Antler Hill Enters into Definitive Agreement for Qualifying Transaction

Antler Hill Mining Ltd announces definitive agreement with Rockford Mining Ltd. (“Rockford”) to complete a business combination which will constitute Antler Hill’s “Qualifying Transaction”

Antler Hill Mining Ltd (TSXV:AHM.H) (the “Corporation” or “Antler Hill”) is pleased to announce that it has entered into a definitive agreement (the “Agreement”) dated February 3, 2020 with Rockford Mining Ltd. (“Rockford”) to complete a business combination which transaction (the “Proposed Transaction”) is intended to constitute Antler Hill’s “Qualifying Transaction” (within the meaning of Policy 2.4 – Capital Pool Companies (“Policy 2.4”) of the TSX Venture Exchange (the “TSXV”)).

It is anticipated the Proposed Transaction will proceed by way of a three-cornered amalgamation (the “Amalgamation”) whereby a wholly owned subsidiary of Antler Hill incorporated under the federal laws of Canada will amalgamate with Rockford to form a corporation to continue under the name, Rockford Holdings Ltd. Immediately following completion of the Proposed Transaction, Rockford Holdings Ltd. will be a wholly owned subsidiary of Antler Hill and will hold all of Rockford’s assets and conduct the business of Rockford, which is classified as being part of the mining sector.

Rockford Mining Ltd.

Rockford is a private company incorporated under the Canada Business Corporations Act on January 29, 2018 and has been engaged in the business of seeking and identifying copper, gold and lead-zinc properties in Brazil since incorporation.

SGM Mineração Ltda. (“SGM”), a company incorporated in Brazil and a wholly owned subsidiary of Rockford, entered into a joint venture option agreement (the “JV Option Agreement”) with GRB Grafite Do Brasil Mineração Ltda. (“GRB”) on September 19, 2018, to acquire an 80% interest in the mineral rights of a group of exploration licenses (the “Licenses”) to explore an area approximately 13,644 hectares in size containing zinc and lead targets located in the Rio Grande do Sul State, approximately 290 km west-southwest of the state capital, Porto Alegre (the “São Gabriel Project” or the “Property”).

On December 5, 2019, SGM and GRB amended the JV Option Agreement (the “Amended Option Agreement”). Under the terms of the Amended Option Agreement, SGM can acquire an 80% interest in the Property by:

- completing a minimum 1000m drill program on the Property by April 30, 2020, with the scope, nature and extent of the drill program to be determined at the discretion of SGM;

- the payment to GRB of $US20,000 on the date of signing the Amended Option Agreement; and

- Rockford issuing a total of 28,000,000 common shares to GRB or its designee.

As at February 3, 2020, Rockford had 28,000,000 common shares issued and outstanding (the “Rockford Shares”).

Ali Haji, residing in Toronto, Ontario is the sole director and officer of Rockford. Americas Investments & Participation Limited, a company incorporated in Brazil, has ownership of 28,000,000 Rockford Shares representing 100% of Rockford’s issued and outstanding shares and is a control person of Rockford. Luis Azevedo, a director of SGM and a person resident in Brazil, is a director and control person of Americas Investments & Participation Limited.

The São Gabriel Project

Over the last 40 years, the Sao Gabriel region has been the object of several mineral research projects carried out by the Brazilian Geological Survey (CPRM) and mining companies. Currently, Nexa Resources is developing the Santa Maria Pb-Zn-Ag deposit in a region located east of the Sao Gabriel Project. In 2016, CPRM discovered the Lajeado Zn-Pb occurrence, as a result of a geological mapping program to investigate previously selected air-magnetic anomalies in the Sao Gabriel region. According to CPRM, the Lajeado Zn-Pb occurrence is also associated with anomalous values of Cd and Ag.

The Property is located in the southern portion of the Atlantic Shield, in a geological area called Mantiqueira Province, which is a large and complex structural province deformed by the Neoproterozoic/Early Paleozoic Brasiliano orogenic event. Metavocanosedimentary sequence, plutonic rocks and remnant fragments of ophiolites (oceanic crust) comprise the main rock units in the project area.

In 2016, GRB conducted a reconnaissance exploration program on the Sao Gabriel Project to evaluate the regional potential of the mineral properties. This program included rock channel, soil and stream sediment sampling. In addition, an airborne geophysics magnetic and radiometric survey was acquired from CPRM.

A geophysical interpretation made by GRB based in magnetic characteristics of the Lajeado Zn-Pb occurrence, have identified 13 new targets within the Property area, commonly aligned with regional NE-SW-trending and NW-SE-trending structures.

