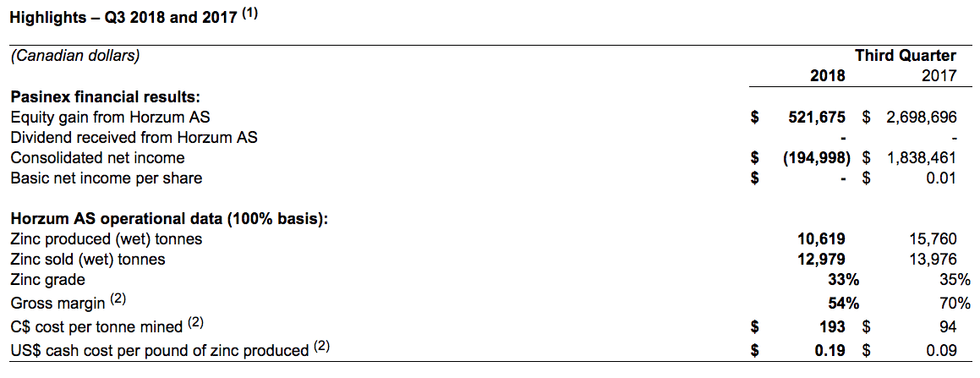

Pasinex (CSE:PSE, FSE:PNX) (The “Company” or “Pasinex”) reported a small loss for the third quarter (Q3) of 2018 of $0.2 million compared to net income of $1.8 million in Q3 2017.

Pasinex (CSE:PSE, FSE:PNX) (The “Company” or “Pasinex”) reported a small loss for the third quarter (Q3) of 2018 of $0.2 million compared to net income of $1.8 million in Q3 2017. The decrease in net income is due to a lower equity gain from Horzum AS (the 50% owned joint venture that holds the Pinargozu mine) caused mainly by the drop in zinc prices in Q3.

- Refer to Note 1

- Refer to Note 2

Steve Williams, CEO of Pasinex commented, “The third quarter equity gain from Horzum AS showed a 54% gross margin and although this is a strong result we recorded a small loss on the Pasinex income statement. This small loss was due to a weaker zinc price in Q3 leading to a lower equity gain from Horzum AS as well as expenditures for exploration at the Spur Zinc Project in Nevada.”

“Liquidity issues facing our joint venture partner in Turkey have put a significant drain on our cash flow. We are optimistic going forward that with sales being invoiced and collected directly from Horzum AS we can control cash flows and bring dividend funds back to Pasinex in the short term.”

“We are particularly excited about the discovery of zinc sulphides at the Spur Zinc Project and want to continue to move this project forward in 2019. Pasinex looks forward to continued strength in the new year.”

Pasinex Highlights

- Pasinex reported a loss for Q3 2018 of $0.2 million, which included a $0.5 million equity gain from Horzum AS offset by $0.3 million in exploration spending at the Spur Zinc Project and $0.4 million in general and administration costs.

- The equity gain decreased period over period mainly due to lower zinc prices in Q3 2018 (see Horzum AS Highlights below).

- An initial drilling program of four inclined diamond drill holes has been completed at the Spur Zinc Project for a total of 2,291 feet (698 metres) resulting in a new zinc sulphide discovery and verifies high grade zinc oxides: 43.9 metres at 14.2% zinc including 13.7 metres at 26.1% zinc and 5.6 ounces of silver (see also Pasinex press release dated September 11, 2018). As a result of these positive drill results the Company maintained its obligation under the Spur Option Agreement and paid a combination of US$200,000 cash and issued 2.2 million Pasinex common shares in September.

- In March 2018, Horzum AS declared a Turkish Lira (“TRY”) 40 million dividend payable to both of its 50% shareholders to be paid in instalments during 2018. As of the date of this news release, Pasinex received $1.0 million of this dividend ($0.2 million was received in October 2018 and no dividends were received in Q3).

- The lack of cash flow from Horzum AS to Pasinex is a direct result of the financial difficulties faced by Akmetal, Pasinex’s joint venture partner. In the past, the sales of zinc material from Horzum AS were sold through a subsidiary of Akmetal. Payment of the trade receivables have historically been slow and in the third quarter no payments were received by Horzum AS and therefore no payment was made against the dividend owing to Pasinex. As a result the Company:

— reviewed the credit worthiness of the Akmetal receivable and made an adjustment (see Horzum AS Highlights below)

— received loans from certain of its shareholders and directors amounting to $745,000 ($65,000 of which was received after September 30, 2018) to fund its obligations under the Spur Option Agreement and make payment on a significant portion of its trade payables

— altered the sales arrangement at Horzum AS to require that all direct ore sales would be contracted by Horzum AS, rather than sold through Akmetal’s trading company. As a result, cash received from sales will go directly to Horzum AS where Pasinex has shared control over cash disbursements. In October, sales proceeds were directly received by Horzum AS and used to draw down trade payables and pay a portion of the dividend owing to Pasinex. - The value of the TRY significantly declined in Q3 2018. The TRY to Canadian dollar fell from a rate of 3.5 at June 30 to 4.7 at September 30 and the TRY to US dollar fell from a rate of 4.6 to 6.1 over the same period – both representing a greater than 30% devaluation in the TRY. The impact of the devaluation has a positive effect on Horzum AS TRY profitability because revenues are US dollar based, over 80% of costs are TRY based and there is minimal TRY cash on hand. However, the TRY based dividend (of TRY 17.6 million at September 30) and the net investment in Horzum AS are subject to foreign exchange risk. In Q3 2018 the value of the dividend receivable decreased $1.3 million and the net investment in Horzum AS decreased $1.3 million (the sum of which is shown as other comprehensive loss, which is a non-cash item to be reflected in the income statement only if the loss is realized). As of the date of the MD&A the TRY has recovered substantially (over 15%).

