capital cost to double production capacity will be $7.5 million from the previous estimate or $37.5 million in total.

All numbers are in US dollars. A final decision on whether to put the First Cobalt Refinery back into production has not been made at this time and is contingent on the outcome of ongoing discussions and studies. The Company has not completed a feasibility level study of the economic viability of operating the Refinery. Any decision to restart the Refinery will be based on a supply of third party feed material and not the anticipated development of any of the Company’s current mineral projects.

Highlights

- Ausenco defined the production capacity, capital costs and operating costs associated with recommissioning the Refinery in Ontario, Canada using third party cobalt hydroxide as the primary feed material to produce a battery grade cobalt sulfate

- Study outlines potential to double production to over 5,000 tpa of cobalt by increasing the initial capital investment from $30 million to $37.5 million and expanding the flow sheet circuit to optimize the existing building footprint

- Discussions continue with Glencore and other third parties on definitive commercial terms for feed supply and financing to restart the First Cobalt Refinery within 18 to 24 months

Trent Mell, President & Chief Executive Officer of First Cobalt, commented:

“The First Cobalt Refinery is a strategic North American asset and producing cobalt materials for the North American market is our quickest path to cash flow. The facility is in excellent condition with permits in place, good community support and a short timeline to potential production.

The ability of the First Cobalt Refinery to produce 5,000 tonnes per annum in a global cobalt market that totaled approximately 130,000 tonnes in 2018, would be an important contribution to the global supply chain, particularly the U.S. market.”

First Cobalt engaged Ausenco to complete a scoping-level study in support of restarting the refinery, located near Cobalt, Ontario. The debottlenecking study assessed the production capacity of the refinery and associated constraints assuming that cobalt hydroxide would be the primary source of feed material for the production of cobalt sulphate. Previous studies assumed that the refinery would treat lower grade arsenic-rich concentrate material.

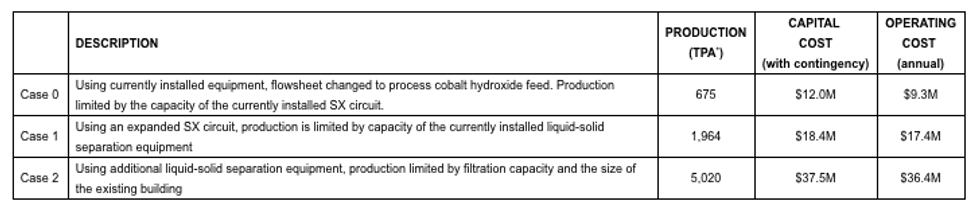

The report outlined three restart scenarios, each assuming that the refinery would primarily treat cobalt hydroxide grading approximately 30% cobalt. In all scenarios, the Refinery’s autoclave circuit is not required thereby eliminating the first constraint to higher production rates. The first scenario (Case 0) assumed minimal capital investment outside refurbishing existing equipment. The next scenario (Case 1) assumed an additional capital investment to alleviate the bottleneck in the current solvent extraction (SX) circuit. The final scenario added an additional capital investment to alleviate the liquid-solid separation limitations of the currently installed equipment. Details of the three scenarios are summarized in Table 1.

Table 1. Potential production scenarios (Numbers in US$)

Today’s results further support the business case to restart the First Cobalt Refinery as it could be expanded from its previously anticipated production potential of 2,000-2,500 tpa to over 5,000 tpa of cobalt in sulfate.

While the 675 tpa production scenario offers a minimum investment case, based on the minimal increase in capital requirements from the 2018 Primero study, First Cobalt intends to explore the potential to increase production to 5,000 tpa of cobalt contained in sulfate. The capital requirements presented here include contingencies of $3.02 million, 4.61 million and 10.39 million for cases 0, 1 and 2 respectively. Capital estimates are provided with an indicative accuracy range of -30%/+50% and are based on previous historical data metrics from similar projects.

The 675 tpa production scenario involves simply restarting the refinery “as is” using only currently installed equipment and making necessary flowsheet changes to process cobalt hydroxide to produce cobalt sulfate. In this scenario, production of cobalt sulfate is limited by the capacity of the currently installed solvent extraction (“SX”) circuit.

Building on the 675 tpa scenario, the 1,950 tpa scenario includes the additional capital to overcome the limitation imposed by the current SX circuit. Under this operating scenario, production of cobalt sulfate is limited by the capacity of the currently installed liquid-solid separation equipment.

The preferred 5,000 tpa scenario then builds on both lower production rate scenarios and includes additional capital to overcome the limitation imposed by the liquid-solid separation equipment. Under this operating scenario, production of cobalt sulfate is limited by filtration capacity and the size of the existing building.

The study completed by Ausenco does not access the economic viability of operating the Refinery, and instead estimates the costs associated with recommissioning and operating the Refinery under the above scenarios.

