While not as recognizable as its competitors, the NEO Exchange is taking advantage of US cannabis market policies to appeal to more investors.

Canada’s NEO Exchange launched two new marijuana funds focused exclusively on the US market last month, and the exchange’s operators expect trading volumes to match those seen on the Toronto Stock Exchange (TSX).

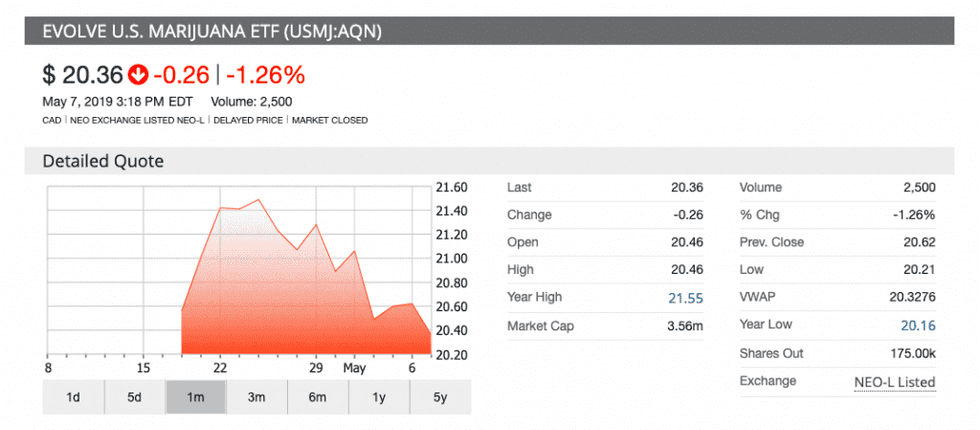

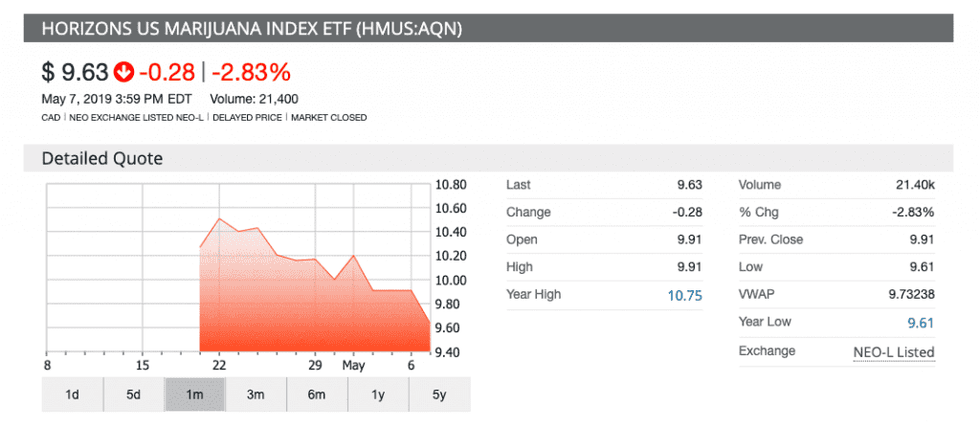

In April, exchange-traded fund (ETF) firms Evolve Funds Group and Horizons ETFs Management (Canada) raced to launch two new NEO Exchange-listed funds that provide exposure the US cannabis market.

While the NEO Exchange doesn’t hold the same instant recognition factor as the TMX Group (TSX:X) exchanges or the Canadian Securities Exchange (CSE) — which has risen in profile thanks to a plethora of marijuana listings — the Toronto-based exchange is angling for more interest from the marijuana investment community with these offerings.

Jos Schmitt, president and CEO of the NEO Exchange, told the Investing News Network (INN) that, since the exchange launched in 2015, it has started to gain more attention from the market instead of having to conduct a lot of outreach to gain exposure as it did previously.

“Clearly we are moving now in a period where there was a lot of focus on US marijuana firms,” Schmitt told INN. “There’s a lot of interest in that space.”

Case in point — the two firms launched new funds on the NEO Exchange with a shared goal: to offer investors a play in the fast-paced US cannabis market.