Horzum AS Highlights (described on a 100% basis)

- In Q3 2018, Horzum AS produced 10,619 tonnes (wet weight) of direct shipping material with an average grade of 33% zinc, a decrease from Q3 2017 production of 15,760 tonnes (average grade of 35% zinc).

- Difficult ground conditions in 2018 and mineralization accessibility issues in Q3 resulted in lower production than planned and so the Company modified its production guidance for the year and now expects 2018 production to be approximately 44,500 tonnes as compared to the original targeted production of between 54,000 and 60,000 tonnes. However, with higher grades anticipated zinc production pounds should only be about 10% below expectations.

- The decrease in equity earnings between periods is a result of lower sales revenues.

- Sales revenue for Q3 2018 was $4.9 million from the sale of 10,435 wet tonnes of zinc oxide, 2,356 wet tonnes of zinc sulphide and 188 tonnes of lead. This compares to $9.3 million of revenue in Q3 2017 from the sale of 9,473 wet tonnes of zinc oxide, 4,240 wet tonnes of zinc sulphide and 263 tonnes of lead.

- Q3 2018 revenues were impacted by lower zinc prices. The average London Metals Exchange (“LME”) zinc price for Q3 2018 was US$1.15 per pound compared to US$1.34 per pound in Q3 2017. In addition, Q3 2018 had $2.7 million in negative pricing adjustments in relation to sales from the first half of 2018 which sales prices were not finalized during that period.

- Total costs per tonne mined in Q3 2018 were $193 per tonne, more than double the $94 per tonne mined in Q3 2017, which is largely due to lower production being mined at moderately higher cost (refer to Note 2).

- Net income for Horzum AS for Q3 2018 was $1.0 million compared to $5.4 million in Q3 2017. 50% of these amounts are included as an equity gain in Horzum AS for the respective periods.

- Gross margin in Q3 2018 was 54% compared to 70% in Q3 2017, which reflects the lower sales prices for zinc and slightly higher costs between periods (refer to Note 2).

- Net income in Q3 2018 includes a finance expense of $7.5 million and a foreign exchange gain of $6.5 million in relation to the Akmetal receivables. The finance expense reflects the increased credit risk on the Akmetal receivables owing to Horzum AS. The Company expects full recoverability of the receivable but potentially over a longer time horizon. The finance expense represents the loss incurred from the increased time frame expected to receive funds (time value of money). The foreign exchange gain is a result of the revaluation of the US dollar based receivable to the TRY functional currency.

Note 1

Please note that all dollar amounts in this news release are expressed in Canadian dollars unless otherwise indicated. Refer also to the interim unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2018 and the corresponding Management’s Discussion and Analysis (MD&A) found on SEDAR.com and Pasinex.com for more information.

Note 2

This news release includes non-GAAP measures, including gross margin, cost per tonne mined and US$ cash cost per pound of zinc produced. A reconciliation of these non-GAAP measures to the GAAP financial statements is included in the MD&A.

About Pasinex

Pasinex Resources Limited is a Toronto-based mining company which owns 50% of the producing Pinargozu high grade zinc mine and, under a Direct Shipping Program, sells to zinc smelter / refiners from its mine site in Turkey. The Company also holds an option to acquire 80% of the Spur (formerly named Gunman) high-grade zinc exploration project in Nevada. Pasinex has a strong technical management team with many years of experience in mineral exploration and mining project development. The mission of Pasinex is to build a mid-tier zinc company based on its mining and exploration projects in Turkey and Nevada.

The Pinargozu mine is held in a separate entity, Horzum Maden Arama ve Isletme A.S. (Horzum AS), which is a corporate joint venture held equally between Pasinex and Turkish mining house, Akmetal Madencilik San ve Tic. AS (Akmetal AS). Akmetal AS is one of Turkey’s largest family-owned conglomerates which also owns the nearby past-producing Horzum zinc mine.

Visit our web site at: www.pasinex.com

On Behalf of the Board of Directors

PASINEX RESOURCES LIMITED

“Steve Williams”

| Steve Williams President/CEO Phone: +1 416.861.9659 Email: info@pasinex.com | Evan White Manager of Corporate Communications Phone: +1 416.906.3498 Email: evan.white@pasinex.com | |

The CSE does not accept responsibility for the adequacy or accuracy of this news release.

This news release includes forward-looking statements that are subject to risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of the Company to be materially different from the historical results or from any future results expressed or implied by such forward-looking statements.

All statements within, other than statements of historical fact, are to be considered forward looking. Although Pasinex believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, exploration results, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.

Click here to connect with Pasinex (CSE:PSE, FSE:PNX) for an Investor Presentation.

Source: globenewswire.com