Osisko Metals Releases 2019 Pine Point Mineral Resource Estimate

Osisko Metals Incorporated is pleased to announce the 2019 Mineral Resource Estimate Update for its 100% owned Pine Point Project.

Osisko Metals Incorporated (the “Company” or “Osisko Metals”) (TSXV:OM, OTCQX:OMZNF, FRANKFURT:0B51) is pleased to announce the 2019 Mineral Resource Estimate Update (“2019 MRE”) for its 100% owned Pine Point Project (“Pine Point” or “the Project”), located near Hay River, in the Northwest Territories of Canada. The 2019 MRE was prepared by BBA Inc. (“BBA”). Cut-off grades are based on estimated long-term metal prices, mining costs, metal recoveries, concentrate transport, and smelter costs.

Highlights:

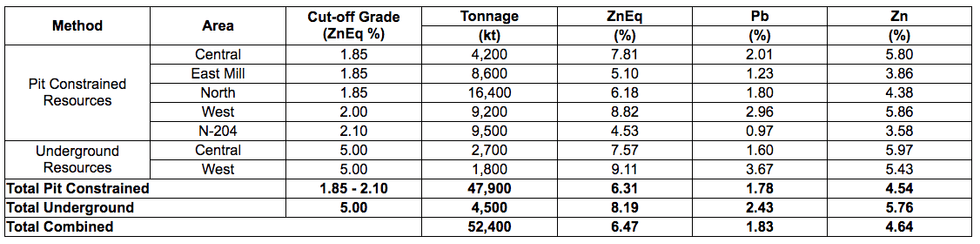

- The Pine Point MRE now totals 52.4 Mt grading 4.64% zinc and 1.83% lead (6.47% Zinc Equivalent (“ZnEq”)) containing approximately 5.3 billion pounds of zinc and 2.1 billion pounds of lead in-situ.

- Compared to the previous MRE (see press release dated December 6, 2018), the tonnage of the 2019 MRE increased by 36% with a minor 0.11% drop in the ZnEq grade. Tonnage increase is attributable to the 2018-2019 drilling campaign, historical resources on newly acquired claims and the inclusion of newly modelled underground resources.

- Underground mineral resources were incorporated into the 2019 MRE and totaled 4.5 Mt grading 5.76% zinc and 2.43% lead (8.19% ZnEq). For the underground resource, a cut-off of 5% ZnEq was used.

- The central core of the Project (East Mill, Central and North Zones) now contains approximately 31.9 Mt grading 6.22% ZnEq or 3.1 billion pounds of zinc and 1.1 billion pounds of lead in situ.

- Even though drill density in certain portions of the Project would have permitted resource classification in the Indicated category, management decided to classify the entire resource as Inferred until such time as the entire historical database can be validated, including an ongoing resampling of the historical drill core from Cominco Limited era.

- Metallurgical test work completed to date continues to highlight Pine Point as potentially producing among the cleanest high-grade zinc and lead concentrates globally.

- An updated MRE is planned to accompany an upcoming Preliminary Economic Assessment (“PEA”) in Q2-2020 with the aim of continuing to increase the mineral resource base.

- A Technical Report supporting this 2019 MRE will be filed within the next 45 days.

Jeff Hussey, President & CEO of Osisko Metals, commented: “Following our maiden MRE in December 2018, we are very pleased to again demonstrate significant asset growth at Pine Point. Global zinc and lead projects with all supportive infrastructure and more than 50Mt in near-surface resources are extremely rare and we are delighted that Pine Point now enters this select group. There is a depleted pipeline of quality zinc development projects globally and we believe Pine Point will place Osisko Metals at the forefront of junior base metal exploration and development companies.”

“Having achieved our objective of increasing the resource base to the 50Mt threshold, we now believe that the Project could develop into a mine large enough to enter the top 10 global zinc mines on an annual zinc-in-concentrate basis. We would also emphasize that exploration at Pine Point has been minimal in the last 30 years, we believe there is more to come for the Project.”

The 2019 MRE is divided into five geographic zones, each zone composed of individual deposits (see Pine Point Property Map and Table 1).

Table 1: Inferred 2019 Mineral Resource Estimate for Pine Point as reported by BBA

Notes:

- All tonnages rounded to nearest thousand tonnes.

