Green Thumb Industries Enters New Long-term REIT Agreement

Innovative Industrial Properties and Green Thumb Industries are reconnecting for a brand new cannabis real estate investment trust agreement.

A leading cannabis real estate investment trust (REIT) firm has signed a long-term deal with Green Thumb Industries (GTI) (CSE:GTII,OTCQX:GTBIF).

On Monday (February 3), Innovative Industrial Properties (IIP) (NYSE:IIPR) confirmed that its new partnership with the Illinois-based multi-state operator (MSO) will begin with a sale-leaseback transaction for a processing facility in Toledo, Ohio.

This isn’t the first agreement completed between the two firms, as last year the duo came together for a cultivation and processing facility sale-leaseback agreement in Danville, Pennsylvania.

Ben Kovler, GTI’s founder and CEO, said in a statement that the funds for the deal in Ohio will be used for expansion purposes.

“IIP provides a flexible real estate capital solution that effectively addresses our expansion needs at the processing facility in Toledo,” the GTI executive said.

The total agreed sum for the facility is US$7.2 million, given that GTI completes a list of undisclosed improvements to the operation. If the facility work is not completed, IIP will only pay US$2.9 million, according to the joint announcement from the US firms.

“GTI continues to distinguish itself with its cannabis product offerings and dedication to patient experience and right to well-being, providing safe, high quality cannabis products in a compassionate environment,” said Paul Smithers, president and CEO of IIP.

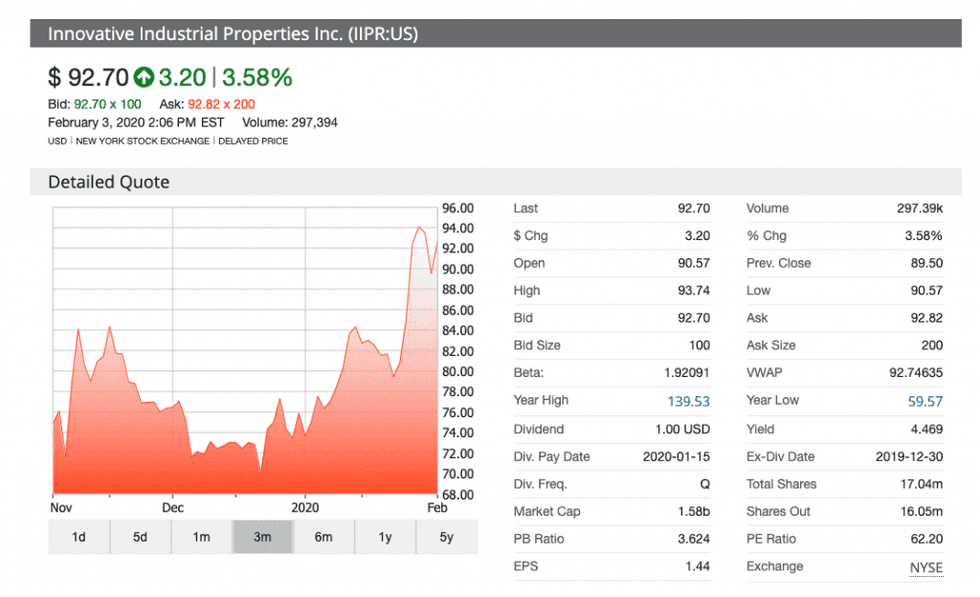

The market offered differing takes for each company on the announcement. Shares of IIP soared at open, and as of 1:30 p.m. EST were trading at US$92.74, representing an increase of 3.7 percent.

On the other hand, GTI shares dragged in Monday’s trading session with a 3.4 percent drop in value, resulting in a price per share of US$12.22.

IIP has quickly embedded itself as a capital solution for cannabis companies facing the harsher realities of the capital markets, thanks to the REIT strategy.

The REIT company has seen this interest reflected in its share price so far this year, experiencing a jump in value of over 20 percent. While most of the cannabis universe has struggled recently, IIP has continued to grow and offer investors access to a cannabis play while remaining compliant with regulations for the New York Stock Exchange.

In a previous interview with the Investing News Network (INN), Smithers said investors feel more comfortable with the company as it adheres strictly to real estate operations. With every deal completed, IIP does not obtain a stake in the cannabis company participant.

“We’re strictly a real estate company and I think there’s a certain group of investors that like that. It’s a little more stability than a company that is perhaps growing,” said Smithers.

MSOs in the US have embraced the REIT model, with fellow MSO Cresco Labs (CSE:CL,OTCQX:CRLBF) completing separate agreements with both IIP and GreenAcreage Real Estate.

“It becomes a higher operating cost that that company will incur for the term of the lease and some of these are 15 years, and they’re not very cheap,” Mike Regan, an analyst with Marijuana Business Daily’s Investor Intelligence, previously told INN. “But that’s still cheaper than going out of business.”

Shares of the REIT company have been added to the recently debuted Medical Cannabis & Wellness UCITS ETF (XETRA:CBDX). The fund trades in Europe and offers investors established cannabis plays with no connection to the recreational space in North America.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.