Rock channel sampling carried out along the Lajeado mineralized outcrop delineated an intersection of 14.30m at 0.65% Zn, including, 7m at 1.11% Zn, 3m at 1.89% Pb, 7m at 12ppm Ag, and 7m at 377ppm Cd. Chemical analyses were carried out by SGS Geosol laboratory, located in Belo Horizonte, Brazil. SGS Geosol is an ISO-accredited (ISO:17025:2005) commercial laboratory, completely independent of GRB. Rock samples were initially analyzed by Inductively Coupled Plasma Optical Emission Spectroscopy (ICP OES) with aqua regia digestion. Where Zn and Pb results exceed the upper detection limit (10,000ppm), the referred samples were re-analyzed by Atomic Absorption Spectrometry (AAS) with a multi-acid digestion. In addition, the rock samples were also analyzed for Au (ppb) by Fire Assay. Duplicate, standard and blank samples were inserted by SGS Geosol, assuming a nominal frequency of 1 per 20 samples and no significant discrepancies were found on these QA/QC samples.

In 2018, GRB conducted a second exploration program, which was focused on the Lajeado Zn-Pb occurrence and its possible extensions along the strike. An exploration grid was opened, followed by a detailed ground magnetic survey, soil sampling and a fixed-loop transient electromagnetic (FLTEM) survey.

Soil samples collected in 2018 were prepared and analyzed at GRB’s field office by the company’s exploration team, using handheld portable XRF equipment and no QA/QC samples have been included. Interesting Zn results (up to 5,721ppm) in soils have been obtained on Lajeado region, suggesting the extension of the Lajeado mineralization along the strike. In addition, there are Cu, Co and Ni in-soil anomalies that should also be submitted to a more detailed investigation.

Two significant magnetic anomalies have also been delineated on the Lajeado area. The geological potential of these features is currently not understood but it is possible one of anomalies (SG-01) could be related to the outcropping Zn-Pb mineralization. SG-01 magnetic anomaly lies about 250 metres north of the Lajeado Zn-PB occurrence. And covers an area of approximately 9.45 hectares.

A well-defined EM conductor was also identified close by the Lajeado Zn-Pb sulphide mineralization and this feature should be the first priority target, assuming the sulphide nature of the known mineralization. The EM conductor trends NE-SW, which is the same orientation of the Zn-Pb mineralization found at surface (Lajeado occurrence).

The São Gabriel Project is an early stage exploration project with potential to host an economic Zn-Pb sulphide mineralization. The geological endowment is fertile as attested by the presence of operating mines and other mineral deposits in the region. The author of the geological report prepared for GRB in accordance with disclosure standards of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), Paulo I. de Brito, BSc. Geology, recommends a work program of approximately C$450,000 for the 12 month period after completion of the Proposed Transaction.

The Proposed Transaction

The Proposed Transaction will result in the Corporation acquiring all of the issued and outstanding Rockford Shares in consideration for the issuance of common shares of the Resulting Issuer (“Resulting Issuer Shares”) to holders of Rockford Shares on a one-to-one basis by way of the Amalgamation. The deemed issue price per Resulting Issuer Share to be issued to holders of Rockford Shares is $0.05 per Resulting Issuer Share.

Concurrent with the completion of the Proposed Transaction, Rockford intends to complete a non-brokered/brokered private placement financing on terms to be determined (the “Offering”). The net proceeds of the Offering to be completed by Rockford will be used for financing Rockford’s obligations in connection with the completion of the Qualifying Transaction, a recommended work program on the São Gabriel Project and for general working capital requirements. Details of the terms and conditions of the Offering will be disclosed when they become available.

It is expected that following the completion of the Proposed Transaction, Antler Hill shareholders will hold 18,765,000 Resulting Issuer Shares, representing approximately 40.13% of the common shares of the Resulting Issuer, and shareholders of Rockford will hold approximately 28,000,000 Resulting Issuer Shares, representing approximately 59.87% of the common shares of the Resulting Issuer (immediately prior to giving effect to the Offering to be completed in connection with the Proposed Transaction).

The Proposed Transaction will result in the Corporation continuing Rockford’s mining exploration business in Brazil and the listing for trading of the Resulting Issuer’s common shares on the TSXV as a tier 2 mining issuer. Upon completion of the Proposed Transaction, Antler Hill will continue under its current management and does not expect to change its name or the TSXV trading symbol for its common shares.

The Qualifying Transaction does not constitute a Non-Arm’s Length Qualifying Transaction under Policy 2.4 and is not a “related party transaction” as defined in Multilateral Instrument 61-101 and consequently the Corporation does not expect that it will be required to obtain any shareholder approvals. Ali Haji is the Chief Executive Officer and a director of Rockford as well as a director of the Corporation and is a “Non-Arm’s Length Party to the CPC” (as defined under Policy 2.4) as well as an insider of Rockford. There are no finder’s fees payable pursuant to the Proposed Transaction.

