August 30, 2022

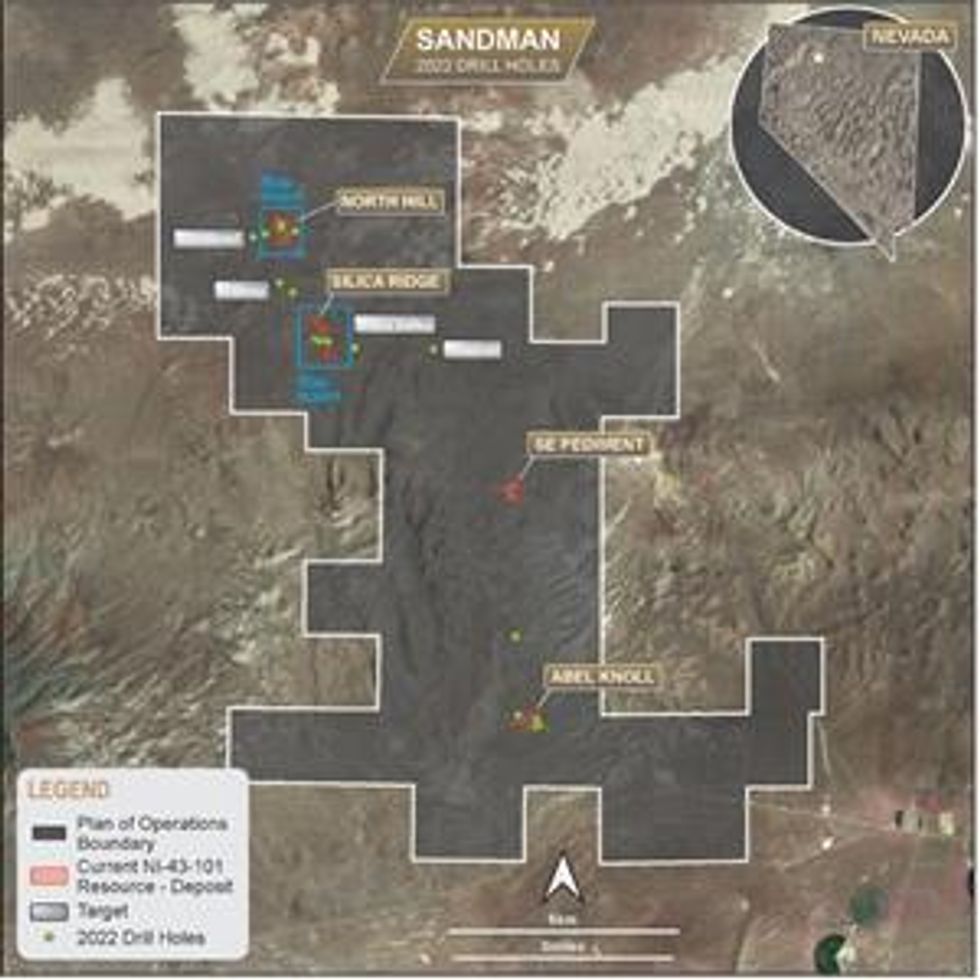

Gold Bull Resources Corp. (TSX-V: GBRC) ("Gold Bull" or the "Company") is pleased to report completion of the 2022 Drill Program with all gold assays received from its 100% owned Sandman Project ("Sandman" or the "Project") located in Humboldt County, Nevada, USA. The reverse circulation (RC) drilling program comprised 24 holes for 4,954m (16,253ft). High grade gold intersections were drilled at North Hill and Silica Ridge. Gold intersections extended beyond the Abel Knoll resource by 100 m to the east, and it remains open at depth and along strike. Scout drill holes in the Sandbowl target west of North Hill and at a new exploration target north of Abel Knoll intersected significant zones of anomalous gold, worthy of follow-up.

DRILL PROGRAM HIGHLIGHTS & UPDATE:

- Hole SA-0052 at Silica Ridge intersected a broad mineralized zone of 83.8m (275 ft) @ 1.50 g/t Au from surface (all oxide) and included a high-grade feeder of 3m @ 14.67 g/t from 1.5m.

- Hole SA-0044 also at Silica Ridge, returned 47.2m (155ft) of gold mineralization grading 1.54 g/t Au from 1.5m including 6.1m @ 8.01g/t from 3m (all oxide).

- Hole SA-0037 from North Hill returned 32m @ 1.31g/t Au from 42.7m including 1.5m @ 9.34g/t Au (all oxide).

- At a new project area, Sandbowl, SA-0053 intersected 1.5 m @ 0.46 g/t Au from 13.7 m (45 ft) and 7.6 m @ 0.24 g/t Au from 102.1 m (335 ft), and SA-0054 intersected 13.7 m @ 0.22 g/t Au from 97.5 m (320 ft) and 3.0 m @ 0.82 g/t Au from 149.4 m (490 ft). These hits indicate a newly defined gold system worthy of follow-up targeting.

- SA-0057 located 1.7 km (1.1 mile) north of Abel Knoll intersected 13.7 m (45 ft) @ 0.42 g/t Au from 175.2 m (575 ft) within an interpreted north-south structure forming part of a Tertiary basin margin zone linking SE Pediment and Abel Knoll. This newly discovered mineralized zone is open to the north and south.

