The Flowr Corporation Announces Third Quarter 2019 Results and Provides Corporate Update

The Flowr Corporation herein announces its financial and operational results for the third quarter ended September 30, 2019.

The Flowr Corporation (TSXV:FLWR, OTC:FLWPF) (“Flowr” or the “Company”) herein announces its financial and operational results for the third quarter ended September 30, 2019. In addition, the Company is providing a comprehensive corporate update to supplement third quarter 2019 results.

Select recent operational and financial highlights since the beginning of the third quarter 2019 include:

- The Company generated gross revenue of approximately $2.1 million and net revenue of approximately $1.3 million net of excise taxes, pricing concessions and product returns. These figures exclude approximately $0.3 million of design and construction fees earned from Hawthorne Canada Limited in relation to the construction of the research and development (“R&D”) facility on its Kelowna Campus;

- The Company closed on the remaining 80.2% interest in Holigen Holdings Limited (“Holigen”) in August 2019, creating a global cannabis Company with access to 7 million square feet of anticipated low cost EU-GMP compliant outdoor grown cannabis in southern Portugal, to supply the emerging and rapidly growing European and Australasian medicinal cannabis markets;

- The Company completed its first outdoor and poly-film shade-house harvest from Flowr Forest, yielding approximately 3,100 kilograms;

- The construction of Kelowna 1, Flowr’s flagship indoor facility, is substantially complete and the final evidence package for licensing has been submitted to Health Canada for approval which when approved will double the number of grow rooms in operation; and

- The Company strengthened its financial position with the closing of a $43.5 million equity financing in August 2019, and a $25 million credit facility (with a first tranche of gross funding on closing of approximately $20 million) in November 2019.

The Company’s progress to-date has positioned Flowr to achieve its objective to be cash flow positive in the second half of 2020, which is aided by the Company’s efficient infrastructure footprint that supports addressing the global recreational and medical market from three locations.

MANAGEMENT COMMENTARY

“Our third quarter revenues were short of expectations as we continued to manage construction and production activities as well as ramp up sales and marketing. While we are disappointed in the delay of our commercial ramp up, we are excited to be exiting 2019 with our infrastructure now in place globally and we are confident in our ability to effectively scale our business in 2020. Our strategy is driven by a focus on building the right facilities, meaning no large-scale greenhouses, and growing quality product consumers want, instead of targeting scale before proving out our business. In Canada, we are on pace to end the year with our most significant capital expenditures complete and, for the first time, we will be operating without the additional burden of cultivating while simultaneously completing construction on our flagship indoor facility. In addition, we are in the process of introducing new genetics into our production to drive further operational improvements and enhance our product mix. We continue to believe that the Canadian industry will be in short supply of premium dry flower.” commented Vinay Tolia, Flowr’s Chief Executive Officer. “Subsequent to quarter end, we completed our first harvest at Flowr Forest. More than half of that harvest was flash frozen in anticipation of producing live resin products including vape pens, that we believe will give us a highly differentiated product offering.

“Globally, we continue to target an enormous opportunity from an efficient footprint as the integration of Holigen is advancing as expected. We continue to invest significantly in our global operations and our first cannabis harvest from Portugal is expected later this year. Additionally, we are advancing the EU-GMP certification process for Sintra, our indoor cultivation and manufacturing facility in Portugal, with an eye on having GMP compliant product available for sale in early 2020. Based on demand for EU-GMP compliant product in Germany, Australia, and other countries, we believe we are well positioned to distribute products into these underserviced markets.”

