Constantine Announces Maiden AG Zone Resource Estimate for Palmer Project of 4.26 Million Tonnes Grading 9.04% Zinc Equivalent

Constantine Metal Resources Ltd. (TSXV:CEM) (“Constantine” or the “Company”) is pleased to announce a maiden mineral resource estimate for the AG Zone at the Palmer Copper-Zinc-Lead-Silver-Gold Project (“Palmer” or “Project”). AG Zone is the second deposit to be defined at Palmer and adds to the existing mineral resource base.

Constantine Metal Resources Ltd. (TSXV:CEM) (“Constantine” or the “Company”) is pleased to announce a maiden mineral resource estimate for the AG Zone at the Palmer Copper-Zinc-Lead-Silver-Gold Project (“Palmer” or “Project”). AG Zone is the second deposit to be defined at Palmer and adds to the existing mineral resource base. The total consolidated mineral resource now stands at 4.68 million tonnes of 10.2% zinc equivalent in the indicated category and 9.59 million tonnes of 8.9% zinc equivalent in the inferred category.

“The rapid evolution of the AG Zone from discovery to maiden resource has increased the value of this deposit in a very short time frame,” commented President and CEO Garfield MacVeigh.

This initial estimate establishes the AG Zone as a significant precious-metal rich zinc deposit, which has increased the total resource tonnage at Palmer by 43%. Located just three kilometers from the main Palmer Deposit, AG Zone has potential to have a positive impact on the economics of the project. It also clearly confirms the multi-deposit district potential of the 81,000-acre property. The opportunity to discover additional deposits and expand the two known resource areas is considered excellent.

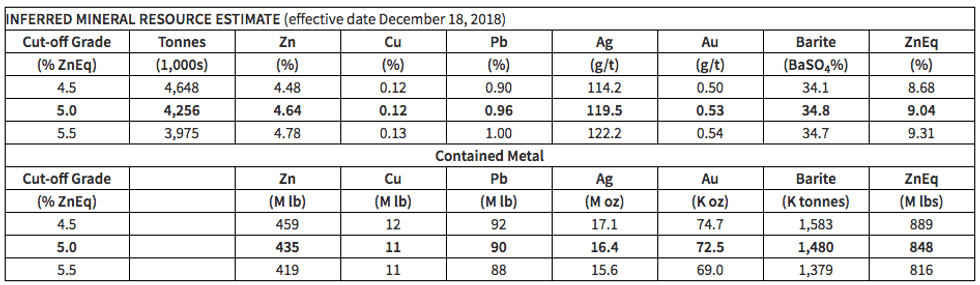

Table 1. AG Zone Deposit Only: Sensitivity by Cut-off Grade

Notes:

- Includes all drill holes completed at AG Zone; drilling completed between June 2017 and September 2018.

- Zinc Equivalent (“ZnEq”) based on assumed metal prices and 100% recovery and payable for Cu, Zn, Pb, Ag and Au.

- ZnEq equals = ($66 x Cu% + $25.3 x Zn% + $22 x Pb% + $0.51 x Ag g/t + $40.19 x Au g/t) / 25.3.

- Assumed metal prices are US$3.00/lb for copper (Cu), US$1.15/lb for zinc (Zn), US$ $1.00/lb for lead, US$1250/oz for gold (Au), US$16/oz for silver (Ag).

- Barite (BaSO4) not included in the Cut-off determination or reported ZnEq.

- Mineral resources as reported are undiluted.

- Mineral resource tonnages have been rounded to reflect the precision of the estimate.

- Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability.

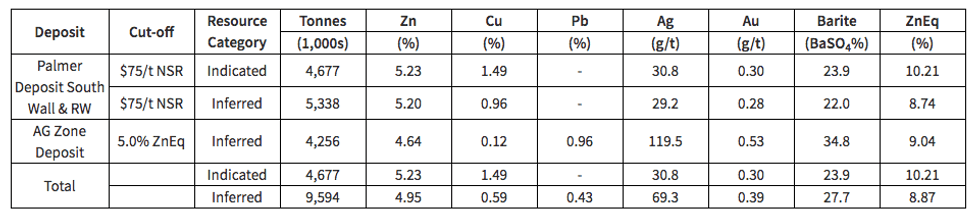

Table 2. Total Mineral Resource for the Palmer Project (all deposits)

Notes:

- See news release dated September 27, 2018 for Palmer Deposit resource estimate

- Net Smelter Return (“NSR”) equals (US$16.01 x Zn% + US$48.67 x Cu% + US$23.45 x Au g/t + US$0.32 x Ag g/t). NSR formula is based on estimated metallurgical recoveries, assumed metal prices, and assumed offsite costs that include transportation of concentrate, smelter treatment charges, and refining charges.