- Sandman Scoping Study investigating circa 40,000 ounce per annum production scenario is underway and is expected to be completed in September 2022

Gold Bull CEO, Cherie Leeden commented:

The drill results yielded widespread gold intersections, including high grade at North Hill, Silica Ridge and Abel Knoll, with the best gold intersection received from Silica Ridge SA-0052 returning 83.8 m @ 1.50 g/t Au from the surface, including a significant intersection of 3m @ 14.67g/t gold and 1.5m @ 15.53g/t gold as well as hole SA-0037 from North Hill returning 32m @ 1.31g/t Au from 42.7m including 1.5m @ 9.34g/t gold at North Hill. The intersections of low-grade gold mineralization over significant widths at Sandbowl and north of Abel Knoll open new areas for further exploration. A scoping study investigating the economic parameters of a near-term production scenario is well underway.

2022 Sandman Drill Program Summary

The Sandman 2022 drill program comprised 24 reverse circulation drill holes for 4,954m (16,253 feet). All assays have now been received. The program included eight (8) holes targeting deeper mineralization beneath the existing mineral resources at North Hill and Silica Ridge, a further eight (8) holes were drilled around existing deposits testing for extensions to the currently defined Mineral Resource Estimate (MRE). Eight (8) scout holes were drilled testing targets at Midway, Sandbowl and Windmill.

Although the scout holes did not yield a high-grade discovery, the intersection of multiple zones of low-grade strata-bound mineralization at Sandbowl may indicate the presence of a gold-bearing fluid feeder structure that has not yet been intersected by drilling. Similarly, the intersection of 13.7 m (45 ft) @ 0.42 g/t Au from 175.2 m (575 ft) in an interpreted north-south striking structure 1.7 km (1.1 mile) north of Abel Knoll defines a potentially significant new mineralized zone that is open in all directions. Further evaluation of these results is warranted to understand the potential for a higher-grade orebody close to these intersections.

Best drilling results from the program included:

- SA-0035: 7.6 m (25 ft) @ 1.51 g/t Au from 48.8 m (160 ft), including

- 1.5 m (5 ft) @ 5.10 g/t Au from 50.3 m (70 ft)

- SA-0036: 19.8 m (65 ft) @ 0.71 g/t Au from 33.5 m (110 ft), including

- 9.1 m (30 ft) @ 0.84 g/t Au from 33.5 m (110 ft), including

- 1.5 m (5 ft) @ 2.91 g/t from 36.6 m (125 ft)

- 1.5 m (5 ft) @ 1.23 g/t Au from 51.8 m (170 ft)

- 9.1 m (30 ft) @ 0.84 g/t Au from 33.5 m (110 ft), including

- SA-0037: 32 m (105 ft) @ 1.31 g/t Au from 42.7 m (140 ft), including

- 19.8 m (65 ft) @ 1.56 g/t Au from 42.7 m (140 ft), including

- 1.5 m at 9.34 g/t Au

- 7.6 m (25 ft) @ 1.40 g/t Au from 67.1 m (220 ft)

- 19.8 m (65 ft) @ 1.56 g/t Au from 42.7 m (140 ft), including

- SA-0038: 7.6 m (25 ft) @ 2.35 g/t Au from 83.8 m (275 m), including

- 1.5 m (5 ft) @ 9.3 g/t Au from 88.4 m (290 ft)

- SA-0044: 47.2 m (155 ft) @ 1.54 g/t Au from 1.5 m (5 ft), including

- 6.1 m (20 ft) @ 8.01 g/t Au from 3 m (10 ft)

- 1.5 m (5 ft) @ 13.87 g/t from 3 m (10 ft)

- 1.5 m (5 ft) @ 1.15 g/t from 24.4 m (80 ft)

- SA-0045: 74.7 m (245 ft) @ 0.93 g/t Au from 0 m (0 ft), including

- 3 m (10 ft) @ 1.55 g/t Au from 0 m (0 ft)

- 51.8 m (170 ft) at 1.12 g/t Au from 22.9 m (75 ft), including

- 3 m (10 ft) @ 2.28 g/t Au from 25.9 m (85 ft)

- 18.3 m (60 ft) at 1.98 g/t Au from 38.1 m (125 ft), including

- 1.5 m (5 ft) @ 13.13 g/t Au from 41.1 m (135 ft)

- 7.6 m (15 ft) @ 1.25 g/t Au from 65.5 m (215 m)

- SA-0049: 56.4 m (185 ft) @ 0.20 g/t Au from 103.6 m (340 ft)

- SA-0052: 83.8 m (275 ft) @ 1.50 g/t Au from 0 m (0 ft), including

- 13.7 m (45 ft) @ 4.52 g/t Au from 0 m (0 ft), including

- 3 m (10 ft) @ 14.67 g/t Au from 1.5 m (5 ft), including

- 1.5 m (5 ft) @ 15.53 g/t Au from 1.5 m (5 ft)

- 3 m (10 ft) @ 14.67 g/t Au from 1.5 m (5 ft), including

- 3 m (10 ft) @ 2.75 g/t Au from 36.6 m (120 ft)

- 16.8 m (55 ft) @ 3.05 g/t Au from 65.5 m (215 ft)

- 6.1 m (20 ft) @ 8.24 g/t Au from 71.6 m (235 ft)

- 13.7 m (45 ft) @ 4.52 g/t Au from 0 m (0 ft), including

Figure 1. location map showing 2022 Sandman drill program with drill holes relative to deposits North Hill, Silica Ridge and Abel Knoll. Targets were also tested at Windmill, Midway and Sandbowl. Insert maps for North Hill and Silica Ridge are shown in blue boxes.

