Delta 9 Secures Supply Deal and Investment from Auxly

Manitoba-based LP Delta 9 Cannabis will begin distributing edible products from Auxly’s line of brands. At the same time, Auxly bought nearly six million shares of the LP.

Two Canadian marijuana companies have expanded a partnership to include an investment agreement and a supply deal.

On Tuesday (February 25), cannabis licensed producer (LP) Delta 9 Cannabis (TSX:DN,OTCQX:VRNDF) confirmed it would begin distributing the edible and infused products from the diverse line-up of Auxly Cannabis Group (TSXV:XLY,OTCQX:CBWTF), both online and through its four Manitoba stores.

Alongside the supply partnership, Auxly will be investing C$16.25 million in Delta 9 by way of a nearly six million share purchase in the LP.

The new supply and investment agreement arrives on the heels of an existing partnership between the two public firms for cannabis product development.

John Arbuthnot, CEO of Delta 9, said the products from Auxly have captured the attention of consumers. He particularly highlighted products under the Foray and Kolab Project brand names.

“Delta 9 was one of our first strategic partners, and we are so excited to reaffirm our partnership and joint commitment to developing a robust platform for the recreational cannabis market across Canada,” Hugo Alves, CEO of Auxly.

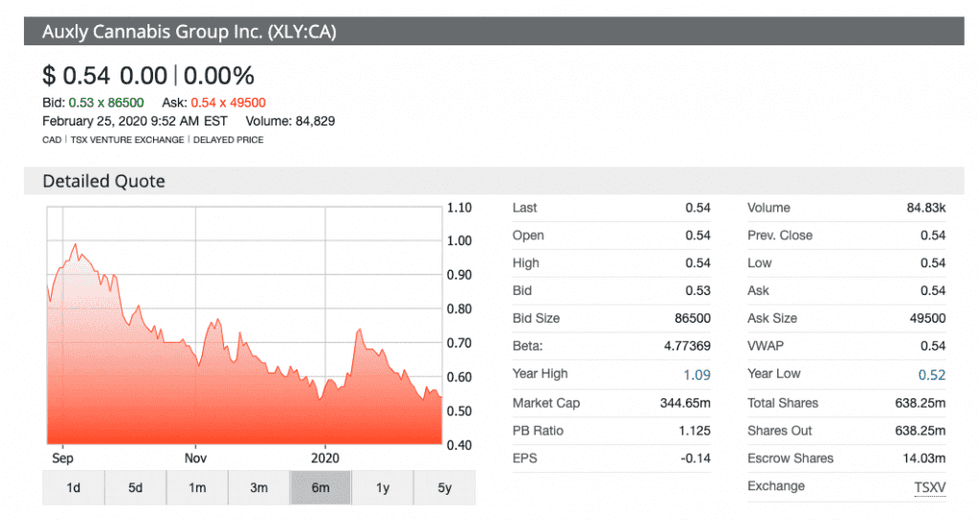

At the opening of Tuesday’s trading session, Delta 9 saw a minimal reaction to the supply deal and investment, while shares of Auxly dropped nearly 2 percent as of 10:23 a.m. EST.

The two partners have struggled in the open market given the state of the capital markets in relation to the marijuana industry, particularly in Canada where both companies are heavily focused at the moment.

After becoming CEO of Auxly last year, Alves told the Investing News Network (INN) that he viewed the launch of edible products in Canada, often referred to as the 2.0 stage of legalization in the country, as a reset for the entire industry.

Over the past six months, both companies have dropped in value by over 30 percent as the entire marijuana stock universe continues to struggle with critical issues of low sales and limited points of sale in specific Canadian markets.

Amid the increased pressure for cannabis firms, many players have been forced to make serious cuts in the workforce in order to better find the right operating balance. Bigger names in the industry, such as Tilray (NASDAQ:TLRY), Aurora Cannabis (NYSE:ACB,TSX:ACB) and most recently The Supreme Cannabis Company (TSX:FIRE,OTCQX:SPRWF) have been forced to announce layoffs.

“(Companies now understand) they have to have tight operations (and) cost-effective operations to compete in this market where there’s a plethora of producers and really not as many consumers have switched over from the black market,” Nawan Butt, a portfolio manager at Purpose Investments, told INN in the wake of the increase in firings.

According to analyst data aggregator site TipRanks, Greg McLeish, an analyst with Mackie Research, holds a “buy” rating for both Delta 9 and Auxly with respective price targets of C$1.13 and C$1.32.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.