- ZnEq equals = ($66 x Cu% + $25.3 x Zn% + $22 x Pb% + $0.51 x Ag g/t + $40.19 x Au g/t) / 25.3.

- Assumed metal prices for NSR and ZnEq formulas are US$3.00/lb for copper (Cu), US$1.15/lb for zinc (Zn), US$ $1.00/lb for lead, US$1250/oz for gold (Au), US$16/oz for silver (Ag).

- Estimated metal recoveries for Palmer Deposit are 93.1% for zinc, 88.9% for copper, 90.9% for silver (70.8% to the Cu concentrate and 20.1% to the Zn concentrate) and 69.6% for gold (49.5% to the Cu concentrate and 20.1% to the Zn concentrate) as determined from metallurgical locked cycle flotation tests completed in 2018. No recovery data is available for AG Zone deposit.

- Barite (BaSO4) not included in the Cut-off determination or reported ZnEq.

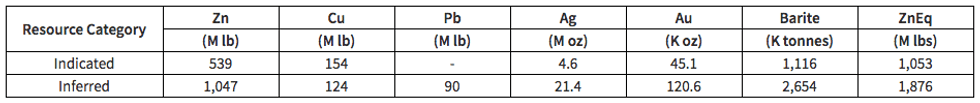

Table 3. Total Contained Metal for the Palmer Project (all deposits)

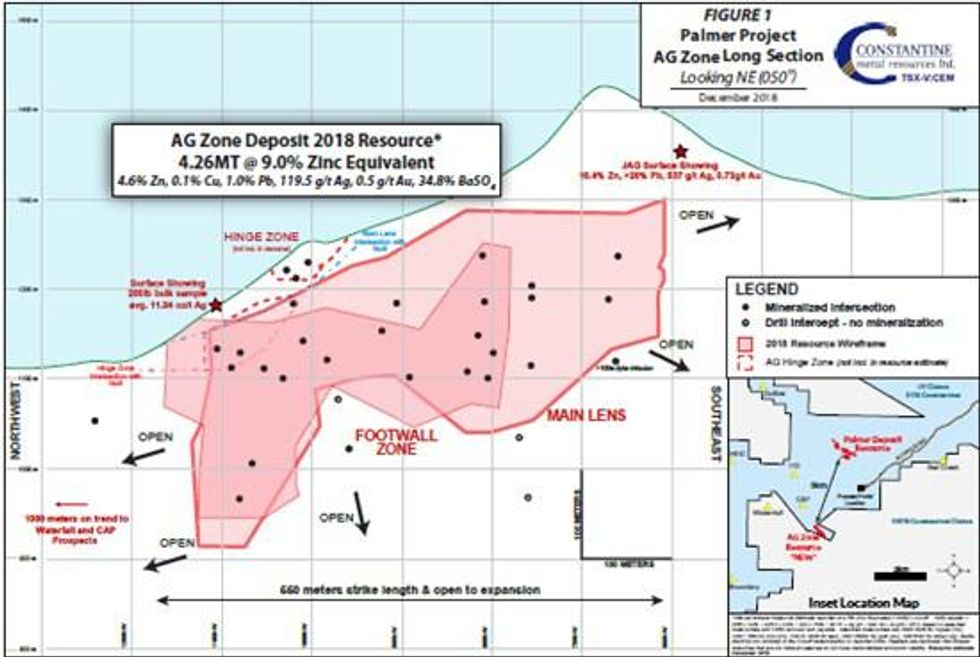

AG Zone Resource Model

The mineral resource estimate prepared by James N. Gray of Advantage Geoservices Ltd. is reported in accordance with Canadian Securities Administrators’ NI 43-101 and conforms to the Canadian Institute of Mining “Estimation of Mineral Resources and Mineral Reserves Best Practices” guidelines. The resource incorporates all exploration drilling in the AG Zone Deposit area completed since initial discovery in 2017. Twenty-nine (29) exploration diamond drill holes for 10,766 metres and geological surface mapping were used to generate the geological and structural model for the AG Zone. Twenty (20) holes intersected the interpreted mineralized solids. Outlier assays were capped and all assays within the mineralized zones were composited to 1.5-metre lengths. Metal grades were estimated using inverse distance cubed interpolation into a three-dimensional (“3D”) block model with block dimensions of 6 x 6 x 6 metres, which is consistent with the main Palmer Deposit. Density was estimated by inverse distance squared interpolation with unique density values determined by conventional analytical methods for all assay samples.