- ZnEq percentages are calculated using metal prices, forecasted metal recoveries, concentrate grades, transport costs, smelter payable metals and charges.

- Pit constrained cut-off grade range mostly due to variable transportation distances to presumed mill location.

- Weighted average strip ratio for all modelled pit constrained mineralization is 7.5:1.

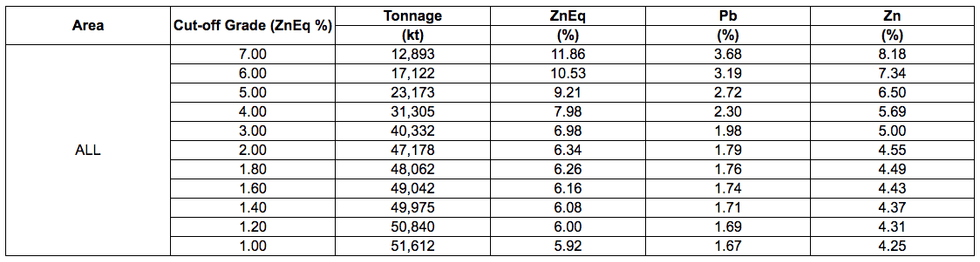

Sensitivity to Cut-Off Grades

Cut-off grades lower than 1.80% ZnEq do not significantly change the Inferred Mineral Resource (Table 2), indicating that the bulk of mineralization is above 2% ZnEq. Higher cut-off grades significantly increase the average grade of the deposit, as expected, with a complimentary drop in tonnage.

Table 2: Pit Constrained Inferred Cut-Off Grade Sensitivity

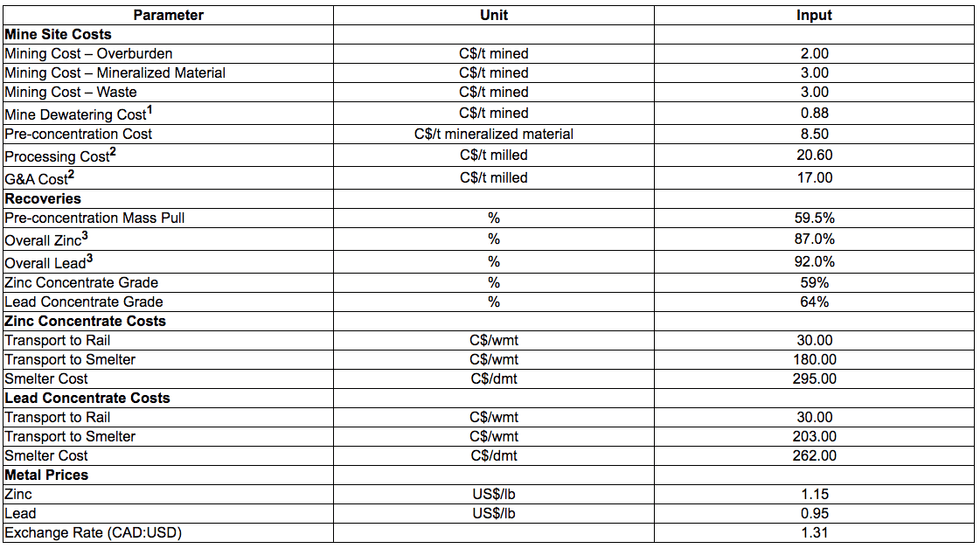

The in-pit Inferred MRE is constrained within pit shells that were developed from a pit optimization analysis that was done with Hexagon’s Mine Plan software using the economic and operating parameters presented below:

Table 3: Pit Optimization Parameters

1 Applied to both mineralized material and waste tonnages

2 Costs per tonne milled are based on a 59.5% Weight Recovery inclusive of fines

3 Inclusive of mineralized material sorting test program results; Lower concentrate and recoveries expected at N204

The Project continues to benefit from supportive infrastructure that includes paved roads, rail (accessible in Hay River) and hydro-electrical power. The site also benefits from one hundred kilometres of pre-existing haul roads from the original mining operation, providing access to all major deposit areas at Pine Point.