Conditions to the Proposed Transaction

Closing of the Proposed Transaction is subject to completion of the Offering and the parties obtaining all requisite corporate and regulatory approvals relating to the Proposed Transaction, including, without limitation, TSXV approval.

Selected Financial Statement Information

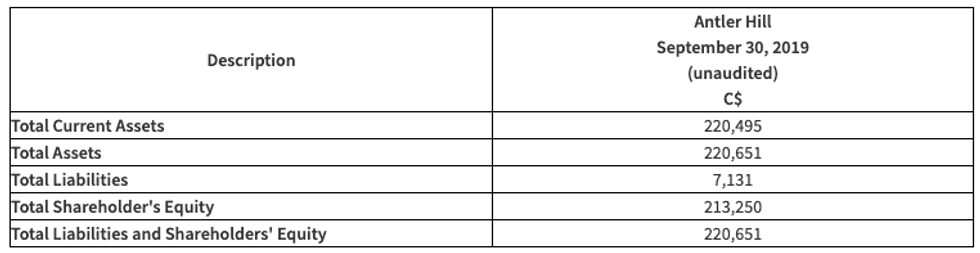

The following table presents selected financial statement information on the financial condition and results of operations for the Corporation. Such information is derived from the unaudited financial statements of the Corporation for the period ended September 30, 2019. The information provided herein should be read in conjunction the Corporation’s audited financial statements. The Corporation’s financial statements have previously been filed on SEDAR.

Selected financial information on Rockford will be provided in subsequent news releases.

Insiders, Officers, and Board of Directors of the Resulting Issuer

To the knowledge of the directors and executive officers of the Corporation, the only person who will beneficially own, directly or indirectly, or exercise control or direction over more than 10% of the Resulting Issuer Shares is Americas Investments & Participation Limited.

Upon completion of the Proposed Transaction, it is anticipated that the board of directors of the Resulting Issuer will continue to be comprised of the current board of directors of Antler Hill. The following sets out the names and backgrounds of all persons who are currently officers and directors of Antler Hill and expected to be the officers and directors of the Resulting Issuer.

Peter Bures, Chief Executive Officer and Director

Mr. Bures spent the first few years of his career at Placer Dome mines in Timmins, Ontario followed by ten years on the sell side in equity research. Mr. Bures worked at Deutsche Bank, HSBC in New York and Toronto, and as Precious Metals & Mining Analyst/Strategist for Orion Securities (Toronto). In 2007 Mr. Bures transitioned to the buy side with Sentry Investments as an associate portfolio manager, specializing in metals and mining where he comanaged several top-ranked funds. Mr. Bures joined the BMO Capital Markets institutional sales desk in New York in 2011 as Director Global Mining Sales. Mr. Bures was most recently with Canaccord as VP analyst covering gold and silver producers and royalty companies. Mr. Bures holds a Bachelor of Applied Science (geological and mineral engineering) from the University of Toronto.

Jing Peng, CFO

Mr. Peng is a Canadian Chartered Professional Accountant. He has worked in public accounting for the past nine years providing financial services primarily to junior exploration companies. Mr. Peng has been the CFO of Austin Resources Ltd., a TSXV-listed company, since September 2015 and the CFO of NWT Uranium Corp., a TSXV-listed company, since March 2014. In addition, since December 2010, Mr. Peng has been the senior financial analyst at Marrelli Support Services, a well-respected supplier of accounting and reporting services. Prior thereto, Mr. Peng was a senior account at MSCM LLP from June 2009 – December 2010 and at KPMG LLP January 2007 – June 2009. Mr. Peng holds a Masters degree in Management and Professional Accounting from Rotman School of Management, University of Toronto.

Matthew Wood, Chairman and Director

Mr. Wood is an outstanding mineral resource explorer and developer with over 25 years global industry experience in mining and commodities investment. He has managed successful deals in diamonds, coal, energy, ferrous metals, base and precious metals and other commodities. His unique skills in technical and economic evaluation of resource opportunities has been proven by an impressive record of nurturing resource deals from early stage, to market listings and successful exit strategies for his investors. Mr. Wood has an Honours Degree in Geology from the University of New South Wales and a Graduate Certificate in Mineral Economics from the Western Australian School of Mines.

Aneel Waraich, Director

Mr. Waraich is the co-founder and Executive Director of Steppe Gold Ltd., a near-term precious metals producer in Mongolia. Mr. Waraich is also founder and managing partner of ATMA Capital Markets and ATMACORP LTD. and is a financial services professional with progressive experience in both the asset management and corporate finance businesses. Mr. Waraich focuses primarily on advising public and private companies in the Natural Resources sector. In previous roles at Goodman and Company Investment Counsel and Dundee Capital Markets he worked as an analyst valuating private equity companies. Most recently Mr. Waraich worked as an investment banker focusing on deal origination, going-public transactions and financings for both public and private companies in the resource and technology sectors. Mr. Waraich completed his MBA from the Goodman Institute of Investment Management at the John Molson School of Business.

