Valens Reports Record Revenue, Adjusted EBITDA and Profitability for the Third Quarter of Fiscal 2019

Valens GroWorks Corp. (TSXV:VGW, OTC:VGWCF) is pleased to report its financial results for the third quarter of fiscal 2019.

Valens GroWorks Corp. (TSXV:VGW, OTC:VGWCF) (the “Company” or “Valens”), a vertically integrated provider of industry leading extraction products and services; including a diverse suite of extraction methodologies, next generation cannabinoid delivery formats and an ISO 17025 accredited analytical lab is pleased to report its financial results for the third quarter of fiscal 2019.

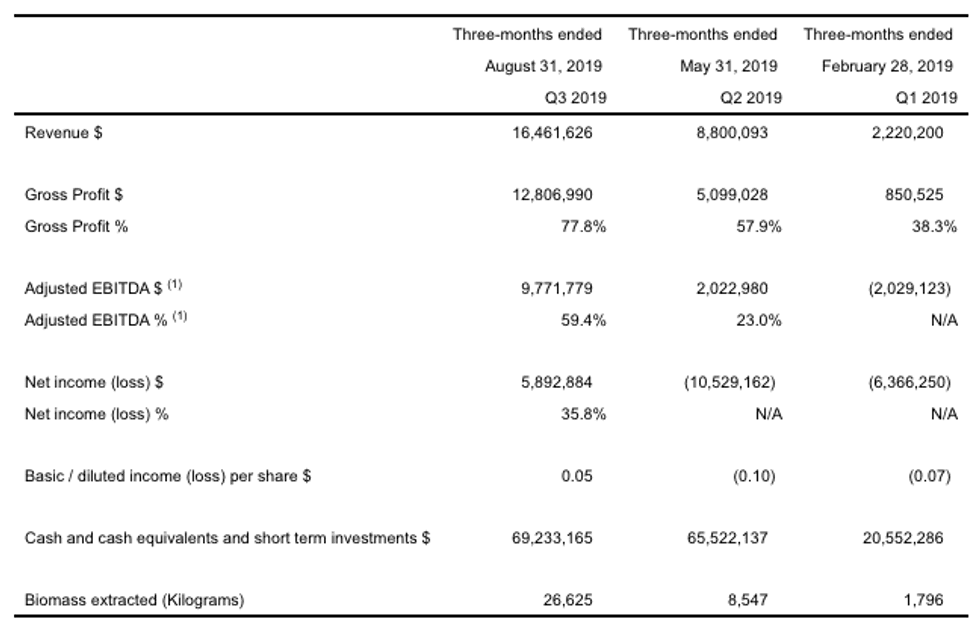

Key Financial Highlights of The Third Quarter of Fiscal 2019

- Revenue increased to $16.5 million, an 87.1% increase over the second quarter and a 641.4% increase over the first quarter of 2019.

- Gross profit increased to $12.8 million, or 77.8% of revenue, for the third quarter of 2019 compared to $5.1 million or 57.9% of revenue in the second quarter.

- Adjusted EBITDA(1) of $9.8 million in the third quarter, or 59.4% of revenue compared to $2.0 million or 23.0% of revenue in the second quarter of 2019.

- Net income of $5.9 million (or $0.05 per share basic and diluted) in the third quarter, compared to a net loss of $10.5 million (or a loss of $0.10 per share basic and diluted) in the second quarter of 2019.

- Strong balance sheet with $69.2 million in cash and cash equivalents and short-term investments and a net working capital position of $84.1 million as at August 31, 2019.

“We are extremely pleased with the roll-out of our business plan and the continued scale up in the Company’s extraction operations which have allowed us to continue our aggressive quarter over quarter growth in volumes, revenue, adjusted EBITDA and net income.” said Tyler Robson, CEO of Valens. “The Company’s performance in the third quarter clearly demonstrates our industry leading technical capabilities, the quality of our products and the earnings power of our platform. While we anticipate that our margins in future quarters will continue a strong upward trend from the levels seen in previous quarters, especially as our volumes continue to ramp and efficiencies are realized, margins in the third quarter were aided, in part, by a one-time contract opportunity which we do not anticipate recurring in future quarters. Finally, our net income in the quarter has made us the most profitable public company in the Canadian cannabis sector with the highest net income margin (excluding biological asset fair value adjustments).”

Key Operating Highlights of The Third Quarter of Fiscal 2019

- 26,625 kilograms of dried cannabis and hemp biomass was processed in the third quarter of 2019, a 212% increase over the second quarter of 2019. The Company has already processed 13,423 kilograms of biomass in the first 45 days of the fourth quarter. During the early part of the quarter we worked with a number of our clients to process smaller, higher revenue white label product lots in preparation for the launch of edibles and concentrates later this year. This is anticipated to result in higher revenue per gram of input compared to previous quarters. Volumes are expected to accelerate into the back half of the fourth quarter, particularly as we begin to process larger white label lots for sale in 2020 and resume the processing of our previously announced contracted volumes.