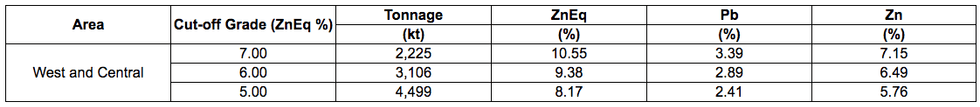

Underground Mineralization

The underground portion of the 2019 MRE utilizes similar financial and smelting assumptions to the pit-constrained portion of the 2019 MRE. Importantly, it differs from estimates calculated by previous operators and comprises easily accessible mineralization found adjacent to the pit wall boundaries of certain deposits, as well as mineralization that is relatively continuous over longer distances between pit-constrained mineralization.

Table 4: Underground Inferred Cut-Off Grade Sensitivity

The K69 cross-section shows a typical cross-section with both pit constrained and underground mineralization. Underground mineralization outlined in the 2019 MRE could be accessed by ramp at the bottom of adjacent pits.

Metallurgy

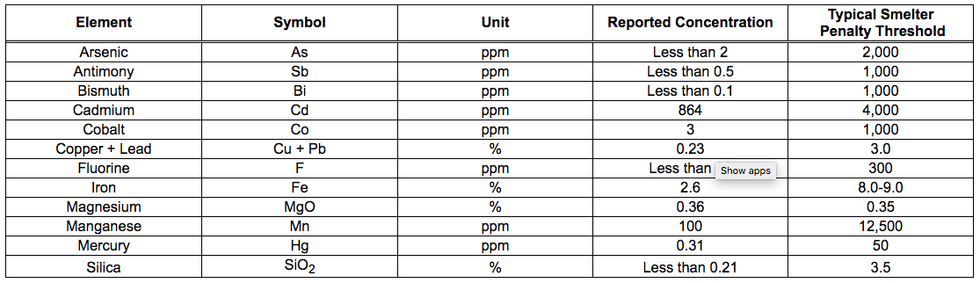

Following metallurgical test work completed during Q2-2019, zinc and lead mineralization demonstrated recoveries and concentrate grades with conventional flotation (see press release dated August 7. 2019). Historically, Pine Point produced among the cleanest concentrates globally over its 24-year mine life. The resulting zinc and lead concentrates from our test work were analyzed for impurities and deleterious elements. Based on the results, at this time, Osisko Metals does not anticipate any smelter or refinery penalties for Pine Point concentrates and believes the historical quality will be replicated. Table 5 summarizes the main deleterious elements analyzed in the zinc concentrate and lists typical minimal threshold for smelter penalties.

Table 5: Concentrate Elemental Analysis

2019 and 2020 Drill Program

The brownfield exploration campaign is expected to continue into H1-2020 and will be testing high-potential target areas with a focus on high grade “prismatic” type deposits. Compilation work is ongoing and is being combined with the airborne gravity gradiometry survey completed in August 2019 and the LIDAR topographic surveys flown in 2018.

Drilling completed in 2018 and early 2019 was incorporated into this latest MRE. The objective of this previous drilling campaign was to decrease drill spacing to 30 meters from 40 to 60 meters in the central core of the Project. While this objective is still part of the plan, no Indicated Mineral Resources are being declared in the 2019 MRE. A concurrent resampling program of historical drilling was initiated in Q2-2019 as multiple historical holes in the database listed with no assays were found to contain significant mineralization. This is expected to positively impact future updates to the Pine Point MRE as a grade of zero was applied to these holes.

Notes Regarding Mineral Resource Estimate

- The independent qualified person for the 2019 MRE, as defined by National Instrument (“NI”) 43-101 guidelines, is Pierre-Luc Richard, P.Geo., of BBA Inc. The effective date of the 2019 MRE is November 10, 2019. Mr. Richard has also approved the technical contents of this press release.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured, however It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Resources are presented as undiluted and in situ for an open-pit scenario and are considered to have reasonable prospects for economic extraction. The constraining pit shells were developed using overall pit slopes of 45 to 50 degrees in bedrock and 26.6 degrees in overburden.