THIRD QUARTER 2019 RESULTS

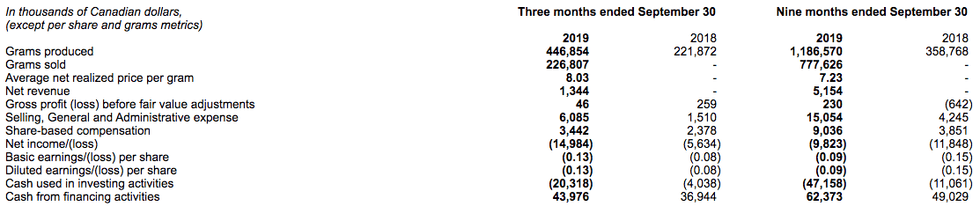

The following table summarizes the Company’s key financial and operational results:

- During the third quarter of 2019, the Company produced 447 kilograms of dried cannabis, a decrease of 3% compared to the second quarter. The primary reason for this decrease was the use of two rooms within Kelowna 1 in the second quarter and into the beginning of the third quarter to support clone production in preparation for planting the Flowr Forest and for shipment to Portugal for both indoor and outdoor grows, rather than using those rooms for growing product. As a result, indoor production was reduced by approximately 120 kg and these rooms were not propagated until the middle of the third quarter, with production harvested too late to be sold during the third quarter.

- Net revenue for the third quarter was approximately $1.3 million. Revenues were impacted by the concurrent construction and production activities at Kelowna 1, as well as the timing of the propagation of clones for Flowr Forest, the Company’s outdoor and shade-house facility, as well as our assets in Portugal.

- Furthermore, third quarter net revenue reflected approximately $0.4 million in provisions for product returns and pricing adjustments. The majority of the provisions were due to slower selling strains that the Company is sunsetting in favor of new genetics which the Company believes will better address consumer demand. The Company’s production planning and sales during the first year of legalized recreational cannabis in Canada were hindered by the lack of reliable consumer insights. Going forward, the Company is prioritizing data acquisition to ensure its production planning is driven by consumer insights and that its portfolio of finished products will address consumers’ preferences.

The Company expects production from 10 rooms during most of the fourth quarter to support an increase in sales volumes.

The following table summarizes the Company’s financial results for the three and nine months ended September 30, 2019:

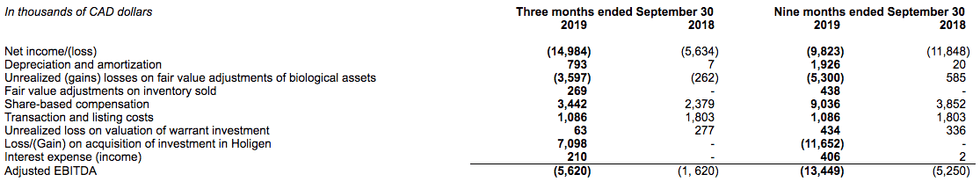

Adjusted EBITDA (Non-IFRS Measure)

Adjusted EBITDA is defined as net loss, plus (minus) income taxes (recovery), plus (minus) interest income (expense), net, plus depreciation and amortization, plus share-based compensation, plus (minus) non-cash fair value adjustments on biological assets and inventory sold, plus listing expense costs and plus (minus) loss (gain) on investments. Management believes this measure provides useful information as it is a commonly used measure in the capital markets and as it is a close proxy for repeatable cash used by operations.

For a full discussion of Flowr’s operational and financial results for the three and nine months ended September 30, 2019, please refer to the Company’s third quarter 2019 Management’s Discussion & Analysis and Financial Statements, which have been filed on SEDAR.

CANADIAN OPERATIONS

The Company is advancing its plan for its Kelowna Campus to be a single hub for all aspects of cultivation, processing and packaging to service the Canadian cannabis market. The Company has only invested in either highly controlled indoor growing environments (like Kelowna 1) or low cost outdoor and shade-house production for extraction (like Flowr Forest). Notably, the Company has not invested in expensive greenhouses which it believes are undesirable growing facilities given they cannot produce high quality premium smokable products and at the same time, are much more expensive to build and operate than low cost outdoor and shade-house grows providing similar quality inputs for extraction.

Kelowna 1 Indoor Facility

Kelowna 1 is a state-of-the-art indoor facility that allows for a highly controlled cultivation environment, which the Company expects will produce some of the highest caliber dried flower available in Canada. When Kelowna 1 is fully licensed and “dialed in”, the Company expects to produce approximately 10,000 kg of premium cannabis per year.