Next Steps

First Cobalt recently announced a memorandum of understanding (“MoU”) with Glencore AG to supply cobalt feedstock and financing to recommission the facility (May 21, 2019 press release). Discussions are ongoing and the parties have agreed to a 60-day timeline to negotiate definitive agreements.

The First Cobalt Refinery project team is continuing to work with engineering firms, process experts and financial advisers to finalize a business plan to restart the facility. Next steps include advanced metallurgical testing to demonstrate that the flowsheet will achieve the desired product specifications. Feasibility level engineering and test work will be required to support the design of new equipment, specifically solvent extraction and liquid-solid separation, and to generate detailed quotations, engineering and further cost estimates.

About the First Cobalt Refinery

The First Cobalt Refinery is a hydrometallurgical cobalt-silver-nickel refinery in the Canadian Cobalt Camp, approximately 600 kilometres from the US border. The facility was commissioned in 1996 and currently has a nominal throughput of 12 to 24 tpd. The Refinery historically treated mine concentrates and is permitted to treat feed with high arsenic content. The current footprint includes an empty feed warehouse that once housed a mill. The facility is located on a 40-acre property that can be expanded to 120 acres with two settling ponds and an autoclave pond (Figure 2).

With respect to existing tailings capacity, it was noted that the autoclave pond has not been fully constructed and has an estimated 40,000 m3 (approximately 70,000 tonnes assuming a specific gravity of 1.74 tonnes per cubic metre) of remaining permitted capacity yet to be constructed. Operating at 24 tpd, the autoclave pond would reach capacity after eight years of operation. Thereafter, the Company could avail itself of 80 acres to the north of the Refinery (Figure 3) to permit additional tailings storage capacity. The primary settling pond is also not yet constructed to its full capacity and it was noted that doing so would improve discharge water quality through additional retention time and increased capacity for water storage.

Previous Studies

In 2018, First Cobalt completed three studies to assess options for a restart of the facility: (1) a desktop engineering review of the current flowsheet and associated capital and operating costs to treat arsenic-rich mine concentrates at a throughput rate of 12 to 50 tpd; (2) a permit review to assess the time required to renew and amend existing operating permits; and (3) a market study to identify potential feed sources and final products and estimate gross margin opportunities (see October 10, 2018 press release).

Subsequent studies by SGS to test the suitability of cobalt hydroxide as feedstock and using the processes in the current refinery flowsheet the Refinery flowsheet is capable of producing a high purity, battery grade cobalt sulfate from cobalt hydroxide (see November 8, 2018 and April 3, 2019 press releases)

For purposes of this earlier baseline engineering study, Primero Group assumed that the Refinery would continue to treat mine concentrates, that the flowsheet would remain unchanged and that the final product would be cobalt carbonate. However, with the decision to treat third party cobalt hydroxide material, Ausenco was retained to prepare a new scoping level assessment under a modified flowsheet.

As part of the engineering review, Primero Group estimated the replacement (or new build) value of the refinery building at the various throughput rates. In 2012, Hatch estimated the replacement cost of the Refinery at $78M. Primero’s results from the current study range from $53M to $143M, inclusive of a 30% contingency. In instances, replacement cost estimates were limited to the refinery building and did not include replacement costs of site level infrastructure, including roadways, power lines and the tailings management facility. The value of the permits was also excluded for purposes of this exercise.

Corporate Update

The Company has engaged Catch Advisory Group (“Catch”) to conduct investor relations activities on its behalf. Catch will be paid in cash based on a prescribed hourly rate which is expected to approximate $5,000 per month. Catch currently does not hold any securities of First Cobalt and have no immediate intention of acquiring any of the Company’s securities in the foreseeable future.

About First Cobalt

First Cobalt is a Canadian-based pure-play cobalt company and owner of the only permitted primary cobalt refinery in North America. The Company is exploring a restart of the First Cobalt Refinery in Ontario, Canada, which could produce over 5,000 tonnes of contained cobalt in sulfate per year. First Cobalt’s main cobalt development project is the Iron Creek Cobalt Project in Idaho, USA, which has an inferred mineral resource estimate available on the Company’s website. The mineral resource delineated on the Iron Creek Cobalt Project is not expected to provide a source of feed for the First Cobalt Refinery.

On behalf of First Cobalt Corp.

Trent Mell

President & Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects’, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved”. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements are set forth in the management discussion and analysis and other disclosures of risk factors for First Cobalt, filed on SEDAR at www.sedar.com. Although First Cobalt believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, First Cobalt disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

For further information: visit www.firstcobalt.com or contact: Elina Chow, Investor Relations, info@firstcobalt.com, +1.416.900.3891, +1.416.645.0935 x226

Related Links

Source: www.newswire.ca