TriStar Gold Inc. (TSXV: TSG) (OTCQX: TSGZF) (the Company or TriStar) is pleased to provide an update on advancements in environmental permitting activities toward requesting the Liçença Previa (Preliminary Licence or LP) for the Castelo de Sonhos gold project in Pará state Brazil. TriStar has also initiated metallurgical test work as part of a value engineering study on the prefeasibility design process facility at Castelo de Sonhos.

Mr. Nick Appleyard, CEO, stated, "We are very pleased to report that SEMAS has been responsive and are working with our team to ensure that our requests are being addressed in a timely fashion. SEMAS confirmed approval of two key requests: fauna capture and transportation license, as well as an expansion of the Terms of Reference for the EIA to include two adjacent concessions. This level of responsiveness and professionalism bodes well for keeping our permitting timelines reasonable and moving forward without delay."

Mr. Appleyard continued, "We are committed to the responsible development of the Castelo de Sonhos mine for the benefit of both our shareholders and the local communities, as well as for Altamira Municipality and Pará State. This includes the basic rights of our neighbors to clean water and a clean environment for future generations. TriStar is committed to advancing the United Nations Sustainable Development Goals in an impactful way within the State of Pará."

Plant Optimization

Metallurgical testing has been initiated on a composite sample from Esperança South, which is the source of plant feed for the Pre-Feasibility Study (PFS) projected phase one of operations, where gold production is approximately 150,000 ounces per year. The intent is to evaluate the impact of changing leach feed grind size on plant throughput, leach residence time and metallurgical recovery. Results will be coupled with value engineering studies to optimize the preliminary design concepts contained in the recent PFS, providing the basis for ongoing plant development.

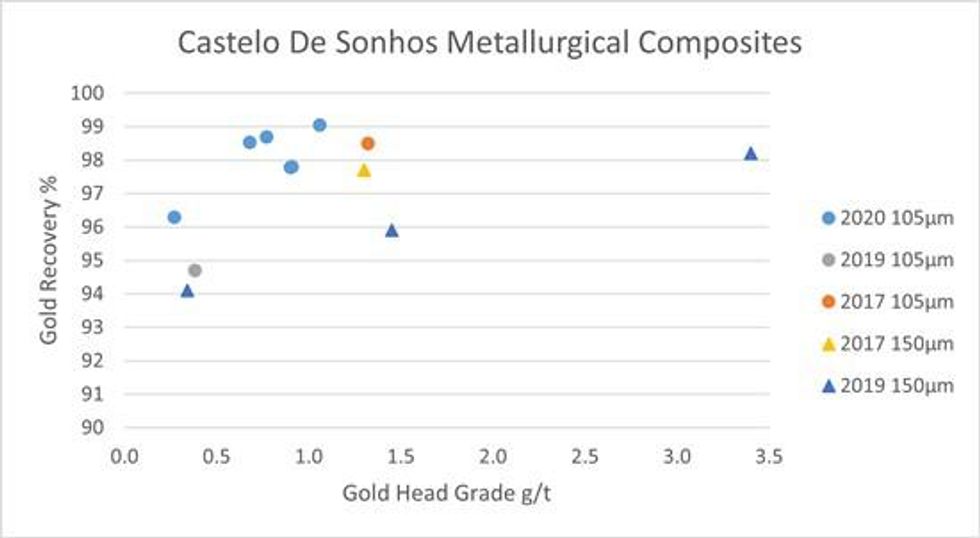

Previous test work showed that at a 105-micron grind size eight samples averaged 98% recovery (with three of the eight having no detectable gold in the tails sample), which was used as the basis for the PFS metallurgical recovery assumptions. Additional test work conducted at a grind size of 150 microns averaged 96% recovery across four composite samples. Figure 1 below, shows the results from the metallurgical test programs (for more information please see Company press release dated July 23, 2020, 'TriStar Gold Metallurgical Results and Corporate Update'). The new metallurgical program is designed to aid our understanding of the relationship between grind size of 105 microns up to 250 microns and metallurgical recovery.

Figure 1, Metallurgical results from composite samples (previously announced).