- The 2019 MRE was prepared using GEOVIA GEMS 6.8.2 and is based on 19,341 surface drillholes and 162,375 samples, of which 8,328 drillholes and a total of 47,115 assays were included the modeled mineralization. The drillhole database includes recent drilling of 70,859 metres in 1,032 drillholes since 2017 and also incorporates Cominco Ltd.’s historical drillholes, the use of which was partially validated by a drillhole collar survey, twinning programs, and a partial core resampling program. The cut-off date for the drillhole database was October 3, 2019.

- The 2019 MRE encompasses 247 zinc-lead-bearing zones each defined by individual wireframes with a minimum true thickness of 2.5 m. A value of zero grade was applied in cases of core not assayed.

- High-grade capping was done on the composited assay data and established on a per zone basis for zinc and lead. Capping grades vary from 10% to 35% Zn and 5% to 40% Pb.

- Density values were calculated based on the formula established and used by Cominco Ltd. during their operational period between 1964 and 1987. Density values were calculated from the density of dolomite, adjusted by the amount of sphalerite, galena, and marcasite/pyrite as determined by metal assays. A porosity of 5% was assumed. Waste material was assigned the density of porous dolomite.

- Grade model resource estimation was calculated from drillhole data using an Ordinary Kriging interpolation method in a percent block model using blocks measuring 10 m x 10 m x 5 m in size.

- Zinc equivalency percentages are calculated using long term metal prices indicated below in (10), forecasted metal recoveries, concentrate grades, transport costs, smelter payable metals and charges.

- The estimate is reported using a ZnEq cut-off varying from 1.85% to 2.10% for open-pit resources and 5.00% for underground resources. Variations take into consideration trucking distances from the pit constrained mineralization to the mill and metallurgical parameters for each area. The cut-off grade was calculated using the following parameters (amongst others): zinc price = USD1.15/lb; lead price = USD0.95/lb; CAD:USD exchange rate = 1.31. The cut-off grade will be re-evaluated in light of future prevailing market conditions and costs.

- The 2019 MRE presented herein is categorized as an Inferred resource. The Inferred Mineral Resource category is constrained to areas where drill spacing is less than 100 metres and shows reasonable geological and grade continuity.

- The pit optimization to develop the resource constraining pit shells was done using Hexagon’s Mine Plan Version 15.6.

- Calculations used metric units (metre, tonne). Metal contents are presented in percent or pounds. Metric tonnages were rounded and any discrepancies in total amounts are due to rounding errors.

- CIM definitions and guidelines for Mineral Resource Estimates have been followed.

- The QP is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issues that could materially affect this MRE.

About Osisko Metals

Osisko Metals Incorporated is a Canadian exploration and development company creating value in the base metal space with a focus on zinc mineral assets. The Company controls Canada’s two premier zinc mining camps. The Company’s flagship projects are: 1) the Pine Point Mining Camp (“PPMC”), located in the Northwest Territories, has an Inferred Mineral Resource of 52.4 Mt grading 4.64% zinc and 1.83% lead (6.47% ZnEq), making it the largest pit-constrained zinc camp in Canada; 2) The Bathurst Mining Camp (“BMC”), located in northern New Brunswick, has Indicated Mineral Resources of 1.96 Mt grading 5.77% zinc, 2.38% lead, 0.22% copper and 68.9g/t silver (9.00% ZnEq) and Inferred Mineral Resources of 3.85 Mt grading 5.34% zinc, 1.49% lead, 0.32% copper and 47.7 g/t silver (7.96% ZnEq) in the Key Anacon and Gilmour South deposits. In 2019, the Company will continue to diligently develop and explore in order to confirm and grow both projects. The Company is also active in Quebec where it is advancing multiple base metal targets.

The Inferred Mineral Resource Estimate mentioned in this press release conform to National Instrument 43-101 standards and were prepared by independent qualified persons, as defined by NI-43 101 guidelines. The above-mentioned mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological, grade and/or quality continuity.

| For further information on Osisko Metals, visit www.osiskometals.com or contact: | |

| Jeff Hussey President & CEO Osisko Metals Incorporated (514) 861-4441 Email: info@osiskometals.com www.osiskometals.com |

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, capital and operating costs varying significantly from estimates; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR at www.sedar.com. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

In context of current mineral resources reported by the Company, mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Images accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1a73cb1b-1987-4851-8986-556b7fbcc73c

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f904e45-2611-49f0-8814-3e72f554310e