Khiron Reports Q3 Fiscal 2019 Financial Results, With $47.9 Million Cash Balance and $2.8 Million in Quarterly Revenue

Khiron Life Sciences Corp. (TSXV:KHRN, OTCQB:KHRNF) announced today its financial results for the third quarter ended September 30, 2019.

Khiron Life Sciences Corp. (“Khiron” or the “Company”) (TSXV:KHRN, OTCQB:KHRNF), a cannabis company with core operations in Latin America announced today its financial results for the third quarter ended September 30, 2019. These filings are available for review on the Company’s SEDAR profile at www.sedar.com. All financial information in this press release is reported in Canadian dollars, unless otherwise indicated.

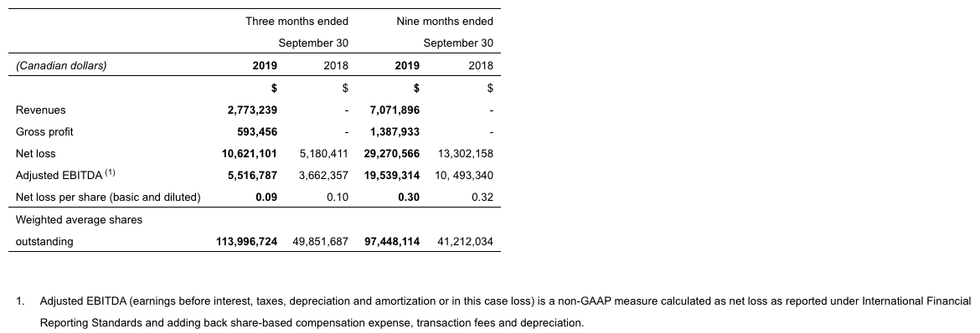

Summary of key financial results

Discussion of operations for three months ended September 30, 2019

The Company recorded a net loss for the three months ended September 30, 2019 of $10.6 million ($0.09 per share) compared to a net loss of $5.2 million for the same period in 2018. Adjusted EBITDA, which excludes mostly non-cash items, was $5.5 million for the three months ended September 30, 2019. The Company ended the quarter with a strong $47.9 million balance in cash and short-term investments.

Revenues of $2.8 million were recognized from the sale of services at its clinics (ILANS) and sale of its cosmeceutical products (Kuida), both of which commenced in the fourth quarter of 2018.

Revenues at ILANS in the third quarter increased 23% from the previous quarter at a healthy 20% gross margin. The increase in sales quarter over quarter was largely due to a higher number of surgical procedures at improved margins. It is expected that the fourth quarter will not sustain the same level revenues as the third quarter because traffic to the clinics is likely to slow down during the holiday season in December.

Awareness for Kuida CBD brand products continues to grow through the Company’s marketing channels and increased distribution networks, and the Company expects Kuida revenues to continue to strengthen in the fourth quarter of 2019 especially with the expansion into new markets outside of Colombia and the holiday shopping season.

Adjusted EBITDA was a loss of $5.5 million for the third quarter of 2019, which was $1.9 million higher than the prior year second quarter largely due to the growth of the business, which included cultivation and operating costs of $1.0 million as the Company prepares to manufacture and sell its first medicinal cannabis extracts, expected in January 2020, as well as increased marketing and selling costs to boost Kuida brand awareness as it enters new markets and adds SKUs.

The Company has a strong financial position at September 30, but the growth in revenues and cash inflows is contingent on advancements in cannabis related regulation globally. As a result, the Company is focused on allocating its capital towards countries where regulatory approvals appear more imminent. In Colombia, the low-cost cultivation facilities are being expanded and energy sources being improved at a total cost of approximately $3.7 million commencing in the fourth quarter of 2019. In Uruguay, the construction of the $10 million cultivation and processing facility in Juan Lacaze has been put on temporary hold pending further advancement in regulation. The licenses remain in good standing.

Management Commentary

Alvaro Torres, Khiron CEO and Director, commented: “We continue our positive momentum in executing our strategic initiatives. Revenues are improving at ILANS, we are adding SKUs to our Kuida CBD line and expanding into new markets, including our recent launch in the US. We are in a strong cash position to continue this momentum and we will sensibly find the right balance in prioritizing our cash spending needs and executing our growth plans.”

Mr. Torres continues, “Subsequent to the quarter we achieved several firsts; authorization for the commercialization of high THC cannabis for domestic sale and export, successful first sales of our Kuida CBD brand in the US, and we became the exclusive Latin America provider to Project Twenty21, the largest medical cannabis research study in Europe. As we grow our dominant market position and revenue in Colombia, we prudently continue to increase new market presence as regulations open for us, backed with a strengthened board, experienced leadership and committed operational teams.”

About Khiron Life Sciences Corp.

Khiron Life Sciences Corp. is positioned to be the dominant integrated cannabis company in Latin America. Khiron has core operations in Latin America and is fully licensed in Colombia for the cultivation, production, domestic distribution, and international export of both tetrahydrocannabinol (THC) and cannabidiol (CBD) medical cannabis. The company delivers best in class regulatory compliance, has the first approved set of CBD cosmetic products on shelf in Colombia, and is currently facilitating testing to meet and surpass all license requirements for commercial cannabis derived products.

With a focused regional strategy and patient oriented approach, the Company combines global scientific expertise, agricultural advantages, branded product market entrance experience and education to drive prescription and brand loyalty to address priority medical conditions such as chronic pain, epilepsy, depression and anxiety in the Latin American market of over 620 million people. The Company is led by Co-founder and Chief Executive Officer, Alvaro Torres, together with an experienced executive team, and a knowledgeable Board of Directors that includes former President of Mexico, Vicente Fox.

Cautionary Notes

Forward-Looking Statements

This press release may contain certain “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation. All information contained herein that is not historical in nature may constitute forward-looking information. Khiron undertakes no obligation to comment analyses, expectations or statements made by third-parties in respect of Khiron, its securities, or financial or operating results (as applicable). Although Khiron believes that the expectations reflected in forward-looking statements in this press release are reasonable, such forward-looking statement has been based on expectations, factors and assumptions concerning future events which may prove to be inaccurate and are subject to numerous risks and uncertainties, certain of which are beyond Khiron’s control, including the risk factors discussed in Khiron’s Annual Information Form which is available on Khiron’s SEDAR profile at www.sedar.com. The forward-looking information contained in this press release is expressly qualified by this cautionary statement and are made as of the date hereof. Khiron disclaims any intention and has no obligation or responsibility, except as required by law, to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

United States Disclaimer

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as such term is defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.