Massachusetts-based MSO Curaleaf Holdings has finally completed its deal for Cura Partners, which owns the Select cannabis brand.

A multi-state operator (MSO) of cannabis assets in the US has closed a key pending acquisition target, adding 53 stores to its portfolio.

Curaleaf Holdings (CSE:CURA,OTCQX:CURLF) has been working on its deal for Cura Partners, the owner of the Select brand, for quite some time, as the acquisition was originally unveiled in May 2019.

CEO Joseph Lusardi said the transaction offers the company “an unprecedented phase of growth.”

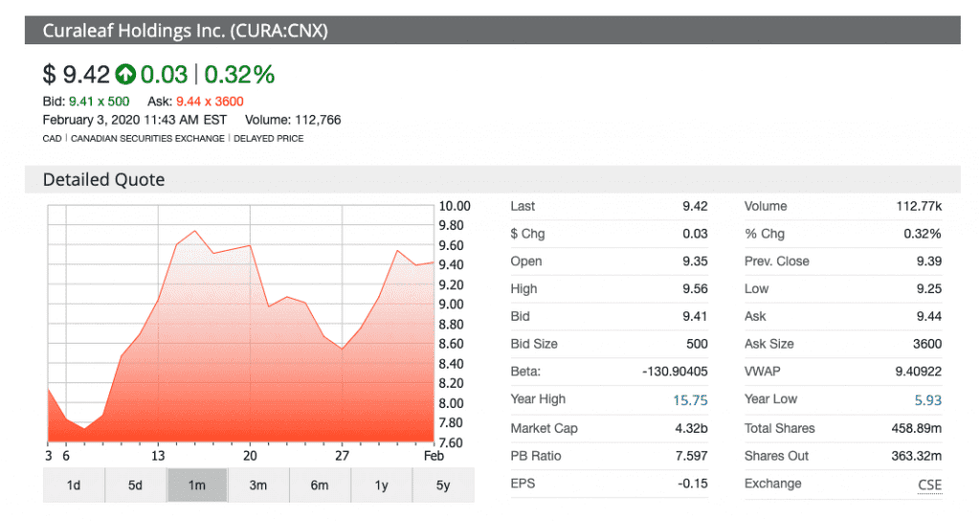

So far, 2020 has been a solid year of returns for Curaleaf shareholders, as over a year-to-date period the company is up nearly 18 percent in value. However, as of 12:18 p.m. EST on Monday (February 3), the firm was down 0.64 percent, resulting in a price per share of US$9.33.

This transaction for the company faced a rocky road to completion given an unexpected level of scrutiny from antitrust regulators in the marijuana space. In 2019, several MSO deals were put on hold due to the regulations around the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR) and potential second requests from the US Department of Justice (DOJ).

Originally, the Cura Partners transaction was valued at US$875 million. This changed in October, when the MSO told investors it would be adjusting the original agreement and reducing the total offer as a result of devaluations seen in the cannabis market throughout 2019.

This change in valuation was completed as part of the overall transaction, and it was able to clear the waiting period attached to the HSR review.

Most recently, in January, Curaleaf indicated it was working to complete a license transfer in Oregon related to the overall closure of the acquisition.

During an October investor event, Curaleaf Chairman Boris Jordan indicated that the DOJ was using this review process as way to “get an education on the sector.” Charlie Bachtell, CEO of fellow MSO Cresco Labs (CSE:CL,OTCQX:CRLBF), echoed that sentiment in an investor call. Cresco similarly faced federal roadblocks for its now-completed acquisition of Origin House.

Alongside the assets acquired, Curaleaf confirmed to investors it will also appoint new roles as part of the deal. Jason White from Select will become the first chief marketing officer for Curaleaf.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.