Here’s what’s behind Actinium Pharmaceuticals’ huge share price leap this year.

2016 was a rough year for the biotech sector, but experts agree that 2017 looks bright. Volatility caused by drug pricing discussions, the US election and other factors is in the past, and a number of biotech sub-sectors are poised to succeed.

Immuno-oncology is one biotech sub-sector that’s set to soar. Companies in this field are working to find ways to enhance patients’ immune systems so that they can better combat cancer cells, and many are making significant progress. As Jeff Margolis, vice president of RespireRx (OTCQB:RSPI), recently said, “[t]his is a sub-sector of the healthcare space that is coming into its own now, and progress should be rapid.”

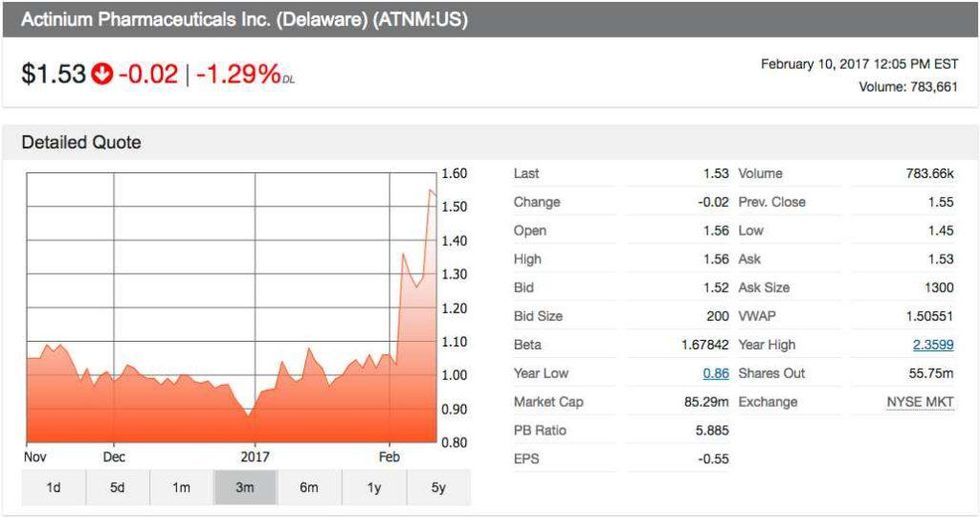

Actinium Pharmaceuticals (NYSEMKT:ATNM) is one company that’s proving that point. It’s focused on developing innovative targeted payload immunotherapies for the treatment of advanced cancers, and as of 10:14 a.m. EST on February 10, its share price was up over 70 percent year-to-date. Read on to learn what’s driving Actinium’s share price and what’s next for the company this year.

New clinical trial

Actinium has been busy since 2017 began, but as the chart below shows, its share price really began climbing at the beginning of February, then shot up this week. While some gains appear to have come on the back of company presentations at a number of different conferences and events, news released this week has also been a major driver of Actinium’s share price.

According to a February 7 press release, Actinium has begun a Phase 1 clinical trial to study Actimab-M in multiple myeloma. Multiple myeloma is a blood cancer characterized by the malignant transformation of white blood cells. It is the second most commonly diagnosed blood cancer, and it is treatable but not curable. Actinium describes Actimab-M as a targeted treatment for the disease, and will be looking at how it works in “patients who have progressing disease after 3 prior multiple myeloma treatment regimens or are refractory to QUAD.”

“We are incredibly excited to see the initiation of this trial for Actimab-M in multiple myeloma. Not only does this mark the beginning of the expansion of our clinical pipeline beyond [acute myeloid leukemia], it also demonstrates the broad applicability of our radioimmunotherapy technologies that we intend to progress into new indications and patient populations,” said Sandesh Seth, executive chairman of Actinium.

View full chart here.

In addition to its Phase 1 Actimab-M clinical trial, the company is working on a Phase 2 clinical trial of Actimab-A and a pivotal Phase 3 clinical trial of Iomab-B. Like Actimab-M, Actimab-A is a targeted treatment, and the clinical trial is aimed at determining its efficacy in newly diagnosed acute myeloid leukemia in patients over the age of 60. Iomab-B is a bone marrow transplant asset, and Actinium is testing how it works it in patients over 55 with relapsed or refractory acute myeloid leukemia.

Is it time to buy?

Biotech market watchers are taking note of Actinium, and many believe as its clinical trials progress this year it will enjoy further gains. Joshua Rodriguez of GuruFocus said this week that he will be watching for “more robust data” as the clinical trials move forward; he believes “it is not unreasonable to project the potential for it to enjoy a transformational rise in share price.” Similarly, BayStreet.ca notes that Actinium’s share price “is likely to appreciate further as the company progresses through its trials.”

Reuters data shows that Actinium has a consensus “buy” recommendation from analysts, as well as a 12-month price target of $7.33 per share — that’s about 370 percent above the company’s current share price. Investors interested in biotech and its booming immuno-oncology sub-sector would do well to keep an eye on the company in the coming months.

Don’t forget to follow us @INN_LifeScience for real-time news updates.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.