April 27, 2022

GALENA MINING LTDLTD. (“Galena” or the “Company”) (ASX: G1A) reports on its activities for the quarter ending 31 March 2022 (the “Quarter”), primarily focused on construction of its 60%-owned Abra Base Metals Mine (“Abra” or the “Project”) located in the Gascoyne region of Western Australia.

HIGHLIGHTS:

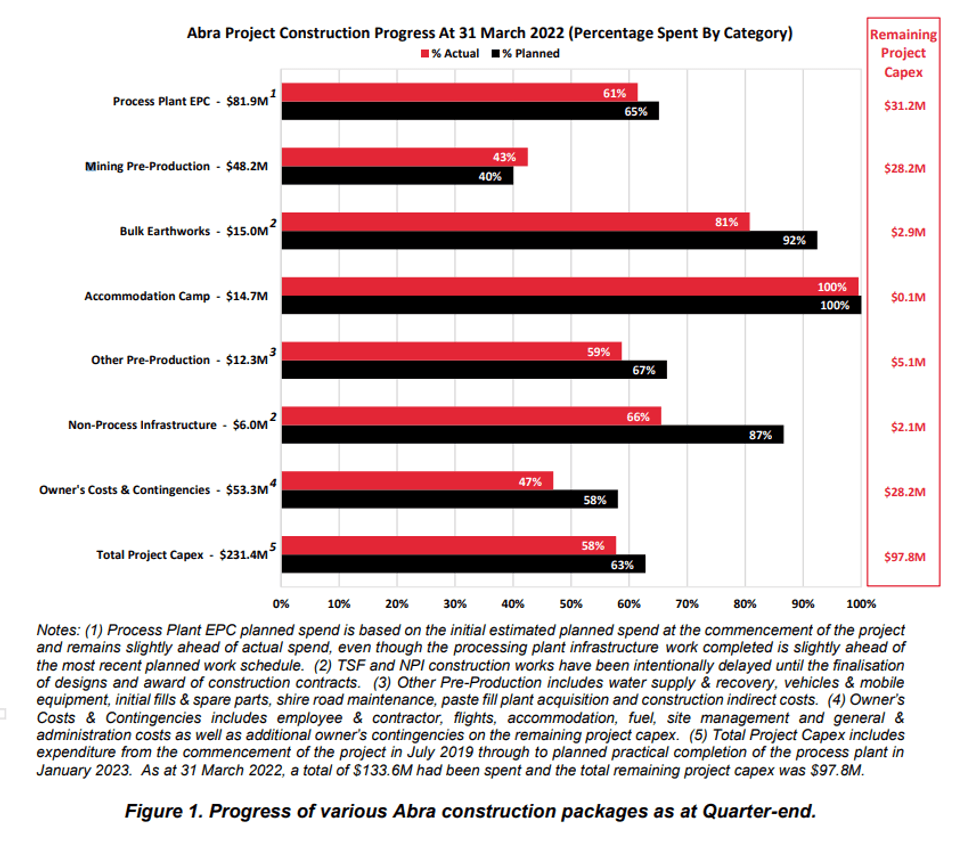

- Abra Project 58% complete at end of the March Quarter (19% of Abra construction works were completed during the March Quarter). Project focus remains on underground access to the Abra orebody and completion of the processing plant and power station.

- Underground development achieved 694m advance during the Quarter remaining ahead of schedule with the decline reaching 1,395mRL. The decline is 82m above the orebody and 155m below the surface.

- Overall processing plant construction has reached 61% complete. Plant engineering and drafting work is 95% complete and site construction work is 35% complete.

- Contracts have been awarded for the remaining non-processing surface infrastructure work representing only 10% of the remaining project capex of $97.8M.

- Power supply company Contract Power have commenced site works associated with the Abra power station (build, own, operate contract).

- US$35M additional debt drawdown was completed under the Taurus Debt Facilities, leaving US$45M remaining undrawn.

- Cash balance at Quarter-end A$60.0M.

ABRA BASE METALS MINE (60%-OWNED)

Abra comprises a granted Mining Lease, M52/0776 and surrounding Exploration Licence E52/1455, together with several co-located General Purpose and Miscellaneous Leases. The Project is 100% owned by Abra Mining Pty Limited (“AMPL”), which in turn is 60% owned by Galena, with the remainder owned by Toho Zinc Co., Ltd. (“Toho”) of Japan.

Abra is fully permitted and under construction. First production of its high-value, high-grade lead- silver concentrate is currently scheduled for the first quarter of 2023 calendar-year.

Project construction / development

During the Quarter Abra Project construction works continued, passing the half-way to completion mark as the Quarter progressed.

Abra construction works conducted during the Quarter were comprised of site civil and earthworks, underground mine development, processing plant construction and ongoing front- end engineering design and procurement, including:

- Underground mining – During the Quarter, underground development continued to progress ahead of schedule, with a further 694 metres of development being completed. As at Quarter-end, total development reached 1,134 metres consisting of 885 metres of decline development and 249 metres of other lateral development. The decline reached 1,395mRL, 82 metres above the Abra orebody and 155 metres below the surface. During the Quarter the first raise bore hole (4.5m) was successfully completed for development of the mine’s primary ventilation infrastructure. The ventilation shaft is one of 3 surface holes that will be completed to provide underground ventilation as the mine progresses.

Click here for the full ASX Release

This article includes content from GALENA MINING LTD. , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

02 February

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

10h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00