Citi: Cautious Zinc, Lead Outlook for Now, Positive Medium Term

Oliver Nugent, commodities strategist at Citi, is constructive on the base metals complex in the medium term.

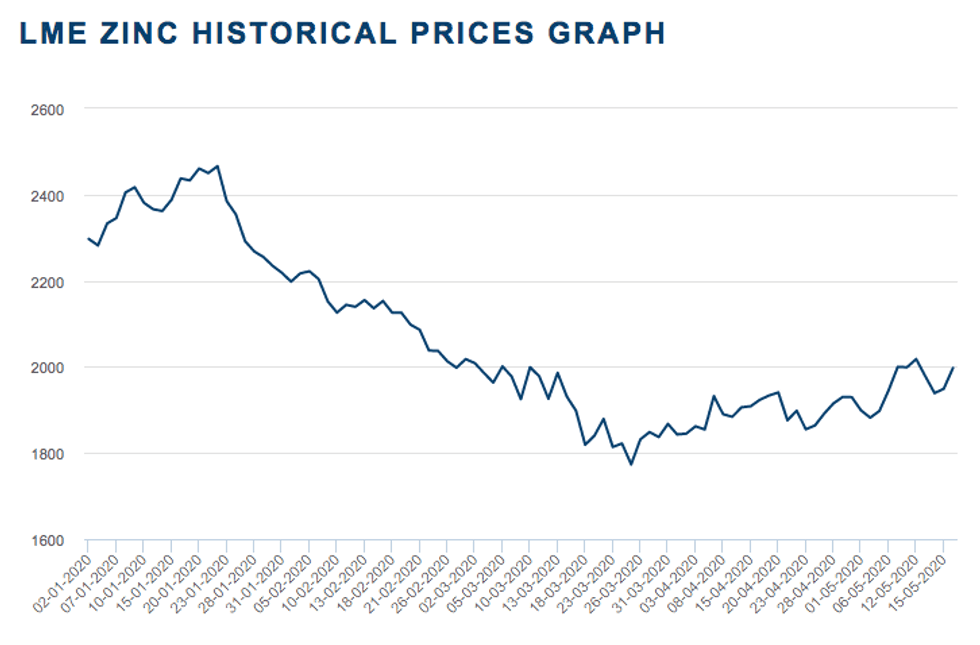

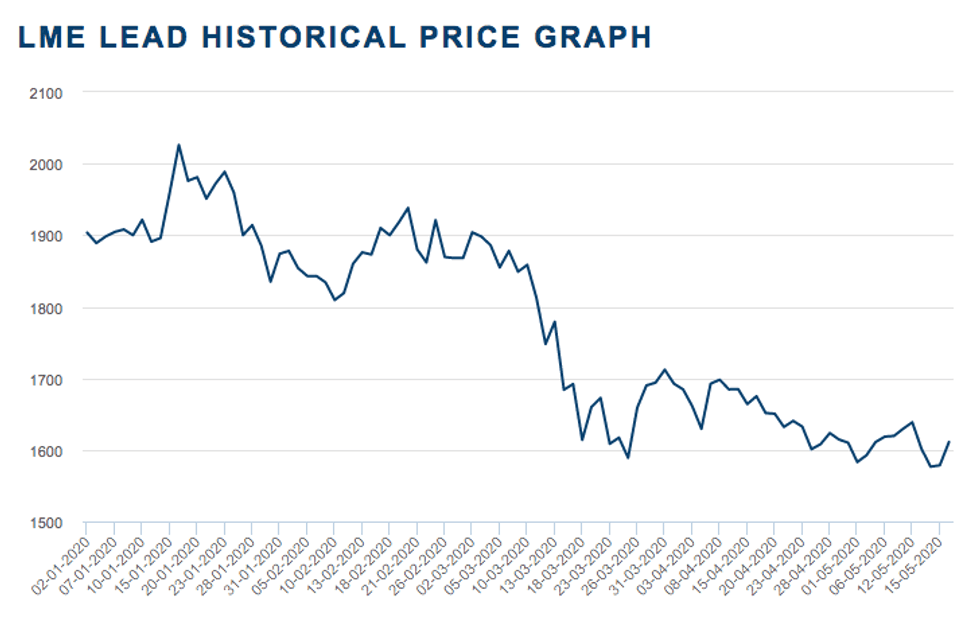

Base metals kicked off the year on a high note, with both zinc and lead trading above US$2,000 per tonne as the US-China trade deal seemed to be on its way.