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8c736b6-017d-4144-8697-7866f2c1ed74

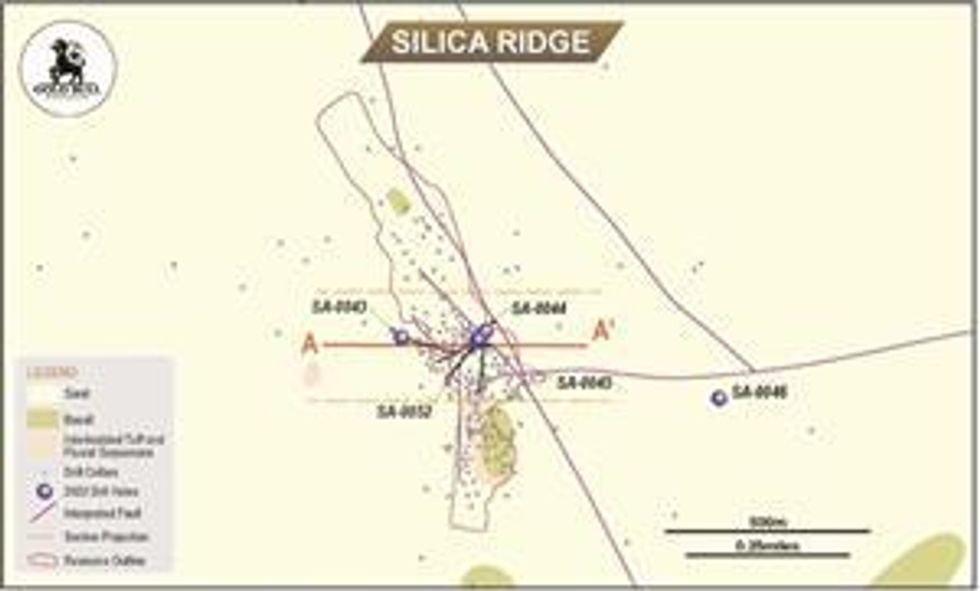

Silica Ridge

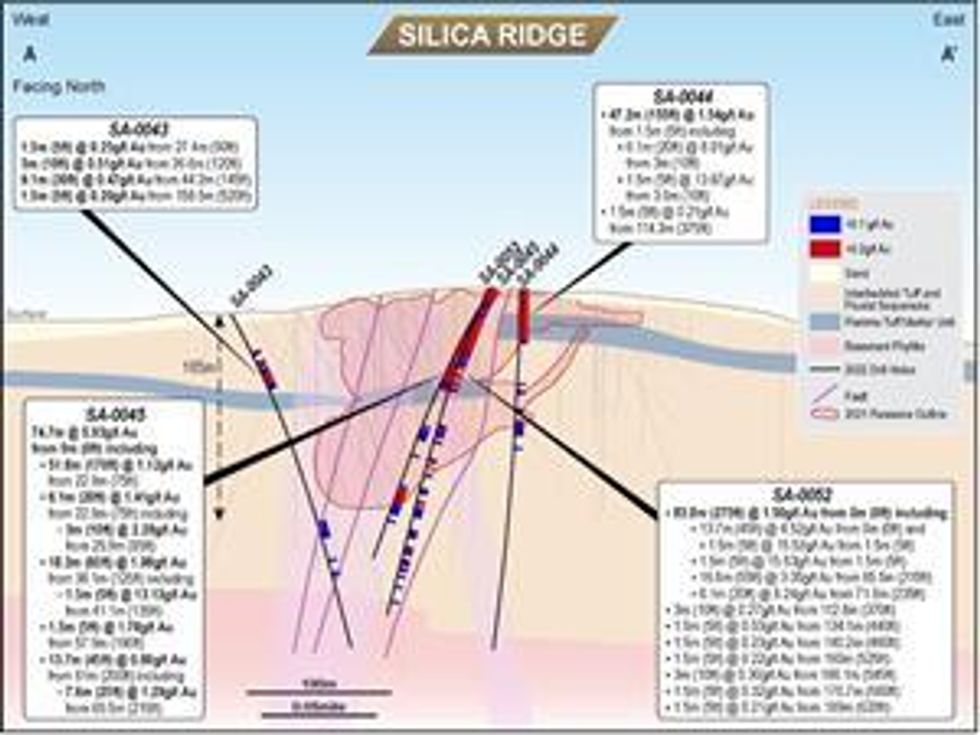

Six (6) holes were drilled at Silica Ridge, with four drill holes (SA-0043, SA-0044, SA-0045, SA-0052) targeting down-dip extensions to the Mineral Resource Estimate (Figure 2 and Figure 3). (Refer to press release "Gold Bull intersects 83.8m at 1.5 g/t Au from surface, including 3m at 14.67g/t Au, defining significant extension of higher-grade oxide zone within the Silica Ridge deposit at Sandman", dated June 9, 2022, for discussion of SA-0044 and SA-0052 results. Hole SA-0045 results are discussed in the press release "Gold Bull drilling intersects high grade gold mineralization at Sandman, up to 13g/t gold (over 1.5m) at Silica Ridge", dated April 19, 2022.) The holes targeted intersections of structures projected beneath the deposit close to the basement contact, at which hydrothermal mineralizing fluids flow from the tighter Triassic phyllite basement rocks into the more porous Tertiary units above. The holes intersected silicified tuff and quartz-adularia altered, iron oxide-stained sandstone, conglomerate, and tuff.