Three-dimensional geologic solids (Figure 1) were constructed by Darwin Green, Vice President of Exploration, and reviewed by QP Ian Cunningham-Dunlop, P.Eng. Vice President, Advanced Projects, and, in general, were limited to material grading > 2% Zn or > 60 grams per tonne (“g/t”) Ag that could be correlated with definable stratabound zones. As a general rule, solids were extended no more than 50 metres up-dip, down-dip and along strike from a drill hole except where geology supported extension between holes in the trend of mineralization. Two (2) solids for sulphide mineralization were included in the Inferred Mineral Resource: the AG main lens, and the AG footwall zinc zone.

Material was classified as Inferred Mineral Resource where estimated by at least three holes (96% of blocks) or by two holes if the closest is within 75 metres (3%) or by a single hole if within 30 metres (1%). The complete NI 43-101 Technical Report will be released within 45 days of this news release.

Ian Cunningham-Dunlop, P.Eng, Vice President of Advanced Projects to Constantine Metal Resources Ltd., is a Qualified Person as defined by NI 43-101 for the Palmer project. James N. Gray, P.Geo of Advantage Geoservices Ltd. is the Qualified Person as defined by NI 43-101 for the resource estimate discussed above. They have reviewed and approved the contents of this release.

Discussion of AG Zone, Barite and Next Steps

Compared to the main Palmer Deposit, the AG Zone resource contains significantly higher-grades of silver, gold, lead and barite, similar zinc grade and lower copper grade. On a zinc equivalent basis, the grade of the two deposits is roughly comparable. Mineralogy is similar but with different relative abundance of the primary ore-minerals. QEMSCAN mineralogical analyses for AG Zone indicate good liberation and exposure of ore-minerals at moderate grind sizes. Good metal recoveries are expected based on the QEMSCAN data and benchmarking to metallurgical data for the main Palmer Deposit and other like deposits.

A barite market study has been completed for the Project that supports the potential economics of recovering barite as a saleable commodity. In addition to estimating wholesale price and size of North American drilling-grade barite markets, the study also assessed the logistics and cost of transportation.

The Company and its consultants plan to evaluate the potential integration of the new AG Zone resource into its ongoing preliminary evaluation of project economics for the main Palmer Deposit.

About the Palmer Project

Palmer is a high-grade volcanogenic massive sulphide-sulphate (VMS) project being advanced as a joint venture between Constantine (51%) and Dowa Metals & Mining Co Ltd. (49%), with Constantine as operator. The Project is located in a very accessible part of coastal Southeast Alaska, with road access to the edge of the property and within 60 kilometers of the year-round deep-sea port of Haines. Mineralization at Palmer occurs within the same belt of rocks that is host to the Greens Creek mine, one of the world’s richest VMS deposits. VMS deposits are known to occur in clusters, and with at least 25 separate base metal and/or barite occurrences and prospects on the Project, there is abundant potential for discovery of multiple deposits at Palmer.

About the Company

Constantine is a mineral exploration company led by an experienced and proven technical team with a focus on premier North American mining environments. In addition to the Company’s flagship copper-zinc-lead-silver-gold (barite) Palmer Joint Venture Project, Constantine also controls a portfolio of high-quality, 100% owned, gold projects that the Company intends to spin out into a separate entity. These include the very high-grade Johnson Tract Au-Ag-Zn-Cu-Pb deposit, located in coastal south-central, Alaska and projects in the Timmins, Ontario gold camp that include the large, well-located Golden Mile property and the Munro Croesus Gold property, which is renowned for its exceptionally high-grade past production. Management is committed to providing shareholder value through discovery, meaningful community engagement, environmental stewardship, and responsible mineral exploration and development activities that support local jobs and businesses.

Please visit the Company’s website (www.constantinemetals.com) for more detailed company and project information.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/5413/41719_5807e7f114deb81a_003full.jpg

On Behalf of Constantine Metal Resources Ltd.

“Garfield MacVeigh”

President

For further information, please visit the Constantine Metal Resources website at www.constantinemetals.com, or contact:

Naomi Nemeth

Vice President, Investor Relations

Email: info@constantinemetals.com

Phone: +1 604 629 2348

Or

Garfield MacVeigh, President

Email: info@constantinemetals.com

Phone: +1 604 629 2348

Notes:

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”).” Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the mineral resource estimate, potential mineralization and geological merits of the Palmer Project and other future plans, objectives or expectations of the Company are forward-looking statements that involve various risks and uncertainties.There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future barite and metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Source: www.newsfilecorp.com