But the coronavirus hit the world in the first quarter of the year, bringing uncertainty to all levels of society and high volatility into every market. Even now, with the global economy entering a new phase as lockdowns are eased and stimulus plans are worked out, it still remains tough to predict how base metals may perform for the rest of the year.

At a zinc- and lead-focused webinar hosted by Fastmarkets, Oliver Nugent, commodities strategist at Citi, said he is constructive on the base metals complex in the medium term, but is cautious in the near term.

“We are noticing quite a dichotomy between sentiment in China and outside of China,” he said. “Investors outside China are cautious, there’s still lots of concerns about what is the new normal we are getting into and what risks are surrounding the market.”

But in China, he noted, there’s bidding, both in the physical market and in terms of speculation.

“We are a bit concerned that that bid might fall away in the next couple weeks,” he said, adding that what happens at China’s National People’s Congress meeting will be key for the market.

Nugent is also cautious about the physical market, which might see pressure in the coming weeks.

“In June, July, China tends to go for a seasonal pullback, you tend to see a pullback in construction rates, appliance output — that’s going to add pressure on the physical inventory built.”

Speaking about how zinc mine supply has been affected by COVID-19 prevention measures, Nugent said it completely changed his outlook for the year.

“Before (the outbreak) we were seeing a very big concentrate surplus and a smaller refined surplus, but the surplus has now shifted from concentrate to refined,” he said. “In the past two months, we’ve been running at over 20 percent of zinc units lost on a daily basis.”

Furthermore, Nugent believes 4 percent of the total market was lost during the first half of the year.

“The challenge now (that lockdowns are eased) is getting back up to utilization and that ramp up process, and how quickly they can do it,” he explained. “One big concern for zinc is the amount of mining that takes place underground.”

Nugent expects a lot of mines not to come back as a result of lower prices. That’s why he expects the concentrate market to be balanced at best, but probably in deficit.

The way countries have been coming out of lockdown has been very much about industrial demand, getting the factories running — but for Nugent right now there’s a bit of a lag between production and end-user sales.

“We think there’s been a significant build up of finish and intermediate goods along the supply chain. If that destocks, that will add up to that physical pressure,” he said. “We are not necessarily saying to people to buy just yet, but we are medium-term bullish.”

For Nugent, demand for metals will recover, as they are an inherent option on a vaccine eventually being produced — and when that happens the demand trajectory will reevaluate quite quickly.

That said, he would not recommend zinc to play this potential upside, saying he remains neutral about that particular base metal.

Chart via London Metal Exchange.

“The risk/reward of zinc at US$2,000 is pretty narrow,” he said. “Zinc still has this supply theme overshadowing it — if prices go significantly up above cost, you could see mine supply restarting and zinc would go back to its old trajectory.”

Citi is expecting zinc to trade around US$2,000 this year, getting to US$2,100 next year.

“We think we touched the low at US$1,800. There were a lot of mines losing money, it was very deep into the cost curve. To break the US$2,300 level we need to see pretty hefty news on the stimulus side.”

Looking over to lead, Nugent said it is not the most exciting market, at least in the near term.

“Demand is very weak, but lead will probably trade with the complex and that medium-term story,” he said. “We see it getting to US$1,800 sometime next year.”

Chart via London Metal Exchange.

“What is fascinating about this downturn is the lockdowns, and in particular how we are not using our cars, and with that goes the need for replacing batteries — for lead that is right now a particularly reduced end sector.”

Nugent pointed out that as car usage picks up again, there will be a gap between battery replacement and the supply chain not being able to meet that need for some months.

“Demand in lead is deferred, but it is not destroyed,” he said. “We will end up in a period where car usage will be higher again … add that to the temporal gap in supply — that’s when things could get more interesting.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.