The best results intersected at Silica Ridge were received from holes SA-0044, SA-0045 and SA-0052 (figure 2 and 3). Hole SA-0044 returned 47.2m (155 ft) @ 1.54 g/t Au from 1.5m (5 ft), including 6.1m (20 ft) @ 8.01 g/t Au from 3m (10 ft), as well as 1.5m (5 ft) @ 13.87 g/t from 3m (10 ft) and 1.5m (5 ft) @ 1.15 g/t from 24.4m (80 ft). Hole SA-0045 intersected 74.7m (245 ft) @ 0.93g/t Au from 0m (0ft), including 3m (10ft) @ 1.55g/t Au from 0m (0 ft) and including 51.8m (170 ft) @ 1.12 g/t Au from 22.9m (75 ft), as well as 3m (10 ft) @ 2.28 g/t Au from 25.9m (85 ft) and 18.3m (60 ft) @ 1.98 g/t Au from 38.1m (125 ft), and a high grade intersection of 1.5m (5 ft) @ 13.13 g/t Au from 41.1m (135 ft) and 7.6m (15 ft) @ 1.29 g/t Au from 65.5m (215m). Gold mineralization with grades >0.1g/t extends intermittently to a down-hole depth of 195m (635 ft) in hole SA-0052.

Hole SA-0043 intersected an upper 25.9 m wide zone of low-grade zone containing strata-bound mineralization to the west of the current Mineral Resource Estimate, returning 1.5 m (5 ft) @ 0.25 g/t Au from 27.4 m (90 ft), 3.0 m (10 ft) @ 0.51 g/t Au from 36.6 m (120 ft), and 9.1 m (30 ft) @ 0.47 g/t Au from 44.2 m (145 ft). This result indicates that shallow incremental gold ounces could be added to an open pit resource by extension drilling to the west of Silica Ridge.

The highest-grade mineralization within the Silica Ridge Mineral Resource Estimate occurs at the intersection of structures striking north-northwest to south-southwest and east-west, intruded by a mafic dike. Drillhole SA-0046 was collared east of Silica Ridge to test the intersection of the E-W dyke with a NNW striking dyke associated with an extensive lag geochemical anomaly. However, the hole failed to test the targeted structure due to early abandonment caused the hole collar blowing out.

Figure 2. Silica Ridge map showing drill hole locations for 2022 holes SA-0043, SA-0044, SA-0045, SA-0046 and SA-0052 relative to the 2021 Mineral Resource outline in red. Cross-section line A - A' is provided in Figure 3 and section window as broken line.

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb422182-aa2c-4ada-a0ed-430d04cfa690

Figure 3. Silica Ridge cross section showing results for holes SA-0043, SA-0044, SA-0045 and SA-0052. Gold mineralization >0.1g/t extends intermittently to a downhole depth of 195m (635 ft) and vertical depth of 165m in hole SA-0052. Red indicates downhole gold mineralization >0.2g/t and blue indicates downhole mineralization >0.1g/t gold. Consistent gold mineralization was intersected which demonstrates extensive gold mineralization in the Tertiary sequence overlying the basement phyllite.

https://www.globenewswire.com/NewsRoom/AttachmentNg/43187fb6-eb53-4511-a43e-11176b059ea8