- Construction of the 85,000 square foot facility is largely complete and is expected to be fully operational in early 2020 pending Health Canada approval.

- Currently, 10 of the planned 20 rooms are licensed and fully operational, with the remaining rooms to come online when they are licensed. The evidence package and licensing application for rooms 11-20 have been submitted to Health Canada. The Company expects to double its operating capacity with all 20 grow rooms projected to be operational in the first quarter of 2020 with production from new rooms coming online in the second quarter onwards, with a deliberate staggering to ensure efficient turnover of production rooms.

- The Company is in receipt of an automated packaging line with installation and commissioning pending licensing of the remainder of Kelowna 1.

- Flowr plans to deliver finished products from new genetics into the marketplace in 2020, which are expected to deliver higher yields as well as support the rollout of an expanded line of high THC products.

- The Company expects to continue to realize premium pricing relative to the broader adult-use market.

- The total capex for Kelowna 1 is estimated at $36.8 million, all of which is already funded.

Flowr Forest Outdoor and Greenhouse Facility (“Flowr Forest”)

Flowr Forest is located adjacent to Kelowna 1 and currently consists of 42 poly-film shade-houses totaling 189,000 square feet and an outdoor cultivation area of 150,000 square feet. With a full year to harvest, Flowr Forest is expected to produce 10,000 kilograms per annum. Flowr Forest is also licensed for storage of harvested cannabis. The Company’s is planning to launch a live resin vape offering as its first extract product, with other concentrates to follow.

- The Company completed the first harvest of the outdoor area on October 11, 2019, with the shade-houses completed in early November 2019. In total, the Company harvested approximately 3,100 kilograms of dried flower equivalent. The initial harvest should provide sufficient cannabis for the planned 2020 launch of Flowr’s extract product offerings in Canada.

- Flowr Forest is expected to be propagated with its next harvest in the second quarter of 2020.

- The Company believes it will have its live resin vape offering available in the market in the second half of 2020. Revised timing is due to a more modest development schedule and changes to planned extraction infrastructure installation.

- The Company currently expects all the required infrastructure for a live resin vape offering and other extracts to be in place by the end of the first quarter of 2020.

Flowr/Hawthorne R&D Facility (“R&D Facility”)

Flowr and Hawthorne have entered a strategic R&D alliance to build a state of the art, 60,000 square foot R&D Facility, the 1st of its kind in Canada.

- Construction of the R&D Facility continues to progress, and the Company expects to submit the evidence package to license the first floor in the first quarter of 2020.

GLOBAL OPERATIONS

In Europe, the Company is focusing its international efforts on the construction of an indoor cultivation and processing facility in Sintra, Portugal, and a large-scale outdoor cultivation and partial processing facility in Aljustrel, Portugal. The Company is targeting first revenue from its European operations in the first half of 2020 with a more meaningful contribution and an accelerated ramp-up during the second half of 2020. The Company is in the process of establishing sales and distribution channels in Europe and Australia, which are expected to provide an entry to deliver medicinal cannabis to currently underserviced markets.

Portugal

Sintra, Portugal Indoor Facility

Sintra is an indoor cultivation, extract processing and finished product packaging facility. Construction of the facility is 70 per cent complete.

- The Company had its final GMP inspection in September 2019 and pending final approval, the Company anticipates receipt of EU-GMP certification in early 2020. This certification is a critical step to the production and sales of a high value medicinal product which can be distributed to any country where federally legal medicinal cannabis frameworks exist.

- Three cultivation rooms are complete with the first harvest from the first room expected in December 2019. All three rooms are expected to be propagated with plants by year end.

- Completion of the remaining three grow rooms for a total of six in the facility is expected in the first quarter of 2020.

- The oil extraction infrastructure is expected to be installed and operational in the second quarter of 2020 with GMP packaging expected to be online by mid-2020.

