As the COVID-19 coronavirus continues to spread, the markets took a beating on Monday due to uncertainty about its impact.

Fear surrounding the impact of more COVID-19 coronavirus cases is causing a depression in markets across the globe.

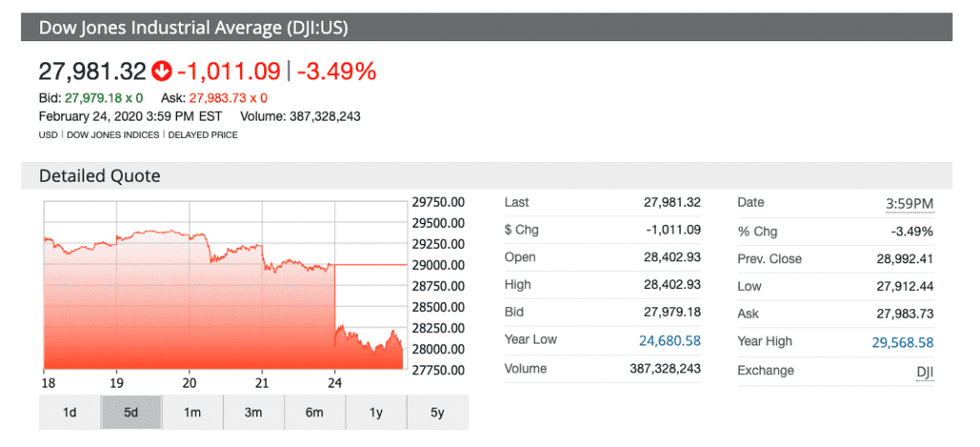

On Monday (February 24), the Dow Jones Industrial Average (INDEXDJX:.DJI) dropped over 1,000 points, or nearly 4 percent in value, as the world faced an increase in instances of the disease beyond its initial appearance in Wuhan, China.

The Dow closed Monday at 28,033.41 points, indicating a year-to-date loss of 1.74 percent.

“With stock prices and valuations still near cycle highs, the risk of a worsening virus outbreak has not been priced into the market to a great extent,” Keith Lerner, chief market strategist at Truist/SunTrust Advisory, told CNBC.

Similarly, the NASDAQ Biotechnology Index (INDEXNASDAQ:NBI), which tracks both the pharma and biotech public markets, dropped by 2.66 percent to close at 3,766.1 points on Monday.

The latest updates for the virus include heightening tension from countries like South Korea and Italy, where cases are rising. For the Asian nation, the disease is now a “red alert” threat at a national level. Besides China, South Korea is now the country with the highest recorded cases of the virus.

Italy has become the country with the fastest spreading of the virus outside of Asia, according to a report from the Washington Post.

Meanwhile, in China, 398 new cases and 149 more deaths were confirmed by officials in Hubei province.

According to a report from MarketWatch, the staggering drop on Monday for the Dow represents the first time in over a year that a 3 percent decline has been seen for this benchmark; it sank alongside the S&P 500 Index (INDEXSP:.INX) and the NASDAQ Composite Index (INDEXNASDAQ:.IXIC).

Companies in the life science space have been racing to find early stage treatments for the virus.

Don’t forget to follow @INN_LifeScience for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.