In a rare sign of uplifting sentiment for the marijuana industry, investors are responding to new key hires at the executive level for producer Tilray.

Cannabis producer Tilray (NASDAQ:TLRY) jumped over 20 percent in value after announcing new additions to its C-suite.

The company confirmed on Tuesday (January 14) that it has hired former Revlon (NYSE:REV) commercial executive Jon Levin as its chief operating officer, while Michael Kruteck, a former executive with privately held Pharmaca Integrative Pharmacy most recently and Molson Coors Beverage (NYSE:TAP,TSX:TAP) previously, has joined as its new chief financial officer.

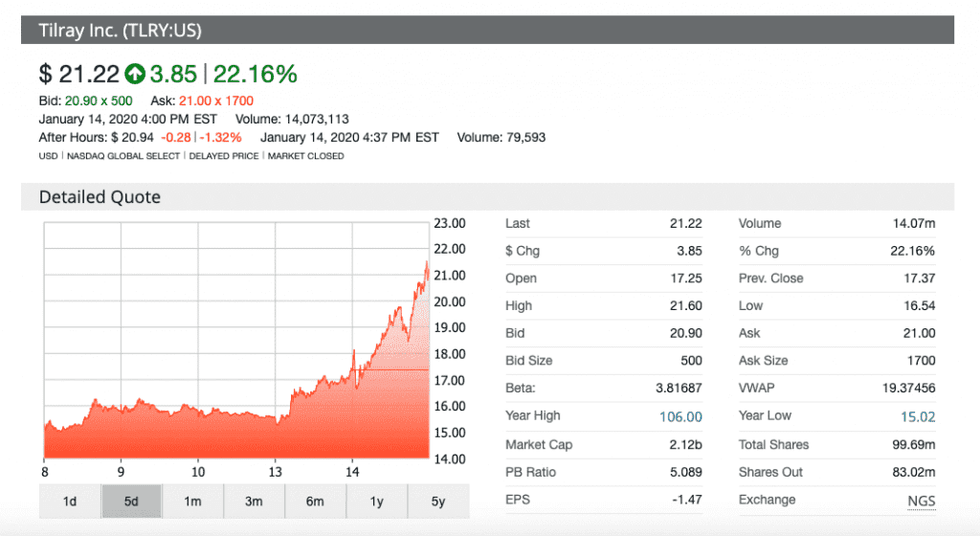

Shares of the company closed Tuesday’s session at US$21.22, representing a 22.31 percent hike for the day. During after-hours trading, the firm was up an additional 0.85 percent as of 4:23 p.m. EST.

“Jon and Michael come to Tilray with extensive expertise in their respective fields and we look forward to their contributions as we pioneer the future of cannabis and hemp around the world,” Brendan Kennedy, CEO of Tilray, said in a press release.

Last year, Tilray was hit with severe share price and valuation drops as part of a grueling year for the marijuana industry. In 2019, the share price of the company declined by 76.74 percent, resulting in a loss per share of US$53.68. The company finished the year with a share price of US$16.27.

Tilray has faced one of the most volatile paths in the cannabis stock market since its original initial public offering in 2018. The company originally faced a frenetic trading pace, which led it to at one point be priced at US$300 per share.

Last summer, Tilray pursued a deal with its largest investor, Privateer Holdings, in order to lock up the shares owned by Privateer and create special restrictions for them.

“We believe this transaction will give Tilray greater control and operating flexibility, while allowing us to effectively manage our public float,” Mark Castaneda, who was chief financial officer for Tilray at the time, said about the deal.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.