- Based on current timelines, the Company expects to begin commercial sales of dried cannabis flower in the first quarter of 2020 and of cannabis oils by mid-2020, pending all regulatory approvals.

- At full capacity, Sintra is expected to grow up to approximately 3,000 kilograms of dried flower and process up to 30,000kgs of flower into derivative products using inputs from our substantial outdoor grow in Aljustrel.

Aljustrel, Portugal

Aljustrel is a 7 million square foot outdoor cultivation facility which the Company expects will include a partial extraction and processing facility. Flowr’s Aljustrel asset has been deemed a Project of National Interest by the Portuguese Government, the only cannabis related project to receive this designation. The Company expects a phased ramp up of production at Aljustrel to match capacity with the revenue potential of an expanding European medicinal cannabis market.

- 100,000 square feet of cultivation area was initially propagated in August 2019. This initial crop is expected to be completed by the end of the year.

- In 2020, the Company expects to deliver a minimum of two harvests from approximately 1,000,000 square feet of planted cultivation area for each harvest. The Company expects these harvests to yield approximately 15,000 – 30,000 kilograms of dry flower.

Australia

The Company maintains its GMP compliant packaging facilities in Australia, which were obtained in November 2018. Flowr expects its assets in Australia to be a hub for distribution and sales of medicinal cannabis into the Australasian region.

FINANCIAL UPDATE

- As of September 30, 2019, the Company has cash and cash equivalents of approximately $25 million, which is sufficient to complete the above development plans as well as ongoing corporate requirements.

- The Company anticipates becoming cash flow positive in the second half of 2020 spurred by the expected completed ramp-up of Kelowna 1, the beginning of sales of its live resin vape offering and the ramp-up of its European operations.

- Recently, the Company closed a $25 million non-dilutive credit facility (“the ATB Facility”) with a syndicate of lenders led by ATB Financial, with a first tranche of funding on closing of approximately $20million (subject to certain holdbacks), giving the Company sufficient liquidity to meet its near-term strategic objectives.

The board of directors of the Company (the “Board”) has approved the granting of 10,000 incentive stock options (the “Options”) and 140,000 restricted share units (the “RSUs”) to a certain officer and a director of the Company. The Options are exercisable at a price of CAD$3.08 per share for a period of five years. The Options will vest in equal tranches of thirty-three and one-third percent (33⅓%) over a period of three years. The RSUs will vest in equal tranches of thirty-three and one-third percent (33⅓%) over a period of three years.

CONFERENCE CALL AND WEBCAST

The Company will host a conference call and webcast to review these results today at 5:30 p.m. Eastern Time.

Conference call and webcast details are as follows:

| Toll Free: 1-833-227-5845 | |

| Toll/International: 1-647-689-4072 | |

| Webcast: flowr.ca/investors |

Conference call replay details are as follows:

| Toll Free: 1-800-585-8367 | |

| Toll/International: 1-416-621-4642 | |

| Passcode: 8052839 | |

| Webcast: flowr.ca/investors |

The replay of the conference call will be available through midnight on Tuesday, December 3, 2019.

About The Flowr Corporation

The Flowr Corporation is a Toronto-headquartered cannabis company with operations in Canada, Europe, and Australia. Its Canadian operating campus, located in Kelowna, BC, includes a purpose-built, GMP-designed indoor cultivation facility; an outdoor and greenhouse cultivation site; and a state-of-the-art R&D facility that is currently under construction. From this campus, Flowr produces recreational and medicinal products. Internationally, Flowr intends to service the global medical cannabis market through its subsidiary Holigen, which has a license for cannabis cultivation in Portugal and will operate GMP-designed manufacturing facilities in Portugal and Australia.

Flowr aims to support improving outcomes through responsible cannabis use and, as an established expert in cannabis cultivation, strives to be the brand of choice for consumers and patients seeking the highest-quality craftsmanship and product consistency across a portfolio of differentiated cannabis products.