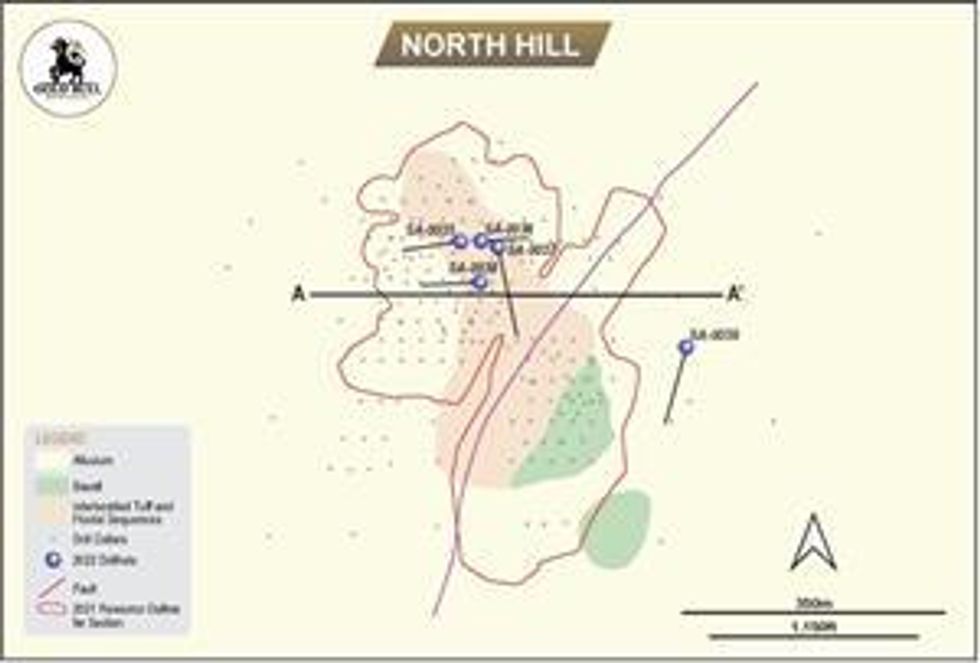

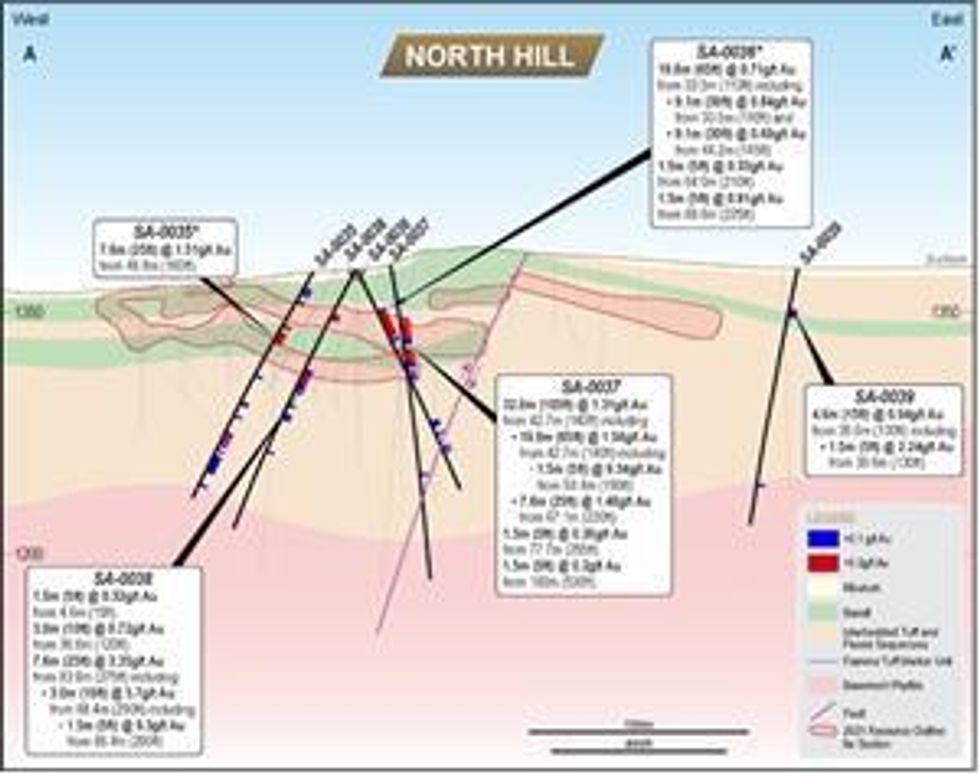

North Hill

Five (5) drill holes were drilled at North Hill with four (4) holes (SA-0035, SA-0036, SA-0037 and SA-0038) targeting modelled feeder structures below the Mineral Resource Estimate. The fifth hole (SA-0039) was drilled east of the Mineral Resource, testing a down dip extension to strata-bound mineralization. The intersection of 4.6 m (15 ft) at 0.94 g/t Au from 39.6 m (130 ft) in SA-0039 extended the known deposit laterally by 80m. (Refer to press release "Gold Bull drilling defines eastern extension at North Hill and extends Abel Knoll mineralization outside Mineral Resource Estimate" dated May 10, 2022)

The drill holes targeted intersecting gold bearing structures below the North Hill deposit and high-grade gold was intersected in the upper portions of the holes, with intermittent lower grade (>0.1 g/t) gold intersected in the deeper portions of the drill holes. Results from SA-0035 returned more consistent gold at depth above the basement phyllite contact, indicating the hole is possibly close to a gold bearing structure. Further evaluation of this hole and potential feeder structures is required.

The best North Hill intersections include holes SA-0035 returning 7.6 m (25 ft) @ 1.51 g/t Au from 48.8 m (160 ft), and SA-0036 returning 19.8m (65 ft) @ 0.71 g/t Au from 33.5m (110 ft) including 9.1m (30 ft) @ 0.84 g/t Au from 33.5m (110) ft and including 1.5m (5 ft) @ 2.91 g/t from 36.6m (125 ft). Hole SA-0037 returned 32m (105ft) @ 1.31 g/t Au from 42.7m (140 ft), including 19.8m (65 ft) @ 1.56 g/t Au from 42.7m (140 ft) and 1.5m (5 ft) @ 9.34 g/t Au from 59.4m (195 ft). Hole SA-0038 returned 7.6m (25ft) @ 2.35 g/t Au from 83.8m (275m), including 1.5m (5 ft) @ 9.3 g/t Au from 88.4m (290 ft).

Figure 4. North Hill plan showing deep deposit drill holes SA-0035, SA-0036, SA-0037 and SA-0038 and down dip extension hole SA-0039 in the east.

https://www.globenewswire.com/NewsRoom/AttachmentNg/94e4159f-77d3-4a6f-82cd-7af81467dd97

Figure 5. North Hill cross section depicting results for holes SA-0035, SA-0036, SA-0037 and 0038. Higher grade gold intersections are shown in red >0.2g/t and blue >0.1g/t gold.

https://www.globenewswire.com/NewsRoom/AttachmentNg/65e8ff52-2e07-4010-b65a-34cfefe29147

Abel Knoll

Six (6) holes were drilled at Abel Knoll targeting deposit step-out holes with five (5) drilled to the east of the prior 2021 Mineral Resource Estimate (MRE) boundary and one (1) drilled north of the western mineralized diatreme breccia.

