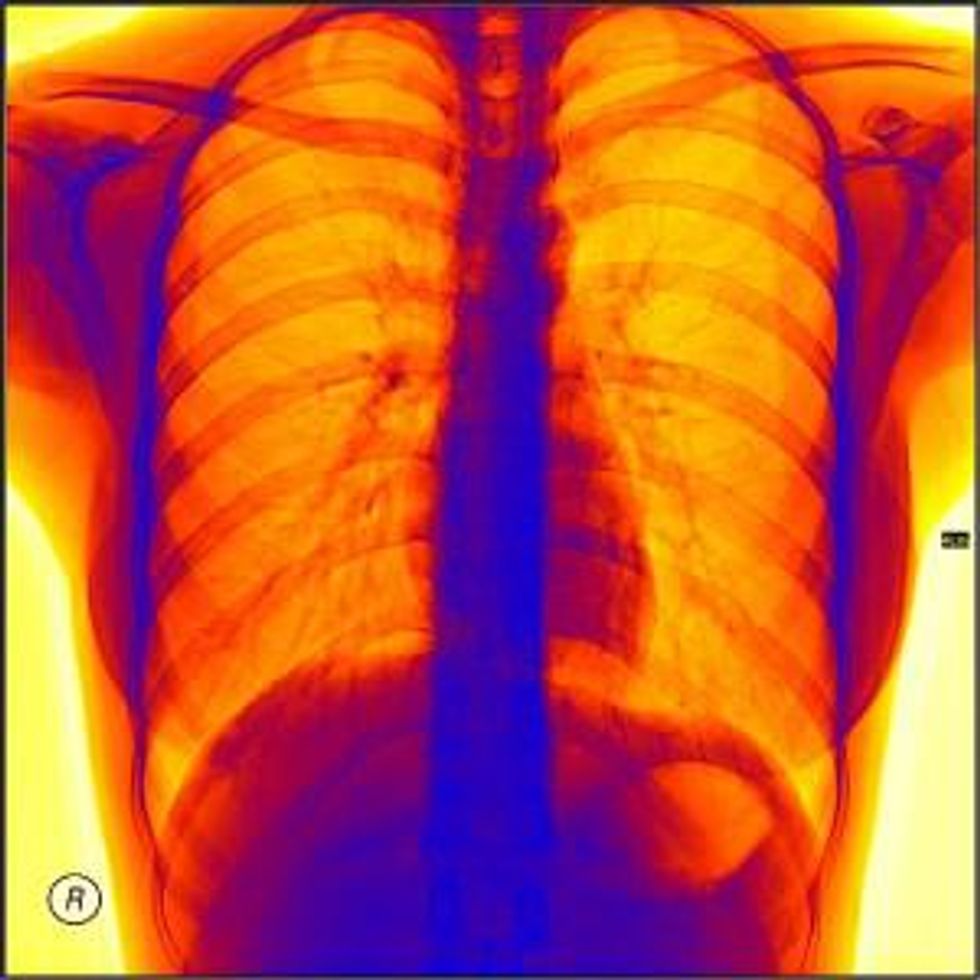

Growing Market for Cardiac and Breast Imaging Technologies

Global medical imaging market revenues are expected to grow from $24.1 billion in 2012 to nearly $30 billion by 2017.

Global medical imaging market revenues are expected to grow from $24.1 billion in 2012 to nearly $30 billion by 2017, according to research from Frost & Sullivan’s 2013 global Medical Imaging Equipment Market Outlook Report. Medical imaging includes X-rays, magnetic resonance imaging (MRI), computed tomography (CT) scans, ultrasound and nuclear medicine.

In the US, the medical imaging market is projected to reach $4.5 billion by 2017, according to Millennium Research Group, with demand for ultrasound applications increasing by $1.8 billion over the next three years.

Medical imaging tools are not only used in the proactive detection and treatment of diseases but also in clinical trials of pharmaceuticals. Technology in this market is growing rapidly alongside demand as modern medicine continues to emphasize early detection and minimally invasive procedures.

Cardiac and breast imaging applications are creating the biggest buzz. “An aging population has been the foremost driver in the healthcare market. The rising incidence of cardiovascular diseases is expanding the patient pool, while resulting in escalating demand for equipment and software that enable better diagnoses. This is highlighting the need for technologically advanced medical imaging modalities,” noted a recent Frost & Sullivan press release showcasing the research firm’s report on “Global Trends in Medical Imaging — Cardiology Applications”.

Increasing incidences of breast cancer are driving the development of new screening technologies designed for early detection and reducing the number of false positives, making the global breast imaging market “one of the fastest growing multi-billion dollar markets in the healthcare industry,” stated Research and Markets in a May 2013 press release. In “Breast Imaging Technologies Market Analysis” the research firm reports that this sector of the healthcare market has a compound annual growth rate (CAGR) of 15.37 percent and is projected to reach nearly $5 billion by 2017.

Medical imaging market opportunities

VentriPoint Diagnostics (TSXV:VPT) created the VMS-2DE™ heart analysis system, a diagnostic ultrasound tool for monitoring patients with heart disease. VMS™ enables doctors to examine the heart, specifically by measuring right ventricle heart function, offering a speed of diagnosis as much as 20 times that of traditional MRIs while providing a more realistic image.