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/4509/107510_tristar.jpg

Permitting/EIA

TriStar is pleased to report that work on the Environmental Impact Assessment and Environmental Impact Report (EIA) for the Castelo de Sonhos gold project in Pará State, Brazil has significantly advanced. All activities are being conducted in strict accordance with the Terms of Reference for the EIA issued in March 2020 by the Environmental Licensing Directorate of the Secretariat of Environment and Sustainability (SEMAS) for Pará State. The Terms of Reference lay out specifications, guidelines and expectations for the content and final presentation of the EIA.

The EIA will culminate in the application for the Preliminary License (LP), which will indicate the government's conditional approval of the environmental viability of the project. The LP is the first of three environmental licenses to be acquired in advance of mine commissioning, the other two being the Construction License (LI) and the Operation License (LO). TriStar anticipates making the formal request for the LP in Q2 of 2022.

The EIA is a collaboration between TriStar, Brazilian regulators, and various environmental and socio-economic consultants, with SETE Ambiental of Belo Horizonte overseeing preparation of the EIA. Groundwater and surface water monitoring as well as hydrogeological modeling are being performed by Water Services & Technologies in close coordination with SETE. Air, noise & vibration monitoring as well as speleological (caving) studies have also been undertaken as part of the EIA.

TriStar is pleased to report that all significant baseline data collection is now complete. In strict accordance with the Terms of Reference as well as all applicable national and state regulations, the seasonal collection of data relating to flora and fauna, ground & surface water, air, noise & vibration, socio-economic aspects of the area, caves, archeology & paleontology is finished. A forest inventory has been completed, and with the recent completion of the PFS, TriStar's EIA team is excited to move from baseline data collection into impacts analysis and mitigation.

Stakeholder Engagement

TriStar and our contractors regularly engage and receive guidance from regulators at the state and municipal level around expectations and the required documentation in advance of the LP application. We are collaborating with Convergente Soluçõese Resultados (a Brazilian specialist consultant in community relations) around stakeholder engagement and communications, while building up our internal team and capabilities. We continue to formally and informally share information and consult with local leaders, businesses, and organizations in the region, updating them on our environmental studies and activities at site; laying the groundwork for future partnerships and responsible collaboration with all of our local stakeholders in alignment with International Finance Corporation (IFC) Performance Standards.

TriStar has also received confirmation from two federal entities related to land in the region of the project. Both the National Institute for Colonization and Agrarian Reform (INCRA) and the Federal Heritage Secretariat (SPU) confirm that the CDS mineral concessions that comprise the Directly Affected Area of the project do not overlap with any of the areas of interest registered by the National Indian Foundation (FUNAI), Ministry of Environment, Brazilian Forest Service, Chico Mendes Institute for Biodiversity Conservation, INCRA or the SPU.

Qualified Person

Alan Lambden (P.Geo.), project geologist for TriStar and the Qualified Person for the technical information presented in this press release, has approved its publication.

About TriStar:

TriStar Gold is an exploration and development company focused on precious metals properties in the Americas that have the potential to become significant producing mines. The Company's current flagship property is Castelo de Sonhos in Pará State, Brazil. The Company's shares trade on the TSX Venture Exchange under the symbol TSG and on the OTCQX under the symbol TSGZF. Further information is available at www.tristargold.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY:

Nick Appleyard

President and CEO

For further information, please contact:

TriStar Gold Inc.

Nick Appleyard

President and CEO

480-794-1244

info@tristargold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Forward-Looking Statements

Certain statements contained in this press release may constitute forward-looking statements under Canadian securities legislation which are not historical facts and are made pursuant to the "safe harbour" provisions under the United States Private Securities Litigation Reform Act of 1995. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects" or "it is expected", or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward looking statements in this press release include all estimates from the PFS such as the cash flow, IRR, NPVs, cash cost, AISC, initial capital, life of mine production, average annual production and payback period time. Such forward-looking statements are based upon the Company's reasonable expectations and business plan at the date hereof, which are subject to change depending on economic, political and competitive circumstances and contingencies. Readers are cautioned that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause a change in such assumptions and the actual outcomes and estimates to be materially different from those estimated or anticipated future results, achievements or position expressed or implied by those forward-looking statements. Risks, uncertainties and other factors that could cause the Company's plans to change include changes in demand for and price of gold and other commodities (such as fuel and electricity) and currencies; changes or disruptions in the securities markets; legislative, political or economic developments in Brazil; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of the Company's projects; risks of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining or development activities; the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves and resources; and the risks involved in the exploration, development and mining business. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107510