Step out drilling east of the Abel Knoll MRE intersected low-grade (0.2 to 0.4 g/t Au) mineralization in holes SA-0048, SA-0049, SA-0050, SA-0051, and SA-0056. Significant mineralized intervals were intersected in SA-0048 and SA-0049. SA-0048 returned intersections including 42.7 m (140 ft) at 0.35 g/t Au from 74.7 m (245 ft) and 18.3 m (60 ft) @ 0.26 g/t Au from 135.6 m (445 ft). SA-0049 returned a best intersection of 56.4 m (185 ft) @ 0.2 g/t from 103.6 m (340 ft). These intersections are located east of the previously reported intersection of 90 m (295 ft) at 0.6 g/t Au from 76.2 m in SA-0031 (press release "Gold Bull Reports Significant New Gold Mineralization Outside of Current Resource at Sandman Including: 90m at 0.6 g/t Au" dated July 28, 2021) and the mineralized zone remains open to the east.

Mineralization remains open to the east, north and below the existing 2021 Mineral Resource at Abel Knoll and further studies are required to understand the potential to add ounces to the existing estimate by further exploration in these areas.

Exploration Scout holes

Eight (8) exploration scout holes were drilled to test targets at Sandbowl (SA-0053 and SA-0054), Midway (SA-0040 and SA-0041), east of the Silica Ridge deposit (SA-0046), Windmill (SA-0055), west of North Hill (SA-0034) and north of Abel Knoll (SA-0057).

Gold mineralization was intersected in the Sandbowl holes, with SA-0053 and SA-0054 returning low grade but anomalous gold in a fluviatile Tertiary sequence. Hole SA-0053 intersected 1.5 m @ 0.46 g/t Au from 13.7 m (45 ft) and 7.6 m @ 0.24 g/t Au from 102.1 m (335 ft), and SA-0054 intersected 13.7 m @ 0.22 g/t Au from 97.5 m (320 ft) and 3.0 m @ 0.82 g/t Au from 149.4 m (490 ft). These results are very encouraging, as the holes are not located close to a deposit (400m west of North Hill deposit) and are potentially near a feeder structure for mineralizing fluids that has not yet been drilled.

Hole SA-0057 north of Abel Knoll returned 13.7m (45 ft) @ 0.42g/t Au from 175.2m (575 ft) along a north-south striking fault, which is interpreted to be part of the eastern basin-bounding structural zone associated with the Abel Knoll and SE Pediment deposits. The results for this hole are encouraging, as the intersection is close to historic mineralization on competitor tenure and remains open in all directions.