In April, the company announced it had received an expanded license from Health Canada to sell VMS-2DE™ for clinical use in Canada, allowing “clinicians to rapidly and accurately assess the status of the right ventricle in all patients that do not have significant congenital heart defects or pulmonary hypertension, yet may have a variety of other conditions, such as left-heart failure or valve disease.” The system is also approved for clinical use in Europe. Upcoming catalysts for VentriPoint include US-FDA marketing clearance which the company is currently pursuing through the 510(k) process.

VentriPoint has a market cap of $11.81 million and was trading at 0.09 cents per share Wednesday.

Although PLC Systems Inc. (OTCMKTS:PLCSF) isn’t a pure medical imaging company, it does provides opportunity for an interesting play in this sector of the healthcare market. The company has developed the RenalGuard Therapy® system to limit patient exposure to toxins in dyes infused intravenously during cardiac and vascular diagnostic imaging tests. The toxins can cause serious kidney problems.

On Tuesday, PLC Systems reported that data from studies conducted on RenalGuard® can be used safely in patients undergoing Transcatheter Aortic Valve Implantation (TAVI) procedures and “supports the further development of RenalGuard Therapy® to minimize Acute Kidney Injury (AKI),” a serious complication of TAVI with high incident rates.

RenalGuard is undergoing a clinical trial in the US, as required for approval by FDA.

“The company has early revenues and a broad international network,” stated Dr. Michael Berry of Morning Notes, “The company has established a presence with distribution partners in 17 countries and reported nascent revenues of $348,000 in the first quarter of 2013.” PLC Systems’ latest financials report shows a gross profit of $169,000 for the first quarter compared to $7,000 for the same period in 2012.

The company has a market cap of $3.58 million and was trading at 0.11 cents per share Wednesday.

iCAD Inc (NASDAQ:ICAD) provides an advanced range of high-performance upgradeable computer-aided detection (CAD) solutions for mammography and MRI products for breast and prostate cancers and CT scans for colorectal cancer. The company received FDA approval in January for its next generation mammography CAD platform, PowerLook Advanced Mammography Platform (AMPT) with Digital CAD for Philips’ MicroDose Full-Field Digital Mammography System.

“PowerLook AMP provides radiologists with the ability to customize their CAD solution to meet the needs of their individual work environment. The technology expands on iCAD’s SecondLook Digital algorithm and is the CAD platform upon which all future breast imaging CAD offerings from iCAD will be built,” stated the company press release.

In March of this year, the company announced it had entered into a research, development and commercial agreement with Invivo, a Philips Healthcare Business, for a next generation platform for prostate and breast imaging. iCAD will develop advanced MRI image analysis software products and Invivo will incorporate them into its suite of MRI product solutions for global commercial sale. The first of these products is slated to hit the market in the second quarter with additional products anticipated for release in the second half of the year.

“As we continue to innovate and transform our business, we are now seeking to align the commercial strategy of our MRI products similar to that of our successful mammography business,” stated iCAD CEO Ken Ferry in the press release.

Last month, iCAD released its financial results for the first quarter of 2013, which Brian Marckx, Senior Medical Device/Diagnostics Analyst at Zacks Investment Research, called “very strong” remarking that revenue was “at the highest level since Q3 2011 and over 10 percent better than our estimate.” Marckx expects iCAD can reach a sustainable positive cash flow level this year and begin generating positive net income and earnings per share as early as next year.

While the majority of the company’s total revenue comes from its cancer detection business, more than 41 percent of its first quarter 2013 revenue came from its cancer therapy products,“demonstrate[ing] the growing adoption of the Xoft® Axxent® Electronic Brachytherapy System® for the treatment of breast and skin cancers,” explained iCAD CEO Ferry. The Xoft system was a featured subject of several scientific and training sessions at the 14th annual American Society of Breast Surgeons meeting earlier this month. The Xoft System is also cleared for the treatment of non-melanoma skin cancer, endometrial and cervical cancers.

iCad has a market cap of $66.32 million and was trading at $5.99 per share Wednesday.

Hologic, Inc. (NASDAQ:HOLX) develops, manufactures and supplies diagnostic products and medical imaging systems that target women’s healthcare issues including breast health. The company is the largest provider of 2D and 3D breast tomosynthesis (mammography) systems in the world. Approved for use in over 50 countries, Hologic’s 3D mammography was approved for use in the US for breast cancer screening and diagnosis in 2011 and is now in use in 48 states.

This week, Hologic announced FDA approval for the use of its new C-View 2D imaging software and expects to begin shipments in the U.S. in June 2013. The new software will replace the conventional 2D exposure previously required as part of a Hologic 3D mammography screening exam. “The combination of Hologic’s 3D and C-View 2D images results in less time under compression, for greater patient comfort and a lower radiation dose, while still providing the 2D images required as part of Hologic’s FDA approved 3D mammography screening exam,” stated the press release.

The announcement follows last week’s news that a large-scale U.S. study demonstrated that Hologic’s 3D mammography screening “significantly reduces unnecessary recalls while simultaneously increasing cancer detection.”

Earlier in the month, the company released its operating results for the second fiscal quarter ended March 30, 2013. While the company’s adjusted earnings were higher than analysts’ projections it failed to meet the revenue expectation, decreasing 1.94 percent from $631.36 million in the previous quarter. The loss sent a negative message to investors about the company’s growth potential and shares fell 2 percent on the news.

Hologic has a market cap of $5.47 billion and was trading at $20.11 a share Wednesday.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.