Similar to larger sibling funds from the same firms, the main distinction between the Horizons US Marijuana Index ETF (NEO:HMUS) and the Evolve US Marijuana ETF (NEO:USMJ) is active management.

The Evolve fund is actively managed by Elliot Johnson, chief investment officer and chief operating officer for Evolve ETFs and manager of the Evolve Marijuana Fund.

“We know how US companies tend to dominate globally … One would expect at some point (that) some of these US companies will become leaders,” Johnson previously told INN.

He explained that the US market is poised for some developments in 2019 as policy regulation in the country could offer relief to the existing companies in an industry that still faces federal illegality.

“As the US continues to further liberalize its marijuana regulations, we anticipate that more investors will be looking to invest in companies with significant business operations in the US market, and HMUS will provide a diversified and liquid way to gain that exposure in one ETF,” Steve Hawkins, president and CEO of Horizons ETFs, said in a press release.

The Horizons US Marijuana Index ETF is the second marijuana ETF from Horizons to trade on the NEO Exchange. In February 2018, the firm launched the Horizons Emerging Marijuana Growers Index ETF (NEO:HMJR).

Both Horizons and Evolve also manage existing TSX-listed ETFs that offer exposure to the larger marijuana market.

The Evolve Marijuana Fund (TSX:SEED), the firm’s first marijuana ETF, made its public debut in February 2018, while the Horizons Marijuana Life Sciences Index ETF (TSX:HMMJ) launched in April 2017. Neither holds US assets. Since then both funds have grown in listings and in returns offered to investors.

In September 2018, the Life Sciences ETF crossed the C$1 billion mark in assets under management, while the Evolve Marijuana Fund reported returns of 40.63 percent over a one year period since launch.

We opened NEO this morning with @HorizonsETFs to celebrate the recent launch of the world’s first US Cannabis Index ETF – the Horizons US Marijuana Index ETF $HMUS @swordless @HorizonsHawk https://t.co/7WvQ41Fy3I pic.twitter.com/axTDaP4MD8

— NEO Exchange (@Aequitas_NEO) May 3, 2019

Exchanges in Canada elect to not block US marijuana trade

The reason these two new US-centric funds launched on the NEO Exchange is because the TSX won’t allow any issuers to participate in the US market while cannabis remains illegal at the federal level.

While investors and companies have asked for a re-evaluation of this stance, exchange regulators remain committed to it.

During a panel at the Arcview Investor Forum in Vancouver, Anna Serin, director of listings development with the CSE, said the restrictions for the TSX are due to the risk factor associated with allowing business that remain technically illegal.

The NEO Exchange doesn’t block US marijuana operations from trading as long they acknowledge the risks they are exposed to in their prospectus, according to Johnson.

Schmitt told INN that the exchange made the decision to not prevent listings from operating in the US cannabis market.

“We’re fine to proceed with this; this is an area of growth,” Schmitt told INN, explaining the exchange’s comfort level when it decided to not prevent listings from operating in the US cannabis market.

“It’s an area of growth in Canada, it’s an area of growth in the US and it’s an area of growth globally.”

While the two new funds are trading on the NEO Exchange, a vast majority of the stocks used for the funds trade on the CSE.

This exchange has become a hub for multi-state operators, companies managing marijuana assets in legal US states that have gained popularity with investors.

Richard Carleton, CEO of the CSE, told Bloomberg in April that the exchange hosted 65 US marijuana listings. In 2018 these companies raised nearly US$3 billion.

“We have worked closely with the US cannabis industry over the last three-plus years to provide them with access to lower cost of capital, liquidity for early-stage investors and acquisition currency,” he said.

However, due to the status of the CSE as a venture exchange it can’t list ETFs, Johnson told INN in an email statement.

Investor takeaway

For now it remains to be seen if the launch of these new funds will become a major stepping stone for the NEO Exchange. It’s not hard to see how the strategy could attract more interest from investors.

Of course, as the cannabis market has shown in the past, volatility dominates the space, and it’s difficult to project how things will look moving forward.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.