Drill Summary Tables

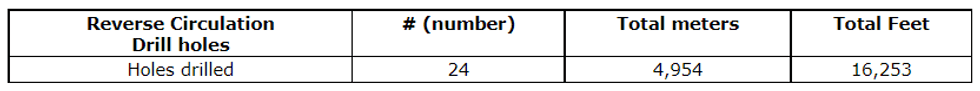

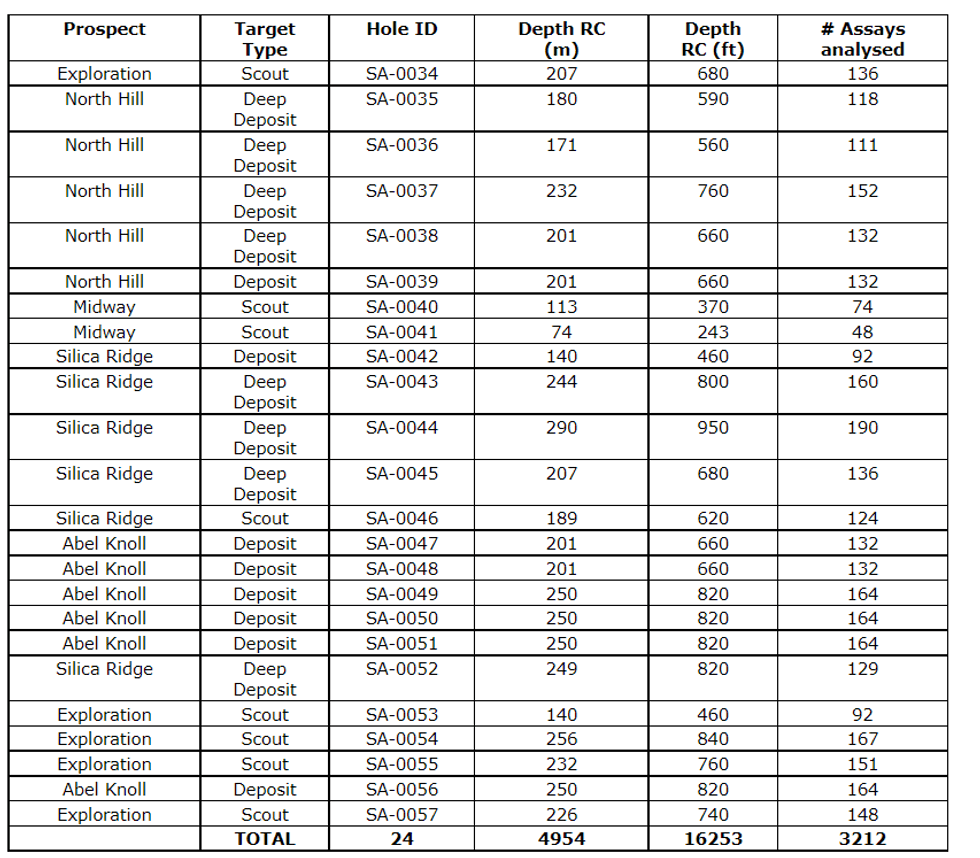

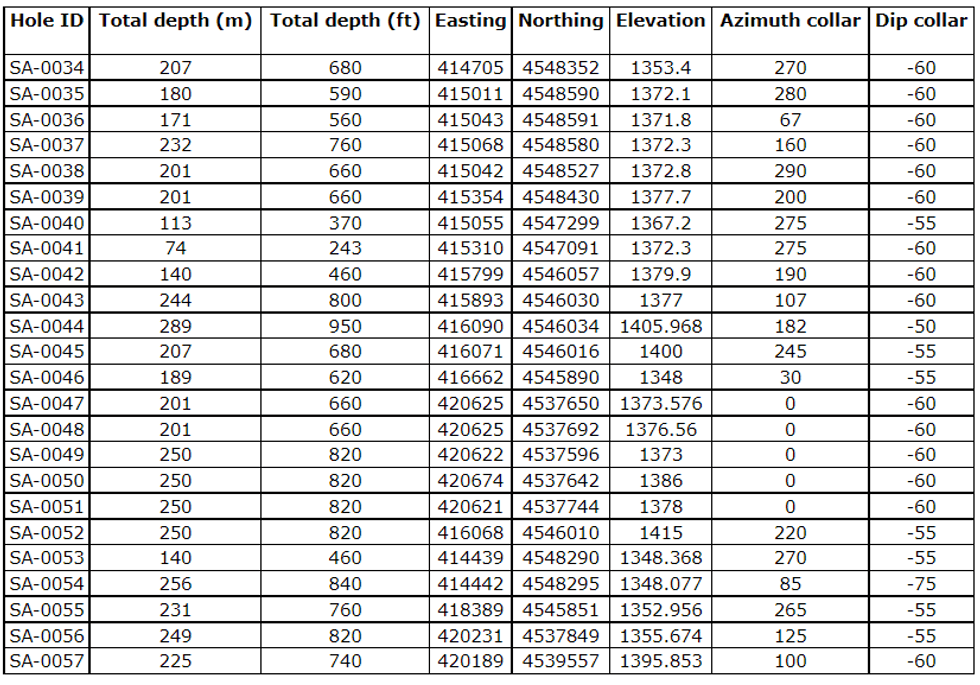

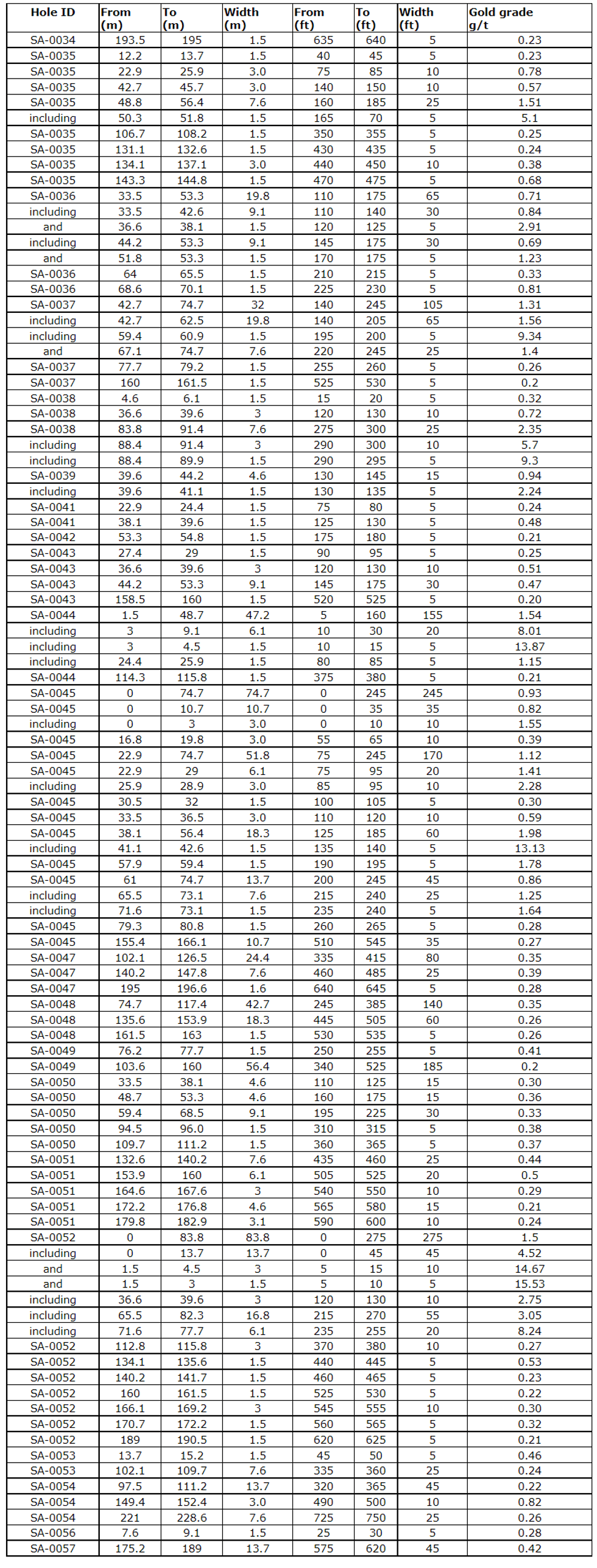

Tables 1 to 4, in the Appendix are summaries of the 2022 Sandman drilling program. Table 1 provides summary of the 2022 Sandman reverse circulation drill program with the number of holes drilled with total drilled meters and feet. Table 2 provides summary of the holes drilled per Prospect and include hole target type, hole ID, hole depth in meters and feet and the number of assays per drill hole analysed. Table 3 provides summary of the drill hole details including hole ID, total depth in meters and feet, easting, northing, and elevation collar location as well as drill hole azimuth and dip. Table 4 provides summary of significant mineralized intersections with hole ID, from and to in meters and feet, width of downhole mineralized interval (not true width) and calculation of gold grade in grams per tonne.

Next Steps

Geological Evaluation of the 2022 Sandman Drill hole results is ongoing along with further assessment of Sandman's potential mine scenario via a detailed Scoping Study. The Scoping Study is anticipated to be completed in the second half of September 2022.

About Sandman

In December 2020, Gold Bull purchased the Sandman Project from Newmont. Gold mineralization was first discovered at Sandman in 1987 by Kennecott and the project has been intermittently explored since then. There are four known pit constrained gold resources located within the Sandman Project, consisting of 21.8Mt at 0.7g/t gold for 494,000 ounces of gold; comprising of an Indicated Resource of 18,550kt at 0.73g/t gold for 433kozs of gold plus an Inferred Resource of 3,246kt at 0.58g/t gold for 61kozs of gold. Several of the resources remain open in multiple directions and the bulk of the historical drilling has been conducted to a depth of less than 100m. Sandman is conveniently located circa 25-30 km northwest of the mining town of Winnemucca, Nevada.

Qualified Person

Cherie Leeden, B.Sc Applied Geology (Honours), MAIG, a "Qualified Person" as defined by National Instrument 43-101, has read and approved all technical and scientific information contained in this news release. Ms. Leeden is the Company's Chief Executive Officer. Cherie Leeden relied on resource information contained within the Technical Report on the Sandman Gold Project, prepared by Steven Olsen, a Qualified Person under NI 43-101, who is a Qualified Persons as defined by the National Instrument NI 43-101. Mr. Olsen is an independent consultant and has no affiliations with Gold Bull except that of an independent consultant/client relationship. Mr. Olsen is a member of the Australian Institute of Geoscientists (AIG) and is the Qualified Person under NI 43-101, Standards of Disclosure for Mineral Projects.

Quality Assurance - Quality Control

Samples are submitted to American Assay Laboratories' analytical facility in Sparks, Nevada for preparation and analysis. The AAL facility is ISO-17025 accredited by IAS. The entire sample is dried, weighed and crushed, with 70% passing -10 mesh, then riffle split to 250 g aliquots, which are fine pulverized with 90% passing -150mesh. Analysis for gold is by 30 g fire assay lead collection with Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES) finish with a lower limit of 0.003 ppm. Samples were also analyzed using a 36 multi-element geochemical package by 5-acid digestion, followed by Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES) for the 36 elements.

