Zenabis Delays Facility Expansion to Protect Cash Flow

Shares of Zenabis Global dropped on Monday after the company confirmed it is delaying a segment of its facility expansion in Langley, British Columbia.

A Canadian cannabis producer has adjusted its construction plans for a facility expansion in British Columbia, Canada, in an attempt to prevent disruption to its cash flow.

In an update to investors issued on Monday (October 21), Zenabis Global (TSX:ZENA) confirmed the adjusted timeline for the facility. The new plan will delay the site in reaching full capacity.

According to Andrew Grieve, CEO of Zenabis, the facility will still achieve production of 96,400 kilograms by the end of 2019.

Zenabis will split its remaining Zenabis Langley expansion into two phases: Zenabis Langley — Part 2B and Zenabis Langley — Part 2C.

“While the timeline revision for Zenabis Langley will delay achieving full design capacity at the facility, we expect to have 96,400 kg of capacity licensed and operational by the end of 2019 with approval of the Zenabis Langley – Part 2A amendment,” Grieve said.

Zenabis filed an amendment for the 2A phase of its expansion in September and anticipates it will obtain Health Canada approval this year.

The firm plans to submit its license amendment to the regulator for the 2B section in November, while 2C will have to wait until early 2020.

Zenabis indicated that this decision was made due to market conditions at the moment and as way to lower ramp-up risk.

The marijuana producer has lofty expectations for its facility operations and production in Langley.

“By early in the first quarter of 2020, we expect to have 111,200 kilograms of capacity licensed and operational with the approval of the Zenabis Langley — Part 2B amendment,” Grieve said.

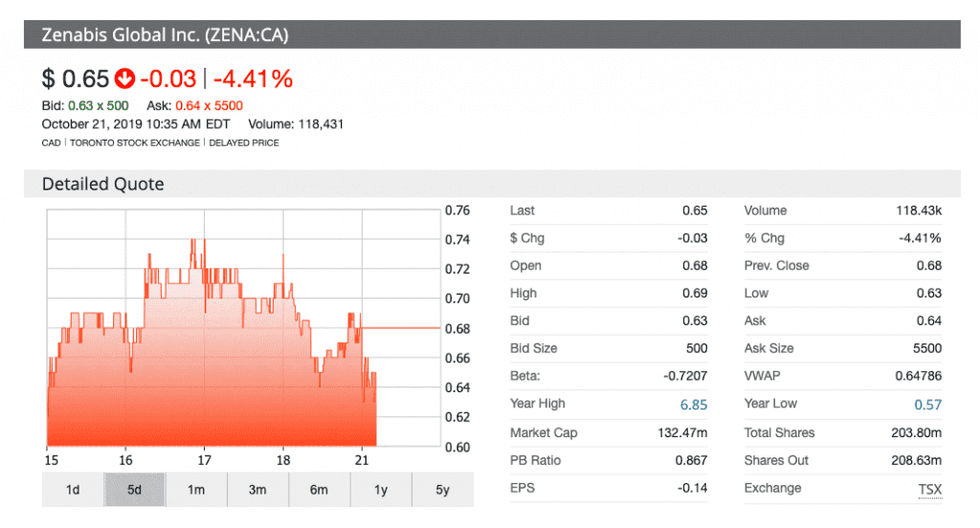

The market did not take kindly to the delay in Monday’s trading session. Shares of Zenabis opened at C$0.68 and then quickly fell by 4.41 percent to C$0.65 as of 10:35 a.m. EDT following the announcement.

On analyst data aggregator TipRanks, Zenabis currently holds a “moderate buy” rating based on two recent reviews of the stock.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.