The “Ordinary People” singer said that PLUS’ commitment to producing high-quality product was a selling point for the partnership.

The hemp-derived cannabidiol (CBD) industry in the US gained a legendary new celebrity spokesperson this week.

PLUS Products (CSE:PLUS,OTCQX:PLPRF) announced on Tuesday (September 17) that it is teaming up with American singer-songwriter John Legend as a part of the nationwide launch for its first hemp-derived CBD product line.

The California-based cannabis and hemp edibles company said in a press release that Legend will be tasked with advocating for the new line on behalf of the firm.

“I have been a believer in the benefits of CBD for some time,” said Legend. The “Ordinary People” singer added that PLUS’ commitment to producing high-quality product was a selling point for the partnership.

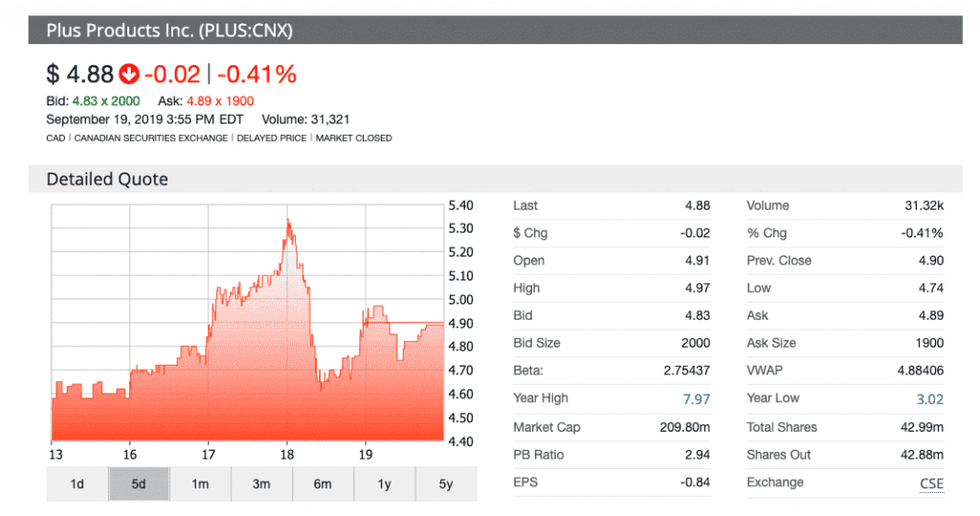

Shares for PLUS rose on Tuesday, starting the trading day at C$4.88 and closing at C$5.25, a value increase of 7.6 percent. As of 3:10 p.m. EDT on Thursday (September 19), the company was at C$4.89.

“We established our reputation in edibles by offering customers a consistent and precisely-dosed gummy using high-quality extracts,” said company CEO Jake Heimark.

The executive added that the PLUS CBD lines will expand from the firm’s home state of California to “nearly all fifty states overnight.”

PLUS’ new edibles line includes CBD gummies in three different flavors, and tout benefits for physical balance, energy and aiding sleep, the last of which is also a part of another partnership for the launch.

PLUS’ national launch comes thanks to the farm bill that was passed in the US last year. The bill legalized hemp, which effectively opened the doors for the production and sale of hemp-derived CBD products.

Legend not the only partnership for new PLUS products

Global sleep company Casper will be introducing PLUS’ new CBD and melatonin-infused sleep gummies to consumers.

“We’re always exploring new ways to improve sleep across the entire sleep arc — from sunset to sunrise,” Neil Parikh, chief strategy officer at Casper, said in a statement.

The CBD company reported total revenues of US$3.6 million in its second quarter this year, a 125 percent increase from the US$1.6 million in revenues reported in the same quarter last year.

There was also in increase in operating costs during the most recent quarter for the company. Costs totaled US$5.3 million in Q2 2019, up from US$1.3 million in Q2 2018, due to the hiring of key personnel and consulting fees, according to the company.

Celebrities join the industry

Legend joins a string of celebrities who have recently bought into CBD in the US. In July, rapper Jay-Z joined privately owned cannabis company Caliva as chief brand strategist. Whoopi Goldberg has also expressed her interest in the drug and has since created the Whoopi & Maya brand of cannabis-derived epsom salts and menstrual relief rubs.

Earlier this year, Martha Stewart joined forces with Canopy Growth (NYSE:CGC,TSX:WEED) to develop CBD products for the US market, through a partnership with Sequential Brands Group (NASDAQ:SQBG).

Similarly, rapper Wiz Khalifa holds a partnership with Canadian producer The Supreme Cannabis Company (TSX:FIRE,OTCQX:SPRWF) by way of his firm Khalifa Kush Enterprises.

“Canada is a very important place to me… it’s the perfect start for the international expansion of Khalifa Kush,” Khalifa said in a statement.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.