About Gold Bull Resources Corp.

Gold Bull's mission is to grow into a US focused mid-tier gold development Company via rapidly discovering and acquiring additional ounces. The company's exploration hub is based in Nevada, USA, a top-tier mineral district that contains significant historical production, existing mining infrastructure and an established mining culture. Gold Bull is led by a Board and Management team with a track record of exploration and acquisition success.

Gold Bull's core asset is the Sandman Project, located in Nevada which has a 494,000 oz gold resource as per 2021 43-101 Resource Estimate. Sandman is located 23 km south of the Sleeper Mine and boasts excellent large-scale exploration potential. Drilling at Sandman is currently underway.

Gold Bull is driven by its core values and purpose which includes a commitment to safety, communication & transparency, environmental responsibility, community, and integrity.

Cherie Leeden

President and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull Resources Corp., please visit our website at www.goldbull.ca or email adminatgoldbull.ca.

Cautionary Note Regarding Forward-Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed "forward-looking statements" with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "indicates", "opportunity", "possible" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although Gold Bull believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company's ability to raise sufficient capital to fund its obligations under its property agreements going forward, to maintain its mineral tenures and concessions in good standing, to explore and develop its projects, to repay its debt and for general working capital purposes; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations, future prices of copper and other metals, changes in general economic conditions, accuracy of mineral resource and reserve estimates, the potential for new discoveries, the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

APPENDIX - Drill hole summary 2022 Sandman Drill Program

Table 1 below provides a summary of the 2022 Sandman reverse circulation drill program with the number of holes drilled with total drilled meters and feet.

Table 2 below is a summary of the 2022 Sandman reverse circulation drill program holes. The table provides summary of drilled holes per Prospect, hole target type, hole ID, hole depth in meters and feet and the number of assays per drill hole analysed.

Table 3 below details drill holes completed for the 2022 Sandman reverse circulation drill program and includes hole ID, total depth in meters and feet, easting, northing and elevation collar location, drill hole azimuth and dip.

Table 4 below details significant mineralized intersections for the 2022 Sandman reverse circulation program. These drill intersections include hole ID, from and to in meters and feet, width of downhole mineralized interval and calculation of gold grade in grams per tonne.

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

GBRC:CA

The Conversation (0)

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

1h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00