Potash West Boosts Potash and Phosphate Resources at Dinner Hill Project

Potash West had a productive day on Wednesday. It announced a significant increase in the phosphate and potash resources at the Dinner Hill deposit, located within its Perth-based Dandaragan Trough project.

Potash West (ASX:PWN) had a productive day on Wednesday, announcing a significant increase in the phosphate and potash resources at the Dinner Hill deposit, located within its Perth-based Dandaragan Trough project.

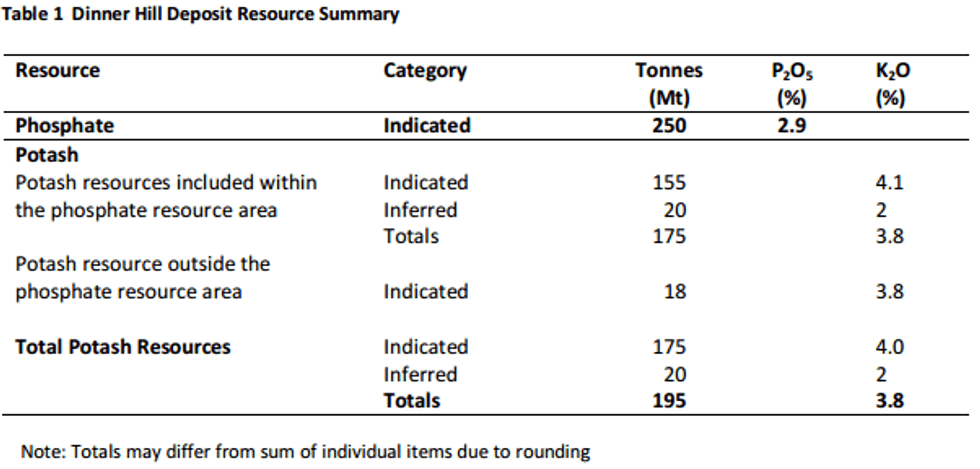

Specifically, the indicated phosphate resource rose to 250 million tonnes at 2.9 percent P2O5, using a cut off of 2.9 percent P2O5. That’s a 108-percent increase for the resource and a grade increase of 4 percent.

The phosphate resource also includes an indicated potash resource of 155 million tonnes at 4.1 percent K2O and an inferred potash resource of 20 million tonnes at 2 percent K2O. In total, that comes to an indicated and inferred potash resource of 175 million tonnes at 3.8 percent K2O, a 43-percent rise from the previous total.

Outside the phosphate resource there is a further indicated potash resource of 18 million tonnes at 3.8 percent K2O.

The resource updates for Dinner Hill incorporate 2014 and 2015 drill results, including 90 aircore drill holes across 2,732 meters. That drilling extended the north-south length of the deposit from 4,000 meters to 7,200 meters, and the east-west width in the central area of the deposit from about 2,700 meters to 3,700 meters.

Commenting further on the importance of that drilling, Potash West’s managing director, Patrick McManus, said, “[i]mportantly, the mineral inventory for phosphate production has increased substantially, and there is still a significant area of the prospective Dinner Hill tenement to be explored. Phosphate and potash mineralisation are open to the east and to the south … which offers considerable upside at Dinner Hill for increased project life, or capacity increases.”

He added, “[w]e look forward to incorporating these new findings into the scoping study for Dinner Hill.”

And indeed, moving forward, Potash West’s next step will be to use the updated report to develop a mining plan that will be the basis for a new scoping study model for Dinner Hill. The company has two development options: it will either mine the phosphate-rich parts of the deposit to produce single superphosphate for the life of the indicated resource, or use the phosphate mining project as a “springboard” to generate cashflow, devoting some of that money to completing development work for its K-Max process.

The K-Max process was developed by Potash West to produce sulfate of potash (SOP), high-magnesium SOP, single superphosphate, iron oxide and aluminum sulfate from the glauconite it extracts from the greensand deposits at Dandaragan Trough.

The work mentioned above is expected to be completed within the next two months and will feed into a revised financial model. The company will also be using samples collected for metallurgical studies to complete various other tasks, generating process information continuously over a six-month period.

At close of day Wednesday, Potash West’s share price was down 2.08 percent, trading at AU$0.047. Year-to-date it’s up 4.44 percent.

Securities Disclosure: I, Kristen Moran, hold no direct investment in any of the companies mentioned in this article.

Editorial Disclosure: Potash West is a client of the Investing News Network. This article is not paid-for content.

Related reading: