21C Metals Commences Drilling on East Bull Palladium Project

21C Metals Inc. is pleased to announce the awarding of a diamond drill contract to Vital Drilling of Val Caron, Ontario.

21C Metals Inc. (CSE:BULL, FSE:DCR1, OTCQB:DCNNF) (“21C Metals” or the “Company”) is pleased to announce the awarding of a diamond drill contract to Vital Drilling of Val Caron, Ontario. The diamond drill program comprised of 10 to 15 holes will commence within the next week.

Following on from a successful summer sampling program (Press Release September 17, 2019) the diamond drill program will focus on expanding the Pit Constrained Inferred Mineral Resource Estimate of 523,000 Palladium Equivalent (PdEq) ounces and determining a potential higher grade starter pit location.

To join 21C Metals’ investor group please follow this link https://bit.ly/Join21CGroup.

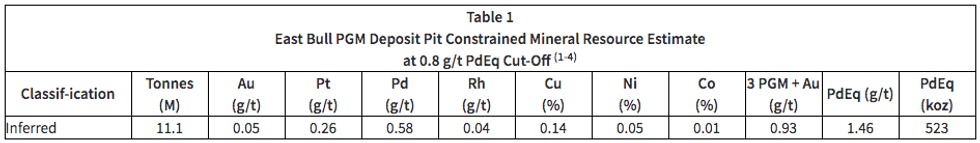

Drill holes have been selected by 21C Metals geologists with the assistance of technical advisor Richard H. Sutcliffe, PhD, PGeo. The NI 43-101 Initial Mineral Resource Estimate (Table 1) for the East Bull Palladium Project is filed on https://www.sedar.com/.

The recent demand for Palladium has driven the Palladium price to over $1,600/oz (USD). The implementation of cleaner emission standards by governments around the world has increased the use of Palladium and Platinum in catalytic converters for internal combustion powered vehicles. This demand has been supported by the growth in sales of hybrid vehicles which are growing faster than electric car sales. Supply is already constrained and wage negotiation deadlocks in South Africa may potentially further effect supply[1].

East Bull is located ~ 90 kilometers west of Sudbury Ontario. Sudbury is home to the fully integrated base and precious metal mining, processing, and smelting complexes of Vale Canada Limited and Glencore PLC.

Wayne Tisdale, President of 21C Metals, commented: “We are pleased to be able to move our exploration program forward so rapidly after such a successful summer sampling campaign. This has been possible thanks to our excellent geological and operational teams and the ease of accessibility of the project”.

P&E Mining Consultants Inc. has completed a Technical Report and Initial Mineral Resource Estimate on the East Bull Property for the Company. The Pit Constrained Inferred Mineral Resource Estimate at a 0.8 g/t PdEq cut-off is summarized in Table 1.

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues, although 21C Metals is not aware of any such issues.

(2) The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(3) The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

(4) Values in the table may differ due to rounding.

The PdEq cut-off is based on the following 24-month trailing average US$ metal prices as of January 31, 2018: Pd – $767/oz; Pt – $973/oz; Au – $1,262/oz; Rh – $1,000/oz; Cu – $2.55/lb; Ni – $4.62/lb; Co – $20/lb. In addition to metal prices, the PdEq cut-off grade takes into consideration assumptions for mining costs, concentrate recoveries, smelter payables and refining charges that are summarized in the NI43-101 technical report.

Information regarding the NI43-101 technical report and resource estimate in this news release has been reviewed and approved by Independent Qualified Person, Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc.

Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is the “Qualified Person” as defined in NI 43-101, who has reviewed and approved the technical content in this press release.

For additional information please contact:

21C Metals Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4455

Investors are cautioned that the estimates do not mean or imply that economic deposits exist on the Property. Other than as provided for in this press release, the Company has not undertaken any independent investigation of the estimates or other information contained in this press release nor has it independently analyzed the results of the previous exploration work in order to verify the accuracy of the information. The Company believes that the information contained in this press release are relevant to continuing exploration on the Property because they identify significant mineralization that will be the target of the Company’s exploration program.

For Notice

Pavey Ark’s samples were analyzed by Actlabs in Ancaster, Ontario. All samples were transported under the direct supervision of R.H. Sutcliffe and delivered from the Project directly to the laboratory receiving facilities of Actlabs in Ancaster, Ontario. Samples were analyzed for Pt, Pd, Au by 50 g fire assay with ICP-OES finish and for Ag, Co, Cu, Ni by total digestion with an ICP finish at Actlabs, in Ancaster, ON. Rh was analyzed separately by 30 g fire assay with ICP-MS finish at Actlabs in Ancaster, ON.

Actlabs is an independent commercial laboratory that is ISO 9001 certified and ISO 17025 accredited. The accreditation program includes ongoing audits to verify the QA system and all applicable registered test methods.

Actlabs has developed and implemented a Quality Management System (QMS) designed to ensure the production of consistently reliable data at each of its locations including the Ancaster laboratories. The system covers all laboratory activities and takes into consideration the requirements of ISO standards. Actlabs maintains ISO registrations and accreditations. ISO registration and accreditation provide independent verification that a QMS is in operation at the location in question.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.