For more information, please visit flowr.ca or follow Flowr on Twitter: @FlowrCanada and LinkedIn: The Flowr Corporation.

On behalf of The Flowr Corporation:

Vinay Tolia

CEO and Director

CONTACT INFORMATION:

MEDIA:

Sean Griffin

Vice President, Communications & Public Relations

(877) 356-9726 ext. 1526

sean.griffin@flowr.ca

INVESTORS:

Thierry Elmaleh

Head of Capital Markets

(877) 356-9726 ext. 1528

thierry@flowr.ca

Forward-Looking Information and Statements

This press release contains “forward-looking information” within the meaning of Canadian Securities laws, which may include but is not limited to: the Company being in a position to scale business in 2020; Flowr having access to 7 million square feet of low cost EU-CMP compliant outdoor grown cannabis to supply the emerging and rapidly growing European and Australasian medicinal cannabis markets; Flowr doubling the number of grow rooms in operation at Kelowna 1; Flowr being positioned to achieve its objective to be cash flow positive in the second half of 2020; Flowr’s objective to be cash flow positive in the second half of 2020 being aided by the Company’s efficient infrastructure footprint that supports addressing the global recreational and medical market; the Company’s progress towards its objectives and those objectives positioning the Company for long term success; the Company being on pace in Canada to complete 2019 with its most significant capital expenditures complete; the Company operating without the additional burden of cultivating while simultaneously completing construction at Kelowna 1; new genetics driving further operational improvements and enhancing the Company’s product mix; the Company’s belief that the Canadian industry will continue to experience short supply of premium dry flower; the anticipated launch of the Company’s live resin products, including vape pens; the Company’s belief that live resin products, including vape pens, will give the Company a highly differentiated product offering; Flowr continuing to target an enormous opportunity from an efficient footprint; the Company’s expectations, including timing, for the first harvest from Portugal; the Company’s expectations for EU-GMP certification at its Sintra facility; the Company’s expectation that it will have GMP compliant product for sale in early 2020; the timing of the initial crop and harvesting thereof at Aljustrel; the Company’s belief that it is well positioned to distribute EU-GMP compliant product into underserviced markets; the Company’s belief that sun setting certain strains in favour of new genetics will address consumer demand; the Company prioritizing data acquisition to ensure production planning is driven by consumer insights and that its portfolio of finished products will address consumer preference; the Company’s expectation that production from additional grow rooms during the fourth quarter will support an increase in sales volume; Flowr advancing its plan for its Kelowna Campus to be a single hub for all aspects of cultivation, processing and packaging to service the Canadian cannabis market; the Company’s belief that expensive greenhouses are undesirable growing facilities; the Company’s expectation that Kelowna 1 will produce some of the highest caliber dried flower available in Canada; the Company’s expectations for production capacity at Kelowna 1 once it is fully licensed and “dialed in”; the timeline for Kelowna 1 becoming fully operational; the Company’s expectation that it will double its operating capacity at Kelowna 1 in the first quarter of 2020; the anticipated timing of the Kelowna 1 grow rooms becoming operational and producing product; the anticipated timeline for installing an automated packaging line at Kelowna 1; Flowr delivering finished products from new genetics into the marketplace in 2020; Flowr’s expectation that new genetics will deliver higher yields as well as support the rollout of an expanded line of high THC products; the Company’s expectation for Kelowna 1’s production run-rate at the end of 2020; the Company’s expectation that it will continue to realize premium pricing relative to the broader adult-use market; the estimated total capex for Kelowna 1 and such capex being fully funded; the expected production per annum at Flowr Forest; the Company’s plan to launch a live resin vape offering as its first extract product; the anticipated timing for the launch of a live resin vape product, including the timing for all required infrastructure related thereto being in place; the Company’s intention to launch other concentrate products; the initial harvest at Flowr Forest being sufficient for the planned launch in 2020 of Flowr’s extract product offerings in Canada; the Company’s expectations for propagation and harvesting Flowr Forest in 2020; the anticipated timing for submitting an evidence package to license the first floor of the R&D Facility; the construction of facilities in Portugal; the anticipated timing for revenue from the Company’s European operations; the Company’s expectations with respect to establishing sales and distribution channels in Europe and Australia