- Subsequent to the end of the quarter the Company entered into the following agreements.

- Shoppers Drug Mart – the Company signed an agreement to become the first third party processor to supply Shoppers Drug Mart with cannabis oil products for their online medical cannabis site.

- Iconic Brewing –the Company signed its first beverage agreement with Iconic Brewing to manufacture 2.5 million cannabis beverages over the term of the 5-year agreement.

The Company continues to be engaged in active discussions with additional partners to provide extraction services and expand our existing relationships to add further value-added product development and white label services.

- The Company was accepted for listing the common shares and warrants of the Company on the TSX Venture exchange as a Tier 1 life sciences issuer and qualified and began trading on the OTCQX Best Markets in the US.

- The Company has expanded its operational footprint with the addition of corporate offices located in downtown Toronto, Ontario. The corporate office will improve the Company’s ability to realize on a number of international opportunities, increases its ability to attract and retain top talent, coordinate global operations, manage international customer relationships and expand access to the institutional investment community.

“We have a clear strategic vision for the Company and with our strong balance sheet and demonstrated cash flow generating capabilities, we are well positioned to achieve that vision.” said Jeff Fallows, President of Valens. “In the near term we are focussed on delivering on our existing contracts with industry leading partners, like Shoppers Drug Mart, to provide innovative white label product development and manufacturing services for vape cartridges, tinctures, gel capsules, beverages and topicals. Looking to the future, we will to continue to make strategic capital investments, both domestically and internationally, to improve our technical capabilities and grow our intellectual property portfolio as well as expand the Valens platform to new and strategic markets with the objective of creating long term value for our shareholders and all of our stakeholders.”

The management’s discussion and analysis for the period and the accompanying financial statements and notes are available under the Company’s profile on SEDAR at www.sedar.com.

| (1) | Adjusted EBITDA is a non-GAAP measure used by management that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies. Management defines adjusted EBITDA as income (loss) and comprehensive income (loss) from operations, as reported, before interest, tax, depreciation and amortization, and adjusted for removing share-based payments, unrealized gains and losses from short term investments and other one-time and non-cash items including impairment losses. Management believes adjusted EBITDA is a useful financial metric to assess its operating performance on an adjusted basis as described above. See “Reconciliation of non-IFRS measures” in the Company’s Management’s Discussion and Analysis for the period ended August 31, 2019 for additional information. |

Option Grant

On October 15, 2019, the Company granted 445,000 options to purchase common shares of the Company exercisable at a price of $2.79 per share and expiring on October 14, 2024, to certain new employees as the Company continues to strategically build out its leadership team. The options vest quarterly over a three-year period and are granted pursuant to the terms of the Company’s stock option plan, subject to regulatory approval.

Conference Call Details

The company will host a conference call on Wednesday, October 16, 2019 at 11am Eastern Time / 8am Pacific Time to discuss the financial results and business outlook.

Participant Dial-In Numbers:

Toll-Free: 1-877-407-0792

Toll / International: 1-201-689-8263

*Participants should request the Valens GroWorks Earnings Call or provide confirmation code 13695323

The call will be webcast on the Valens Investor page of the Company website at https://www.valensgroworks.com/investors or at this link. Please visit the website at least 15 minutes prior to the call to register, download, and install any necessary audio software. A replay of the call will be available on the Valens Investor page approximately two hours after the conference call has ended.

Tyler Robson, Chief Executive Officer, Chris Buysen, Chief Financial Officer, Jeff Fallows, President, and Everett Knight, Executive Vice President of Strategy & Investments will be conducting a question and answer session following the prepared remarks.

About Valens GroWorks

Valens GroWorks Corp. (TSXV: VGW) (OTC: VGWCF) is a multi-licensed, vertically-integrated cannabis company focussed on being the partner of choice for leading Canadian and international cannabis brands by providing best-in-class, proprietary services including CO2, ethanol, hydrocarbon, solvent-less and terpene extraction, analytical testing, formulation and white label product development. Valens is the largest third-party extraction Company in Canada with an annual capacity of 425,000 kg of dried cannabis and hemp biomass at our purpose-built facility in Kelowna, British Columbia which is in the process of becoming European Union (EU) Good Manufacturing Practices (GMP) compliant. Additionally, our subsidiary Valens Labs is a Health Canada licensed ISO 17025 accredited cannabis testing lab providing sector-leading analytical services and has partnered with Thermo Fisher Scientific to develop a Centre of Excellence in Plant-Based Science. For more information, please visit https://valensgroworks.com. The Company’s investor deck can be found specifically at https://valensgroworks.com/investors/

Notice regarding Forward Looking Statements

This news release contains certain “forward-looking statements” within the meaning of such statements under applicable securities law. Forward-looking statements are frequently characterized by words such as “anticipates”, “plan”, “continue”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed”, “positioned” and other similar words, or statements that certain events or conditions “may” or “will” occur. These statements are only predictions. Various assumptions were used in drawing the conclusions or making the projections contained in the forward-looking statements throughout this news release. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The Corporation is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.