Ali Haji, Director

Mr. Haji has extensive knowledge of the financial services sector after having spent over 12 years in the Asset Management Industry performing strategic and process improvement roles. He started his career as a technology analyst at Invesco Ltd. in 2006 and advanced into various roles including Technology Risk, Controls, Program Management, and Process Improvement with international assignments involving mergers and acquisitions in Hong Kong, U.S.A and Australia. Most recently, he was also a principal contributor to the creation of a Center of Excellence in London, England for Invesco Ltd. Mr. Haji attended The University of Western Ontario and holds a BSc in Computer Science.

Sponsorship

Antler Hill is currently reviewing requirements for sponsorship and will provide further information when it becomes available.

Qualified Person

All technical information in this press release has been reviewed and approved by Mr. Paulo Ilidio de Brito, BSc (Geology), an independent consultant to the Corporation and Rockford and a “Qualified Person” as defined by NI 43-101. Mr. Brito is a member of the Australian Institute of Geoscientists (MAIG # 5173) and a member of AusIMM – The Australasian Institute of Mining and Metallurgy (MAusIMM # 223453). Mr. Brito is a professional senior geologist with over 34 years of experience in the mining industry, which is relevant to the style of mineralization under consideration.

Mr. Brito has no economic, financial or pecuniary interest in the Corporation and neither on Rockford and he consents to the inclusion in this document of the matters based on his information in the form and context in which it appears.

Filing Statement

In connection with the Qualifying Transaction and pursuant to the requirements of the TSXV, the Corporation will file a filing statement or a management information circular on its issuer profile on SEDAR (www.sedar.com), which will contain details regarding the Business Combination, Amalgamation, Offering, Antler Hill, Rockford and the Resulting Issuer.

Trading in Antler Hill Common Shares

Trading in Antler Hill common shares has been halted in compliance with the policies of the TSXV and will remain halted pending the review of the Proposed Transaction by the TSXV and satisfaction of the conditions of the TSXV for resumption of trading. It is likely that trading in Antler Hill common shares will not resume prior to the closing of the Proposed Transaction. As of the date hereof, Antler Hill has 18,765,000 common shares issued and outstanding.

About Antler Hill Mining Ltd.

Antler Hill was incorporated under the Business Corporations Act (Alberta) on September 11, 2009 under the name “PrimeWest Exploration Inc.”. On March 4, 2013, Antler Hill amended its articles to change its name to “Antler Hill Oil & Gas Ltd.” Antler Hill is a CPC as defined by TSXV Policy 2.4 – Capital Pool Companies. Antler Hill completed its Initial Public Offering on April 20, 2010 and its common shares became listed and posted for trading on the TSXV on April 20, 2010. On August 31, 2012, Antler Hill was transferred to the NEX board of the TSXV.

The principal business of Antler Hill is to identify and evaluate businesses and assets with a view to completing a Qualifying Transaction, and, once identified and evaluated, to negotiate an acquisition or participation in such assets or businesses. Until the completion of its Qualifying Transaction, Antler Hill will not carry on business other than the identification and evaluation of assets or businesses in connection with a potential Qualifying Transaction.

For further information, please contact:

ANTLER HILL MINING LTD.

Peter Bures, CEO and Director

Phone: 437-997-8088

E-Mail: peter@antlerhillmining.com

Web: www.antlerhillmining.com

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Antler Hill cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Antler Hill’s control. Such factors include, among other things: risks and uncertainties relating to Antler Hill’s ability to complete the proposed Qualifying Transaction; and other risks and uncertainties, including those described in Antler Hill’s Prospectus dated April 5, 2010 filed with the Canadian Securities Administrators and available on www.sedar.com. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Antler Hill undertakes no obligation to publicly update or revise forward-looking information.

Completion of the transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable pursuant to TSXV requirements, majority of the minority shareholder approval. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. A halt in trading shall remain in place until after the Qualifying Transaction is completed or such time that acceptable documentation is filed with the TSX Venture Exchange.

The information contained in this press release relating to Rockford and the projects has been furnished by Rockford. Although Antler Hill has no knowledge that would indicate that any statements contained herein concerning Rockford and the projects are untrue or incomplete, neither Antler Hill nor any of its directors or officers assumes any responsibility for the accuracy or completeness of such information or for any failure by Rockford to ensure disclosure of events or facts that may have occurred which may affect the significance or accuracy of any such information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.