to deliver medicinal cannabis to underserviced markets; the anticipated timing for receipt of EU-GMP certification and the timing thereof; the anticipated timing for harvests, propagation, completion of construction and installation of extraction infrastructure at the Company’s Sintra facility; the Company’s expectations for the commencement of GMP packaging and commercial sales in Europe; the Company’s expectations for annual production and processing capacity at its Sintra facility; the Company’s expectation that its Aljustrel facility will include a partial extraction and processing facility; the Company’s expectations regarding a phased ramp up of production at its Aljustrel facility; the anticipated timelines for harvesting an initial crop at the Company’s Aljustrel facility; the Company’s expectations for harvests at its Aljustrel facility in 2020; Flowr’s expectation that its assets in Australia will be a hub for distribution and sales of medicinal cannabis into the Australasian region; the Company’s expectations regarding becoming cash flow positive, including the timing thereof and contributing factors thereto; Flowr servicing the global medical cannabis market and operating GMP-designed manufacturing facilities in Portugal and Australia; Flowr supporting improving outcomes through responsible cannabis use and striving to be the brand of choice for consumers and patients seeking highest-quality craftmanship and product consistency; and Flowr’s business, production and products and Flowr’s plans to provide premium quality cannabis to adult use recreational and medical markets. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “is expected”, “expects”, “scheduled”, “intends”, “contemplates”, “anticipates”, “believes”, “proposes” or variations (including negative and grammatical variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Such information and statements are based on the current expectations of Flowr’s management and are based on assumptions and subject to risks and uncertainties. Although Flowr’s management believes that the assumptions underlying such information and statements are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this press release may not occur by certain specified dates or at all and could differ materially as a result of known and unknown risk factors and uncertainties affecting Flowr, including risks relating to: Flowr’s inability to scale its business in 2020, which could materially adversely impact its financial condition and result in breach of its debt arrangements; Flowr being unable to complete its initial crop and harvest at Aljustrel, which could materially adversely impact its competitive position globally and its business and operations; Flowr being unable to access 7 million square feet of low cost EU-CMP compliant outdoor grown cannabis to supply the emerging and rapidly growing European and Australasian medicinal cannabis markets; the additional grow rooms at Kelowna 1 not becoming operational as anticipated or at all; Flowr being unable achieve its objective to be cash flow positive in the second half of 2020; Company’s infrastructure being unable to support Flowr’s objective to be cash flow positive in the second half of 2020; the Company’s being unable to complete its objectives and/or those objectives not positioning the Company for long term success; the Company being unable to get the additional grow rooms at Kelowna 1 operational and producing product in the timelines described herein, which would materially adversely impact its ability to meet its revenue targets in 2020 and also become cash flow positive; the Company not completing its most significant capital expenditures in Canada in 2019; the Company needing to continue cultivating while simultaneously completing construction at Kelowna 1; new genetics not driving further operational improvements and/or enhancing the Company’s product mix; the Canadian industry not being in short supply of premium dry flower; the failure to launch the Company’s live resin products, including vape pens, and/or the failure of such products after launch; live resin products, including vape pens, not providing the Company a highly differentiated product offering; the Company’s expectations, including timing, for the first harvest from Portugal not being realized; the Company’s expectations for EU-GMP certification at its Sintra facility not being realized; the Company not having GMP compliant product for sale in early 2020; the Company not being well positioned to distribute EU-GMP compliant product into underserviced markets; the Company being unable to address consumer demand with new genetics; the Company being unable to prioritize data acquisition to ensure production planning is driven by consumer insights and that its portfolio of finished products will address consumer preference; production from additional grow rooms during the fourth quarter not being able to support an increase in sales volume; Flowr being unable to advance its plan for its Kelowna Campus to be a single hub for all aspects of cultivation, processing and packaging to service the Canadian cannabis market; Kelowna 1 being unable to produce high caliber dried flower; production capacity at Kelowna 1 once it is fully licensed and “dialed in” being less than expected; Kelowna 1 not becoming fully operational in the anticipated timeframe or at all; the Company being unable to double its operating capacity at Kelowna 1 in the first quarter of 2020; the Company being unable to install an automated packaging line at Kelowna 1 in the anticipated timeframe or at all; Flowr being unable to deliver finished products from new genetics into the marketplace in 2020; new genetics not delivering higher yields and/or not supporting the rollout of an expanded line of high THC products; Kelowna 1 being unable to reach the anticipated production run-rate at the end of 2020; the Company not realizing premium pricing relative to the broader adult-use market; any inaccuracies in the estimated total capex for Kelowna 1; Flowr Forest’s production per annum being less than anticipated; the Company being unable to execute its plan to launch a live resin vape offering as its first extract product, including with respect to anticipated timing; the Company being unable to launch other concentrate products; the initial harvest at Flowr Forest being insufficient for the planned launch in 2020 of Flowr’s extract product offerings in Canada; the Company being unable to satisfy its expectations for propagation and harvesting Flowr Forest in 2020; the Company not submitting an evidence package to license the first floor of the R&D Facility in the anticipated timeframe or at all; the inability to complete construction of facilities in Portugal in a timely fashion or at all; the inability to realize revenue from the Company’s European operations within the anticipated timeframe or at all; the Company being unable to establish sales and distribution channels in Europe and Australia to deliver medicinal cannabis to underserviced markets; the Company not receiving EU-GMP certification within the anticipated timeframe or at all; any failure to realize expectations with respect to the anticipated timing for harvests, propagation, completion of construction and installation of extraction infrastructure at the Company’s Sintra facility; the Company being unable to commence GMP packaging and commercial sales in Europe within the anticipated timeframe or at all; the Company being unable to realize expectations for annual production and processing capacity at its Sintra facility; the inability to complete a partial extraction and processing facility at the Company’s Aljustrel facility; the Aljustrel facility being unable to complete a phased ramp up of production; the inability to harvest an initial crop at the Company’s Aljustrel facility within the anticipated timeframe or at all; the Company’s inability to realize expectations for harvests at its Aljustrel facility in 2020; Flowr’s assets in Australia not being a hub for distribution and sales of medicinal cannabis into the Australasian region; the Company being unable to become cash flow positive within the anticipated timeframe or at all; Flowr being unable to service the global medical cannabis market and/or operate GMP-designed manufacturing facilities in Portugal and Australia; Flowr being unable to support improving outcomes through responsible cannabis use and/or striving to be the brand of choice for consumers and patients seeking highest-quality craftmanship and product consistency; the construction and development of Holigen’s and the Company’s cultivation and production facilities; general economic and stock market conditions; adverse industry events; loss of markets; future legislative and regulatory developments in Canada and elsewhere; the cannabis industry in Canada generally; the ability of Flowr to implement its business strategies; Flowr’s inability to produce or sell premium quality cannabis, risks and uncertainties detailed from time to time in Flowr’s filings with the Canadian Securities Administrators; and many other factors beyond the control of Flowr.

Although Flowr has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information or statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking information or statement can be guaranteed. Except as required by applicable securities laws, forward-looking information and statements speak only as of the date on which they are made and Flowr undertakes no obligation to publicly update or revise any forward-looking information or statements, whether as a result of new information, future events or otherwise. When considering such forward-looking information and statements, readers should keep in mind the risk factors and other cautionary statements in Flowr’s Annual Information Form dated April 3, 2019 (the “AIF”) and filed with the applicable securities regulatory authorities in Canada. The risk factors and other factors noted in the AIF could cause actual events or results to differ materially from those described in any forward-looking information or statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Click here to connect with The Flowr Corporation (TSXV:FLWR) for an Investor Presentation.